Imagine a world where borrowing and lending could happen in minutes, without banks, credit checks, or a mountain of paperwork. That’s the promise of Decentralized Finance (DeFi), particularly in lending protocols, where digital assets can be lent, borrowed, and even leveraged entirely through blockchain technology. Since its rise, DeFi has reshaped traditional finance, and 2025 is a pivotal year.

With the market’s impressive growth, numerous platforms now compete for dominance, offering enticing interest rates and improved security. For investors and enthusiasts, the numbers tell an incredible story, showing how DeFi lending continues to transform the financial landscape. Let’s dive into the data that’s redefining the lending industry.

Key Takeaways

- 1Decentralized exchanges (DEXs) hit a record $462 billion in monthly trading volume in 2025.

- 2Unique DeFi users in 2025 surpassed 20 million, up from 940,000 in 2021, a rise of over 2,000% in four years.

- 3Aave remains the #2 DeFi protocol by TVL in 2025, locking approximately $20.38 billion in smart contracts.

- 4MetaMask has exceeded 100 million total users and maintains 30 million+ monthly active users in 2025.

Total Value Locked (TVL) in DeFi Lending Protocols

- DeFi TVL in 2025 stands at approximately $89 billion, with lending protocols making up 43% of the total.

- Aave, MakerDAO, and Compound collectively hold over 72% of DeFi lending TVL in 2025.

- Ethereum hosts 77% of all TVL in DeFi lending protocols in 2025, remaining the dominant infrastructure.

- Solana and Polygon account for a combined $9.6 billion in TVL in 2025, driven by low fees and fast throughput.

- Average user deposits in 2025 reached $2,800, signaling stronger user trust and lending participation.

- Institutional capital makes up 11.5% of DeFi TVL in 2025.

- Stablecoins like USDC and DAI form 62% of all collateral in DeFi lending platforms in 2025.

Leading DeFi Lending Platforms by Market Share

- MakerDAO leads in 2025 with a 28% market share, still driven by strong adoption of its DAI stablecoin.

- Compound and Aave follow with 24% and 21% market share, respectively, with Aave’s multi-chain flash loans boosting its appeal.

- Uniswap and Curve now hold 6% and 5% of the lending market in 2025, expanding beyond DEX roots.

- Venus Protocol holds $4.2 billion in TVL in 2025, maintaining its role as Binance Smart Chain’s top lending player.

- Tribe DAO commands a 3.5% share in 2025, attracting users with community governance and flexible lending terms.

- The top five, MakerDAO, Compound, Aave, Uniswap, and Curve, make up 84.5% of the DeFi lending market in 2025.

- Stargate and other cross-chain lenders hold a combined $2.4 billion in TVL in 2025, enabling seamless Ethereum-BSC-Solana interoperability.

User Adoption and Growth Metrics

- DeFi lending users globally surpassed 7.8 million in 2025, with a 26% year-on-year growth as blockchain continues its mainstream expansion.

- Asia and North America account for over 52% of total DeFi users in 2025, fueled by strong crypto infrastructure.

- Young investors aged 20–35 make up 59% of DeFi lending users in 2025, driven by mobile-first platforms and simplified interfaces.

- In 2025, around 63% of DeFi borrowers are repeat users, showing sustained platform trust and retention.

- User growth on Layer-2 networks like Arbitrum and Optimism grew by 85% in 2025, thanks to lower fees and faster transactions.

- DeFi wallet addresses rose to 15.1 million in 2025, up 26% from the previous year, signaling broader user base expansion.

- Women’s participation in DeFi has shown steady growth, supported by educational outreach and inclusive ecosystem initiatives, although gender disparities in user demographics remain a challenge.

Security Incidents and Risk Assessments

- DeFi losses in 2025 dropped to approximately $1.1 billion, thanks to stronger protocol-level defenses.

- Flash loan attacks made up 58% of total losses in 2025, continuing to expose risks tied to instant arbitrage exploits.

- Cross-chain bridge hacks accounted for $620 million in losses in 2025, pushing more protocols to enhance interoperability safeguards.

- Audited protocols in 2025 experienced 94% fewer hacks, reinforcing the importance of third-party code reviews and trust signals.

- Bug bounty payouts hit $112 million in 2025, encouraging white-hat disclosures before exploitation.

- DeFi insurance platforms like Nexus Mutual covered $610 million in claims in 2025.

- DAO treasury security budgets grew by 32% in 2025, with funds directed toward infrastructure upgrades, audits, and on-chain monitoring.

The Role of Oracles: Traditional Oracle-Reliant Protocols and Emerging Oracle-Free Protocols

- Over 90% of DeFi protocols rely on traditional oracles like Chainlink, which secure data inputs essential for accurate asset pricing and contract execution.

