As consumers and businesses increasingly move away from cash, electronic payments at the point of sale have grown dramatically. One major driver is the adoption of EFTPOS (Electronic Funds Transfer at Point of Sale), the backbone of in‑store card transactions in many countries. From retail shops to restaurants and public transport, EFTPOS terminals help streamline payments, reduce cash handling risks, and speed up checkout.

Many retailers now rely on EFTPOS to handle increasing volumes of contactless or card‑based purchases. In healthcare, hospitality, and quick‑service restaurants, EFTPOS enables smooth operations by reducing cash errors, proving that the system is more than a convenience, but a business enabler. Dive into the full report to understand where the EFTPOS industry stands.

Editor’s Choice

- Australia boasts 981,187 EFTPOS terminals as of September 2025, with AusPayNet data also showing 979,191 in June and 1,029,871 in March 2025, highlighting steady EFTPOS fleet growth.

- Over 90% of in-person payments in Australia will use EFTPOS or digital wallets in 2025.

- EFTPOS processes over 2 billion transactions annually in Australia as of 2025.

- Merchant fees for EFTPOS average 0.44% of transaction value in mid-2025.

- Australia’s POS market reaches $325.1 million in value entering 2025.

- Global EFTPOS terminals hit 56.6 million units, estimated for early 2025.

- Card payments in Australia total AUD 700 billion in volume for 2025.

Recent Developments

- Australia’s POS terminals per million inhabitants reach about 40,000 in 2025, up from roughly 36,000 in 2020, reflecting strong POS density growth.

- Retail segment claims 35% of POS terminal market share with 21% growth in installations by 2025.

- Australia’s payments market exceeded $1.07 trillion, including POS and digital, in 2025.

- Integrated card readers hold 48% of mPOS revenue in 2025.

- EMV chip technology accounts for 34% of the mPOS market revenue in 2025.

- Least-cost routing expands to online EFTPOS payments from March 2025 in Australia.

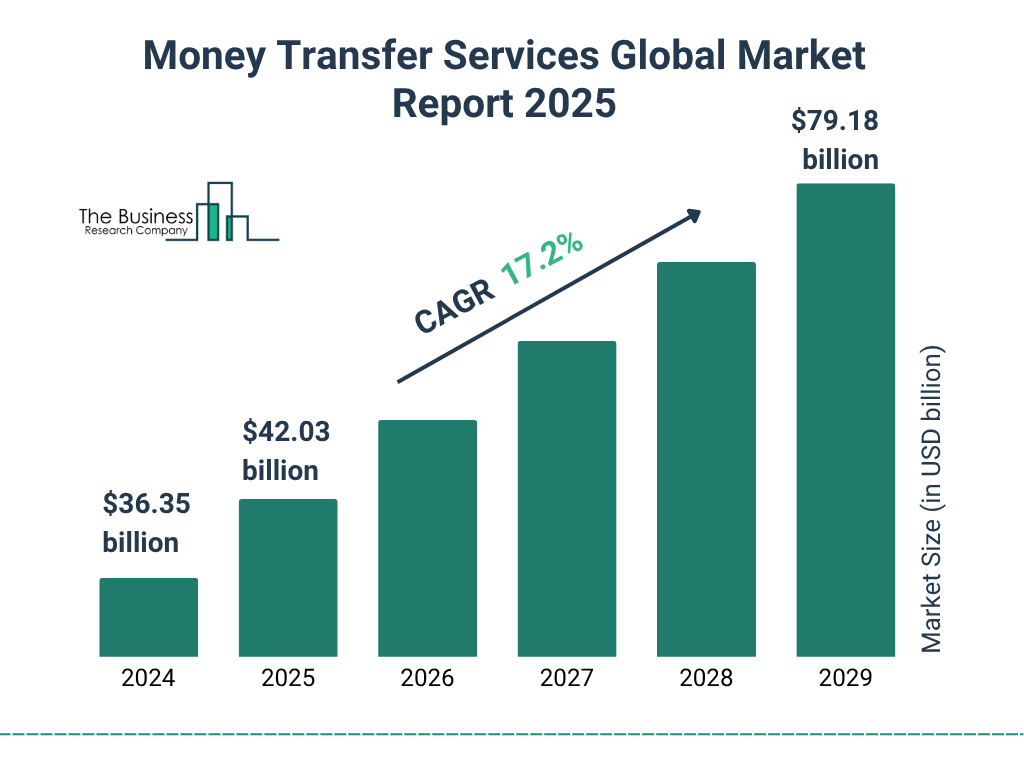

Money Transfer Services Market Growth Highlights

- The global money transfer services market is projected to reach $42.03 billion in 2025, showing a strong upward trend.

