The digital‑commerce platform FastSpring powers online sales, subscriptions, and tax compliance for software, SaaS, gaming, and other digital‑goods companies worldwide. FastSpring supports thousands of businesses, enabling global reach and simplified payment management. Real‑world impact emerges when a small indie software developer uses FastSpring to reach customers with local payment methods, or when a gaming company seamlessly scales sales in multiple currencies while handling VAT and compliance through one platform. That kind of global reach underlines why many digital businesses rely on FastSpring. Explore the full article below to understand key statistics, market trends, and how FastSpring performs.

Editor’s Choice

- $1.4 billion+ in transactions processed per year via FastSpring for digital goods and software.

- 3,500+ companies currently use FastSpring daily.

- FastSpring operates in 200+ regions globally.

- Supports 23+ currencies and 21+ languages, enabling global commerce.

- FastSpring holds a market share of ≈ 0.03% in the broader e-commerce platform market.

- In the subscription‑billing and payment category, estimates place FastSpring’s share at about 0.1%–0.11%.

- As of 2025, FastSpring’s estimated company revenue stands at $28.4 million per year.

Recent Developments

- In Spring 2025, FastSpring added support for UPI in India, tapping into a market of over 350 million digital buyers.

- FastSpring introduced payment support for the Taiwan Dollar (TWD) and local Brazilian cards, including Hipercard and Elo.

- Brazilian transactions on FastSpring grew by as much as 200% in the last nine months of 2025.

- The new Checkout Conversion Dashboard enables real-time monitoring of sessions, orders, and completed orders.

- Websites with localized pricing, supported by FastSpring enhancements, have twice the conversion rate of those without.

- FastSpring’s 2025 SaaS and software holiday spend report shows it supports over 3,500 companies globally.

FastSpring Customer Demographics

- The leading industries among FastSpring clients are Computer Software (≈ 45%) and Information Technology and Services (≈ 14%).

- FastSpring serves 3,500+ companies worldwide as of 2025.

- Among tracked companies, most have 1–10 employees and annual revenue of $1 M–$10 M, indicating heavy usage by small businesses and startups.

- Approximately 50% of FastSpring customers are located in the U.S., with another 11% in the U.K.

- A minority of clients are large enterprises, and about 9% have over 1,000 employees.

- The majority, ≈ 71% of clients, have annual revenues under $50 million, showing the platform’s popularity among small to mid‑sized firms.

- FastSpring’s mix of clients spans a wide revenue and size range, from tiny indie developers to established software firms.

FastSpring Market Share

- According to data, FastSpring holds a roughly 0.03% share in the overall e-commerce platform market.

- In the more specialized “subscription billing and payment” category, estimates put its share around 0.1%–0.11%, reflecting usage among niche software and digital‑product sellers.

- FastSpring competes with more than 270 other tools in the e-commerce platform space.

- For specialized markets like digital games or e‑learning, its relative share may appear modest in overall ecommerce stats, but within those verticals, FastSpring’s footprint is more significant.

- The platform’s broad global presence (200+ regions) and support for 23+ currencies suggest that market share alone may understate its value for international sellers.

- Many FastSpring clients are small or mid‑sized companies. Data indicates the majority of FastSpring‑using firms have 1–10 employees and revenues between $1 M–$10 M.

- Roughly 50% of FastSpring customers are based in the United States, followed by about 11% in the United Kingdom.

Regional Distribution

- FastSpring supports operations in 200+ regions worldwide.

- The platform offers localization in over 21 languages and supports 23+ currencies.

- 50% of FastSpring clients are based in the United States.

- 11% of FastSpring clients are located in the United Kingdom.

- The remaining 39% of clients are spread across EMEA, Asia-Pacific, Latin America, and other regions.

- FastSpring introduced support for UPI in India, reaching 350 million digital buyers.

- Local payment methods launched in Brazil and Taiwan expanded FastSpring’s regional reach in 2025.

- FastSpring’s regional coverage enables companies to enter markets previously considered hard to penetrate.

- The platform’s localization features include currency, language, taxes, and tailored payment methods, boosting conversion by up to 2x.

