The financial sector today is undergoing a significant workforce transformation. With macroeconomic pressures, digital disruption, and regulatory shifts reshaping the industry, thousands of finance professionals are facing layoffs across banking, insurance, asset management, and fintech firms. From global banks in New York and London to regional players in Asia and Europe, staffing strategies are being restructured for resilience and efficiency.

In this comprehensive report, we break down the latest statistics, key drivers, and sector-specific impacts of today’s financial layoffs. Dive in to understand where the job losses are most severe, which roles are evolving, and how firms are adapting to the new economic climate.

Editor’s Choice

- The financial services sector saw over 4,559 layoffs in March 2025, a 145.2% increase from March 2024.

- Over 4,286 companies globally have announced layoffs as of October 2025.

- AI and automation are key drivers, replacing traditional back-office and compliance roles across banks.

- Retail and commercial banking layoffs are accelerating as branches close and digital banking dominates.

- Interest rate volatility and margin compression are pushing firms to restructure their staffing models.

- Redeployment, not rehiring, is the dominant trend, with staff redirected to digital or centralized roles.

Recent Developments

- In Q1 2025, the U.S. financial sector reported 4,559 layoffs, up from 1,859 in Q1 2024.

- JPMorgan began layoffs in February 2025, affecting fewer than 1,000 roles while continuing to post new jobs in tech and compliance.

- Morgan Stanley laid off approximately 2,000 employees globally as part of a cost-saving initiative.

- ANZ Group announced a plan to reduce 3,500 positions worldwide, roughly 8% of its workforce.

- Wells Fargo’s CEO hinted at continued headcount reductions tied to operational streamlining.

- The global job market has seen over 4,286 layoff announcements in the financial sector alone this year.

- Redeployments are increasing, especially among firms adopting centralized tech or compliance functions.

- Hiring remains muted: only 75 new roles were posted across major firms in Q1 2025.

