Digital wallets are reshaping how people manage money, not just for quick payments but for everyday banking needs. More than half of the global population already uses a digital wallet, and the growth is accelerating. Industries from retail to remittances are seeing clear shifts: online merchants increasingly optimize checkout for wallets, while banks and FinTech firms adjust their strategy to stay relevant. In many developing economies, mobile‑money wallets now extend banking services to previously unbanked populations. Read on to explore the latest data comparing digital‑wallet use and traditional bank accounts worldwide.

Editor’s Choice

- Global digital wallet transaction value projected to reach around $17 trillion by 2029, with most growth driven by e‑commerce and mobile‑first markets.

- 65% of U.S. adults are using digital wallets, versus 57% in 2024.

- 76% of adults globally own a bank account.

- 79% of adults worldwide have a financial account (bank or mobile money).

- 17% of consumers are likely to switch financial institutions.

- 34% of consumers use mobile banking apps daily.

- Digital-only banks account for 22% of all new global accounts.

- 45% of U.S. point-of-sale transactions are via digital wallets.

Recent Developments

- 68.8% of central banks operate instant payment systems.

- 70–80% of U.S. financial institutions are expected to receive instant payments by 2028.

- Global A2A payment volumes to hit 186 billion transactions by 2029.

- 39 million neobank users in North America.

- The neobanking market is valued at $210 billion.

- 50% of global e-commerce is via digital wallets.

- 21% rise in fraudulent activity in financial services.

- 78% prioritize real-time fraud mitigation tools.

- Digital wallets to exceed 50% of e-commerce value

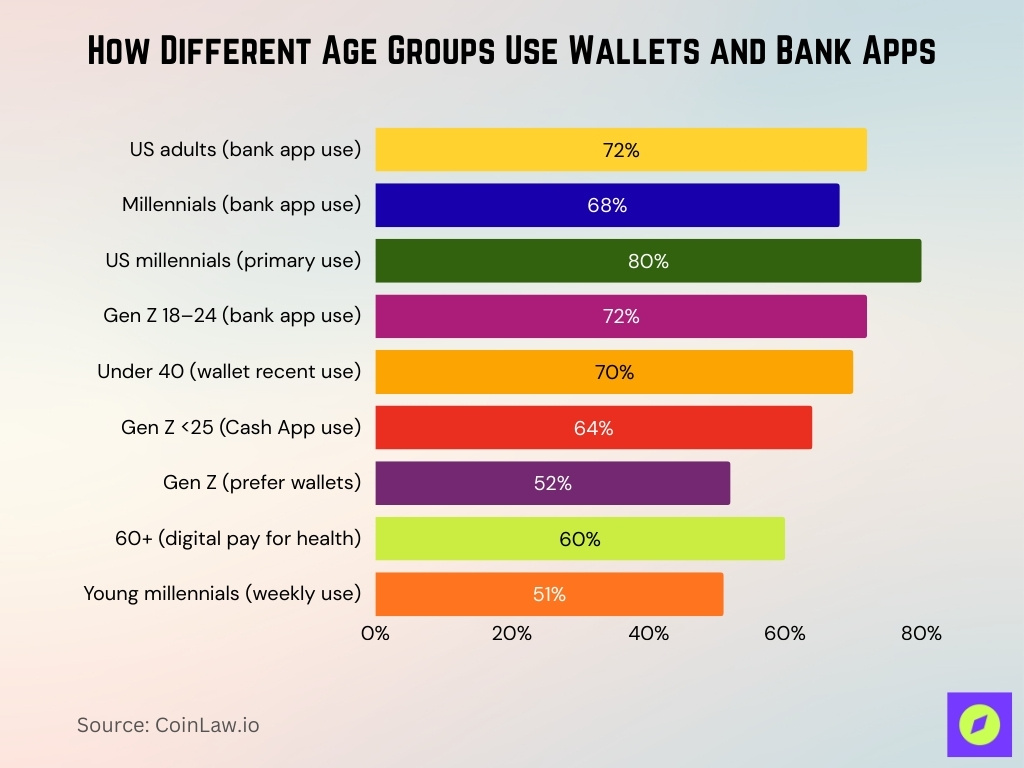

Age-Based Adoption of Digital Wallets vs Bank Accounts

- 72% of US adults use mobile banking apps.

- 68% of millennials primarily use mobile banking apps.

- 80% of millennials in the US use mobile banking as their primary method.

- 72% of Gen Z aged 18-24 actively use mobile banking apps.