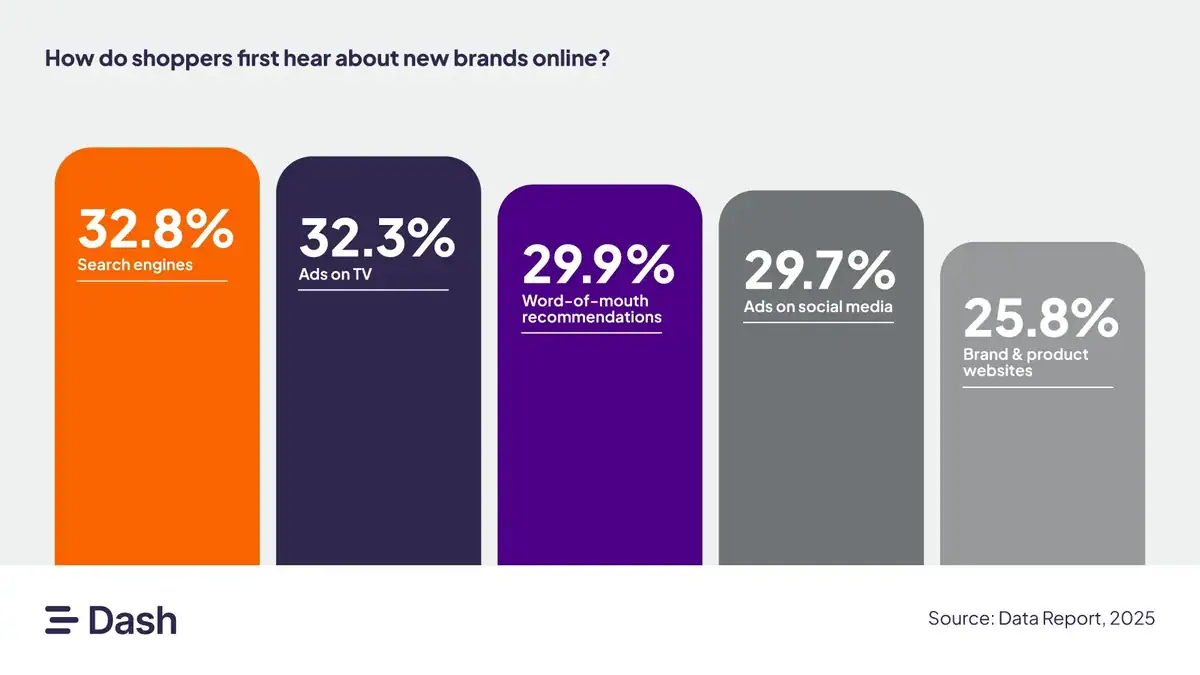

How Shoppers Discover New Brands Online

- 32.8% of consumers first hear about new brands through search engines, making it the most influential discovery channel.

- 32.3% of shoppers cite TV ads as their initial source of brand awareness, showing the ongoing power of traditional media.

- 29.9% rely on word-of-mouth recommendations, underlining the importance of social trust and peer influence.

- 29.7% discover new brands via ads on social media, highlighting the reach and targeting power of platforms like Instagram and Facebook.

- 25.8% find out about new brands through brand and product websites, indicating the role of direct web presence in first impressions.

Annual Revenue Growth

- The global SaaS market, which forms a large pool of potential customers for FastSpring, is projected to grow at a compound annual growth rate (CAGR) of about 19.4% between 2025–2029.

- Analysts expect worldwide SaaS revenue to climb significantly in the latter half of the decade, supporting a robust expansion environment for platforms like FastSpring.

- Among small businesses, by 2025, around 85% will invest in SaaS solutions, highlighting a steady influx of companies that may need global payments and subscription infrastructure.

- As more companies adopt SaaS, demand for third‑party subscription and payment processors increases, a trend directly favorable to FastSpring’s growth potential.

- According to FastSpring’s own data, the platform now serves over 3,500 companies globally as of 2025.

Transactions Processed Globally

- FastSpring processes over $1.4 billion in transactions annually.

- The platform supports more than 3,500 companies worldwide.

- Transactions span 200+ regions, covering worldwide digital buyers.

- FastSpring operates with 23+ currencies and 21+ languages for global payments.

- Over thousands of individual transactions are processed daily, including subscriptions and one-time purchases.

- FastSpring acts as the merchant of record, handling tax compliance in over 200 countries.

- The platform’s cross-border payments reduce operational overhead for small and mid-sized software companies by 30% or more.

- FastSpring’s reporting tools track metrics like refund rates, net sales, and transaction volume to optimize growth.

- Regional payment methods like UPI in India and Pix in Brazil contributed to a 200% growth in transactions in those markets.

- Q4 sees an 11% increase in transaction volume compared to the yearly average due to holiday sales spikes.