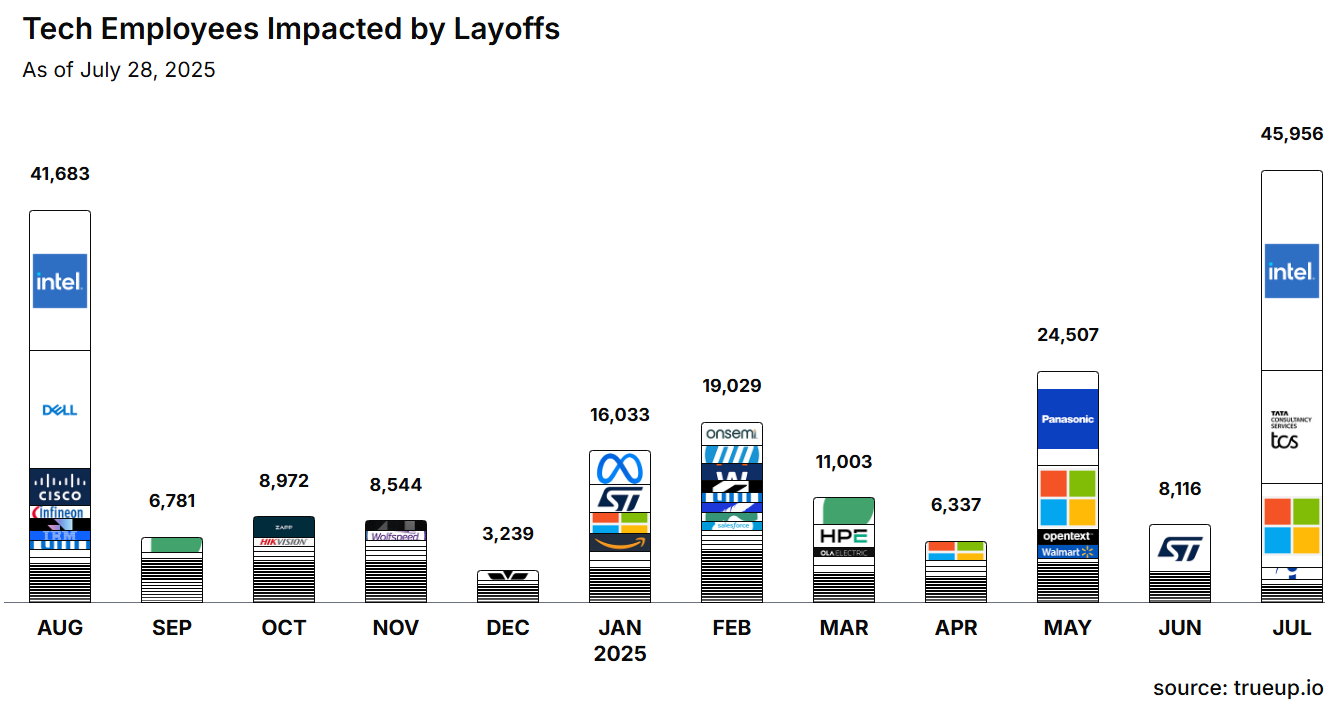

Tech Layoffs Snapshot

- July 2025 recorded the highest layoffs with 45,956 tech employees impacted, driven by major cuts at Intel and TCS.

- August 2024 saw an early wave with 41,683 layoffs, led by Intel, Dell, and Cisco.

- May 2025 experienced a sharp rise, affecting 24,507 workers, with notable contributions from Panasonic, OpenText, and Walmart’s tech division.

- February 2025 had 19,029 layoffs, including cuts from Onsemi, Western Digital, and Salesforce.

- January 2025 saw 16,033 job cuts, primarily at Meta, STMicroelectronics, and Amazon.

- March 2025 impacted 11,003 employees, largely at HPE and Ola Electric.

- October and November 2024 each had over 8,500 layoffs, involving firms like Hikvision, Zapp, and Wolfspeed.

- June 2025 layoffs reached 8,116, including repeat cuts from Intel and STMicroelectronics.

- April 2025 had 6,337 layoffs, largely from Microsoft’s divisions.

- September 2024 registered 6,781 layoffs, mostly from green energy and semiconductor sectors.

- December 2024 had the lowest layoffs during the period, with only 3,239 employees affected.

Key Financial Sector Layoff Statistics Overview

- Financial layoffs in March 2025 surged 145.2% year-over-year, from 1,859 in 2024 to 4,559 in 2025.

- Global job reductions in finance now average 1,500+ per week across institutions.

- Nearly 2 in 3 job cuts in 2025 occurred in non-client-facing functions like operations and compliance.

- U.S. layoffs account for 38% of total global job losses in finance this year.

- The top 10 global banks by assets have all announced some level of restructuring or layoffs in 2025.

- Hiring freezes are active in more than 60% of financial firms surveyed this year.

- New roles being created are predominantly in digital transformation, cybersecurity, and regulatory tech.

- There has been a 36% decline in posted finance job openings between Q4 2024 and Q2 2025.

- The average severance duration reported was 3.6 months, often paired with internal mobility programs.

Financial Sector Layoffs by Region and Country

- In the U.S., financial layoffs are up 47% from 2024, with job cuts concentrated in New York, Chicago, and Charlotte.

- The UK financial sector saw 2,100+ layoffs in Q1 2025, many tied to Brexit-related cost adjustments.

- In Asia, Singapore and Hong Kong have experienced over 3,000 layoffs, driven by shifting banking headquarters and regional consolidations.

- Australia reported 3,500 job losses tied to ANZ Group’s global downsizing.

- Middle East financial hubs like Dubai and Riyadh remain comparatively stable but are watching hiring trends cautiously.

- Latin America’s finance industry has been affected indirectly via global firm cutbacks in Brazil and Mexico.

- Remote and offshore support centers in the Philippines and India report declining headcounts in 2025.

