Digihost Technology Inc has rapidly transformed from a niche Bitcoin miner into a diversified energy infrastructure and digital asset services company. The firm operates U.S.-based mining facilities while increasingly monetizing excess power capacity and colocation services.

In recent years, it has shifted its strategy to balance crypto production with energy market participation, strengthening resilience amid volatile Bitcoin prices. Across U.S. and global markets, Digihost’s performance offers insight into how crypto-native infrastructure companies are evolving today. Below, explore detailed statistical insights into its operations, financial profile, and strategic positioning.

Editor’s Choice

- Digihost reported approximately $8.7 million in energy revenue, reflecting significant year-over-year growth, according to its earnings disclosures.

- NeoCloud Z GPU-as-a-Service platform launching January 2026.

- Phase I 22MW Tier III data center operational in 2026.

- Total digital currency holdings valued at $15.4 million, up 213% YoY.

- Cash, BTC, and ETH equivalents exceed $90 million as of late 2025.

- Operating power at 100MW, expanding to 200MW in 2026.

- Strategic partnership with NANO Nuclear for a 60MW facility.

Recent Developments

- US Data Centers subsidiary launched for 55 MW AI/HPC data centers.

- Phase 1 22 MW HPC capacity targets Q2 completion, $176 million capex.

- Phase 2 adds 33 MW, Q1 2027, $264 million capex, total $440 million.

- NeoCloud Z GPU-as-a-Service platform launches in January.

- ARMS 200 Tier 3 AI Pod deploying Q1 across sites.

- 100 MW operational power, 300 MW reserved for expansion.

- November mined 69.01 BTC, 671% YoY production increase.

- Cash, BTC, deposits hit $10 million end-2024, 257% YoY growth.

- AI infrastructure targets 55 MW total by year-end.

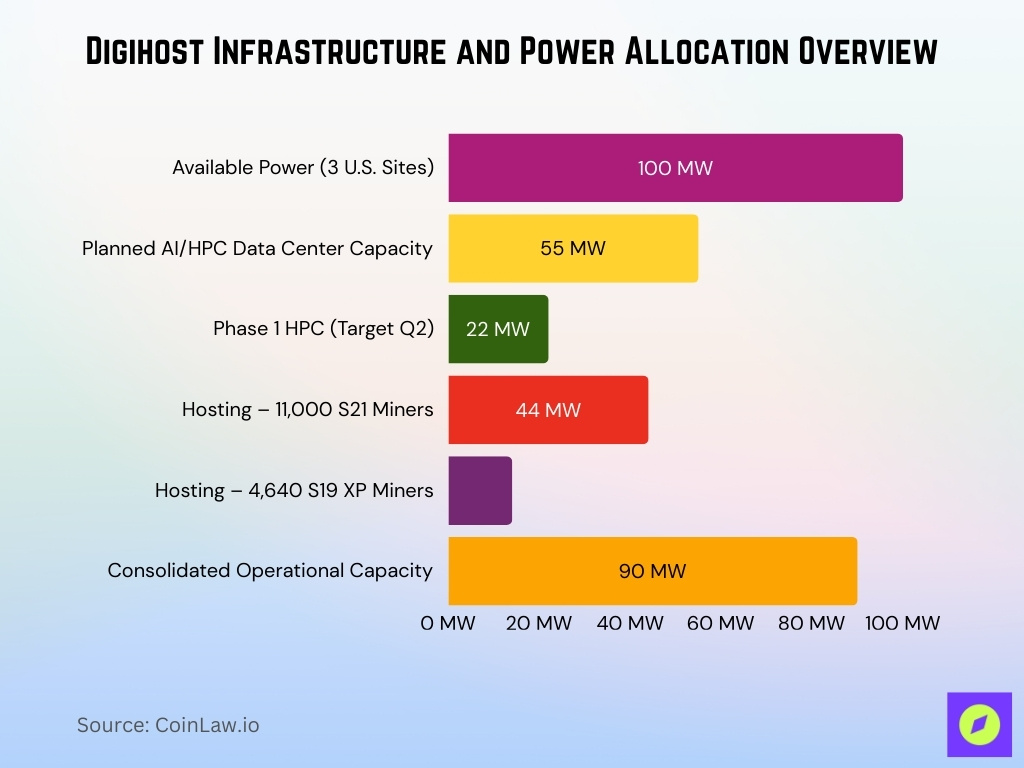

Mining Capacity and Infrastructure

- 100 MW of available power across three U.S. sites.

