The direct lending industry is at the crossroads of finance, where institutional innovation meets private capital. Over the last decade, it has transformed into a pivotal alternative to traditional banking, offering businesses and investors greater flexibility. The industry reflects rapid changes, marked by technological advancements, regulatory adjustments, and surging private credit markets. Whether you’re an investor exploring opportunities or a borrower assessing options, understanding these statistics can guide your decisions in this dynamic landscape.

Editor’s Choice

- The global private credit market topped approximately $3.0 trillion by 2025.

- Direct lending continues to dominate, representing about 50% of private credit AUM in 2025 (≈ $1.5 trillion).

- US-based direct lending funds deployed roughly $500 billion in new loans in 2025 (an estimated 11% increase year-on-year).

- Institutional investors allocated on average 30% of their private credit portfolios to direct lending in 2025.

- The average yield for direct lending portfolios climbed to 9.0%, outperforming traditional fixed-income benchmarks by ~220 basis points.

- SMEs accounted for 60% of loan demand in 2025, reinforcing their continued importance in underserved markets.

- By 2025, 90% of institutional investors expressed plans to further increase exposure to direct lending.

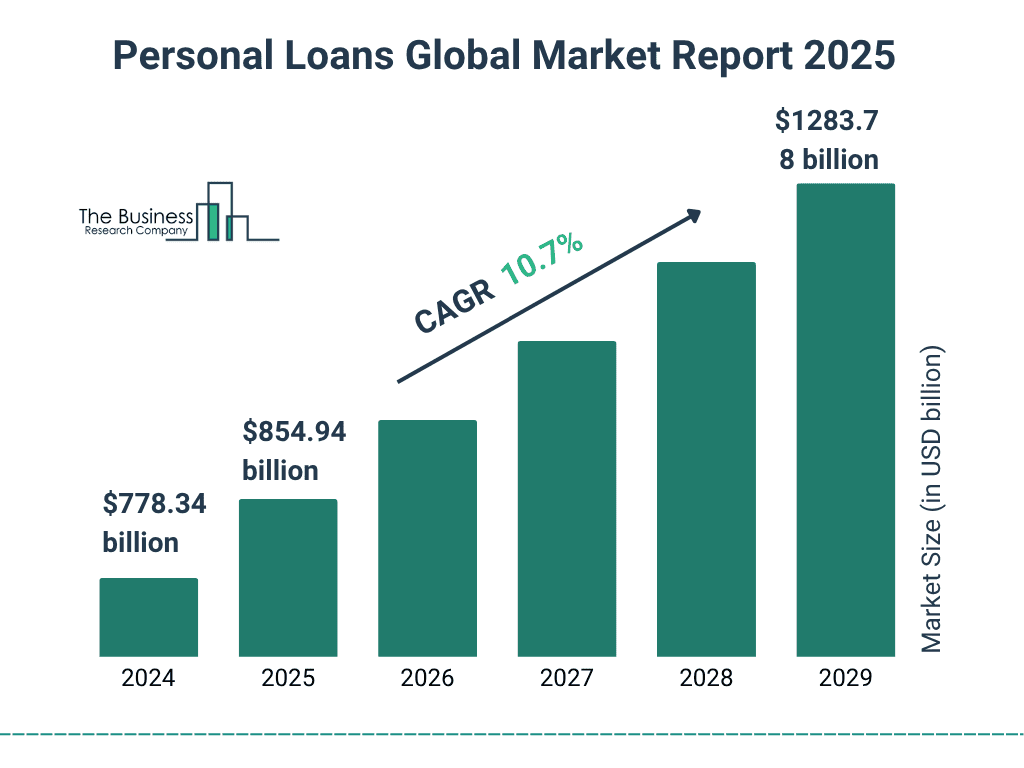

Global Personal Loans Market Growth

- By 2025, the market is projected to grow to $854.94 billion.

- The industry is forecast to expand at a strong CAGR of 10.7% over the next five years.

- By 2029, the market size is expected to hit $1.28 trillion (1283.78 billion).

- This growth reflects rising consumer borrowing, digital lending platforms, and stronger credit access worldwide.

Direct Lending Remains the Key Driver of Overall Private Credit Growth

- Direct lending funds raised $220 billion globally in 2025.

- The share of direct lending in private credit rose to 54% in 2025.

- Institutional investors increasingly prefer direct lending for its stable yield and default rates of ~2.1% in 2025.

- The mid-market lending sector grew by 10% in 2025, driven by SME and startup demand.