Largest Tech Company Layoffs

- Intel leads all companies with ≈34,000 layoffs, marking the largest workforce reduction in the tech sector this year across multiple rounds.

- Microsoft follows with ≈19,000 job cuts, primarily impacting roles across cloud, devices, and support teams.

- Tata Consultancy Services (TCS) laid off ≈12,000 employees in 2025, mainly during mid-year IT services downsizing.

- Panasonic reported ≈10,000 layoffs tied to its 2025 restructuring efforts across global divisions.

- IBM eliminated ≈9,000 roles, continuing its multi-year workforce reshaping in consulting and infrastructure services.

- STMicroelectronics reduced its headcount by ≈5,000, reflecting semiconductor-sector belt-tightening.

- Salesforce cut ≈5,000 jobs, mostly in sales and engineering roles, due to realignment of enterprise priorities.

- Meta trimmed its workforce by ≈3,700, part of its ongoing cost efficiency drive amid slowing growth.

- Amazon laid off ≈3,300 employees, largely from tech, logistics, and corporate teams.

- Oracle also reported ≈3,300 job cuts, appearing on most 2025 “largest layoffs” trackers across databases.

Banking Industry Job Cuts Statistics

- Global banking job cuts have passed 20,000 positions in the first half of 2025.

- JPMorgan has reduced staffing across several divisions while maintaining hiring for specialized roles.

- Morgan Stanley’s 2,000 layoffs include investment banking and back-office operations.

- Wells Fargo continues quiet reductions, primarily in non-customer-facing roles.

- ANZ Group’s 3,500-job reduction signals broader cutbacks across Australian banking.

- Barclays and HSBC have trimmed headcount as part of ongoing cost-efficiency programs.

- Regional banks in the U.S. are more affected due to limited tech infrastructure and local economic dependencies.

- Consolidations and branch closures have led to widespread staff reductions in operations and support.

- Most large banks have paused new hires in traditional retail banking and operations roles.

- Technology investment is accelerating, further reducing reliance on the manual workforce in traditional banking functions.

Investment Banking Layoff Statistics

- Investment banking layoffs increased by 28% year-over-year in 2025 amid slower deal activity.

- Global M&A volume declined by nearly 30% year-over-year, impacting investment banking hiring.

- Equity capital markets teams in major banks operated at 50-60% capacity during 2025.

- Junior bankers reported a 39% increase in workload due to smaller teams.

- Firms cut more than 6,000 investment banking jobs across major banks in early 2025.

- Layoffs surged the highest in investment banking hubs: New York, London, and Hong Kong.

- Over 15-20% of deal-making staff hired in 2021-22 were laid off by late 2025.

- Goldman Sachs cut over 3,000 roles in high-cost investment teams by mid-2025.

- Compliance and legal advisory headcount tied to M&A dropped by 15% in 2025.

- The industry-wide investment banking revenue fell by approximately 45-50% in 2025, triggering cuts.

