Imagine receiving an alert for a payment you didn’t authorize. Your heart races as you wonder how it happened. Digital payment fraud is more than just an inconvenience; it’s a rising global challenge that targets individuals, businesses, and financial institutions alike. As digital transactions dominate, fraudsters are becoming more sophisticated, leveraging new technologies and exploiting vulnerabilities in payment systems. Understanding the scale and nuances of digital payment fraud is the first step to safeguarding your finances and staying ahead of evolving threats.

Editor’s Choice

- The global cost of digital payment fraud is projected to exceed $50 billion in 2025.

- Payment fraud attack rates remain high at 3.3% across global transactions.

- Credit card fraud continues to lead all digital payment fraud types worldwide.

- E-commerce platforms saw a significant rise in fraud attempts, especially during major sales events, with year-over-year increases reported across multiple markets.

- Around 79% of organizations reported being targeted by payment fraud attacks.

- Synthetic identity fraud is now among the fastest-growing fraud types, with estimated losses crossing $35 billion.

- In Q1 2025, over 365,000 identity theft cases were reported, with 80% linked to synthetic identities in new account fraud.

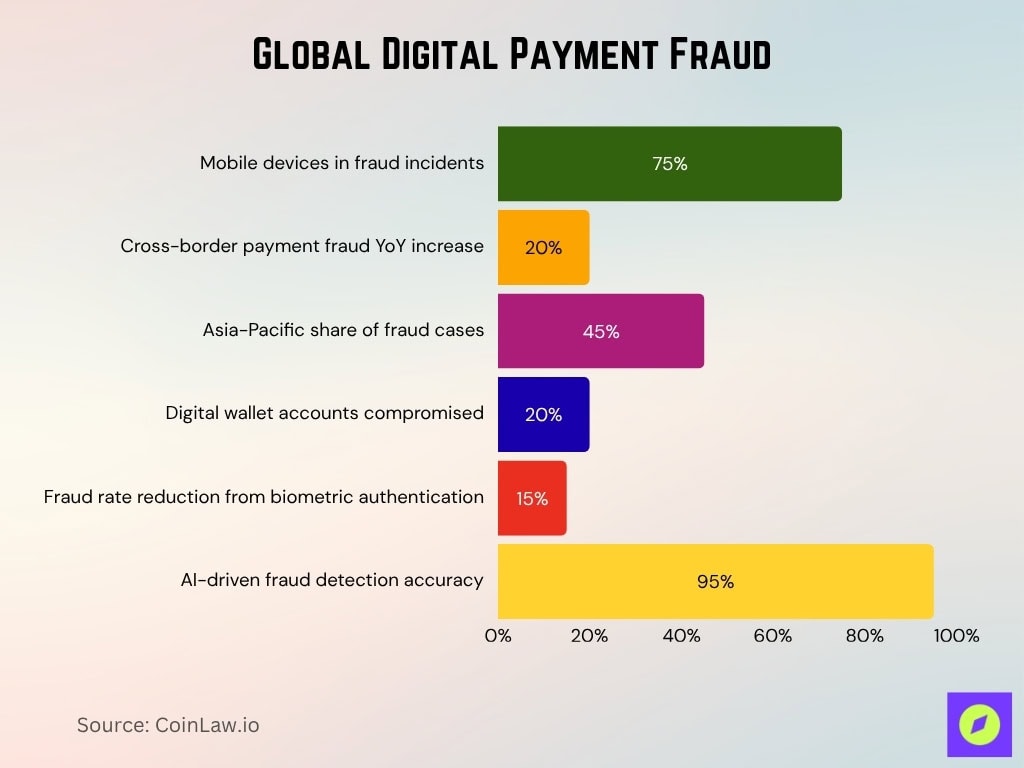

Global Digital Payment Fraud Statistics

- ~75% of digital payment fraud incidents now involve mobile devices.

- Cross‑border payment fraud has increased by 20% year‑over‑year.

- Over $1.5 trillion in global digital payments were flagged for fraud review, with $50 billion confirmed fraud.

- The Asia‑Pacific region remains a hotspot, accounting for 45% of global fraud cases.

- 20% of digital wallet accounts were compromised in 2025.

- Biometric authentication adoption reduced fraud rates by 15% among users.

- AI‑driven fraud detection systems achieved 95% average accuracy globally.

Regional Analysis of Fraud Incidents

- In North America, digital payment fraud losses now surpass $15 billion, with credit card fraud still most widespread.

- Europe sees phishing scams rise by 35% as fraudsters exploit contactless and remote payments.

- Asia‑Pacific is responsible for 48% of global fraud incidents following mass mobile wallet adoption.

- In Africa, mobile money fraud surged 28% indicating growing pressure on mobile banking systems.

