The concept of decentralized insurance, insurance built on blockchain, smart contracts, and community risk pools, has gained currency as a response to opacity, inefficiency, and high cost in traditional insurance. As the digital economy expands, individuals and organizations increasingly seek transparent, programmable coverage, especially in Web3, crypto, and parametric risk domains. In logistics, parametric crop insurance can trigger payouts when weather sensors cross thresholds, in crypto, funds locked in DeFi protocols benefit from smart‑contract insurance for hacks.

Editor’s Choice

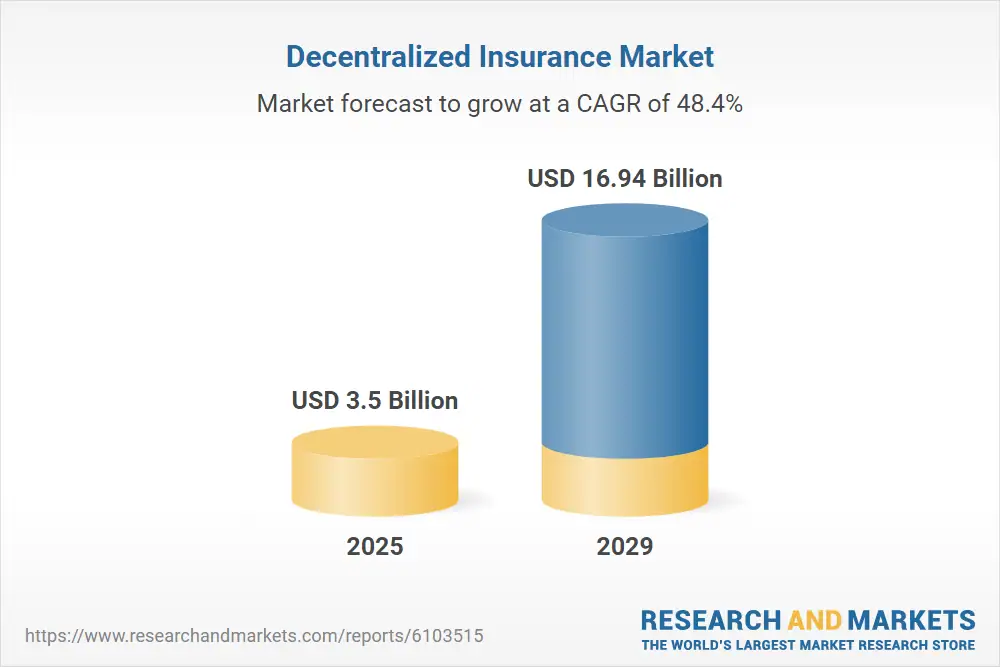

- The global decentralized insurance market is projected to reach $3.5 billion in 2025.

- That represents a 48% compound annual growth rate (CAGR) from $2.36 billion in 2024.

- Around 58% of insurers plan to increase blockchain investment in 2025, particularly in claims automation and fraud prevention.

- 77% of insurance firms expect blockchain to become a core component for policy issuance and settlement within two years.

- In traditional insurance, 78% of industry leaders report expanding tech budgets in 2025, and 36% say AI will claim the largest share.

- The DeFi ecosystem’s Total Value Locked (TVL) rose from under $1 billion in 2020 to $61.6 billion in mid‑2022, a key enabler for decentralized insurance.

Recent Developments

- Investment in blockchain for insurance is accelerating; 58% of insurers plan to boost spending in 2025 for claims and fraud systems.

- 77% of firms view blockchain as core to future policy issuance and settlement.

- In traditional insurance more broadly, 78% of leaders are upping overall technology budgets in 2025.

- 36% of those say AI will get the largest slice of that budget.

- Blockchain in insurance (wider domain) is projected to grow from a relatively low base to $82.56 billion by 2033.

- The Geneva Association’s DeFi insurance report emphasizes cost savings, inclusion, and streamlined processes as core value propositions.

- Academic work is now modeling a unified framework to compare different decentralized insurance models mathematically.

- Skeptics caution that, despite hype, adoption remains niche, and many protocols have low utilization.

Major Players in Decentralized Insurance

- Nexus Mutual has over $425 million in cumulative covers sold and has paid out more than $19 million in claims since its launch in 2019.

- Etherisc‘s protocols have facilitated more than $13 million in decentralized flight delay insurance coverage globally as of 2025.

- Bridge Mutual secured over $32 million in total value locked (TVL) at its peak and has supported coverage for more than 25 DeFi protocols.