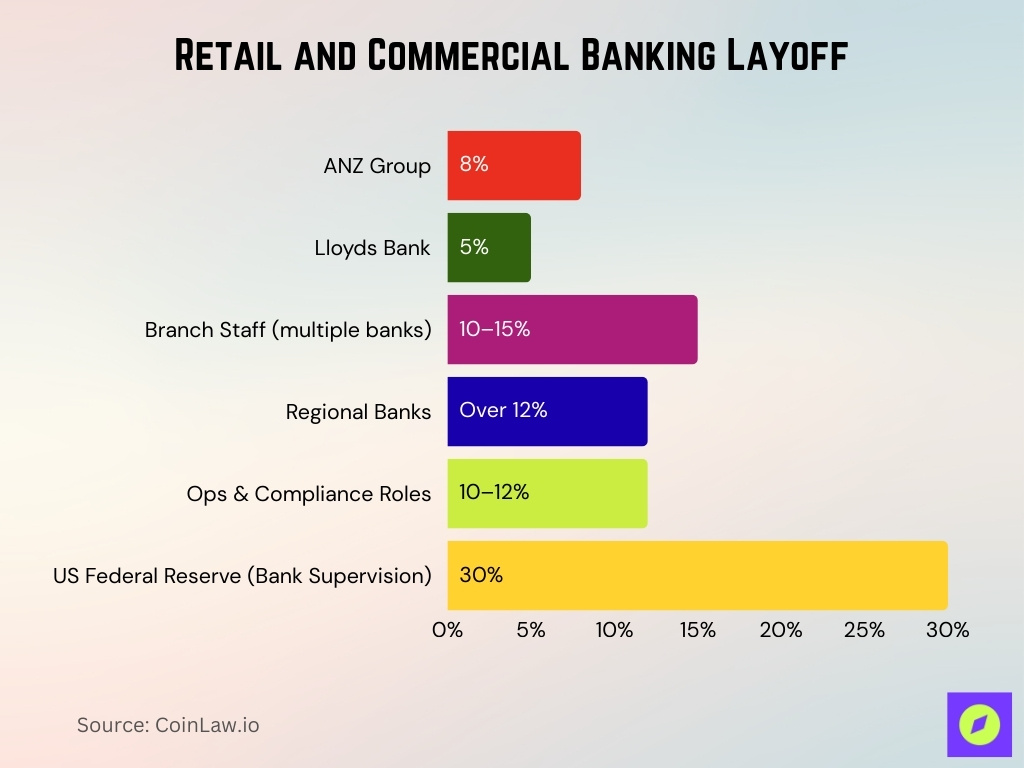

Retail and Commercial Banking Layoff Statistics

- ANZ Group plans to cut 3,500 staff, about 8% of its workforce, by late 2025.

- Deutsche Bank will reduce its retail banking staff by nearly 2,000 employees in 2025.

- Lloyds Bank plans to lay off around 3,000 employees, about 5% of the workforce.

- Wells Fargo expects workforce reductions to continue beyond 2025 due to an efficiency focus.

- Many banks reported branch staff cuts, causing a reduction of 10-15% in branch roles.

- Regional banks face higher cuts, with some posting staff reductions exceeding 12%.

- Hiring freezes lead to net staffing reductions, with minimal replacements in 2025.

- Non-customer-facing roles in operations and compliance dropped by around 10-12%.

- Federal Reserve plans to cut bank supervision staff by 30%, reducing the staff to 350.

Asset Management and Wealth Management Layoffs

- BlackRock cut 200 jobs in early 2025, about 1% of its 21,000 workforce.

- BlackRock announced a second round of 300 layoffs in June 2025, over 1% of staff.

- Morgan Stanley reduced 2,000 employees across divisions, 2-3% of the 80,000 total workforce.

- Morgan Stanley laid off 230 staff across seven offices in June 2025 for efficiency.

- Manulife eliminated 250 jobs, 2.5% of its wealth and asset management unit staff.

- Asset managers cut underperforming roles amid 14% workforce growth from acquisitions.

- Firms paused fund launches, reducing operations and compliance headcount by 5-10%.

- Wealth management automation targeted repetitive roles, cutting 3% net staff expected.

- Industry headcount stayed flat despite volatility, with selective 1-2% reductions firmwide.

Insurance Sector Layoff Statistics

- Allianz plans to cut 650 UK insurance jobs by the end of 2025 across personal and commercial lines.

- Allianz Partners may eliminate 1,500-1,800 jobs in travel insurance call centers over 12-18 months.

- Blue Shield of California reduced over 400 jobs through three rounds of layoffs in 2025.

- Health insurers like Elevance Health laid off 300 employees from Carelon operations in Ireland.

- Carle Health cut 612 positions in its insurance division amid plan terminations.

- Point32Health eliminated 254 jobs, plus 110 positions earlier in restructuring efforts.

- State Farm announced 400 employee layoffs in September 2025 for cost optimization.

