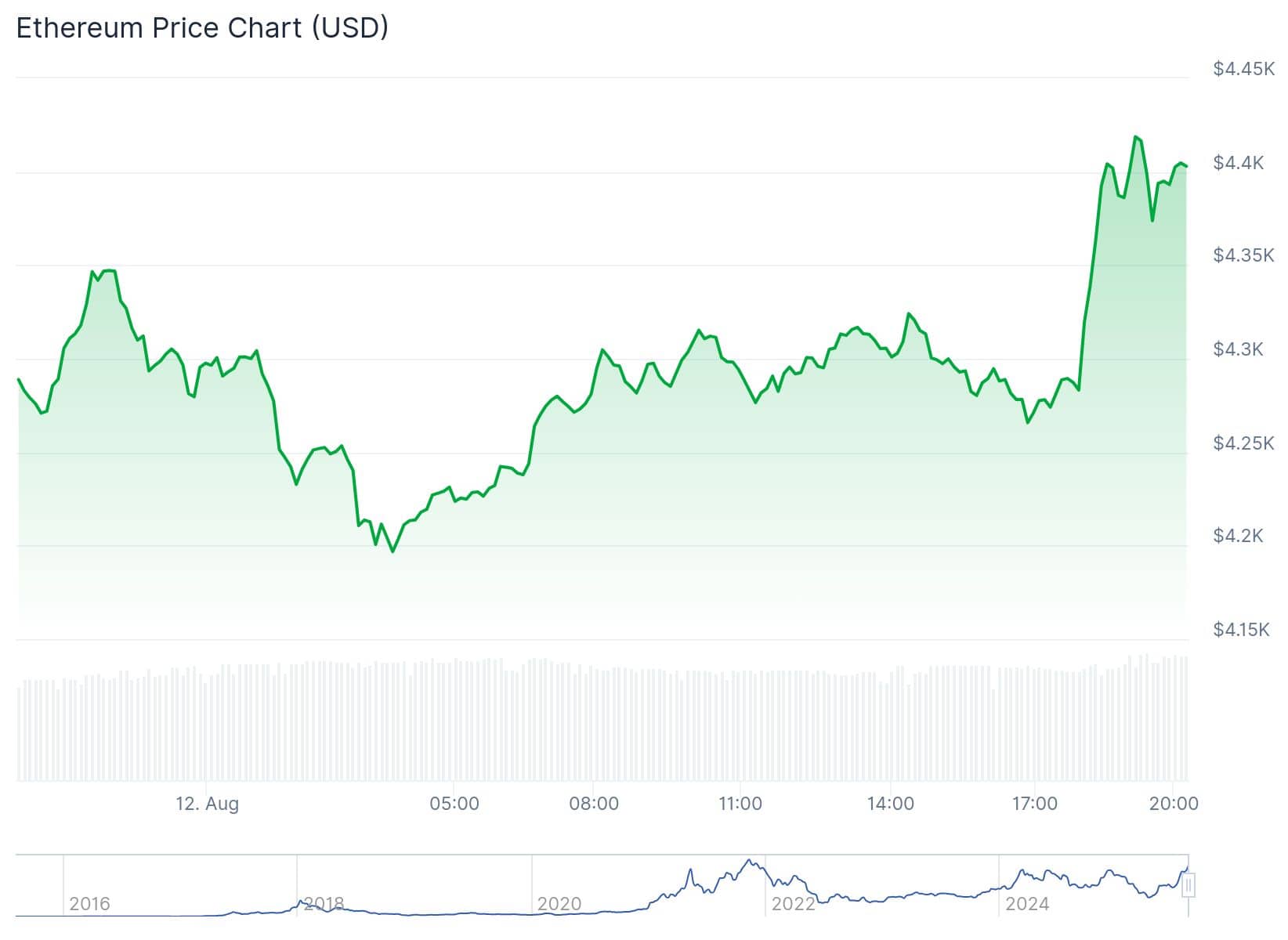

Ethereum is riding a fresh wave of institutional confidence as spot ETFs record their largest inflow and a crypto whale scoops up over $1.3 billion in ETH.