- Chainlink remains the market leader, serving over 80% of DeFi platforms with reliable price feeds and decentralized data inputs.

- Oracle-free protocols, such as those designed for closed-loop financial systems, gained traction, with $500 million in assets locked, aiming to eliminate external data dependencies.

- Layer-2 scaling solutions like Arbitrum integrated custom oracles to reduce data latency, attracting protocols looking for faster price feeds and transaction finality.

- Emerging oracle protocols like UMA adopted novel approaches by incentivizing users to report accurate prices, adding a verification layer through user participation.

- On-chain data sources saw a 50% increase in adoption, providing a safer alternative to centralized oracles by deriving price and market data directly from blockchain transactions.

Data Availability and Recency in DeFi Lending

- Over 82% of DeFi protocols in 2025 offer real-time or near-instant data updates, boosting transparency and platform credibility.

- 91% of major DeFi platforms now provide historical data access, enabling users to analyze trends and assess long-term reliability.

- Open data frameworks like The Graph expanded further in 2025, indexing hundreds of protocols and enhancing API access for developers.

- Analytics tools such as Dune and Nansen saw a 54% rise in DeFi adoption in 2025, driven by both retail and institutional users.

- Only 4% of smaller protocols in 2025 face data recency issues, a result of improved infrastructure and decentralized hosting upgrades.

- Live collateral data is now available on 78% of DeFi lending platforms in 2025, improving risk visibility for users.

- Blockchain explorers like Etherscan and Solscan added more DeFi lending tracking features in 2025, ensuring real-time activity monitoring.

Key Insights on the DeFi & Crypto Market Landscape

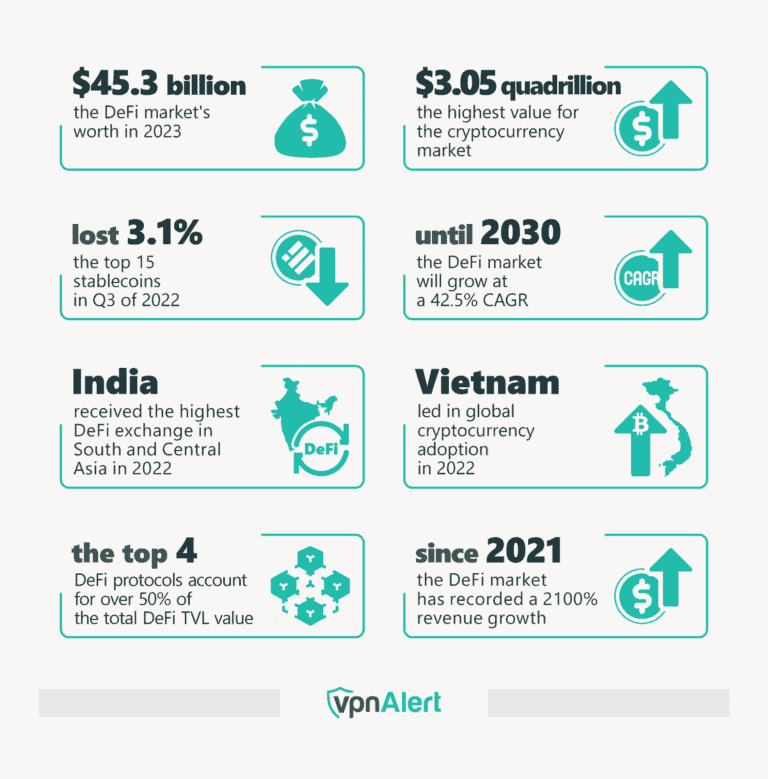

- The DeFi market was valued at $45.3 billion in 2023.

- The cryptocurrency market hit a peak value of $3.05 quadrillion.

- The top 15 stablecoins experienced a 3.1% drop in Q3 of 2022.

- By 2030, the DeFi sector is expected to grow at a 42.5% CAGR.

- India recorded the highest DeFi exchange activity in South and Central Asia in 2022.

- Vietnam led the world in cryptocurrency adoption during 2022.

- The top 4 DeFi protocols contribute to over 50% of the total DeFi TVL (Total Value Locked).

- Since 2021, the DeFi market has seen a massive 2100% revenue growth.

Comparing DeFi Lending to Traditional Peer-to-Peer Lending Platforms

- DeFi lending has consistently outpaced traditional P2P platforms in growth rate over recent years, primarily due to its borderless architecture, automated smart contracts, and 24/7 global access.

- DeFi interest rates in 2025 averaged between 6.8% and 13.5%, while traditional P2P platforms offered 4.5% to 7.5%, widening the yield gap.

- DeFi loans are processed in under 5 minutes via smart contracts, while traditional P2P loans still take 2 to 7 days.

- Collateralization in DeFi remains high at 150–180%, compared to 50–70% required in traditional P2P lending.