- The market is forecast to grow at a CAGR of 17.2% from 2025 through 2029.

- By 2029, the market is expected to hit $79.18 billion, more than doubling in size in five years.

- The growth reflects increased demand for digital remittance, cross-border payments, and real-time transfer solutions.

Number of EFTPOS Terminals

- Australia has 981,187 EFTPOS terminals as of September 2025, within a 979,191–1,029,871 range across 2025 quarters, according to AusPayNet’s device statistics.

- Global EFTPOS terminals are estimated at 60+ million units.

- Global POS installed base exceeds 292 million units.

- mPOS terminals worldwide hit 110+ million units.

- Cellular POS terminals total 146.1+ million units.

- Australia EFTPOS devices grew to 979,191 in June 2025 before rising to 981,187 by September 2025.

- Thailand reports 909,671 EFTPOS terminals.

Transaction Volume Trends

- In the euro area, first‑half 2024 data show the number of card payments at physical POS rose by 10.3%, reaching 40.1 billion transactions compared with H1 2023.

- Over the same period, the value of those card payments increased by 7.0%, totalling about €1.5 trillion.

- Contactless card payments at POS terminals grew 13.2% to 25.8 billion transactions in H1 2024 over H1 2023.

- These contactless transactions accounted for 79% of all non-remote (in-person) card payments by number, and 62% by value.

- In the U.S., contactless payments reached an estimated 17.9 billion transactions in 2023.

- That 2023 contactless total marked substantial growth from 4.7 billion in 2019, showing how rapidly tap‑to‑pay has become mainstream.

- In Australia, total card purchases on Australian‑issued cards increased by 9.0% in value for the year ended December 2024.

- The number of card purchase transactions rose 7.7% to 1,332.9 million transactions over the same period.

- Growth in debit card purchases in Australia was especially strong, value up 10.9% and number of transactions up 8.9%.