- Unslashed Finance has covered $700+ million worth of digital assets against DeFi hacks and exploits, and handled claims related to major protocol incidents.

- Tidal Finance reached a peak TVL of $4.3 million across its coverage pools for leading DeFi protocols.

- Bitdeal provides white-label decentralized insurance software to more than 120 clients globally as of 2025.

- Bright Union aggregates insurance products from multiple protocols, linking users to coverage providers holding over $450 million in coverage capital.

- OpenCover is among the emerging multi-chain decentralized insurance brokers, partnering with protocols that have paid out upwards of $9 million in claims.

- Chainlink oracles power risk and event data feeds for over 50% of top decentralized insurance protocols as of 2025.

- Lemonade Inc. piloted Web3-native insurance policies in 2024, collaborating with the Ethereum Foundation and insuring 5,000+ wallets on test networks.

- Aon and Mapfre have launched blockchain pilot programs with DeFi protocols, conducting insurance settlements on-chain for claims under $1 million each as of 2025.

Coverage by Insurance Type

- Parametric health insurance offerings remain rare and nascent in 2025, with less than 2% of decentralized insurance protocols offering life/health products.

- Index-based life event triggers, such as for pandemics, are planned by approximately 5% of emerging protocols but have yet to see broad adoption.

- Regulatory and privacy concerns limit health insurance adoption, with under 1% of total decentralized insurance premiums originating from health-related products.

- Parametric weather insurance covers over $120 million in risks globally, mostly focused on rainfall and wind speed triggers as one of the earliest decentralized use cases.

- Crop and catastrophe insurance pilots (flood, hurricane) have reported pilot coverage pools exceeding $35 million as of 2025.

- IoT-enabled property damage insurance models are emerging, covering properties with valuations over $50 million in pilot phases.

- Crypto and DeFi risk insurance accounts for the majority share, with an estimated 70%+ of total decentralized insurance TVL focused on smart-contract or protocol failure.

- Hacks and protocol exploits represent the main cause of claims, comprising over 65% of paid decentralized insurance claims since 2020.

- Parametric insurance is primarily used for property, crop, and weather risks, with over 90% of parametric contracts deployed in these categories.

- Parametric triggers are accepted for their directness, reducing loss disputes by more than 40% compared to traditional indemnity models.

- Parametric travel insurance concepts, such as flight delay or cancellation, use Oracle data and represent less than 3% of total product offerings as of 2025.

- Business and commercial decentralized insurance covers experimental niches like supply-chain delays, comprising under 5% of total industry activity.

- Overall, the decentralized insurance market is dominated by crypto/DeFi risk and parametric models, while life/health and business/commercial cover types remain small and exploratory at under 10% combined share.

Types of Decentralized Insurance Products

- Smart-contract cover and protocol failure insurance represent over 68% of all decentralized insurance policies issued as of 2025.

- Parametric insurance products account for about 22% of the market, with payouts triggered automatically using data from oracles or real-world indexes.

- Crypto asset insurance (loss or theft) makes up 15% of available decentralized insurance products on leading platforms.

- Index-based life or health cover remains niche, with 2% of decentralized insurance protocols supporting these products as of 2025.

- Hybrid insurance models now constitute approximately 13% of product launches, blending decentralized triggers with regulated insurance backing.

- Mutual and pool-based insurance models collectively support over $350 million in capital, distributing risk among community policyholders.

- Peer-to-peer (P2P) insurance groups have issued more than 95,000 micro-policies, often between localized or digital affinity groups.

- Decentralized reinsurance and risk layering collectively back more than $120 million in capital pools to support primary protocol coverage.

- Automated, instant-payout claims represent over 80% of recent product growth in DeFi insurance.

- Usage of parametric insurance for agriculture and climate saw year-over-year premium growth of 47% in 2024.

Regional Market Statistics

- North America held the largest share in 2024 of the decentralized insurance market.

- Europe is expected to be the fastest‑growing region over the forecast period.

- Asia‑Pacific is anticipated to show the highest CAGR among non-Western regions, driven by rising blockchain and fintech adoption.

- In some reports, the decentralized insurance market was valued at $2.36 billion in 2024 and is projected to grow to $3.5 billion in 2025.

- The same projection yields a CAGR of ~48% between 2024 and 2025.

- In long‑term forecasts, the market may reach $16.94 billion by 2029.

- Some alternate reports estimate a valuation of $5.47 billion in 2024 and project high growth to 2035.

- In blockchain insurance more broadly, the market is expected to hit $82.56 billion by 2033.

- In 2025, insurtech firms leveraging blockchain are estimated to command strong growth, with insurtech adoption growing fastest in Asia.