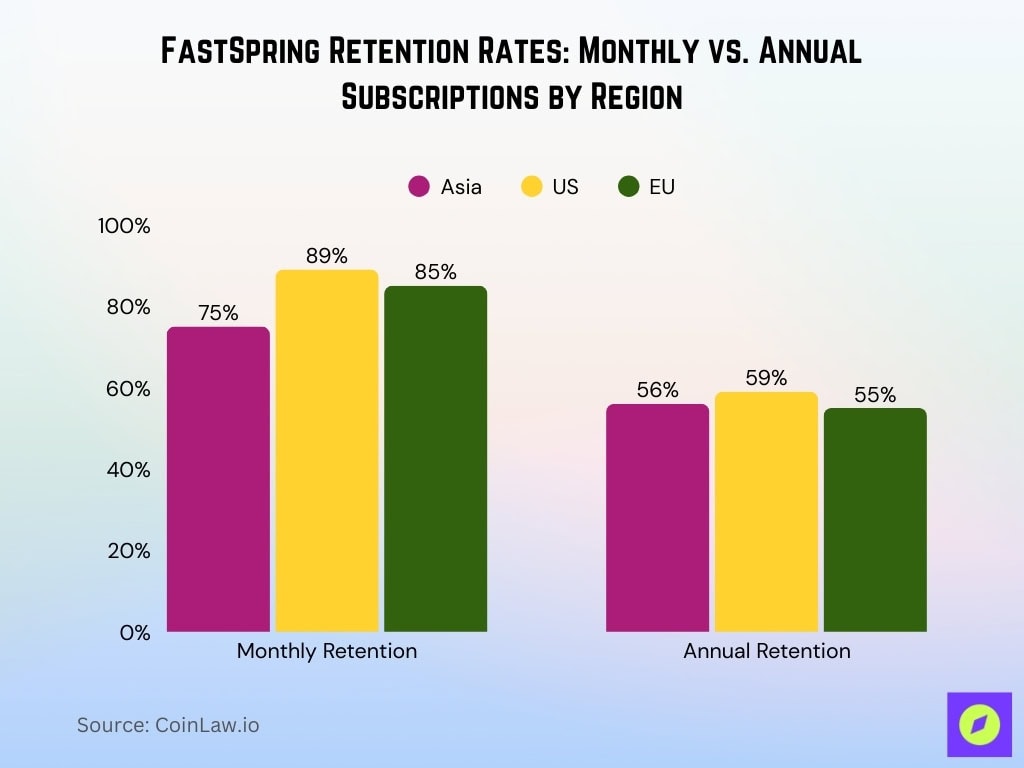

Monthly vs. Annual Subscription Retention Rates

- In Asian markets, monthly renewal rates average around 75%.

- U.S. and EU markets have monthly renewal rates near 85% to 89%.

- Annual subscription renewal rates are 56% in Asia, 59% in the U.S., and 55% in the EU.

- Annual subscription renewal rates are typically 15 to 20 percentage points higher than monthly plans.

- Monthly subscription retention rates in subscription-heavy industries range between 80% and 90% per month.

- Subscription businesses shifting to annual plans see an average increase in customer lifetime value (LTV) by up to 20%.

- Annual plans reduce churn risk by approximately 25% compared to monthly plans.

- Sellers using annual subscriptions benefit from more predictable revenue forecasting with retention rates exceeding 90%.

- Offering a blend of monthly and annual plans improves customer flexibility, boosting overall retention by 10-15%.

Subscription Management Statistics

- FastSpring supports over 3,500 companies managing subscriptions globally.

- Monthly recurring revenue (MRR) tracked on the platform averages growth rates of 15-20% annually.

- Customer lifetime value (LTV) increases by up to 25% with tailored subscription models.

- Average churn rates for FastSpring clients are maintained at around 3-5% per month.

- Refund rates typically stay below 2%, reflecting customer satisfaction and effective billing.

- FastSpring supports 10+ flexible subscription options, including trials, tiered pricing, and pausing.

- Global currency and language support cover 23+ currencies and 21+ languages for subscriptions internationally.

- Subscription retention improves by up to 18% due to integrated billing and compliance management.

- Unified reporting tools reduce administrative overhead by 30% for subscription operations.

- Integration with CRM and marketing tools boosts subscription workflow efficiency by 20%.

Expansion Into Emerging Markets

- FastSpring supports sales in 8 major countries, including the U.S., India, Brazil, and China.