- 55 MW total planned AI/HPC data center capacity.

- 22 MW Phase 1 HPC completion targeted Q2.

- 44 MW hosting from 11,000 S21 miners.

- 14 MW hosting from 4,640 S19 XP miners.

- 90 MW consolidated operational capacity.

- 3 EH/s current Bitcoin mining hashrate.

- 75 EH/s largest hashrate target with AI/HPC integration.

- 6-7 EH/s projected hashrate.

- Over 19,000 ASIC miners in the active fleet.

Overview of Digihost Technology Inc

- Digihost trades on NASDAQ under the ticker DGHI.

- It evolved from a pure Bitcoin mining entity into a hybrid energy infrastructure provider.

- The company operates through self-mining, hosting services, and energy sales segments.

- Its facilities span three U.S. sites with approximately 100 megawatts of available power as of 2025.

- Future expansion includes planned growth toward approximately 200 megawatts of capacity or more.

- The business also pursues HPC and AI-focused data center development through a newly formed subsidiary.

- Leadership continues guiding strategic shifts toward revenue diversification beyond mining.

Bitcoin Mining Operations Overview

- 671% YoY Bitcoin production increase to 69.01 BTC mined in November.

- 77% increase in coins mined Q1 versus the prior year.

- 100 MW operational power capacity across three sites.

- Targeting 3.2 EH/s total hashrate by end-Q3.

- 44 MW added from 11,000 S21 miners deployment.

- $3.4 million monthly revenue in December, 21% YoY growth.

- $9.779 million H1 revenue from digital currency mining.

- 300 MW reserved power for future expansion.

- 30 BTC monthly production self-mining and hosting.

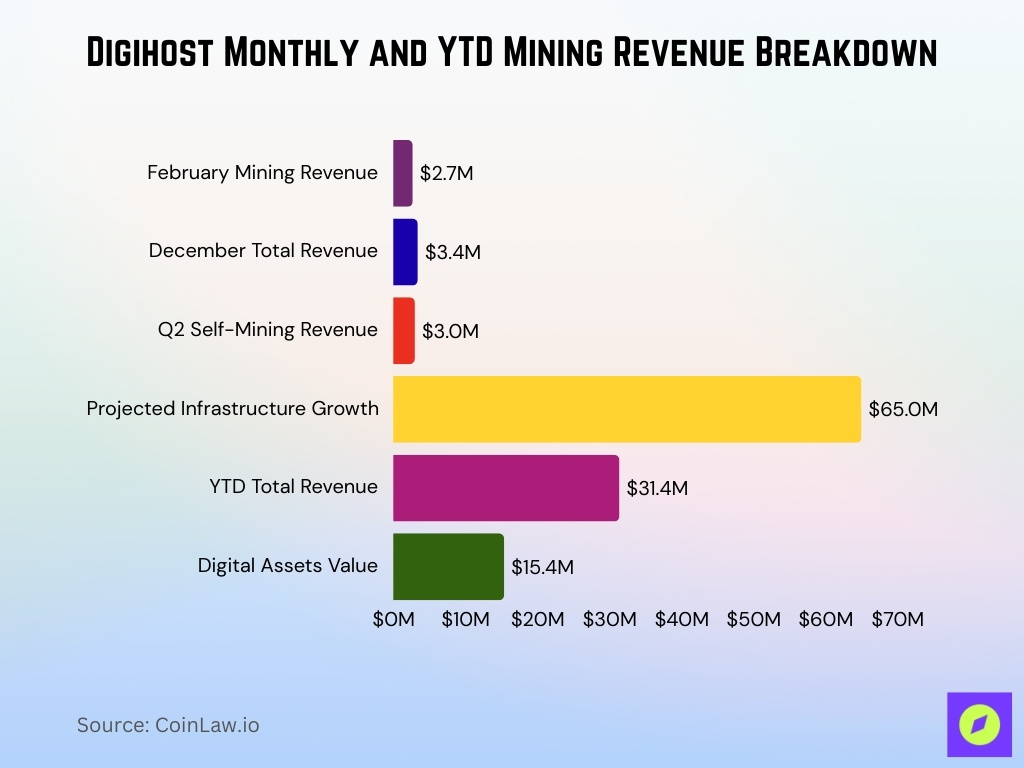

Revenue from Bitcoin Mining

- $2.7 million mining revenue in February at $84,373 BTC.