Decentralized Insurance Market Growth Forecast

- The global decentralized insurance market is projected to expand from $3.5 billion in 2025 to $16.94 billion by 2029.

- This growth reflects a compound annual growth rate (CAGR) of 48.4%, highlighting one of the fastest-rising segments in the Web3 insurance sector.

- The surge is driven by rising DeFi adoption, parametric insurance demand, and blockchain-based risk pools offering transparent coverage.

- By 2029, the market size is expected to be over 4.8 times larger than in 2025, underscoring the rapid mainstream integration of decentralized insurance solutions.

Key Coverage Platforms and Ecosystems

- Nexus Mutual has accumulated over $425 million in coverage sold and facilitated more than $200 million in staking volume for governance and capital pooling.

- Etherisc has launched parametric crop and climate insurance in over 15 countries, supporting modular infrastructure for more than 10,000 policies issued since 2021.

- Bridge Mutual, Unslashed Finance, and Tidal Finance collectively account for more than $55 million in TVL across coverage for DeFi protocols and stablecoins.

- Neptune Mutual reached a TVL of nearly $13 million, offering coverage against exchange and protocol exploits in 2024.

- Chainlink oracles are integrated by over 70 decentralized insurance protocols for real-world data feeds as of 2025.

- Multichain capital pool protocols enable cross-chain insurance, with over $130 million pooled across Ethereum, Polygon, and BNB Chain networks.

- DAO-based governance is standard, with more than 60% of protocols allowing token holders to vote on claims, policy, or upgrades.

- Modular smart contract frameworks like BAKUP enable automated payouts and capital efficiency, with pilot deployments insuring 20+ protocols since 2023.

- Collaborative parametric insurance models have distributed surplus and voting rights to over 8,000 contributors globally in 2025.

- Combined, decentralized coverage platforms have processed upwards of $25 million in claims payouts since launch.

Adoption and Penetration Rates

- In the broader insurance sector, 74% of respondents see FinTech and insurtech innovations as a challenge.

- In blockchain insurance, the market grew from $1.86 billion in 2024 to $2.96 billion in 2025.

- In DeFi insurance, total value locked (TVL) has historically been modest, just above $500 million as of late 2022.

- Many incumbent insurers, 58%, plan to increase blockchain investment in 2025.

- Around 77% of insurance firms expect blockchain to be core in policy issuance and settlement within two years.

- In traditional insurance, about 36% of the tech budget is allocated to AI.

- In peer‑to‑peer insurance research, dynamic pricing models are becoming more prominent.

- Several protocols are still underutilized, with low active policy counts despite TVL backing.

Decentralized Insurance Claim Role Breakdown

- Risk Assessors account for the largest share at 50%, underscoring their central role in evaluating and verifying decentralized insurance claims.

- Claim Adjusters (CA) collectively manage 40% of total claim activities, divided equally between first claims (20%) and second claims (20%), highlighting their importance in follow-up and validation stages.

- Claim Submitters (CS) make up the remaining 10%, split into 5% for first claims and 5% for second claims, representing the initial stage of claim processing.

Claims Processing and Payout Statistics

- Nexus Mutual paid out more than $18.5 million in claims from 2019 to 2025, including over $8.8 million in 2023 and over $6.6 million in 2022.

- The portfolio loss ratio at Nexus Mutual sometimes surpassed 100% in certain pools, reflecting significant claim activity in high-risk periods.

- Smart contracts and oracle data integration in DeFi insurance enable instant or near-instant payouts when trigger conditions are met, often within 2–6 days for valid claims.

- Protocols like Nexus Mutual require claimants to stake tokens and submit off-chain proof of loss, with claims typically locked for a 90-day period post-vote if denied.

- BAKUP and other modular smart contract frameworks ensure robust payout execution and automated settlements, reducing manual errors and vulnerabilities.

- Historical DeFi insurance payouts have included multi-million dollar settlements, such as over $5 million paid to FTX and BlockFi users in 2023.

- Blockchain-based insurance contracts prevent duplicate claims or “double dipping” by recording immutable payout data on-chain for each claimant.

- DeFi insurance community-voted claims have an approval rate above 80% for valid filings, with economic penalties for dishonest voting.

Underwriting and Pricing Models

- Dynamic pricing in peer-to-peer insurance protocols adjusts premiums up to 17% monthly in response to real-time claims and risk data.

- Medved’s risk framework is adopted by over 25% of DeFi insurance protocols to balance full transfer, partial transfer, and risk retention in policy models.