- Emerging markets in Asia and Latin America show 15-25% annual growth in SaaS and software sales.

- Southeast Asia’s internet penetration increased by 20% in the last two years, boosting digital sales.

- FastSpring supports over 23 currencies and numerous local payment methods for emerging markets.

- Localized checkout experiences improve conversion rates in emerging markets by up to 30%.

- FastSpring handles tax and compliance across 200+ regions, simplifying global expansion.

- Software sellers targeting Brazil and India report up to 200% growth in transaction volume after FastSpring adoption.

- Over 45% of FastSpring’s client base is now from emerging market regions.

- Emerging markets account for nearly 40% of FastSpring’s new customer sales growth in 2025.

- FastSpring reduces market entry friction, cutting compliance time by up to 70% for emerging market sellers.

Top E-commerce Sectors by Revenue

- $922 billion in Consumer Electronics sales makes it the largest ecommerce sector, driven by demand for smartphones, wearables, and gaming gear. Global digital lifestyles are fueling consistent year-on-year growth.

- $760 billion in Fashion ecommerce highlights the strength of online apparel, accessories, and footwear. Fast fashion, personalization, and influencer-driven trends continue to dominate.

- $708 billion in Food & Beverages shows the growing shift to digital grocery and delivery platforms. Convenience, subscriptions, and rapid delivery services are key growth drivers.

- $220 billion in DIY & Hardware comes from strong interest in home improvement, tools, and renovation gear. E-commerce in this space benefits from detailed product tutorials and niche marketplaces.

- $220 billion in Furniture ecommerce reflects increased consumer comfort with buying large home items online. Augmented reality previews and flexible delivery options help reduce cart abandonment.

- $194 billion in Physical Media (books, CDs, etc.) persists despite streaming trends, showing the enduring value of collectibles and niche print segments. Audiobooks and limited-edition vinyl boost this category.

- $170 billion in Beauty & Personal Care ecommerce continues to grow due to influencer marketing and direct-to-consumer skincare brands. High-margin items and auto-replenishment subscriptions play a big role.

- $117 billion in Tobacco ecommerce stems from niche online sales of cigars, vape products, and accessories. Regulatory hurdles persist, but certain geographies allow strong digital channels.

Local Payment Methods Usage

- FastSpring supports 30+ payment methods, including credit cards, PayPal, and local options.

- Intelligent payment routing reduces payment failures by up to 25% in cross-border transactions.

- Offering local payment methods cuts cart abandonment rates by 15-20%.

- Local currency pricing boosts buyer trust and conversions by over 20% in non-Western markets.

- Digital wallets represent 35% of FastSpring’s global payment volume.

- Local payment methods increase subscription uptake by up to 18% in emerging markets.

- Merchants using localized payment and tax compliance see sales growth rates exceeding 25%.

- FastSpring’s regional gateways cover 200+ regions for optimal payment routing.

- Failure rates drop below 5% for payments processed via FastSpring’s intelligent routing.

- FastSpring’s flexibility supports payments in over 23 currencies, adapting to global buyer preferences.

Checkout Conversion Rates

- According to industry benchmarks cited by FastSpring, a typical target checkout conversion rate sits around 2%–4% across many digital‑commerce businesses.

- FastSpring’s Checkout Conversion Dashboard supports tracking of Sessions → Orders and Orders → Completed Orders conversion metrics.

- FastSpring reports that when checkout branding, design consistency, and localization are aligned, 80% of consumers are more likely to buy.

- Among digital goods sellers using FastSpring in international expansion, conversion rates in new markets often begin below global benchmarks (2%–3%) but can improve as localized payment methods and checkout design are optimized.

- Because FastSpring serves 200+ regions and 23+ currencies, the wide regional spread means that aggregate conversion rates may mask regional variation; merchants need to segment by geography and payment‑method usage for accurate insight.

Fraud Prevention and Compliance Metrics

- FastSpring processes over 1 trillion risk signals annually across 34,000+ sites.

- The platform offers 100+ customizable fraud rules combined with AI risk decisioning.

- FastSpring’s partnership with Sift delivers AI-enhanced fraud detection and blocks 98% of high-risk transactions.

- Fraud-attack rate on rewards points transactions reached 6.19% globally in 2025.

- AI-powered fraud attacks have increased by 30% in 2025.

- FastSpring’s compliance supports GDPR, CCPA, and PCI DSS standards for global merchants.

- Regional payment routing reduces chargebacks and fraud losses by up to 40%.