- 70% of consumers under 40 used digital wallets recently.

- 64% of Gen Z under 25 actively use Cash App.

- 52% of Gen Z prefer digital wallets over cards.

- 60% of adults over 60 are comfortable with digital payments for medical expenses.

- 51% of younger millennials use mobile wallets weekly.

Digital Wallets vs Bank Accounts by Country

- In 2024, 52.9% of the global population used digital wallets.

- A handful of countries lead digital‑wallet adoption, for example, in 2023, some markets like India, Indonesia, and Thailand reported wallet penetration as high as ~90% among consumers.

- In the United States, 44.9% of smartphone owners used proximity mobile payments in 2024.

- In North America in 2024, digital wallets accounted for around 39% of e-commerce transactions and about 16% of in-store payments.

Urban vs Rural Usage Patterns

- Urban areas exhibit a 75% mobile banking adoption rate.

- Rural areas show a 40% mobile banking adoption rate.

- Rural China’s digital payment usage reached 29.36%.

- Southeast Asia urban daily usage exceeds 80% among smartphone owners.

- Rural Southeast Asia’s digital wallet penetration is below 30%.

- Sub-Saharan Africa rural mobile money drives 40% adult accounts.

- Rural Cameroon mobile payments are at 65.3% with 34.7% banked.

- In low/middle-income economies, digital payments at 62% adults.

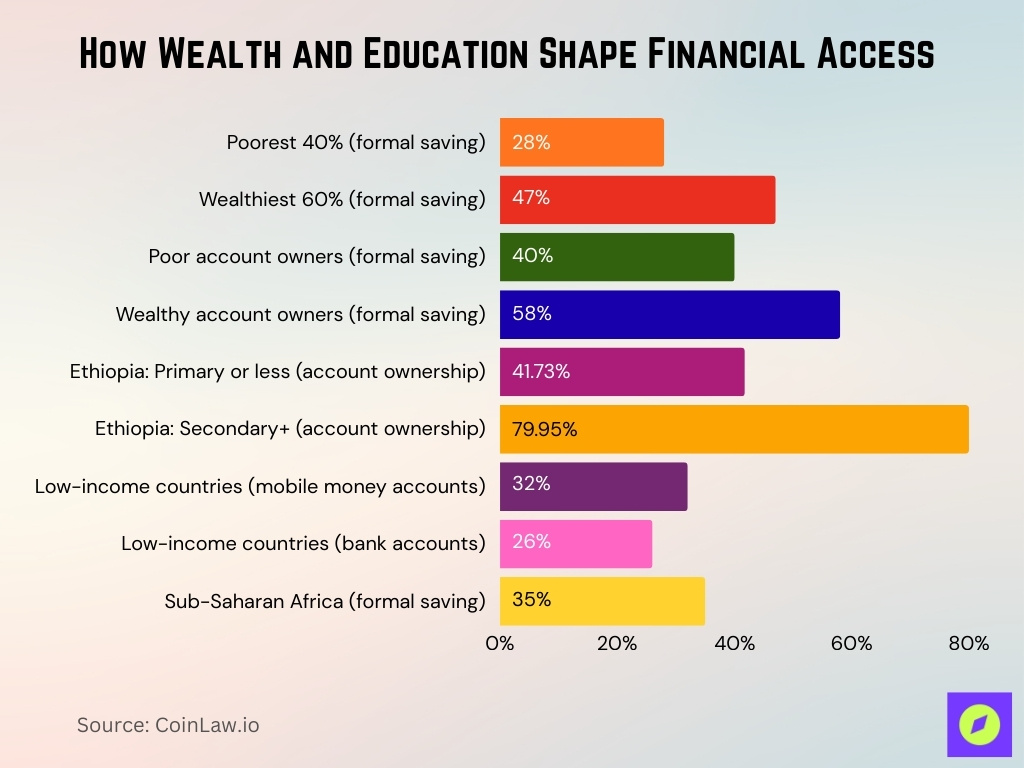

Income and Education Differences in Adoption

- Adults in the poorest 40% of households save formally at a 28% rate.

- Adults in the wealthiest 60% of households save formally at a 47% rate.

- Account owners in poorer households save formally at 40%.

- Account owners in wealthier households save formally at 58%.

- Ethiopians with primary education or less own accounts at 41.73%.

- Ethiopians with secondary education or more own accounts at 79.95%.

- Low-income countries show 32% with mobile money accounts.

