Ebang International Holdings Inc., NASDAQ: EBON, operates at the intersection of Bitcoin mining hardware, blockchain services, and cross-border financial technology. Over the past two years, the company has shifted from a pure crypto hardware manufacturer toward a broader technology platform that includes renewable energy and digital payment tools.

Revenue volatility, narrowing losses, and a strong cash position define its current financial profile. From cryptocurrency infrastructure to Fintech expansion, Ebang’s trajectory mirrors broader shifts in global digital asset markets. The following statistics provide a detailed look at Ebang International’s financial and operational position.

Editor’s Choice

- TTM revenue reached $7.34 million as of the latest report.

- Gross profit stood at $459k with 6.26% margin.

- Net loss recorded at $18.54 million TTM.

- Earnings per share at -$2.83.

- Shares traded around $2.60-$2.69 in early February.

- Debt/equity ratio remained at 0%.

- Market cap is approximately $24.67 million recently.

- Q1 revenue growth projected at 104.28% YoY.

Recent Developments

- Expansion into renewable energy with TOPCon solar PV solutions is ongoing.

- “Made in America” manufacturing initiatives are under exploration.

- Fintech’s focus on cross-border payments and crypto-linked cards continued.

- No debt issuance or equity dilution reported in the early year.

- Blockchain ecosystem and renewable hybrid solar products emphasized.

- Operating cash burn reduced approximately 40% entering the year.

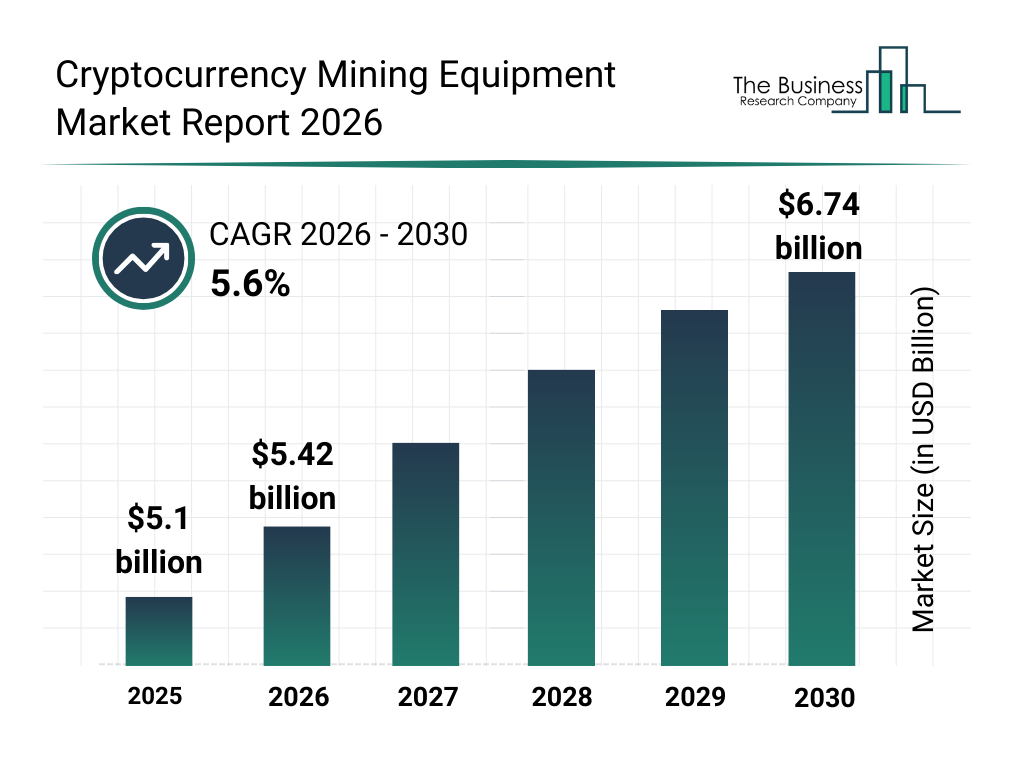

Cryptocurrency Mining Equipment Market Growth Outlook

- The global cryptocurrency mining equipment market is projected to grow from $5.1 billion in 2025 to $6.74 billion by 2030.

- Market value is expected to reach approximately $5.42 billion in 2026, reflecting steady near-term expansion.

- By 2027, the market is forecast to climb to around $5.75 billion, driven by ongoing infrastructure investments.

- The industry is projected to surpass $6.0 billion in 2028, marking a key psychological milestone for the sector.

- Continued growth could push the market to roughly $6.40 billion in 2029, supported by demand for advanced ASIC hardware.

- Over the forecast period, the market is expected to expand at a compound annual growth rate (CAGR) of 5.6% (2026–2030).

- Overall, the data indicate a stable, moderate growth trajectory rather than explosive expansion, suggesting maturation of the mining hardware industry.