- 53% total revenue from mining in February.

- $3.4 million total revenue in December, 21% YoY growth.

- $538,943 Q3 mining revenue versus $4.4 million prior.

- $3.0 million Q2 self-mining revenue.

- $65 million projected infrastructure growth in 2026.

- 24.47 million CAD annual cryptocurrency mining revenue.

- $31.4 million YTD total revenue, 104% YoY.

- Mining below 25% quarterly revenue post-diversification.

- 97 BTC holdings, $15.4 million digital assets value.

Hash Rate Growth and Mining Efficiency

- Fleet efficiency 21-23 J/TH with S21 miners.

- 180% YoY hashrate increase to 2 EH/s.

- Projected 6 EH/s by end-2024 with new miners.

- S21 miners 17 J/TH efficiency (200 TH/3400W).

- 25-30% efficiency gain vs 2023 30 J/TH fleet.

- Post-maintenance targeting 2.75 EH/s hashrate.

- 97%+ uptime Q4 2024 operations.

- 0.3% global market share at 1078 EH/s network.

Bitcoin Production Volume Over Time

- 30 BTC produced in February, matching January levels.

- 95 BTC mined in February 2024, 45% YoY increase.

- 69 BTC mined in November, 671% YoY surge.

- 24 BTC monthly production rate August 2025.

- 62.58 BTC January 2022, 86% YoY growth.

- 74.58 BTC October 2022, 78% YoY rise.

- 77% Q1 coins mined increase versus the prior year.

- 67.97 BTC August 2022, 54% YoY gain.

- 51.28 BTC July 2021, 34% MoM increase.