- P&C insurers anticipate 14% headcount reductions due to automation and overstaffing.

- UCare cut 9% of its workforce, exiting the Medicare Advantage market in 2025.

- WPS Health laid off 313 employees due to federal contract losses in early 2025.

Financial Services Layoffs by Role and Seniority

- Mid-level associates and VPs face the highest layoff risk, targeted in 70% of banking cuts.

- Junior analysts were reduced by 150 roles at Bank of America amid 1% investment banking staff cuts.

- Operations and back-office functions hit hardest, comprising 40-50% of financial services layoffs.

- Contract staff were eliminated first, representing 20-25% of the initial reductions.

- HR and support roles accounted for 18% of PwC’s 1,500 financial services layoffs.

Front-Office vs Back-Office Layoff Trends

- Back-office roles comprise 60-70% of financial services layoffs in 2025 amid automation.

- Deutsche Bank targets 3,500 back-office jobs through 2025 for €2.5 billion cost savings.

- Morgan Stanley cuts affect both front and back-office but spare 15,000 financial advisors.

- Front-office selective cuts hit underperforming capital markets teams hardest in 2025.

- Middle-office risk functions consolidated with 20-30% automation, reducing manual reconciliation.

- Operations processing roles are down 40% in banks adopting digital workflows early.

- Investment banks see higher front-office layoffs than retail banking at 25% of total cuts.

- Global banks forecast 200,000 job losses over 3-5 years, mostly back/middle-office to AI.

- Shared services centers closed, impacting 10-15% of back-office headcount globally.

- Client-facing advisors reduced by digital tools in wealth management firms by 12%.

Financial Sector Layoffs by Company Size

- Large firms (10,000+ employees) account for over 70% of total financial layoffs in 2025.

- Morgan Stanley (80,000 staff) cut 2,000 jobs, 2-3% of the workforce, amid restructuring.

- ANZ Group eliminated 3,500 positions, 8% of its large global banking operations.

- Lloyds Bank plans 3,000 layoffs, 5% of its major UK financial services workforce.

- Goldman Sachs reduced 1,395 roles, 3-5% of its 46,500 employees, in a performance review.

- Mid-sized Ally Financial (11,000 staff) laid off 500 employees for digital optimization.

- TD Bank cut 2,000 jobs, 2% across its North American retail and commercial banking.

- Commerzbank announced 3,900 staff reductions in European mid-large banking operations.

- Smaller regional banks like Sacombank cut 1,354 jobs amid Vietnam’s streamlining efforts.

- PwC (financial services arm) eliminated 1,500 positions from mid-large professional services.

Major Banks with the Largest Job Cuts

- Morgan Stanley announced cutting about 2,000 jobs in Q1 2025, about 2.5% of the workforce.

- JPMorgan Chase laid off nearly 1,000 employees in early 2025, with more cuts planned.

- ANZ Group revealed plans to cut 3,500 positions, approximately 8% of its global workforce.

- Wells Fargo’s workforce declined by 4% year-over-year, continuing ongoing reductions.

- HSBC reduced 348 jobs in France as part of a multi-year restructuring in 2025.

- Deutsche Bank plans to cut nearly 2,000 jobs, mainly from retail banking and branches.

- Barclays cut over 200 investment banking roles, about 3% of IB headcount.

- Goldman Sachs aims to trim 3-5% of its workforce amid AI-driven efficiency efforts.

Notable Financial Institutions Announcing Mass Layoffs

- Over 4,286 companies globally announced mass layoffs since January 2025 as of October.

- Morgan Stanley announced 2,000 job cuts in March 2025, 2-3% of its global workforce.

- JPMorgan Chase began layoffs in February 2025, affecting under 1,000 roles initially.

- ANZ plans to eliminate 3,500 positions through the September 2026 restructuring.

- Lloyds Bank announced 3,000 layoffs, 5% of the workforce, in September 2025 overhaul.