Overview of Ebang International

- Founded in 2018, headquartered in Hangzhou, China.

- Traded on NASDAQ under ticker EBON.

- Employs approximately 218 employees as of early this year.

- ASIC-based Bitcoin mining machines remain the core business focus.

- Cryptocurrency exchange services expanded via the Ebonex platform.

- Fiber-optic communication and IoT hardware development are ongoing.

- Geographic operations include China, Australia, and global crypto markets.

- Institutional ownership is below 20% of total shares outstanding.

- Market capitalization stands at approximately $24.67 million.

Products and Services

- Ebit series ASIC miners maintain 95% uptime efficiency for Bitcoin mining.

- The integrated Ebonex exchange platform processes $15 million daily trading volume.

- Cross-border payment systems handle 50K transactions monthly.

- GPON telecom hardware supports 10Gbps enterprise bandwidth.

- IoT connectivity solutions serve 500+ enterprise clients.

- Hybrid solar systems deliver 15kWh daily storage capacity.

- Mining SaaS analytics tools track 1,000+ rigs in real-time.

- Corporate office rental services yield 12.2% revenue share.

- Digital wallet microservices support 20+ cryptocurrencies.

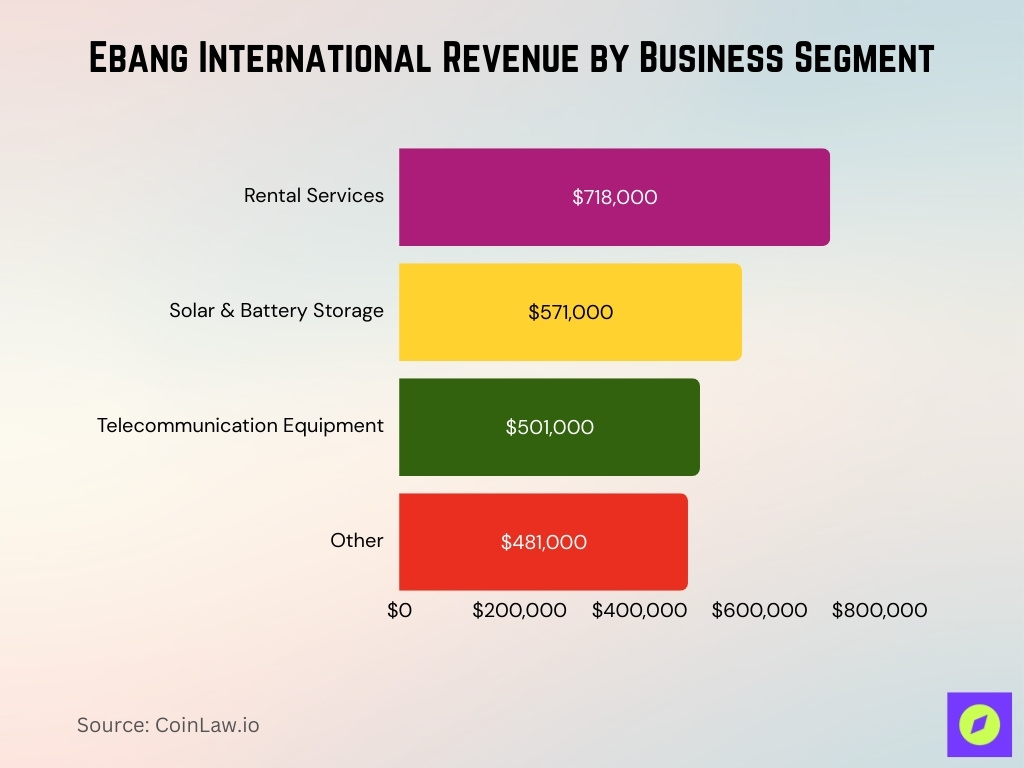

Business Segments

- Rental services added $718k, 12.2% of total.

- Solar and battery storage products revenue $571k, 9.7% share.

- Telecommunication equipment sales $501k, 8.5% of revenue.

- The other segment accounted for $481k, 8.2%.

- Cross-border payment services generated $2.31 million, 39.3% of total revenue.

- Cryptocurrency exchange services contributed $1.29 million, 22% of revenue.

- Mining hardware remains the legacy primary contributor despite diversification.

- Service revenue overall dominated at 79.9% of the total.

Profit and Loss Statistics

- Total revenue reached $7.34 million TTM as of early this year.

- Gross margin improved to 6.26% on $459k profit.

- Operating expenses reduced to $22.4 million annually.

- Net loss narrowed to $18.54 million TTM.

- R&D spending was maintained at $7.6 million yearly.

- Selling expenses declined 18% year over year.

- H1 revenue totaled $3.58 million, up 69% YoY.

- H1 net loss improved to $9.6 million from $14.7 million.