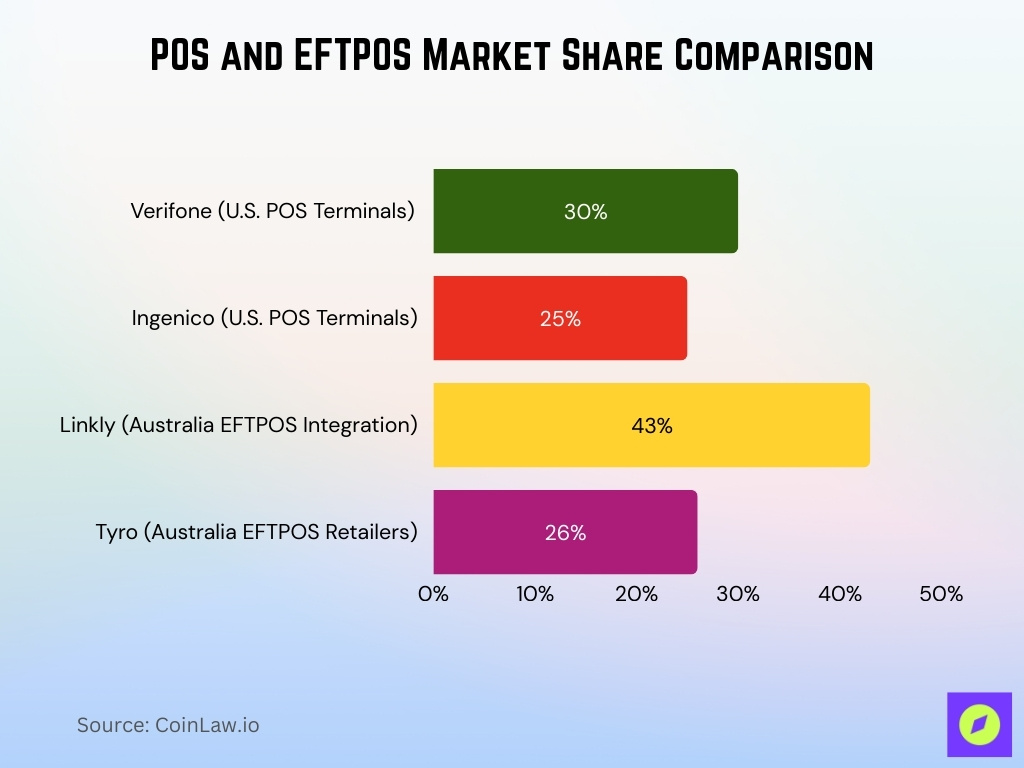

Market Share by Provider

- Verifone maintains approximately 30% share of U.S. POS terminals.

- Ingenico commands around 25% of the U.S. POS terminal market.

- Linkly dominates 43% of the EFTPOS integration market share in Australia.

- Tyro captures 26% market share among Australian EFTPOS retailers.

- Asia-Pacific region accounts for 50.11% of the global POS terminal market share.

- The retail sector holds 30% of the global smart POS terminal market share.

- Fixed POS terminals lead with a 61.30% market share in restaurants.

Reliability and Outage Rates

- POS terminal uptime averages 99.5% annually across major providers.

- EFTPOS downtime incidents reduced by 28% year-over-year in Australia.

- Global POS failure rate stands at under 0.8% for transactions.

- Mobile POS reliability reaches 98.7% availability during peak hours.

- Fixed EFTPOS terminals report 99.9% uptime in retail environments.

- SLA commitments guarantee 99.95% availability for 85% of providers.

- Contactless EFTPOS outage rate drops to 0.3% globally.

- mPOS connection failures average 1.2% in emerging markets.

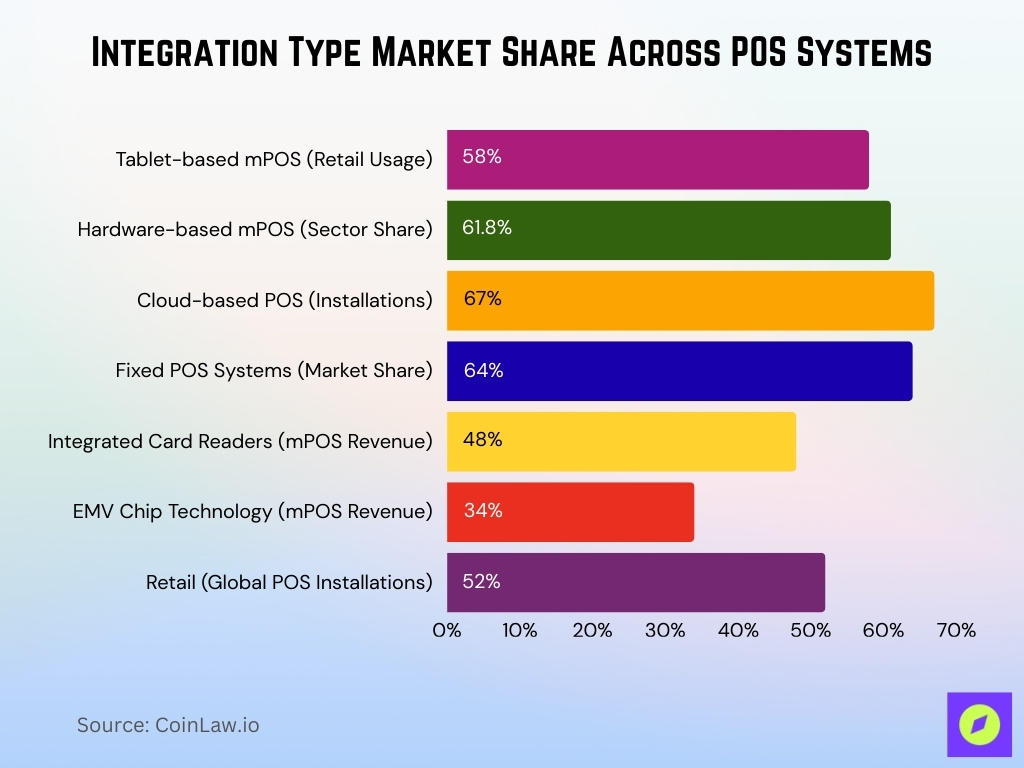

Integration Types Usage

- Tablet-based mPOS systems account for 58% of retail usage.