- Debt consolidation and refinancing transactions in direct lending rose by 18% in 2025.

- Direct lending outpaced traditional banking in approval times, averaging 12 days vs 45 days in conventional systems in 2025.

- The technology and healthcare sectors led borrower demand, accounting for 38% of all direct loans in 2025.

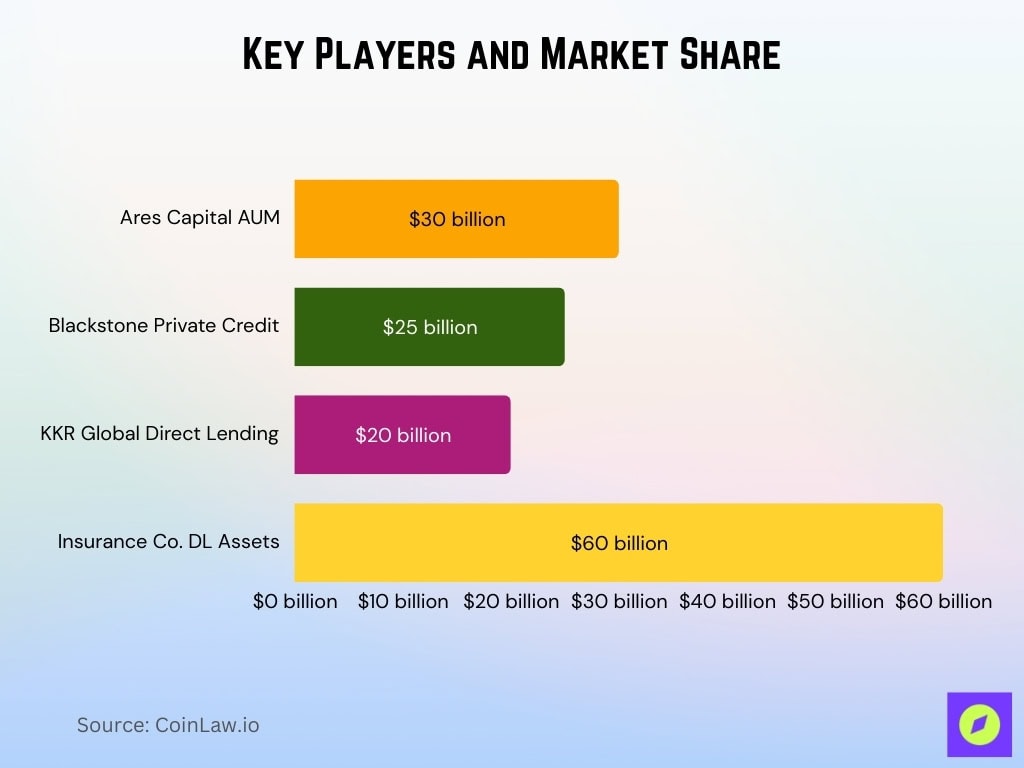

Key Players and Market Share

- Ares Capital Corporation reported $30 billion in direct lending AUM in 2025.

- Blackstone’s private credit platform managed $25 billion in direct loans in 2025.

- KKR’s global direct lending portfolio reached $20 billion in 2025.

- Insurance companies managed nearly $60 billion in direct lending assets in 2025.

- The top 10 global direct lending funds captured over 65% of the market share in 2025.

- In Europe, BlueBay Asset Management accounted for 28% of the regional direct lending market share in 2025.

- The rise of boutique private credit firms contributed to a 12% market expansion in 2025.

Loan Performance Metrics

- Direct lending default rates remained low at ~1.8% in 2025.

- The average loan‐to‐value (LTV) ratio for direct loans stood near 58% in 2025.

- Middle-market loans delivered annualized returns of 11.0% in 2025.

- Recovery rates on distressed loans averaged 78% in 2025.

- The weighted average interest rate on direct loans rose to 9.5% in 2025.

- Prepayment penalties accounted for 11% of lender revenue in 2025.

- Direct lending portfolios experienced volatility of ~0.4% in 2025.

Regulatory Environment

- The US SEC extended the deadline for enhanced private fund disclosure compliance to October 1, 2026, while signaling further adjustments.

- The EU’s AIFMD regime is under review for a “AIFMD 2.0” update in 2025, tightening risk and transparency rules.

- Proposed changes in the EU are considering 8× EBITDA leverage caps in direct lending to limit systemic risk.

- Singapore’s regulatory environment evolved to include tax rebates and reporting relief for private credit funds in 2025.