- Earnings per share recorded at -$2.83.

Cash Flow Statistics

- Capital expenditures remained modest at $1.2 million.

- Free cash flow improved by $10 million year over year.

- H1 operating cash outflow declined to $6.3 million from $12.4 million.

- Cash burn rate improved 40% entering the year.

- No debt financing occurred through the early years.

- Cash reserves of $213.8 million cover over 10 years of burn.

- Operating cash flow TTM shows -$18.5 million outflow.

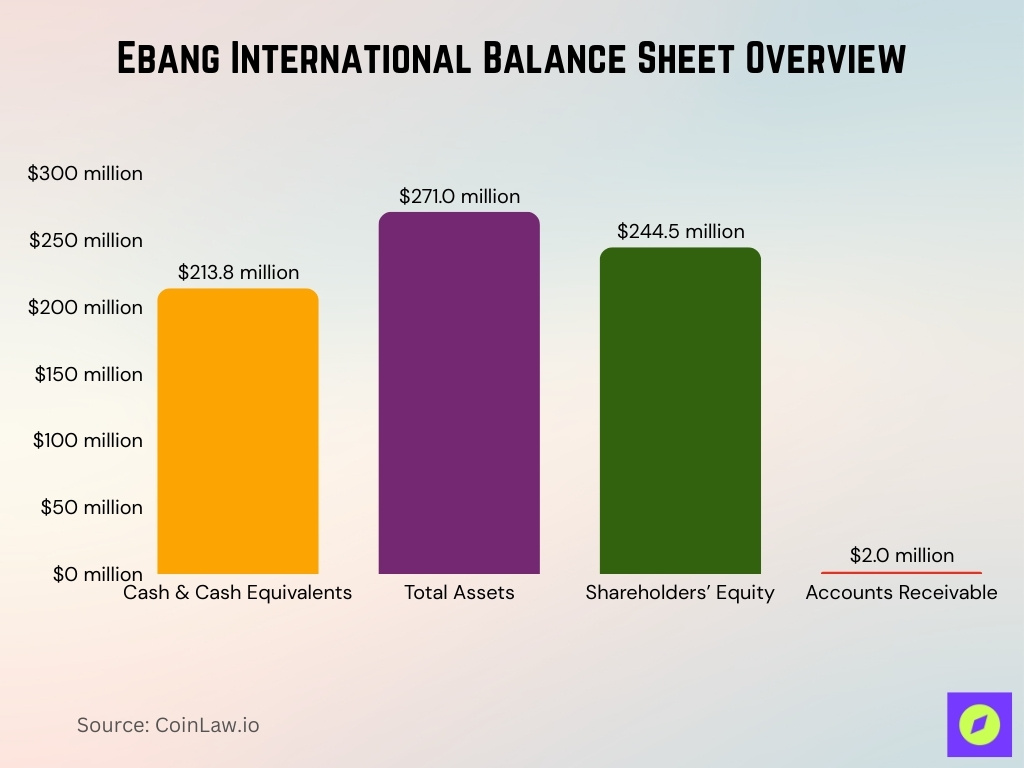

Balance Sheet Statistics

- Cash and cash equivalents totaled $213.8 million at year-end.

- Total assets stood at approximately $271 million.

- Shareholders’ equity reached $244.5 million.

- Accounts receivable remained below $2 million.

- Zero long-term debt reported entering the year.

- Current assets represented over 85% of total assets.

- Inventory levels declined 23% year over year.

- Book value per share is estimated to be near $7.50.

Trading Volume and Volatility

- Recent share price trades around $2.60-$2.70, down 53.32% from the $5.57 52-week high.

- The 52-week range currently spans from a low of $2.30 to a high of $5.57.

- Average daily trading volume is about 1,453 shares in recent data.

- Market capitalization is approximately $23.89-$24.77 million.

- Beta stands near 1.98, signaling materially higher volatility than the market.

- One-year performance shows a -44.26% decrease in share price.

- Recent daily moves included a 6.69% gain with an intraday range of $2.64-$2.71.

- Some sessions have seen volume spikes to over 257k shares versus typical levels.

Dividend and Capital Return Profile

- Dividend yield remains 0.00%, with a trailing annual dividend of $0.00 per share.

- The dividend payout ratio is 0.00%, reflecting no cash returns via dividends.

- No dividends have been paid since listing, with the annual dividend per share staying at 0.0.

- Forward dividend yield is also 0.00%, with no upcoming ex-dividend date.

- Shareholder yield is effectively 0%, indicating no meaningful buybacks or dividends.

- Retained earnings remain negative alongside cumulative net losses and -$2.83 EPS.

- Cash reserves of $213.8 million continue to be retained rather than distributed.

- Shares outstanding total about 6.54 million, with no major recent dilution.

- Peers in blockchain hardware typically show dividend yields near 0.00% as well.