- Low-income countries show 26% with traditional bank accounts.

- Sub-Saharan Africa’s formal savings reached 35% of adults.

Financial Inclusion Driven by Digital Wallets

- 75% adults in LMICs own financial accounts.

- 40% adults in LMICs save formally.

- 61% adults in LMICs make/receive digital payments.

- 10% adults in developing economies save via mobile money.

- 46% financial accounts in Sub-Saharan Africa are from mobile money.

- 37-40% adults in SSA and LAC hold mobile money accounts.

- 79% global adults have formal account ownership.

- 13% low-income adults save via traditional banks, rising to 28% with mobile money.

- Over half of LMIC accounts are digitally enabled via mobile phones.

Account Ownership Among Unbanked and Underbanked Populations

- 79% global adults hold formal accounts.

- 1.3 billion adults worldwide remain unbanked.

- 75% account ownership in low/middle-income economies.

- 900 million unbanked own mobile phones.

- 530 million unbanked have smartphones.

- 58% account ownership in Sub-Saharan Africa.

- 32% low-income adults have mobile money accounts.

- 26% low-income adults have traditional bank accounts.

- 22% unbanked in LMICs distrust financial institutions.

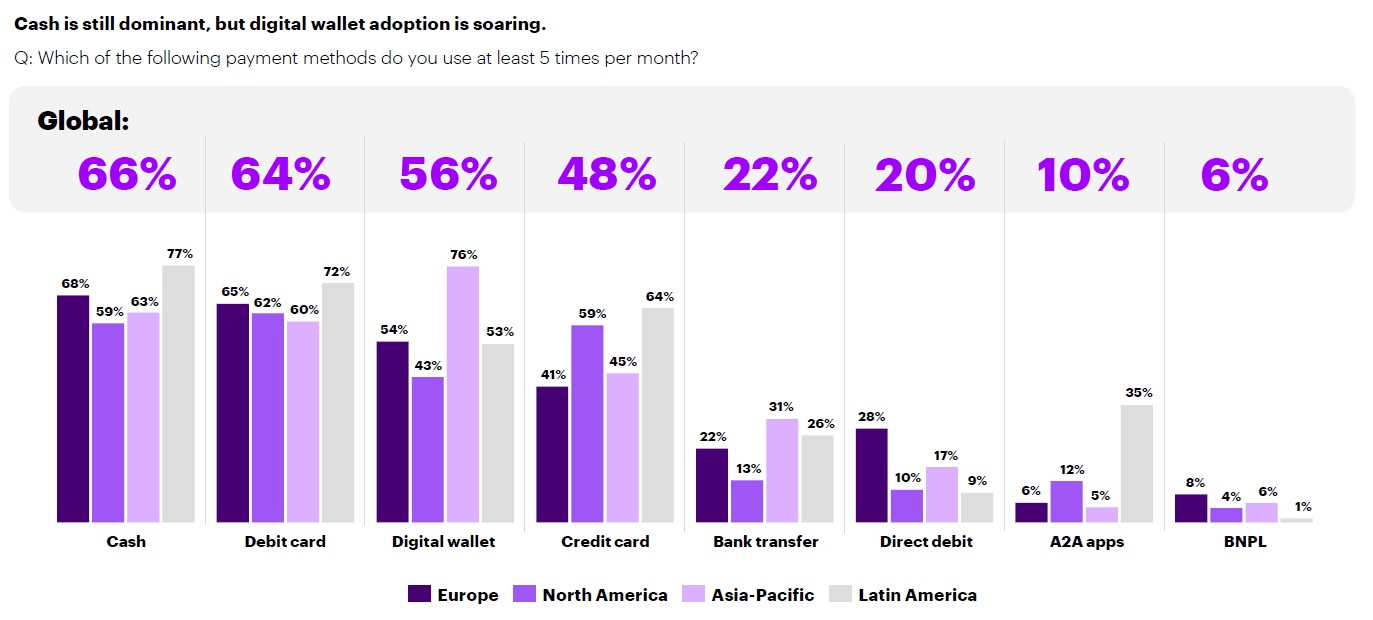

Global & Regional Usage of Payment Methods

- Cash remains the most used payment method globally, with 66% using it at least 5 times per month.

- Europe leads in cash usage at 68%, while North America is lower at 59%.

- Debit cards are used by 64% globally, with Latin America showing the highest usage at 72%.

- Digital wallets see 56% global usage, with Asia-Pacific far ahead at 76%.