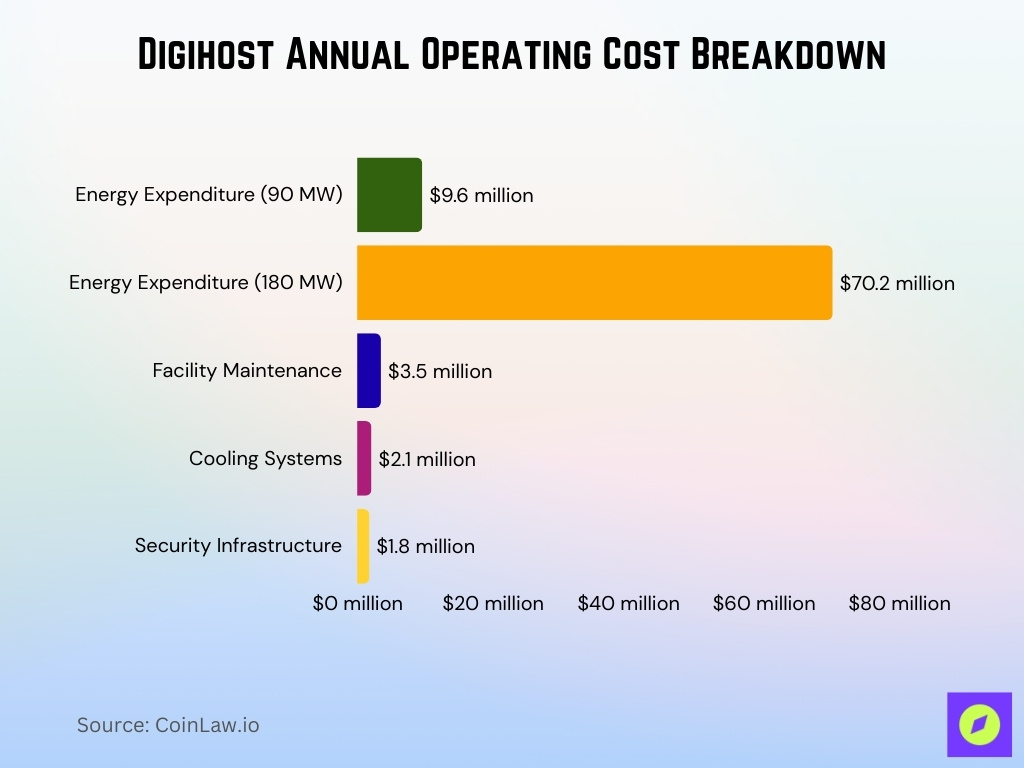

Operating Costs and Cost per Bitcoin Mined

- $9.6 million annual energy expenditure at 90 MW.

- $70.2 million annual energy at 180 MW.

- $3.5 million annual facility maintenance.

- $2.1 million annual cooling systems.

- $1.8 million annual security infrastructure.

- $0.03/kWh average electricity cost.

- $0.045/kWh average electricity rate.

- $30,000+ cost per BTC 2024 post-halving.

Energy Sales and Non-Mining Revenue

- $2.2 million record energy revenue in February, 633% MoM increase.

- $4.7 million total revenue in February, 38% MoM growth.

- $8.7 million Q3 energy revenue, 112% YoY surge.

- $5.7 million Q2 energy sales, 127% YoY growth.

- $3.0 million Q1 energy revenue, 436% QoQ rise.

- $12.1 million Q1 total revenue, 115% QoQ increase.

- 47% revenue from energy in February, 53% mining.

- 25% Q1 revenue from energy sales.

- $31.4 million YTD revenue, 104% YoY.

Cash, Bitcoin Holdings, and Liquidity

- $12.3 million cash, BTC, deposits January 2025, 232% YoY growth.

- $10.0 million cash, BTC, deposits December 2024, 257% YoY.

- $10.0 million cash, BTC, deposits November 2024, 11% MoM.

- $10.1 million combined cash/digital assets, February 2025.

- $6.7 million cash/crypto April 2024, 8% MoM increase.

- $30+ million cash, BTC, ETH equivalents mid-2025.

- $15 million working capital Q3 2025.

- Cash-to-debt ratio 1.15, debt-to-equity 0.02.

- Positive operating cash flow of $5.69 million in the latest year.