- TD Bank cut 2,000 jobs, 2% of its workforce, amid US regulatory restructuring.

- Goldman Sachs trimmed 1,395 roles, 3-5% of 46,500 employees, in the spring review.

- Commerzbank plans 3,900 staff reductions as part of efficiency restructuring.

- PwC eliminated 1,500 positions in its financial services arm during the May 2025 cuts.

- Deutsche Bank targets 3,500 jobs by end-2025 in a multi-year cost-cutting plan.

Drivers of Financial Sector Layoffs

- Credit growth slowed to 10.5% YoY by December 2024, decelerating from 14-16% peaks.

- Margin compression expected from rate cuts, with 5% profit drop for private banks.

- Economic uncertainty drove 199,297 job cuts YTD, the second-highest layoff reason.

- Financial instability was cited by 55% of HR managers for repeat layoffs in 2025.

- Restructuring accounted for 96,871 cuts, targeting non-core operations.

- DOGE actions led with 292,279 planned layoffs impacting federal contractors.

- Automation/AI caused 20,219 job losses plus 10,375 explicitly in 2025.

- Global GDP stagnation at 0.8% in the Eurozone pressured financial profitability.

- 950,000 U.S. jobs cut through September 2025 amid hiring plans down 58%.

- Regulatory pressures like RBI norms slowed unsecured loans, hitting bank margins.

Impact of Interest Rates and Monetary Policy on Layoffs

- Fed cut rates to 4.00–4.25% in September 2025 amid slowing job growth and rising unemployment.

- Net interest margins are projected to contract to 3% by December 2025 due to falling rates.

- Bank deposit costs remain elevated at 2.03% squeezing profitability despite rate cuts.

- Private banks face 5% profit drop from margin compression post-rate reductions.

- U.S. GDP growth is expected to decelerate to 1.5% in 2025, impacting bank staffing.

- Small firms (<50 employees) shed 120,000 jobs, hit hardest by high rates of uncertainty.

- Labor market softening prompted two more Fed cuts expected in late 2025.

- WALR on fresh loans declined 9 basis points MoM in April 2025, pressuring NIMs.

- Jobless claims spiked 27,000 to 263,000, signaling layoff acceleration amid easing.

- Fed signaled two more 2025 cuts to counter labor demand decline risks.

Rehiring and Redeployment After Layoffs in Finance

- About 7.5% of laid-off finance workers were rehired by their previous employers in 2025.

- JPMorgan reported that many open roles remain, with redeployment favored over permanent cuts.

- Around 20% of laid-off employees were successfully redeployed internally in 2025.

- Redeployment mostly favors employees with compliance and tech skills amid automation.

- Legacy roles faced higher cuts, with new hires primarily in digital and compliance functions.

- Some firms combine layoffs with hiring freezes, leading to net workforce reduction despite redeployment.

- Offshoring and role relocation accounted for 15-20% of redeployment strategies.

- Larger firms spent up to 2% more on retraining to support staff redeployment.

- Redeployment efforts helped reduce severance costs by 25-30% across major banks.

Frequently Asked Questions (FAQs)

Employers announced 153,074 job cuts in October 2025.

Over 4,286 companies globally had announced mass layoffs in 2025 as of late October.

The industry recorded 46,386 layoffs through the first nine months of 2025.

Financial‑services firms created only 75 new jobs during the first nine months of 2025.

Conclusion

Major institutions, from global banks to regional lenders, announced widespread layoffs driven by shifting economic conditions, changing interest rates, and growing adoption of automation and AI. The layoffs span back-office operations, retail banking, investment banking, and support functions, with many firms opting for leaner, technology-oriented staffing models.

At the same time, some firms attempt to redeploy talent toward digital, compliance, or centralized functions, signaling a broader structural shift rather than just cyclical downsizing. As monetary policy evolves and market conditions remain uncertain, the financial industry appears to be restructuring for long-term resilience, albeit at the cost of traditional employment patterns.