- Credit cards are used by 48% globally; North America leads at 59%, followed by Latin America at 64%.

- Bank transfers are used by only 22% globally, but Asia-Pacific shows higher usage at 31%.

- Direct debit is used by 20% globally, highest in Europe at 28%.

- Account-to-account (A2A) apps see low global usage at 10%, but Latin America leads sharply with 35%.

- Buy Now, Pay Later (BNPL) adoption is just 6% globally, with Europe showing the highest at 8%, and Latin America the lowest at 1%.

Digital Wallets as Complements vs Substitutes to Bank Accounts

- 32% low-income adults hold mobile money accounts vs 26% bank accounts.

- 75% LMIC accounts are digitally enabled via mobile phones.

- 22% low-income adults banked solely via financial institutions.

- Mobile money drives all recent growth in low/middle-income account ownership.

- 62% mobile money providers partner with banks for services.

- 44% providers offer credit alongside mobile money accounts.

- 59.7% Ghanaian adults have mobile money accounts.

- Sub-Saharan Africa mobile money exceeds bank accounts in 14 countries.

- 2.1 billion registered mobile money accounts globally.

Frequency of Use: Digital Wallets vs Bank Accounts

- 62% adults in LMICs made/received digital payments.

- 82% account owners in LMICs conducted digital payments.

- 42% adults worldwide made digital merchant payments.

- 75% LMIC adults hold accounts, but only 62% use them digitally.

- 15% global adults hold mobile-money accounts.

- 80% account owners use digital payments regularly.

- 30% global point-of-sale volume from digital wallets.

- 56% US consumers use wallets monthly.

- 53% Americans use wallets more than traditional methods.

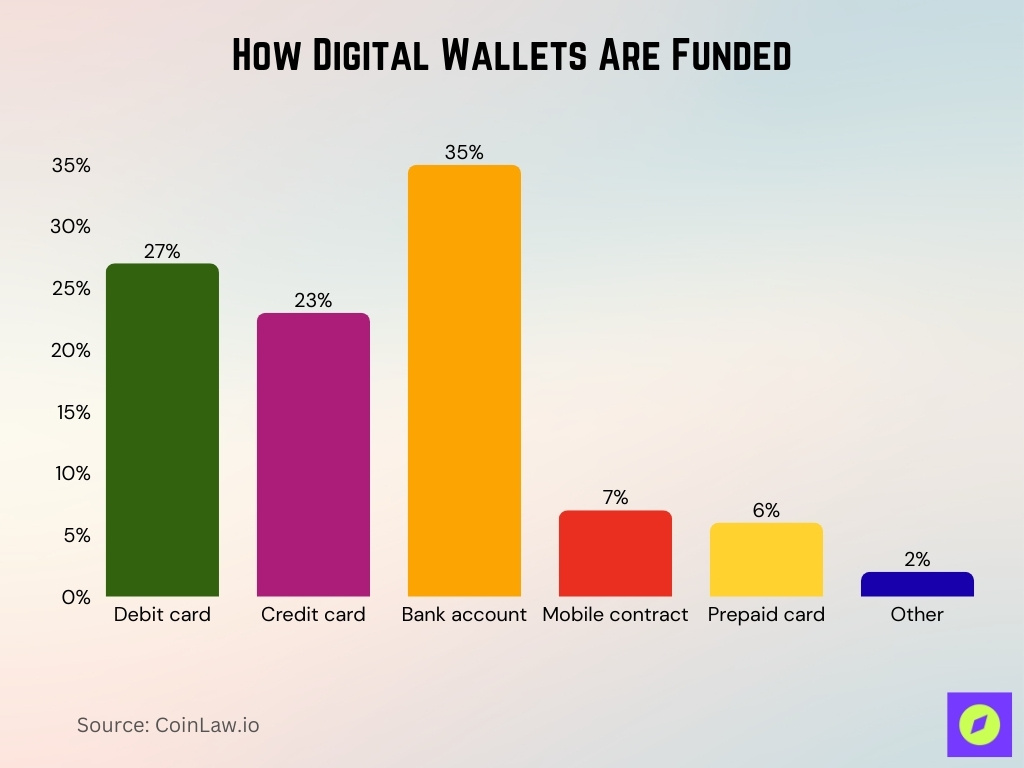

How Digital Wallets Are Funded

- 35% of digital wallets are funded through a bank account, the most common funding method globally.

- 27% rely on a debit card as their primary source of funds.

