Global household savings patterns are shaping economic resilience as families continue to navigate inflation, interest rate shifts, and post‑pandemic recovery. Savings rates influence everything from consumer spending to investment trends, and they reveal how households balance present needs with future financial security.

For example, U.S. personal savings rates remain modest compared with Europe, affecting consumer markets and financial planning. Meanwhile, digital financial tools are reshaping how people save around the world. Explore the data below to understand how household savings are evolving and what that means for the global economy.

Editor’s Choice

- Global average household savings rate trends indicate varying behaviour across regions in 2025.

- U.S. personal savings rate hovered around 4.7% in late 2025.

- Eurozone savings rate increased to over 15% in 2025.

- Nearly 90% of Americans save or plan to save for short‑term goals.

- Global financial assets of households reached another peak in 2024.

- Australia’s savings rate is projected to be near 4.8% of disposable income in 2025.

Recent Developments

- The U.S. personal savings rate was reported at 4.7% in September 2025, unchanged from the prior month.

- Euro zone households increased their savings rate to 15.4% in Q2 2025, above pre‑pandemic norms.

- Surveys show Gen Z and Millennials are outpacing older adults in savings growth in 2025.

- Nearly 90% of Americans are saving or planning to save for short‑term goals, but often in low‑yield accounts.

- Global household financial assets rose by about 8.7% in 2024, reaching record levels.

- Australia’s household saving rate is projected to be around 4.8% of disposable income in 2025.

- Households in many European countries returned to or exceeded pre‑pandemic savings proportions by late 2024.

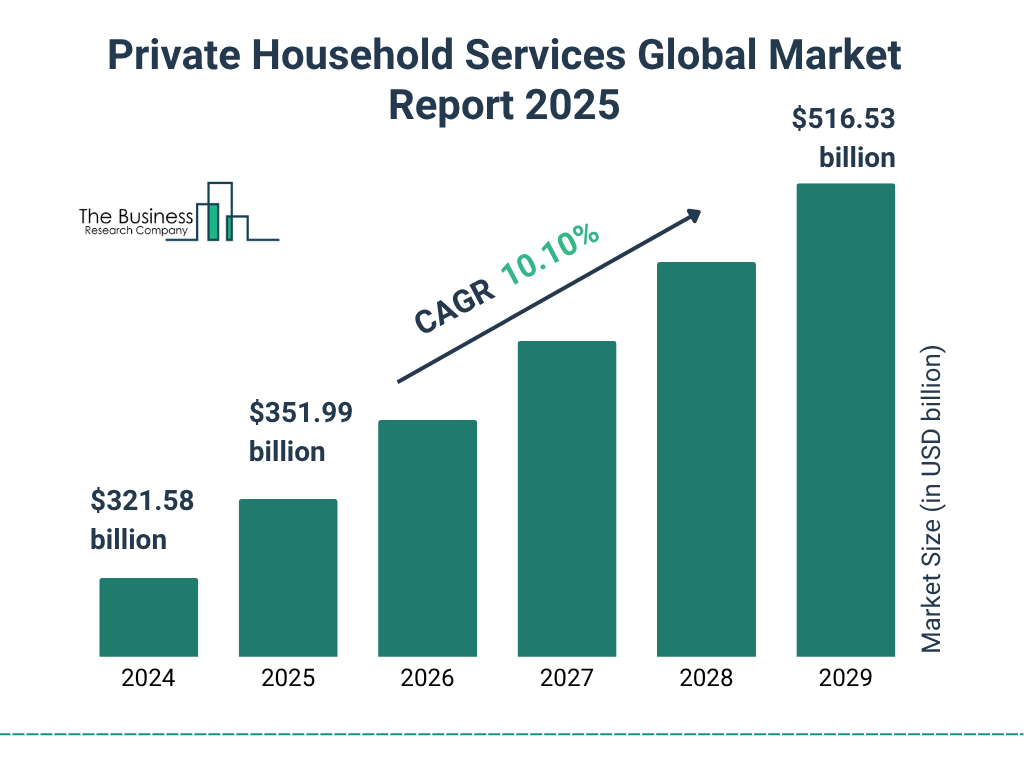

Global Private Household Services Market Highlights

- The global private household services market was valued at $321.58 billion and is projected to grow to $351.99 billion by 2025, reflecting steady demand for domestic help and care services.