- Hardware dominates the mPOS sector with a 61.8% share.

- Cloud-based POS represents 67% of installations.

- Fixed POS systems hold a 64% market share.

- Integrated card readers claim 48% of mPOS revenue.

- EMV chip technology accounts for 34% of mPOS revenue.

- Retail commands 52% of global POS installations.

Fee Absorption Practices

- 72.5% of Australian retailers absorb EFTPOS fees rather than surcharging.

- 32.1% of fee-absorbing retailers consider passing charges on to customers.

- EFTPOS merchant fees average 0.44% of transaction value after a 10% rise.

- 57% of Tyro users currently absorb fees among Australian merchants.

- $1.2 billion in annual surcharge savings proposed by banning EFTPOS surcharges.

- 67.4% of fee-absorbing Tyro merchants contemplate surcharging customers.

- 33% surge in EFTPOS transaction fees reported last quarter.

- Merchant service fees range from 0.5% to 1.5% by card type for EFTPOS.

Settlement Speed Importance

- 85% merchants prioritize settlement speed in POS selection.

- Cloud POS systems enable T+0 settlements for 62% of users.

- Hospitality sector reports 92% same-day settlement adoption.

- mPOS instant payouts boost cash flow by 47% for SMBs.

- Real-time settlement is available to 78% of Australian EFTPOS merchants.

- Average settlement time drops to 24 hours across major providers.

- 67% of retailers cite faster settlements as the top POS upgrade driver.

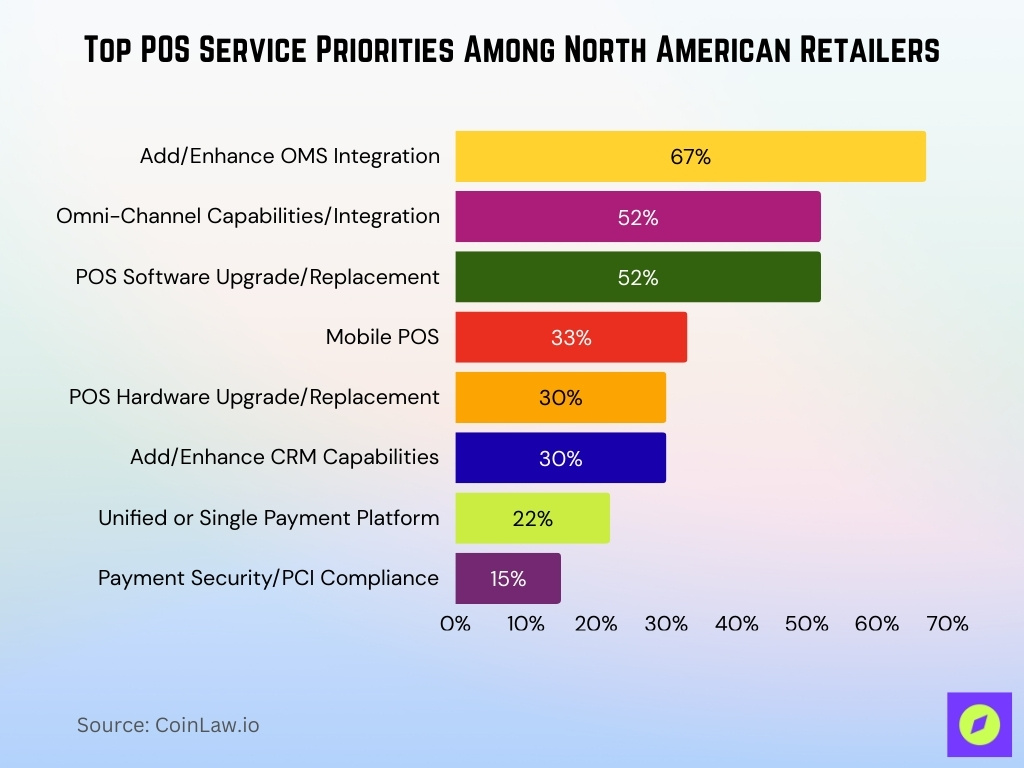

Top POS Service Priorities Among North American Retailers

- 67% of retailers prioritize adding or enhancing OMS (Order Management System) integration, making it the top focus area.