- Latin America reported a 25% increase in e‑commerce payment fraud as online retail expands.

- The Middle East experienced 22% growth in cross‑border fraudulent transactions targeting trade flows.

- Australia and New Zealand achieved a 15% decline in fraud losses through tougher regulations and tech safeguards.

Prevalence of Each Type of Payment Fraud

- Credit card fraud still dominates, with around 35% of all fraud cases globally in 2025.

- Account takeover (ATO) fraud has surged by 30%, heavily impacting online retailers and subscription services.

- Phishing and smishing scams now represent 18% of reported fraud attempts as tactics grow more sophisticated.

- Synthetic identity fraud has exploded, up 100%+ since 2022, making it one of the fastest‑growing fraud types.

- Refund fraud has climbed 28% especially targeting online merchants during return periods.

- Fraud on peer-to-peer (P2P) payment platforms rose 22% with many users reporting unauthorized transactions.

- Card‑not‑present (CNP) fraud accounts for 50% of all e‑commerce fraud in 2025.

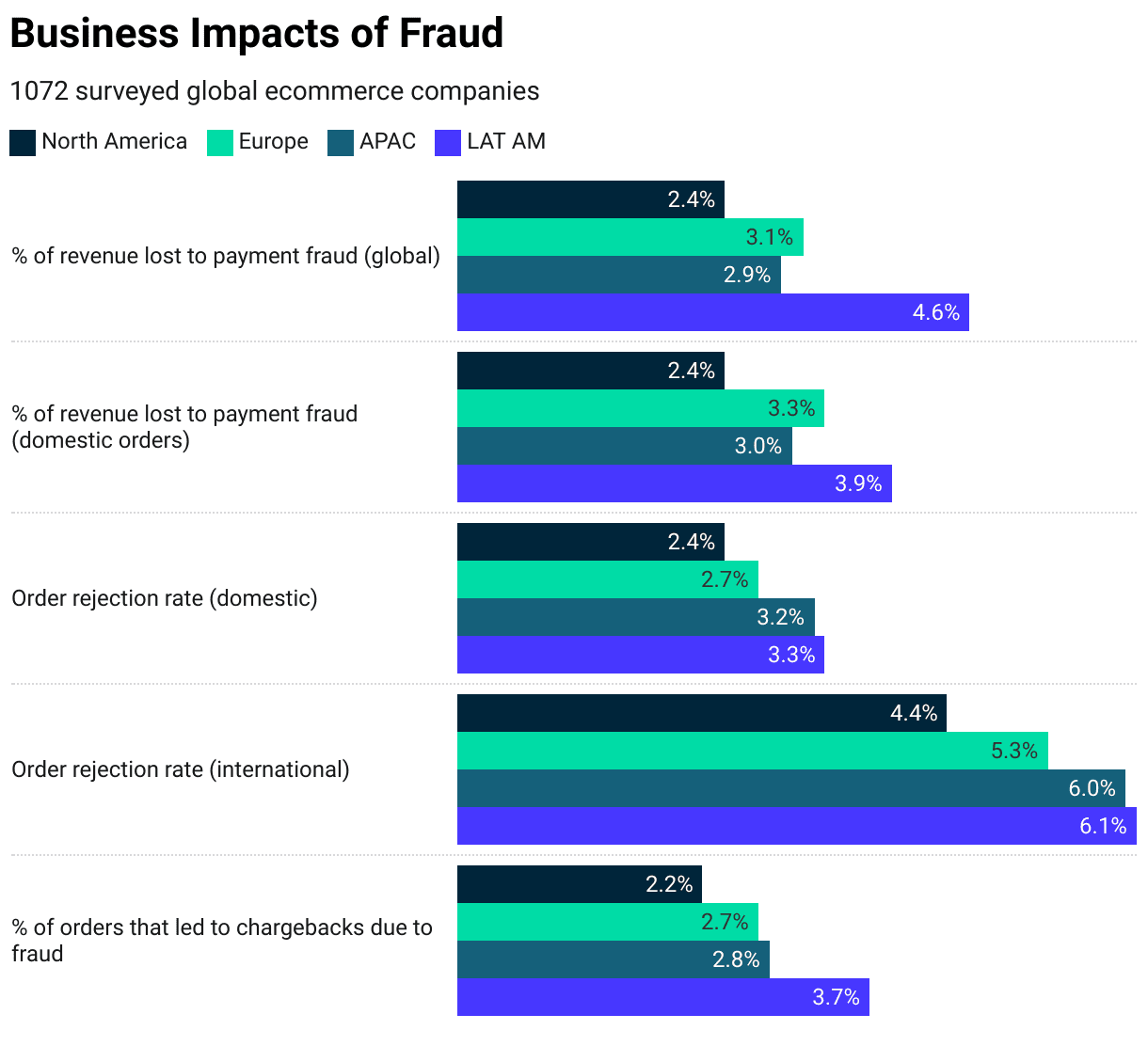

Business Impacts of Fraud

- Global ecommerce companies lose 2.4% to 4.6% of revenue to payment fraud, with Latin America facing the highest losses at 4.6%.