- The market is expected to reach $516.53 billion by 2029, indicating strong long-term growth potential.

- The Compound Annual Growth Rate (CAGR) from 2024 to 2029 is estimated at 10.10%, signaling a robust upward trend.

- This growth is driven by rising dual-income households, aging populations needing in-home care, and increased outsourcing of household tasks.

How Household Saving Rate Is Measured

- U.S. personal saving rate reached 4.7% in September.

- Euro area household saving rate hit 15.4% in Q2.

- U.S. rate stood at 4.7% in August, matching September levels.

- Spain recorded a household saving rate of 12.41% in June.

- U.S. personal saving rate was 4.9% in July.

- Euro area saving rate rose to 15.45% in Q2 from 15.18% prior.

- U.S. rate measured 5.0% in June and 5.2% in May.

- U.S. saving rate forecast to average 4.8% annually.

Global Household Saving Rate Trends

- The U.S. saving rate of 4.7% in 2025 is below the long‑term historical average.

- Across OECD nations, household saving rates vary widely due to income, culture, and economic conditions.

- Global savings as a percentage of GDP averaged around 23.0% in 2023, showing broader macro trends.

- In Ireland, households saved ~13.8% of disposable income in Q4 2024.

- Pandemic effects pushed many savings rates temporarily higher in 2020–21 across advanced economies.

- Shifts in inflation and monetary policy are now influencing how households allocate income to savings.

- Forecast models suggest saving behaviours will evolve with economic conditions into 2026.

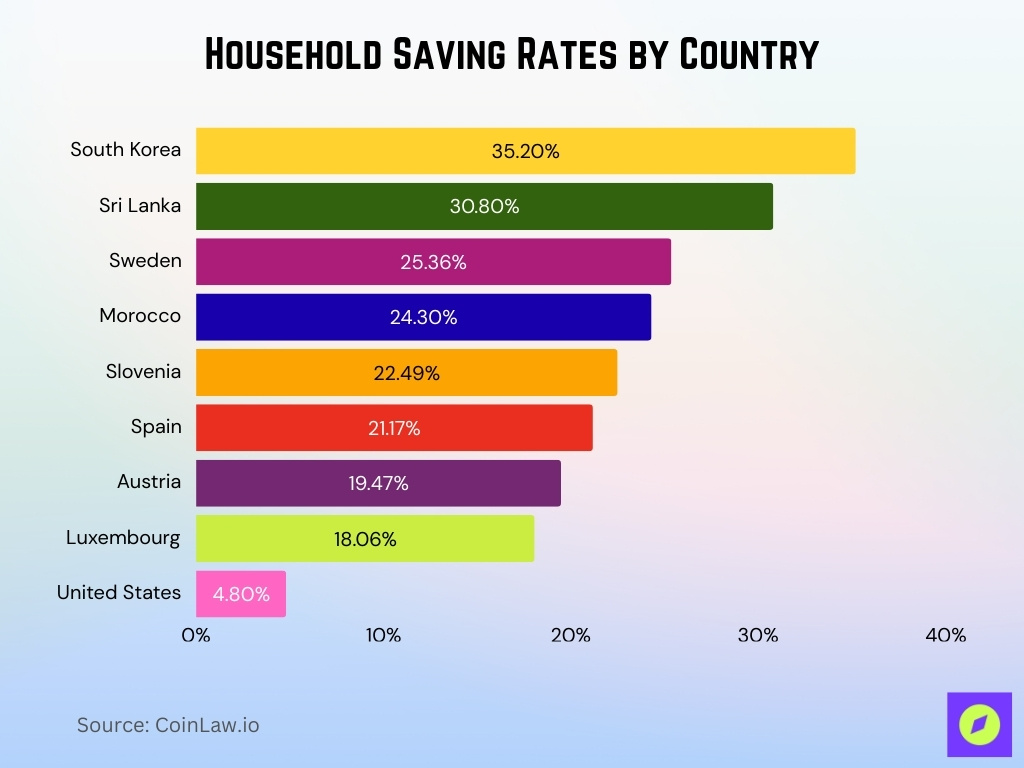

Household Saving Rates by Country

- South Korean households saved 35.2% income.