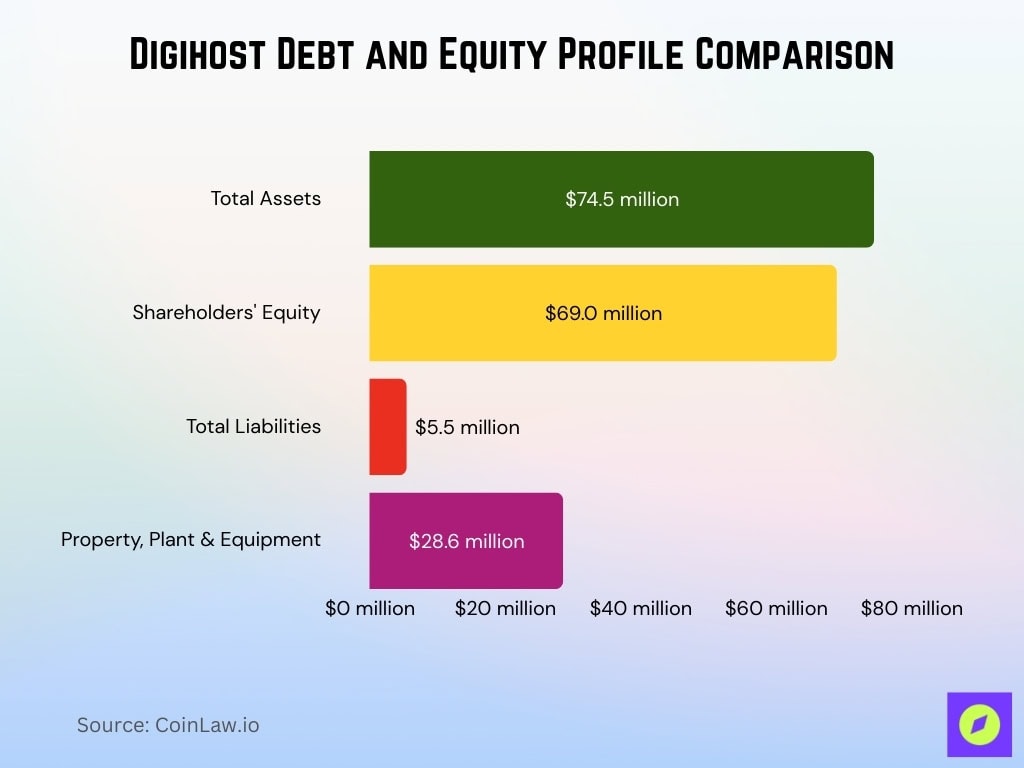

Balance Sheet and Debt Profile

- $74.5 million total assets.

- $69.0 million shareholders’ equity.

- $5.5 million total liabilities.

- $28.6 million property, plant, equipment.

- $0.02 debt-to-equity ratio.

- $0.013 debt ratio.

Capital Expenditures and Investments

- $5.5 million total 2024 capex for infrastructure/miners.

- $176 million Phase 1 22 MW HPC capex Q2 target.

- $264 million Phase 2 33 MW HPC capex Q1 2027.

- $440 million total AI data center project.

- $18.3 million 2023 capex for 4,200 S19 XP miners.

- $0.5 million December 2024 monthly capex.

- $4.5 million LTM capex Q1 2025.

- 100 MW current, expanding to 200 MW.

- 4,640 S19 XP miners added via hosting.

Impact of Bitcoin Price and Halving Events

- 3.125 BTC block reward post-April 2024 halving.

- 911.52 EH/s current network hashrate.

- 1,020 EH/s average daily hashrate in February.

- 999.96 EH/s global network hashrate.

- 663 EH/s seven-month low late January, 30-40% drop.

- 37,856 USD average production cost post-halving.

- 27,900 USD direct cost per BTC post-halving.

- $69,952 BTC price forecast mid-February.

- $124,237 average BTC end-2025, $124,983 January.

ESG, Energy Mix, and Sustainability Metrics

- 90% zero-carbon emissions energy consumption.

- 50%+ renewable energy sources utilized.

- 150 metric tons of CO2 avoided via 29 hours of demand response.

- 28.4 million kg CO2e projected annual emissions.

- 60 MW gas/steam plant transitioning to microreactors in 2031.

- 55% capacity factor North Tonawanda facility.

- $0.065/kWh target electricity cost.

- Net-zero emissions target 2030 electricity consumption.

- 97%+ operational uptime efficiency.

- Crypto Climate Accord signatory.

Regulatory and Compliance Overview

- Nasdaq ticker DGHI transitioned to DGXX in March 2025.

- Form 20-F filed SEC in September 2024, amended in March 2025.

- Form 40-F filed SEC in March 2022 for a Nasdaq listing.

- PSC ordered a review of Digihost’s 60 MW plant emissions in November 2024.

- North Tonawanda 2-year ban on new crypto mining in July 2024.

- Nasdaq delisting warning in October 2022 for bid price <$1.

- Material Change Report filed February 11, 2025.

- IFRS fair value digital assets P&L.

- NY Senate bill proposed a 3-year Bitcoin mining moratorium in May 2024.

Frequently Asked Questions (FAQs)

Digihost reported approximately $31.17 million in revenue most recently.

Energy revenue surged by approximately 112% year over year in Q3 2025.

Digihost’s market cap was reported at approximately $217.07 million.

In past filings, Digihost had approximately 13,000 active miners for self-mining and 10,700 for colocation.

Conclusion

Digihost Technology Inc entered this year in a markedly different position than during prior crypto cycles. While Bitcoin mining once drove most of its revenue, diversification into energy sales and hosting reshaped its financial profile. Liquidity improved, operational efficiency strengthened, and revenue streams broadened beyond block rewards alone. However, the company remains exposed to Bitcoin price volatility, network difficulty growth, and regulatory oversight in the United States.

For investors and industry observers, Digihost’s evolution illustrates how mid-sized miners adapt to halving events and tightening margins. As the Bitcoin ecosystem matures and institutional adoption grows, Digihost’s hybrid energy and infrastructure model may define its competitive positioning in the years ahead.