- DeFi platforms in 2025 offer global access without borders, unlike P2P lending, which faces regulatory and KYC restrictions.

- Real-time transparency is standard in DeFi, with live collateral and fund data, unlike P2P platforms, which lack instant visibility.

- Default risk management in DeFi 2025 is handled by smart contract liquidations, while P2P lenders rely on legal recovery processes.

Regulatory Developments and Compliance

- In 2025, around 28% of DeFi platforms adopted KYC procedures, reflecting increased pressure from regulators in the US and EU.

- MiCA enforcement in 2025 intensified across the EU, demanding full transaction traceability and stricter compliance standards for DeFi platforms.

- The SEC in 2025 reinforced proposals requiring DeFi protocols that facilitate transfers to register as broker-dealers.

- AML compliance rose by 32% in 2025, as more platforms implemented real-time transaction monitoring tools to prevent illicit activity.

- Tax reporting rules affected over 6.3 million US DeFi users in 2025, with platforms required to issue comprehensive transaction summaries.

- Japan’s FSA expanded DeFi regulations in 2025, focusing on liquidity pool auditing and lending oversight.

- Cross-border compliance costs surged 35% in 2025, as multi-jurisdictional protocols grappled with complex legal frameworks.

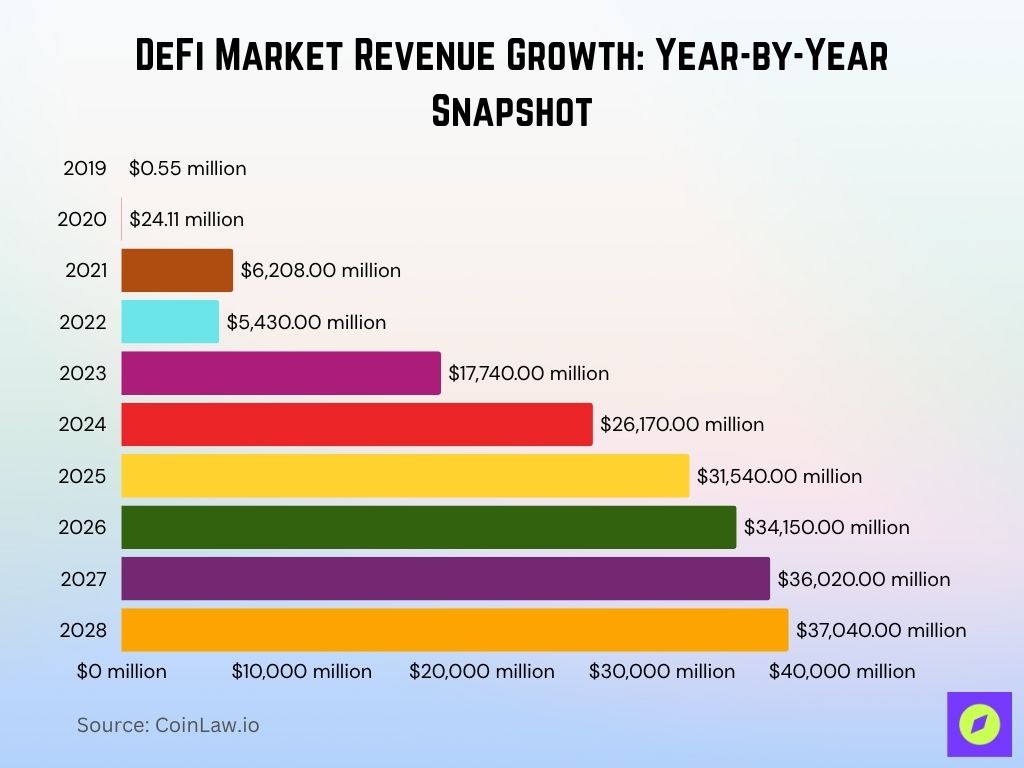

DeFi Market Revenue Growth: Year-by-Year Snapshot

- In 2019, DeFi market revenue was just $0.55 million.

- In 2020, it increased to $24.11 million, a significant early jump.

- 2021 saw revenue hit $6.21 billion, followed by a slight dip to $5.43 billion in 2022.

- A strong rebound in 2023 pushed revenue to $17.74 billion.

- Growth continued in 2024, with DeFi revenue reaching $26.17 billion.

- In 2025, it climbed to $31.54 billion, marking a major milestone.

- The upward trend held steady in 2026 with $34.15 billion, 2027 with $36.02 billion, and 2028 with a projected $37.04 billion.

Integration with Traditional Financial Systems

- Over 19% of DeFi platforms in 2025 have partnered with traditional banks, supporting fiat on-ramps and off-ramps for user convenience.

- Custodial wallets are now offered by 46% of leading DeFi platforms in 2025, catering to institutional investors.