- Sri Lanka recorded a 30.8% household savings rate.

- Sweden achieved a 25.36% share of income saved.

- Moroccan households saved 24.3% of their disposable income.

- Slovenia posted a 22.49% household saving rate.

- Spain households saved 21.17% of their income.

- Austria reached 19.47% savings as income share.

- Luxembourg households saved 18.06% of their income.

- United States recorded a 4.8% personal savings rate.

Advanced vs Emerging Economies

- Advanced economies averaged a 12.5% household saving rate.

- Emerging markets like Mexico reached an 18.6% savings share.

- OECD countries posted an average saving rate of 10-15% range.

- South Africa in emerging markets showed -1.1% net savings.

- Euro area advanced economies hit a 15.4% saving rate in Q2.

- Advanced U.S. households saved 4.8% of disposable income.

- Emerging Sri Lanka recorded a high of 30.8% household savings.

- OECD forecasts advanced saving rates at 8-19% through year-end.

- Emerging South Korea led with 35.2% income saved.

Household Savings by Age Group

- 58% of Gen Z increased savings in the first half.

- 54% of Millennials reported savings growth.

- 47% of Gen X saw higher savings levels.

- 39% of Baby Boomers increased their savings.

- 80% of Gen Z and Millennials prioritize saving.

- Gen Z median savings reached $3,400.

- Millennials held median savings of $9,000.

- Gen X median savings stood at $9,600.

- Baby Boomers averaged a median $11,000 in savings.

- 63% of Gen Z plan to save more next year.

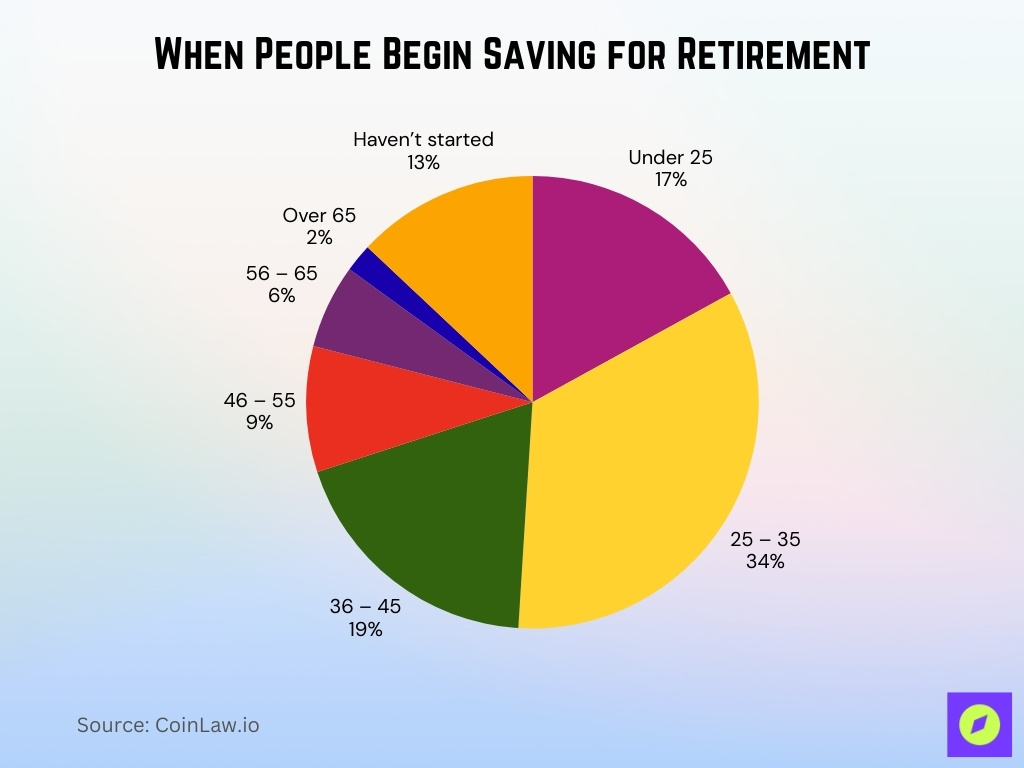

When People Begin Saving for Retirement

- 34% of people start saving between the ages of 25 and 35, making it the most common age group to begin retirement planning.