- Domestic orders experience 2.4% to 3.9% revenue loss to fraud, with Europe at 3.3% and LATAM at 3.9% leading the impact.

- Domestic order rejection rates range from 2.4% in North America to 3.3% in LATAM, showing stricter controls in emerging regions.

- International orders face higher rejection, between 4.4% in North America and 6.1% in LATAM, reflecting greater cross-border risk.

- Chargebacks due to fraud affect 2.2% to 3.7% of orders, with Latin America again leading at 3.7% compared to 2.2% in North America.

New Tech Means More Sophisticated Fraud

- Deepfake technology now aids in 7% of social engineering scams.

- AI and machine learning have enabled fraudsters to automate phishing campaigns, boosting the success rate by 30%.

- Fraud involving cryptocurrency wallets surged by 25% as vulnerabilities in blockchain are exploited.

- IoT‑based fraud now plays a role in 12% of global fraud cases.

- QR code scams rose by 35% tricking users into disclosing payment credentials.

- Synthetic identity fraud using AI‑generated identities grew 45%, complicating fraud detection.

- Fraud driven via dark web tools and stolen data boosted cyber‑enabled payment fraud by 28%.

Modern Challenges for Financial Institutions

- Regulatory compliance is now cited as a major challenge by ~70% of institutions.

- The shift to real‑time payments has lifted fraud risk by 25% as detection windows shrink.

- Legacy systems are still used by 35% of institutions, limiting defense against modern fraud.

- Insider fraud is on the rise, with a 40% increase in reported cases.

- Integration with third‑party fintechs introduces exposure, with 25% of institutions linking fraud to such partnerships.

- Cross‑border fraud in the financial sector grew by 20% in 2025.

- Over 80% of banks say staying ahead of fraud tactics demands continuous investment in advanced technologies.

AI Shines in Fraud Prevention

- AI‑powered fraud detection systems today reach 95% accuracy in spotting suspicious transactions.

- Real‑time AI monitoring has reduced fraud losses by 30% for institutions using these tools.

- Predictive analytics with AI now identifies potential fraud patterns with 83% accuracy before they occur.

- Chatbots and AI verification systems have cut phishing‑related breaches by 24%.

- AI integration has shortened investigation times by 45%, enabling faster resolution.

- Businesses using AI in fraud prevention report a 22% increase in customer trust as fraud incidents drop.

Mitigating Payment Risk in the Modern Age

- Tokenization of sensitive payment data has reduced fraud risks by 34% in industries adopting the method.

- Biometric authentication, like fingerprint and facial recognition, has improved transaction security by 22%.

- Multi‑factor authentication (MFA) adoption increased by 40%, dramatically cutting unauthorized account access.

- Encryption of digital wallets led to an 18% drop in wallet‑based fraud.

- Real‑time transaction flagging with machine learning cut fraud attempts during online sales events by 30%.

- Educating consumers about fraud tactics yielded a 15% decrease in victimization rates, especially among older users.

- Establishing global anti‑fraud coalitions improved cross‑border fraud response times by 22%.

Protecting Your Business and Your Customers

- Implementing end‑to‑end encryption ensures that payment data remains secure during transactions, reducing fraud incidents by 30%.

- Fraud liability shifts to merchants has incentivized stronger prevention efforts, saving businesses $4 billion annually.

- Customer authentication systems like one‑time passwords (OTPs) have decreased unauthorized transactions by 22%.

- Offering fraud insurance now covers many risks, with 30% of small businesses adopting it in 2025.

- Conducting regular security audits has reduced vulnerabilities by 35% in companies with thorough assessments.

- Encouraging customers to use secure payment methods like digital wallets has led to a 20% drop in fraud attempts.

- Collaboration with fraud prevention firms has saved businesses an estimated $7 billion in 2025.