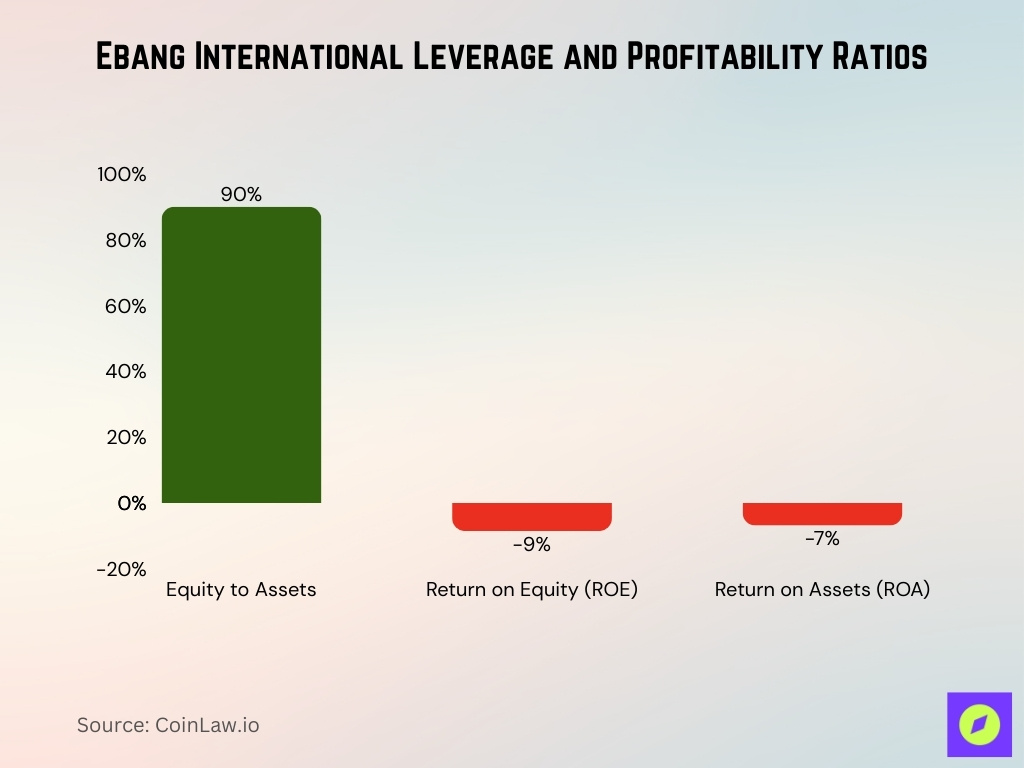

Leverage and Solvency Ratios

- Equity accounted for over 90% of total assets.

- Return on equity is approximately -8.5%, improved from -15%.

- Return on assets recorded at -6.85%.

- Debt-to-equity ratio stands at 0.00.

- The current ratio exceeded 12 times.

- The quick ratio remained above 11 times.

- Asset turnover ratio reached 0.02.

- Interest coverage is not applicable due to zero debt.

- Debt ratio maintained at 0%.

Risk Factors and Financial Health

- Piotroski F-Score is 4/9, signaling neutral financial health.

- Financial profile score registers 58/100, indicating moderate overall strength.

- Short-term assets of about $230.8 million exceed short-term liabilities of $11.9 million by a wide margin.

- The company remains debt-free with 0% debt-to-equity, and interest coverage is not applicable.

- Cash runway exceeds 3 years based on current free cash flow trends.

- H1 2025 still showed a $4.5 million net loss despite 69.46% revenue growth to $3.58 million.

Comparison with Industry Peers

- Ebang carries 0% debt-to-equity, while some peers like Riot and Marathon utilize moderate leverage.

- Ebang’s gross margin of 6.26% trails higher-margin integrated miners with margins often above 30%.

- Market cap near $24.7 million classifies Ebang as a micro-cap versus Riot’s multi-billion valuation and Marathon’s $7 billion peak.

- Institutional ownership in Ebang stays below 20%, while larger peers frequently exceed 40-60%.

- Ebang’s diversification into Fintech and renewables adds segments beyond the mostly pure-play mining focus of Riot, Marathon, and Canaan.

Frequently Asked Questions (FAQs)

$2.30 to $3.50 per share in recent trading sessions.

Approximately 6.28 million shares.

Roughly $7.34 million in revenue.

Conclusion

Ebang International’s profile reflects a company rebuilding operational momentum while maintaining a strong liquidity cushion. Narrowing losses, improving gross margins, and diversified product expansion signal progress. However, stock volatility, competitive pressure, and crypto market dependency continue to shape risk exposure. For investors seeking micro-cap exposure to blockchain infrastructure and Fintech innovation, Ebang presents a high-risk, liquidity-backed turnaround scenario with long-term optionality tied to digital asset market cycles.