- 19% begin saving in the 36 to 45 age range, often driven by career stability or financial awareness.

- 17% start saving before age 25, showing early financial planning habits among younger adults.

- 13% of individuals haven’t started saving for retirement at all, highlighting a significant financial preparedness gap.

- Only 9% begin saving between 46 and 55, and this drops to 6% for ages 56 to 65.

- Just 2% start saving after age 65, often due to delayed financial prioritization or lack of resources.

Determinants of Household Savings

- Income shows a 0.35 coefficient positively impacting savings.

- Households saved approximately 33% of their income.

- Employment status yields a 1264 savings increase coefficient.

- The dependency ratio reduces savings by 5063 units.

- Higher education inversely affects savings with a -127 coefficient.

- Marital status lowers savings by 1724 units.

- Wealth decreases savings with a -1447 coefficient impact.

- Liabilities cut savings by 498 units per household.

- Financial literacy at 49% average correct answers.

Impact of Inflation and Interest Rates on Savings

- UK inflation hit 3.8% in August, eroding savings value.

- Savings at 2% interest lose 1.8% real value against 3.8% inflation.

- High-yield accounts offered up to 5.00% APY versus 0.40% national average.

- $10,000 at 5.00% yields $10,500 after one year.

- 1% real rate rise lowers the saving rate by 0.6% points.

- Bank balances rose 23% from 2019 amid high rates.

- The euro area saving rate increased due to high real interest rates.

- $1,000 at 5.00% earns $125 versus $10 at 0.40%.

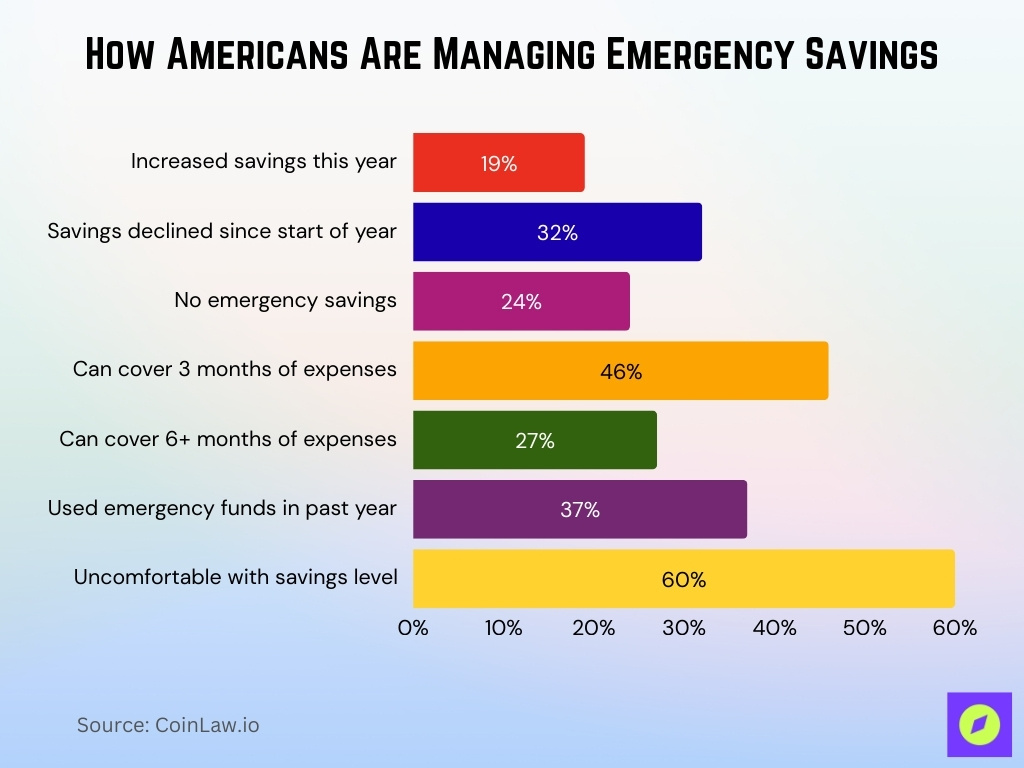

Short-Term vs Long-Term Household Savings

- 19% of Americans increased their emergency savings this year.