- The UK’s Prudential Regulation Authority continues to enforce stricter stress testing protocols for direct lending firms in 2025.

- ESG and sustainability mandates now compel ~25% of private credit managers to embed sustainability-linked lending practices in 2025.

- AML and compliance changes increased operational costs by ~7% for private credit funds in 2025.

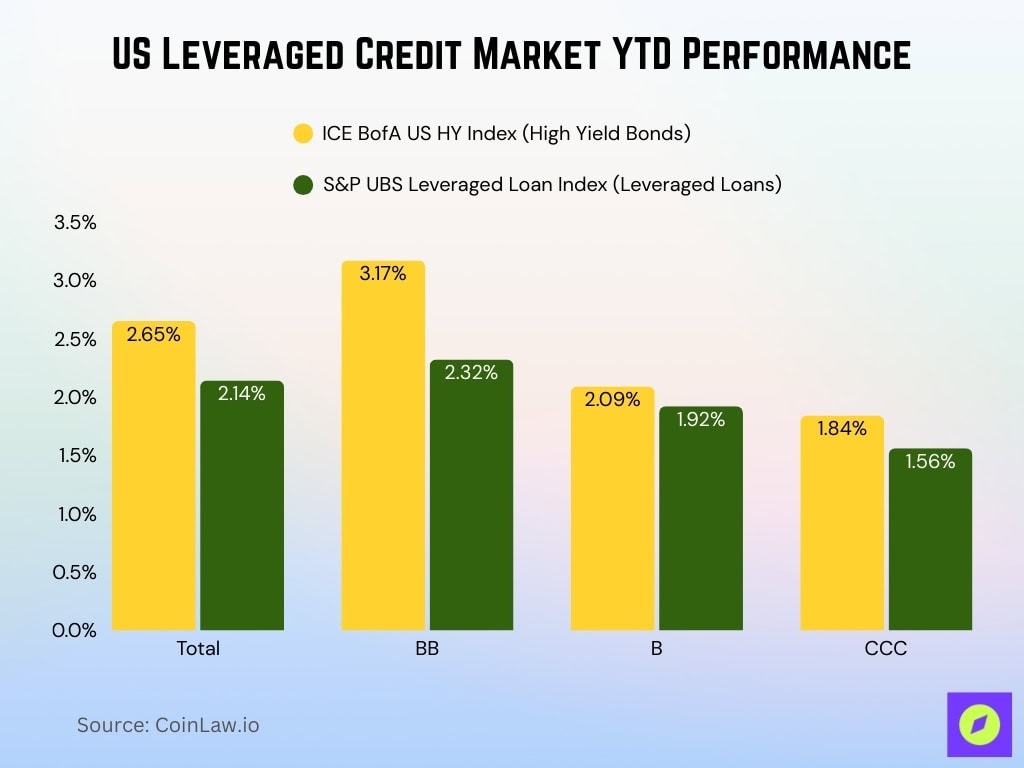

US Leveraged Credit Market YTD Performance

- The total return for US high-yield bonds (ICE BofA US HY Index) reached 2.65%, compared to 2.14% for leveraged loans.

- In the BB-rated segment, high-yield bonds posted 3.17%, outperforming leveraged loans at 2.32%.

- For B-rated credit, high-yield bonds returned 2.09%, while leveraged loans delivered 1.92%.

- The riskiest CCC-rated debt showed more modest gains, with high-yield bonds at 1.84% and leveraged loans at 1.56%.

Opportunities for Investors

- Institutional demand for direct lending is projected to grow by 20% in 2025, with pension funds and endowments driving momentum.

- Private wealth investors increased allocations to direct lending by 30% in 2025, drawn by high yield and low correlation to public markets.

- Emerging markets remain attractive, with Asia-Pacific direct lending growth forecast at 32% annually in 2025.

- The rise of co-investment opportunities enabled investors to directly participate in $100 billion+ large-scale transactions in 2025.

- ESG-focused funds are expected to attract $60 billion in new capital by 2025, driven by sustainability mandates.

- Real estate-backed direct loans gained traction, representing 18% of total direct lending activity in 2025.

- Technology and healthcare sectors continue to dominate, offering investors access to high-growth industries, making up 40% of new direct loans in 2025.