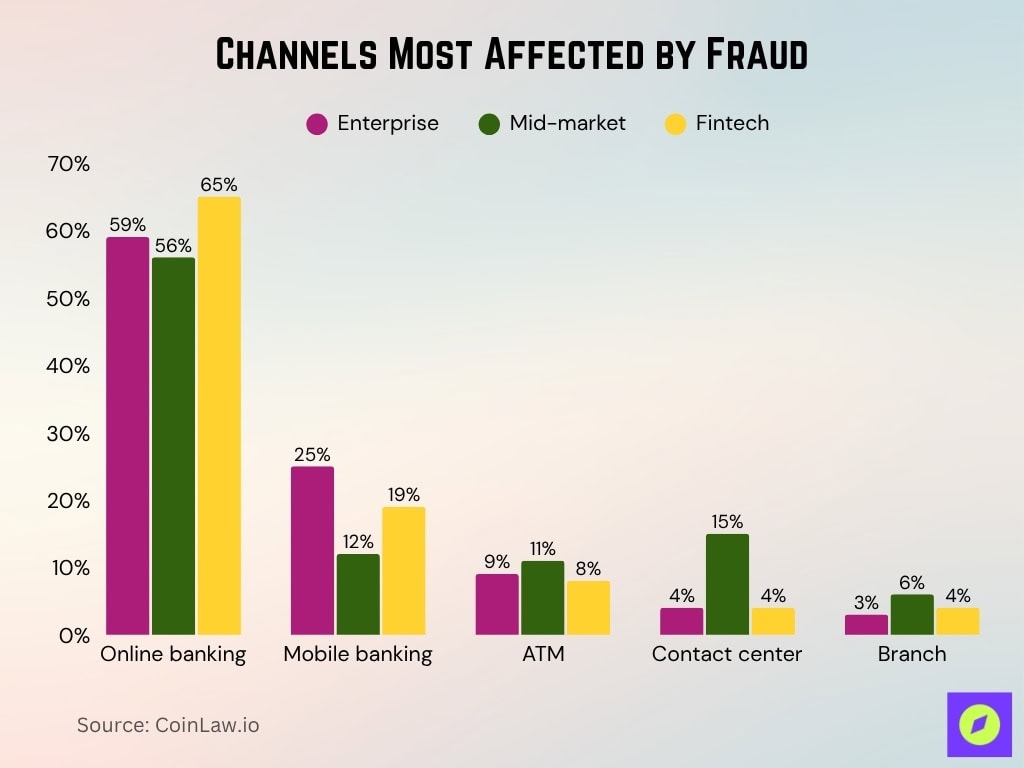

Channels Most Affected by Fraud

- Online banking remains the top fraud channel, impacting 59% of enterprises, 56% of mid-market firms, and a striking 65% of fintechs.

- Mobile banking fraud hit 25% of enterprises, compared to 12% of mid-market and 19% of fintech organizations.

- ATM fraud was reported by 9% of enterprises, 11% of mid-market firms, and 8% of fintechs.

- Contact center fraud is most severe in mid-market firms (15%), while both enterprise and fintech reported just 4%.

- Branch fraud remains relatively low, with 3% of enterprises, 6% of mid-market firms, and 4% of fintechs affected.

Fraud Prevention Strategies and Technologies

- Behavioral analytics tools monitor transaction patterns, reducing fraud by 40% for businesses adopting them.

- Blockchain technology provides tamper‑proof records, minimizing cross‑border payment risks by 25%.

- Dynamic CVV technology has cut credit card fraud rates by 22% especially in card‑not‑present transactions.

- Fraud detection APIs integrate smoothly, helping merchants identify fraud in real time with ~90% detection speed.

- Geolocation verification ensures legitimate transactions, decreasing mobile payment fraud by 28%.

- Partnering with global fraud prevention networks has improved detection accuracy by 35% for e‑commerce businesses.

- Continuous customer education campaigns on phishing and fraud have led to a 16% drop in scam success rates.

Recent Developments in Digital Payment Fraud

- Crypto‑related fraud cases climbed 20% in 2025 as the adoption of digital assets widens.

- Deepfake scams using AI‑generated videos to impersonate individuals have increased by 25%.

- Fraud in embedded finance services rose by 18% as integrated platforms expose new risks.

- QR code payment scams surged by 51%, especially in public spaces like restaurants and transit hubs.

- Cybercriminals using AI‑powered hacking tools pushed cyber‑enabled payment fraud up 30%.

- “Fraud‑as‑a‑service” platforms fueled a 28% rise in the availability of sophisticated fraud tools.

Frequently Asked Questions (FAQs)

Consumer exposure surged by 89 % in Q1 2025 compared to 2024.

The fraud attack rate on rewards points transactions in 2025 is 6.19 %.

60 % of financial institutions and fintechs indicated they experienced an increase in fraud.

1 in 20 verification attempts, or 5%, are considered fraudulent in 2025.

Conclusion

The fight against digital payment fraud is relentless, with new threats emerging alongside technological advancements. By adopting cutting-edge technologies, fostering consumer awareness, and implementing stringent regulations, stakeholders can combat these threats effectively. While challenges remain, the strides made in AI, blockchain, and real-time monitoring offer hope for a more secure digital payment future. Together, we can protect the integrity of financial systems and build trust in the digital economy.