Ethereum’s price has climbed to the $4,000 mark for the first time this year, fueled by rising institutional inflows, strong spot demand, and shifting investor focus away from Bitcoin and Solana.

Key Takeaways

- 1Ethereum hit $4,012, its highest price since December 2024, gaining over 4% in the past 24 hours.

- 2Capital rotation from Bitcoin and Solana into ETH is accelerating, with ETF and treasury accumulation each taking 1.6% of total ETH supply since June.

- 3Futures open interest for ETH reached a record $58 billion, with market share rising to 34.8%.

- 4Analysts see potential for ETH to test $5,000 or higher in the months ahead.

What Happened?

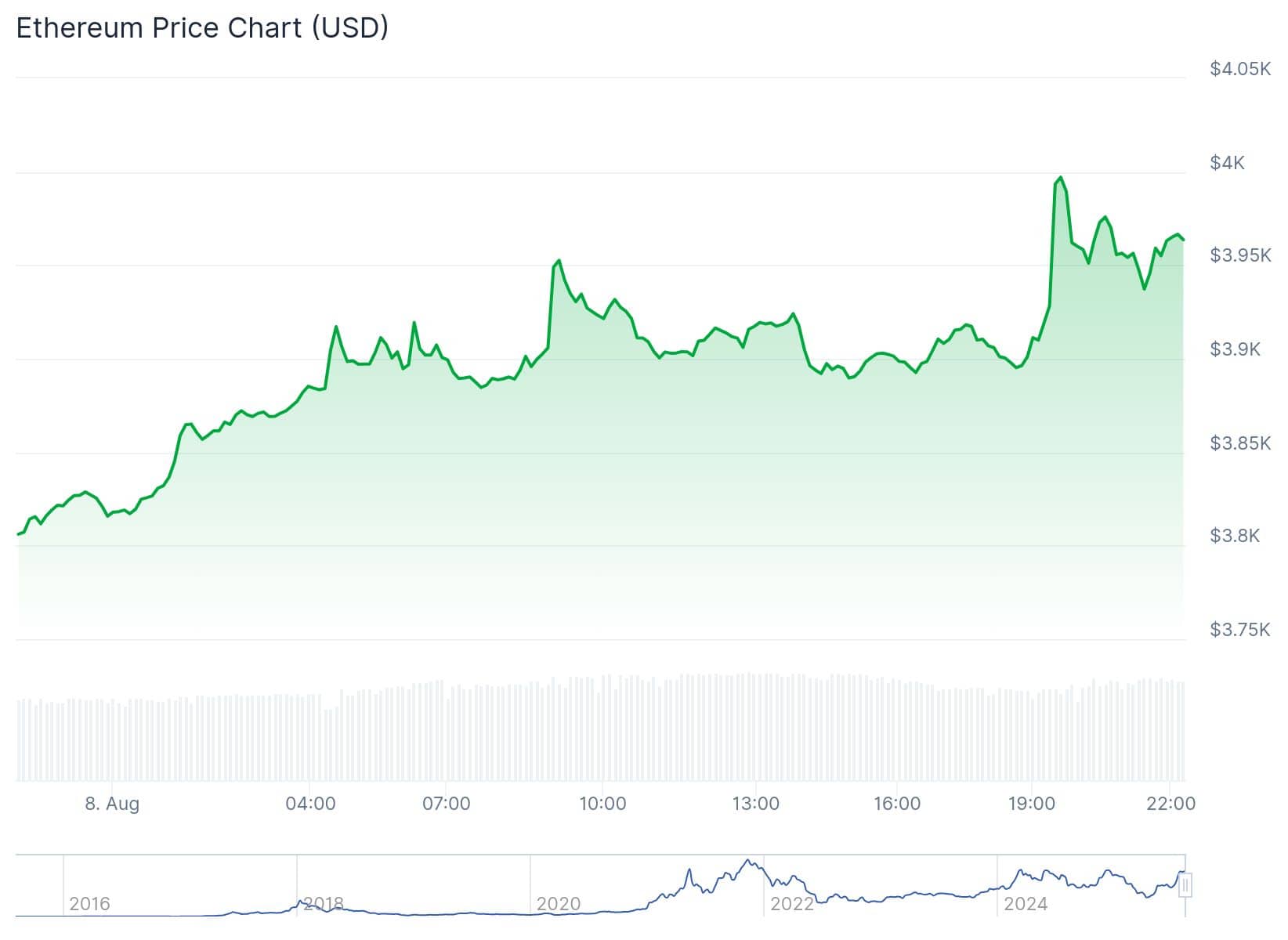

Ethereum crossed the $4,000 level on August 8, marking an eight-month high and a key psychological milestone for traders. Prices briefly reached $4,012 before consolidating around $3,974. The move came as Bitcoin’s dominance in the crypto market continued to slip, with investors showing a clear preference for ETH.

Ethereum’s Rise Back to $4,000

According to Cointelegraph Markets Pro and TradingView data, ETH gained around 1.7% on the day it broke the $4,000 barrier, putting it within $900 of its all-time high. Popular trader Rekt Capital noted that Ethereum’s dominance is already halfway through its macro uptrend, comparing current market behavior to the 2021 bull cycle.

Whale activity has also picked up, with analytics firm Lookonchain tracking large-scale ETH purchases. Market data from TheKingfisher highlighted a “massive wall of long liquidations” below $3,960, suggesting a strong reaccumulation zone.

$ETH Dominance

,Rekt Capital (@rektcapital) August 8, 2025

Ethereum Dominance is already ~50-60% of the way in its Macro Uptrend#ETH #Crypto #Ethereum pic.twitter.com/regkPlcSeF

Institutional Demand and Futures Records

Data from Glassnode shows the SOL/ETH Hot Capital Ratio has dropped to 0.045, the lowest in 2025, indicating capital is rotating away from Solana into Ethereum. ETH/BTC has also surged above its 200-week EMA for the first time in over two years, a technical sign of altcoin market strength.