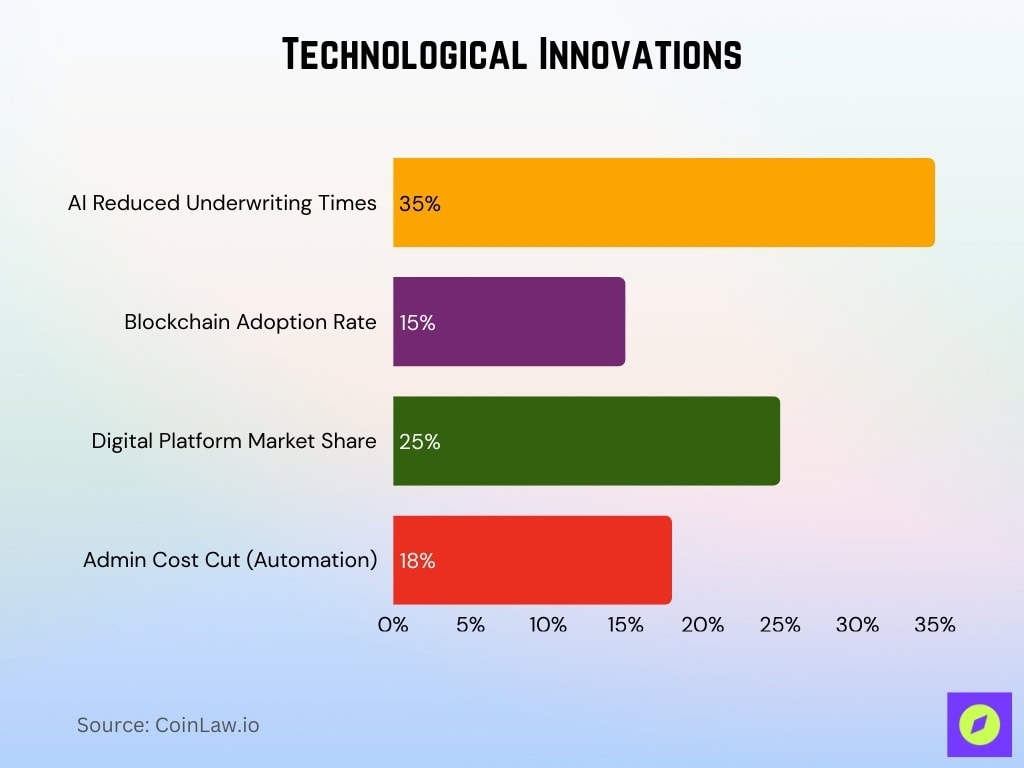

Technological Innovations

- AI-driven risk assessment tools reduced underwriting times by ~35% in 2025.

- Blockchain adoption in direct lending grew so that ~15% of funds used distributed ledger systems in 2025.

- Digital lending platforms captured 25% of the direct lending market in 2025.

- Automation cut administrative costs for direct lending funds by 18% in 2025.

- Predictive analytics helped lenders identify higher-yield, lower-risk opportunities, improving portfolio returns by ~1.5 pp in 2025.

- Cloud-based systems enabled real-time reporting, boosting transparency and investor confidence across direct lending in 2025.

- Data security investments rose by 25% in 2025, reflecting heightened cyber risk concerns in private credit.

Recent Developments

- The largest direct lending transaction in 2025 involved a $4.0 billion loan for a tech M&A deal.

- Private credit secondary markets expanded by 22% in 2025.

- ESG-linked direct loans rose by 25% in 2025 with incentives tied to sustainability milestones.

- Cross-border lending surged by 30% in 2025, reflecting global capital flows.

- The first blockchain-based syndicated direct loan was issued in Q1 2025, marking a key innovation milestone.

- Direct lending funds focused on distressed debt achieved returns exceeding 17% in 2025.

- In Q3 2025, credit funds held $250 billion in dry powder, underscoring capital readiness.

Frequently Asked Questions (FAQs)

$74.1 billion raised globally in H1 2025, with 56.6% from direct lending funds, and 87 funds closed.

The Q2 2025 Private Credit Default Index showed 1.76%, down from 2.42% in Q1.

An HPS-led package for Consumer Cellular totaled ~$3.6 billion in H1 2025.

Direct lending accounts for roughly ~36% of private credit AUM.

Conclusion

The direct lending industry has emerged as a robust pillar of the global financial ecosystem, offering high returns, stability, and innovation. The sector is poised for continued growth, fueled by institutional demand, technological advancements, and favorable regulatory changes. For investors seeking diversification and superior yields, direct lending presents an increasingly attractive avenue. With its ability to adapt to economic shifts and leverage emerging trends, the future of direct lending looks exceptionally promising.