- 32% have less emergency savings than year the start.

- 24% of Americans hold no emergency savings.

- 46% cover three months’ expenses with emergency funds.

- 27% have six months or more of emergency savings.

- 37% tapped emergency savings in the past 12 months.

- 60% uncomfortable with emergency savings levels.

Household Savings and Household Debt

- Global household debt totals approximately $64 trillion.

- U.S. household debt reached $18.20 trillion in Q1.

- Canada’s household debt-to-income ratio hit 173.9% in Q1.

- U.S. average household debt stands at $105,056.

- Mortgage debt comprises 70% of total U.S. household debt.

- Canada’s debt-to-income ratio rose to 171.9% overall.

- U.S. debt payments consume 11.2% of disposable income.

- Canada’s household debt hit $3.07 trillion, with mortgages 75%.

- U.S. household debt-to-GDP ratio at 68.10% in Q1.

Household Savings Before, During, and After the Pandemic

- U.S. excess savings peaked at $2.1 trillion in August 2021.

- U.S. pandemic savings had depleted $291.3 billion below pre-pandemic levels by September.

- Euro area saving rate hit 15.4% in Q2, above pre-pandemic levels.

- Czech household saving rate reached 18.4% in Q2 versus pre-Covid average.

- Eurozone savings rate peaked at 15.5% in Q2, 2.9pp above Q4 2019.

- U.S. personal saving rate dropped to 4.4% post-pandemic from 8.9% average.

Government Policy and Household Savings

- Irish household saving rate reached 12.5% in Q2 post-stimulus.

- 40% of developing economies saved formally via accounts.

- 79% global adults hold financial accounts, up 5pp from 2021.

- 75% low/middle-income adults now have bank accounts.

- 16pp rise in formal savings in developing economies since 2021.

- 50.2% Filipinos own accounts via inclusion schemes.

- Pension tax cuts boosted savings by 7.2pp in experiments.

- 90% Indian adults hold accounts from Jan Dhan Yojana.

Digital Finance and Household Savings Behavior

- 40% of developing economies saved formally via accounts.

- 16pp increase in formal savings since 2021 from mobile money.

- 10% of adults used mobile accounts to save up from 5%.

- 79% global adults hold accounts, 57% use mobile banking.

- 70% urban vs 43.5% rural households adopted digital payments.

- Digital finance boosts financial literacy by 0.112–0.388 points.

- 42% prefer mobile apps for managing finances and savings.

Household Savings and Financial Resilience

- 52% of middle-class households are confident in handling $5,000 unexpected expense.

- 34% of middle-class households hold over 6 months of accessible savings.

- 80% comfortable with savings covering at least 3 months’ expenses.

- 51% cover 6+ months’ expenses with emergency funds.

- 76% uncomfortable with savings unable to cover 3 months’ expenses.

- 36% of uncomfortable savers have no emergency savings.

- 68% middle-class older people are confident in handling $5,000 shock.

- Canada mean financial resilience score of 52.39.

- 82% Canadians report cost of living outpacing income growth.

Frequently Asked Questions (FAQs)

Luxembourg households save approximately 18% of their income, placing them among the highest global savers.

Australian households are expected to save about 4.8% of disposable income in 2025.

The euro zone household savings rate rose to 15.4% in Q2 2025, above pre‑pandemic levels.

The U.S. personal savings rate was 4.6% in Q2 2025, more than double its low point in 2022.

Conclusion

The global landscape of household savings reflects a blend of policy influence, technological progress, and behavioral shifts. Government interventions, from tax incentives to financial inclusion campaigns, continue shaping how and how much households save. Digital finance now plays a pivotal role, enabling access to saving tools even in underserved regions and nudging households toward stronger saving habits.

Meanwhile, financial resilience remains a key objective, one that depends not just on the amount saved but on how wisely savings are managed and accessed in times of stress. As economies evolve through policy, technology, and changing income patterns, understanding these savings dynamics remains essential for individuals, institutions, and policymakers alike.