- Hybrid DeFi/CeFi platforms grew by 24% in 2025, appealing to users who seek regulated access with decentralized flexibility.

- Visa and Mastercard integrations expanded by 34% in 2025, allowing users to fund DeFi accounts via credit and debit cards.

- Tokenized assets surged to $670 million in value in 2025, including real estate-backed and stock-linked tokens.

- Banking API integrations rose by 29% in 2025, enabling users to track DeFi portfolios from traditional banking apps.

- Interoperable lending platforms in 2025 now enable cross-border DeFi loans, offering fiat-backed lending via multi-chain infrastructure.

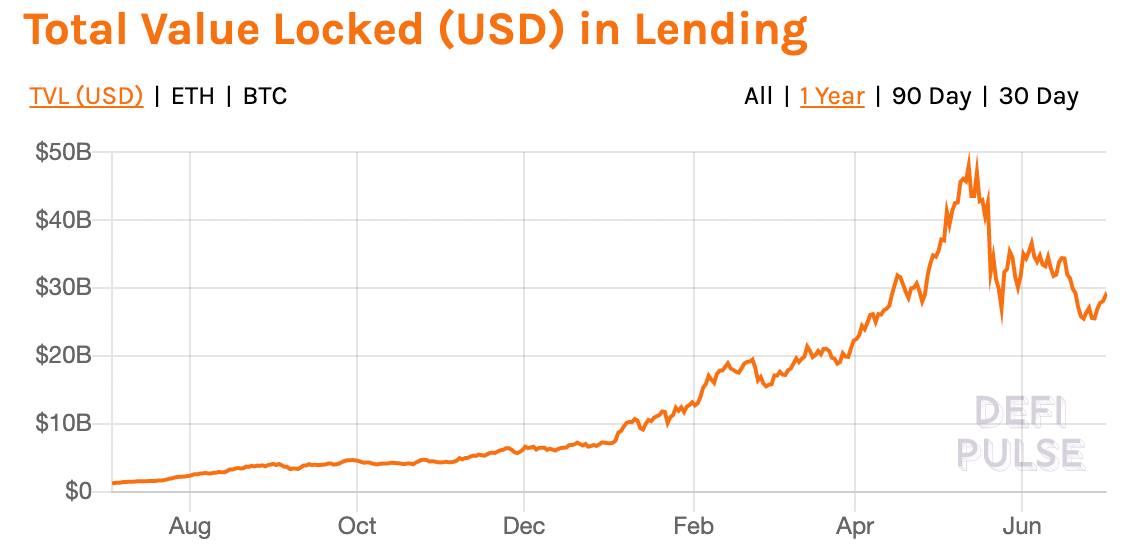

DeFi Lending Market: Total Value Locked (TVL) Trends

- The DeFi lending market started the year with around $1B TVL.

- By August, TVL climbed to approximately $3B, showing early momentum.

- Growth continued through the year, reaching about $7B by December.

- A sharp surge in February pushed TVL beyond $20B.

- April marked the peak, with TVL nearing $47B, the highest in the year.

- The market experienced high volatility in May, fluctuating between $30B–$40B.

- As of June, the market stabilized slightly, ending with $30B in TVL.

Recent Developments

- Market Expansion in 2025 projects the global DeFi market to grow from $71.4 billion to $337.04 billion by 2030, with a 28.2% CAGR.

- User Growth is expected to hit 53.56 million in 2025, with a projected user penetration rate of 0.69% across global populations.

- Shifts in traditional monetary policy, such as interest rate adjustments, continue to influence borrowing dynamics, often enhancing the appeal of DeFi lending platforms due to their transparent, automated, and globally accessible structure.

- Institutional Participation surged in 2025 with rising RWA tokenization and broader use of utility tokens in enterprise-grade DeFi systems.

- Security Enhancements remain critical as DeFi TVL surpassed $89 billion in 2025, reinforcing the sector’s emphasis on risk management and platform integrity.

Conclusion

As DeFi continues its transformative journey into mainstream finance, lending protocols play a pivotal role. With rising TVL, diverse platforms, and evolving compliance standards, DeFi lending has matured into a robust and competitive landscape in 2025. Enhanced security measures, transparent data, and cross-chain integrations are setting new standards for growth and user confidence.

Regulatory frameworks, while challenging, provide a path toward greater trust, making DeFi lending more accessible to institutional investors and everyday users alike. As DeFi aligns more closely with traditional finance, it is clear that decentralized lending protocols are not just an alternative but a powerful complement to conventional systems. The rapid innovations and solid growth metrics suggest a promising future, one where DeFi lending might reshape finance on a global scale.

SWSally W

Love seeing how much DeFi lending has grown! It’s amazing to have options outside regular banks, especially for us non-financial experts trying to make smart moves for our kids’ futures.