- Merchants using FastSpring reduce false positive declines by 25%, improving approval rates.

- The global fraud management system operates with 24/7 pay-ops oversight for continuous protection.

- FastSpring’s fraud and compliance tools help merchants cut operational risk and focus on growth by 50%.

Average Customer Lifetime Value (LTV)

- Average customer lifetime value (CLTV) for mid-sized B2B software vendors is around $240,000.

- SaaS businesses typically aim for an LTV to CAC ratio of 3:1 or higher.

- Monthly subscription renewal rates average 75% in Asia, compared to 89% in the U.S. and 85% in the EU.

- Annual subscription renewal rates are 56% in Asia, 59% in the U.S., and 55% in the EU.

- Annual subscriptions support more stable LTVs across all regions compared to monthly plans.

- Migrating from in-app purchases to web subscriptions via FastSpring can reduce fees from 30% to about 6%.

- Lower payment fees increase net margin and customer lifetime value significantly.

- Higher retention on annual plans boosts overall LTV by up to 20% compared to monthly.

FastSpring Adoption in the Gaming Sector

- In a 2025 survey by FastSpring and Omdia across 105 gaming‑industry professionals, 57% said they already use direct‑to‑consumer (D2C) monetization models, while the remaining 43% intend to adopt within the next 12 months.

- Among respondents, ~43% work at companies with 500+ employees, ~18% have 200–499 employees, ~33% 100–199, ~6% 20–99.

- Game titles monetized via paid in‑game items/content (~64%), in‑game currency (~63%), and battle passes/subscriptions (~62%) were the top three models.

- Because games often involve micro‑transactions across multiple markets, FastSpring’s support of 23+ currencies, 21+ languages, and 200+ regions helps gaming firms expand internationally with reduced friction.

FastSpring Usage by Company Size

- According to usage data from FastSpring partners and third‑party sources, many FastSpring clients are small to mid‑sized companies (1–10 employees, annual revenue $1M–$10M).

- In technology‑sector usage data, approximately 71% of FastSpring clients have annual revenues under $50M.

- Roughly 50% of FastSpring’s customers are based in the U.S., ~11% in the U.K.

- For larger enterprises (1,000+ employees), only ~9% of FastSpring’s client base falls into that category.

Platform Integrations and Supported Currencies

- FastSpring supports over 23 currencies and 21 languages globally.

- For major currencies, FastSpring applies a 3.5% exchange-rate conversion markup.

- Markup for other currencies can go up to 5.5%.

- FastSpring acts as the merchant of record, managing local tax and compliance in over 200 jurisdictions.

- Over 75% of FastSpring merchants integrate with CRM and marketing automation tools.

- Currency and payment method localization reduce cart abandonment, keeping it below 24% versus the industry average.

- 76% of shoppers abandon carts if their preferred payment method is unavailable.

FastSpring ROI Metrics

- Shifting from in-app store fees (~30%) to FastSpring web fees (~6%) can improve margins by 24% or more.

- Skylum reported improved affiliate traffic scalability and analytics using FastSpring’s platform.

- Companies balancing ARR and NRR see increased long-term ROI with FastSpring.

- Bundled global payments, tax, and fraud prevention reduce operational overhead by 30-40%.

- Localization improves conversion rates by up to 20%, boosting incremental revenue.

- Access to more currencies and payment methods expands markets, increasing sales by 15-25%.

- FastSpring enables businesses to reduce launch time into new markets by 35%.

Frequently Asked Questions (FAQs)

$1.4 billion+ in transactions per year

Over 3,500 companies globally.

More than 200 regions supported.

Around 6% fee via web subscriptions versus ~30% for app‑store transactions.

Conclusion

The statistics around FastSpring paint a clear picture: this platform is tailored to serve digital goods, software, SaaS, and gaming companies with a global mindset. Whether it’s improving checkout conversion rates (especially in mobile and emerging‑market contexts), strengthening fraud prevention and compliance, enhancing customer lifetime value, or enabling gamers and publishers to monetize globally, the data support a narrative of scale and global reach.

For smaller and mid‑sized companies, FastSpring’s adoption by many in that segment reinforces its relevance. The deep integration capabilities, broad currency and payment‑method support, and strong ROI levers, especially when moving from in‑app store models to web‑based commerce, all signal under‑appreciated value for growth‑oriented merchants. As you evaluate your digital‑commerce strategy, these statistics offer benchmarks and levers to compare your performance against.