Ethereum futures open interest has hit $58 billion, an all-time high, with its market share climbing to 34.8% compared to Bitcoin’s declining 47.1%, according to Hyblock Capital. Analysts note that despite the rally, funding rates remain low, signaling a rally driven more by spot accumulation than leveraged speculation.

$ETH open interest marketshare continues to increase and is now sitting at 34.8% (of the big8).

,Hyblock (@hyblockcapital) August 7, 2025

Notably, $BTC open interest marketshare has shrunk from 59.3% to 47.1% pic.twitter.com/A6FM3Txa6H

ETF demand is playing a major role. Nate Geraci, president of NovaDius, reported that spot Ethereum ETFs and corporate treasuries have each bought around 1.6% of ETH’s total supply since early June.

Broader Market and Macro Tailwinds

Daily transaction volumes on Ethereum have surged, and the network’s market capitalization now stands close to $480 billion, with daily trading volume topping $41.47 billion, a more than 31% increase in 24 hours.

Upcoming Ethereum blockchain upgrades aimed at improving scalability and efficiency are also fueling optimism. A favorable macro backdrop, including potential US interest rate cuts, is boosting risk assets like cryptocurrencies.

Meanwhile, other altcoins have shown mixed performance. Solana’s momentum has slowed, while smaller tokens such as Remittix (RTX) are gaining attention. Even Ethereum-related stocks like Bitmine Immersion and Sharplink Gaming have seen positive price moves.

CoinLaw’s Takeaway

Honestly, I think this is one of those moments in crypto where the fundamentals and sentiment are lining up beautifully for Ethereum. We have institutional buying, ETFs stacking ETH, whale accumulation, and technicals all pointing in the same direction. Crossing $4,000 is not just a number, it is a confidence boost for the market. If this momentum holds, I will not be surprised if we see Ethereum testing $5,000 before year-end. Bitcoin may still have its moment, but right now, ETH feels like the star of the show.