- 23% of wallets are topped up using a credit card.

- Together, 56% of all wallets are funded by cards (debit + credit).

- 7% are funded via a mobile contract or prepaid account balance.

- 6% use a prepaid card to load funds into their digital wallet.

- Just 2% fall into the “other” funding category, indicating minimal use of alternative sources.

Online and In-App Payments: Wallets vs Bank Accounts

- Digital wallets account for 49–56% global e-commerce transaction value.

- Digital wallets hold a 50% share of the total e-commerce transaction value.

- Credit cards capture 22% of global e-commerce payments.

- Debit cards represent 12% of the e-commerce transaction share.

- Asia-Pacific digital wallets dominate with 82% e-commerce share.

- >50% e-commerce transaction value from digital wallets.

- Digital wallets drive 75% contactless payment growth.

- PayPal commands 20–25% global digital wallet volume.

- Apple Pay and Google Pay share 30–35% mobile transactions.

Cross‑Border and Remittance Payments via Wallets vs Bank

- 42% users prefer digital wallets for cross-border transfers.

- 60% global remittances processed via fintech platforms.

- Digital wallet remittances reach $822 billion annually.

- 92% cite transaction speed for wallet remittance preference.

- 6.49% average bank remittance cost vs lower wallet fees.

- Digital cross-border remittances hit $161.4 billion transaction value.

- 46% digital remittance flows in emerging markets.

- 44% use money transfer operators vs 20% banks for cross-border.

- Digital wallets processed over $60 billion in remittances.

Average Number of Accounts per User (Wallets and Bank Accounts)

- 43% US wallet users link two or more bank accounts.

- 33% US wallet users link at least two debit/credit cards.

- 1.75 billion global digital banking accounts exist.

- 20% consumers use multiple digital wallets.

- 36.2% users rely on two financial apps.

- 6.2% users operate three financial apps.

- Intermediate tech users average 2.1 finance apps.

- 57.5% daily users rely on one financial app.

Interest‑Bearing Balances vs Non‑Interest Wallet Balances

- Traditional banks offer 0.45% average savings interest rate.

- 93% digital wallets pay no interest on balances.

- Digital banks provide up to 15% p.a. savings rates.

- 26.5% Gen Z savings held in non-interest digital wallets.

- Maya wallet base rate at 3.5% p.a., boostable to 15%.

- 4.88% p.a. on digital bank basic deposit accounts.

- 13.3% Gen Z money parked in non-yielding digital wallets.

- Hybrid digital banks yield up to 6.5% on time deposits.

Fees and Costs: Wallets vs Bank Accounts

- $0.30 average wallet P2P transfer fee vs $15 bank wire.

- 1-2% wallet international transfer fees vs 5-7% bank wires.

- 93% wallets charge no monthly maintenance fees.

- $12 average bank overdraft fee is absent in wallets.

- 0.5-1% wallet FX conversion vs 3-5% bank spreads.

- 78% emerging market users cite low fees for wallet choice.

- $35 average bank monthly fee waived by digital platforms.

- 2.5% wallet cash-out fees in Sub-Saharan Africa.

- 85% underbanked prefer wallets due to no minimum balances.

Customer Trust and Perceived Security Levels

- 90% financial institutions use AI for fraud detection.

- AI fraud detection reduced fraudulent activities by 36%.

- 83% consumers worry about identity theft in digital payments.

- 93% digital wallets employ tokenisation for security.

- 50% fraud involves AI-powered deepfakes and phishing.

- 45% ransomware infections originate from phishing.

- 44% confirmed breaches include a ransomware component.

Frequently Asked Questions (FAQs)

Digital wallets are expected to account for 49–56% of global e‑commerce transaction value in 2025.

The global mobile wallet market is projected to grow at a CAGR of 18.56% between 2025 and 2032.

Digital wallet users globally are projected to reach 5.6 billion by the end of 2025.

Conclusion

Digital wallets now play a central role in global finance, serving not only as convenient payment tools but also as pathways to financial inclusion, more affordable remittances, and hybrid financial behavior. Wallet-based cross-border payments are accelerating, transaction fees remain competitive, and account-ownership growth reflects rising acceptance worldwide.

While wallets rarely offer interest-bearing balances and security concerns remain part of user decision-making, improvements in fraud prevention and authentication continue to strengthen trust. Rather than replacing banks, wallets and traditional accounts coexist, offering users flexibility to choose the most efficient option for each financial task.