- Credibility theory algorithms for premium calibration are tested by about 10% of decentralized insurance platforms in pilot phases.

- Protocols enabling underwriters to stake capital and directly underwrite policies account for over $64 million in capital locked across the sector in 2025.

- BAKUP’s modular contracts split oracle, policy logic, and yield, supporting customized risk pools on 4+ blockchains.

- Hybrid pricing models with traditional reinsurers are emerging, backing digital risks in DeFi protocols with $22 million in reinsurance capital in 2024.

- Real-time oracle pricing models result in premium adjustments within seconds to minutes after risk events, reducing manual recalibration effort by 50%.

- Parametric insurance protocols set premiums using volatility indices, with average volatility-driven premium adjustments ranging from 3% to 29% per underwriting cycle.

- Governance voting on pricing and risk parameters is enabled in 61% of protocols, giving token holders direct influence over premium and coverage rules.

- Automated pricing frameworks in DeFi have cut policy setup costs by 35%–48% compared to off-chain traditional insurance underwriting.

Governance Models (DAOs, Community Voting)

- Many protocols use DAO governance, letting token holders vote on claims and changes.

- In Nexus Mutual, claims are subject to community voting and staking.

- Some models explore delegated governance to reduce voter fatigue.

- Participation rates vary, with only 10–30% of token holders actively voting.

- Some frameworks use quadratic voting to reduce dominance.

Capital Pooling and Risk Sharing Statistics

- Protocols maintain capital pools that underwrite multiple risks.

- The decentralized insurance market is projected to reach $3.5 billion in 2025.

- Long-term forecasts project the market to hit $16.94 billion by 2029.

- Bullish estimates place the sector at $514.63 billion by 2034.

- DAO insurance alone could reach $11.66 billion by 2033.

- Capital pooling schemes use reinsurance layering.

- Staked collateral is used to back policies and earn yield.

- Risk sharing enables surplus from one pool to support others.

Regulatory Environment and Compliance Statistics

- About 83% of decentralized insurance protocols currently operate without traditional insurance licenses or direct regulatory supervision as of 2025.

- Unlicensed status enables rapid innovation, but over 47% of market participants cite regulatory uncertainty as the biggest hurdle to scaling.

- Jurisdictions including Switzerland, Bermuda, and Singapore are piloting sandbox frameworks for DeFi and blockchain insurance, with 12+ projects enrolled in 2025.

- Over 22% of active DAOs seek specialized on-chain insurance to cover governance or administrative liability risk.

- 2025 saw new compliance proposals in 3 major regions that would require risk disclosures and audited security measures for permissioned insurance platforms.

- Blockchain insurance law is being debated in more than 18 countries, with pilot statutes focused on enforceable smart contracts and claims payouts.

- Major DeFi protocols have added opt-in compliance modules, resulting in 15% higher adoption among enterprise users.

- Nearly 31% of surveyed protocols anticipate adopting at least one formal compliance regime by 2027 to enable global service.

Cost Comparison: Decentralized vs Traditional Insurance

- Decentralized insurance models can reduce intermediary and administrative costs by up to 40% compared to traditional insurers.

- Automation via smart contracts slashes manual claims handling expenses by 60–80% in DeFi insurance platforms.

- Fixed costs in multi-oracle decentralized setups can remain high, accounting for up to 18% of such platforms’ total operating expenses.

- Decentralized parametric premiums are often 10–30% lower for simple weather or event-based insurance versus traditional markets.

- Traditional insurers allocate over 25% of premiums to compliance, staffing, and agent commissions, driving overall higher costs.

- Overcollateralization in decentralized models may require capital cushions of 125–200% of the insured value for riskier protocols.

- Scale and diversification advantage allow traditional insurers to offer lower premiums for complex, bundled risks in 72% of large-market segments.

- As decentralized insurance platforms mature, early data show scale economies are reducing average per-policy costs by up to 15% annually.

- Traditional insurer client acquisition cost is typically 30–50% higher than for decentralized peer-to-peer insurance platforms.

Frequently Asked Questions (FAQs)

$3.5 billion.

48.4% CAGR.

From $1.86 billion to $2.96 billion (approx 59% growth).

$16.94 billion.

Conclusion

Decentralized insurance is evolving rapidly, with governance DAOs, capital pooling, and parametric triggers at the core of its promise. Yet significant regulatory, cost, and adoption barriers remain. The sector today sits between niche utility and potential mainstream lever. As the industry scales, selective regulatory alignment, robust governance design, and capital efficiency will determine winners. For readers curious about how specific protocols perform, comparative case studies, or forecasts by region, continue on to the full article.