- 52% are investing in POS software upgrades or replacements, showing the push toward more modern and flexible systems.

- 52% also focus on omni-channel capabilities and integration, highlighting the shift to unified retail experiences.

- 33% of retailers are prioritizing mobile POS solutions to support flexible and on-the-go transactions.

- 30% plan to upgrade or replace POS hardware, underlining the need for reliable, updated devices.

- Another 30% aim to add or improve CRM capabilities, supporting better customer relationship management.

- 22% seek to implement a unified or single payment platform across systems.

- Only 15% list payment security and PCI compliance as a current top priority, potentially due to existing compliance or newer competing priorities

Terminal Rental Costs

- Basic EFTPOS terminals rent for $20–$40 monthly in Australia.

- Leasing advanced terminals costs $30–$60 per month.

- Square Terminal purchases at $329 outright in Australia.

- CommBank Smart terminals rent $29.50 monthly.

- Zeller Terminal 2 is available for $199 purchase.

- NAB EFTPOS rental ranges $25–$50 monthly.

- Non-return penalties reach $550 maximum for damaged terminals.

- Suncorp mobile EFTPOS rents $29 monthly after 6 free months.

- Square Reader costs $65 for purchase.

Contactless Payment Adoption

- The global contactless payment market is valued at $56.11 billion in 2025.

- Strong growth is forecast throughout the decade.

- In the U.S., 25% of all card transactions were contactless in 2023.

- The number of U.S. contactless transactions reached 17.9 billion in 2023.

- Over 85% of U.S. merchants accept contactless payments.

- In 2025, 86% of global consumers use contactless payment methods.

- NFC‑based contactless payments represent 58–65% of in‑store digital transactions in the U.S. in 2025.

- Contactless growth is driven by tap‑and‑go convenience and rising mobile‑wallet usage.

Digital Payment Penetration

- 86% global consumers use contactless payments.

- 68% U.S. card transactions are now contactless-enabled.

- 5.6 billion mobile wallet users worldwide by year-end.

- 56% Asia-Pacific transactions are via contactless payments.

- 67% U.S. consumers regularly use contactless payments.

- 75% European transactions are conducted cashlessly.

- 85% Asia-Pacific urban adults use cashless methods.

- 3.2 billion people use mobile payment apps globally.

Provider Comparison Data

- Zeller Terminal purchase at $199 with a 1.4% transaction fee in 2025.

- Tyro Pro EFTPOS rents $29 monthly plus 1.4% fees.

- CommBank Smart terminal rental $29.50 monthly 2025.

- NAB EFTPOS Now starts $24.75 monthly with 1.1% fees.

- Square Terminal available $329 outright, 1.6% flat fee.

- Westpac EFTPOS rental $24.75-$35 monthly, 1.2% rate.

- Smartpay Zero Cost eliminates $0 rental for high volume.

- Tyro No Cost shifts fees to a surcharge pass-through model.

- Zeller Terminal 1 costs $99 one-off purchase.

Frequently Asked Questions (FAQs)

In 2025, around 78% of new POS terminal deployments are reported to include NFC/contactless capability.

In 2025, 86% of global consumers reportedly used contactless payment methods.

The global mini POS terminals market is estimated at $120.9 million in 2025.

Conclusion

EFTPOS remains a core component of modern commerce, and the data show clear trends. Rental costs remain modest, especially for basic terminals, while digital and contactless payment adoption surges globally. Merchants now have flexible options, from owning hardware outright to using soft‑POS or blended fee models. As contactless and mobile payments continue to rise, adopting the right payment‑terminal strategy becomes more critical than ever for businesses aiming to stay competitive and meet customer expectations.