Key Takeaways

- 1Spot Ethereum ETFs saw a record $1.01 billion net inflow, led by BlackRock’s ETHA fund.

- 2A new crypto whale accumulated 312,052 ETH worth $1.34 billion over eight days.

- 3Fundstrat allegedly bought 317,000 ETH and plans to continue buying this week.

- 4Market analysts believe the buying spree could push ETH closer to its $4,891 all-time high.

What Happened?

Ethereum is seeing powerful momentum from both institutional and high-net-worth investors. US spot ETH ETFs just recorded their largest ever single-day inflow of over $1 billion, while an anonymous whale wallet reportedly acquired more than $1.3 billion in ETH. Analysts say this surge in demand may help Ethereum break out of its recent trading range and close in on its all-time high.

Ethereum ETF Inflows Break Records

Ethereum ETFs in the United States are seeing a historic uptick in interest. According to Farside Investors, spot ETH ETFs registered $1.01 billion in net inflows, pushing total ETF inflows close to $10.85 billion. BlackRock’s ETHA fund led the charge with $639.8 million in inflows, marking its own all-time high and reflecting growing institutional adoption.

Whale Accumulation Intensifies

Blockchain data reveals that an anonymous whale created 10 new wallets and began accumulating 312,052 ETH starting August 1. The total stash, worth $1.34 billion, was sourced from trusted institutional platforms including FalconX, Galaxy Digital, and BitGo. Notably, this whale continued to accumulate even during brief ETF outflows on August 1 and August 4.

What a crazy accumulation!

,Lookonchain (@lookonchain) August 12, 2025

This mysterious entity created 10 new wallets in the past 8 days and accumulated 312,052 $ETH($1.34B) from #FalconX, #GalaxyDigital, and #BitGo.https://t.co/1Hk0pVMW6s pic.twitter.com/NTUIpS1QLr

This buying spree has outpaced the record-breaking ETF inflows, showing just how much confidence large investors have in Ethereum’s future.

Fundstrat and Arthur Hayes Join the ETH Rush

In a separate but equally notable development, crypto analyst Pentoshi shared via X that Fundstrat allegedly bought 317,000 ETH worth around $1.3 billion, with plans for further purchases throughout the week. While these claims remain unverified with no wallet addresses or trade data provided, they have sparked speculation about deeper institutional plays in ETH.

.@fundstrat bought an additional 317k $eth worth $1.3b

,🐧 Pentoshi (@Pentosh1) August 11, 2025

You won’t believe what happens next

Hint: They’ll be buying more all week

“But the rsi!” https://t.co/YCEL4BSNts

Adding to the bullish tone, BitMEX co-founder Arthur Hayes purchased 1,750 ETH on August 11 for $7.43 million, while BitMine expanded its Ethereum treasury to $4.96 billion by buying another 316,000 ETH.

Market Outlook Ahead of US Inflation Reports

These developments come just ahead of key US inflation indicators, with the Consumer Price Index (CPI) and Producer Price Index (PPI) due this week. According to analysts at Cointelegraph, these data points could influence Federal Reserve policy at the upcoming September 17 meeting.

While markets are pricing in an 82% chance that the Fed will keep interest rates unchanged, elevated inflation data could stall the crypto rally. Short-term ETH holders are also taking profits, suggesting some near-term volatility.

Yet, market watchers remain optimistic. Javier Rodriguez-Alarcón, CIO at XBTO, noted that Ethereum’s Z-score remains near-neutral, indicating that the price surge is still within normal volatility limits. The combination of corporate treasury buys and ETF demand could create enough momentum for ETH to challenge its previous all-time high of $4,891, now just 12% above current prices.

CoinLaw’s Takeaway

I think this is one of those moments where Ethereum shows how powerful institutional demand can be. When you see billions flowing in from ETFs and whales at the same time, it’s not just noise. It’s conviction. Even if we get a bit of a pullback from retail selling or inflation fears, this kind of backing doesn’t happen without a reason. I’m watching closely to see if this momentum carries ETH past the $4,891 mark. My bet? If institutional players keep stacking, we’ll see a new high sooner than people expect.