The debate between centralized exchanges (CEXs) and decentralized exchanges (DEXs) has shifted from theory to measurable reality. From institutional funds reallocating assets to on‑chain users opting for self‑custody, the landscape is evolving. Financial firms now integrate DeFi primitives into traditional trading desks, and retail traders increasingly prefer platforms where they control keys rather than use an intermediary. Dive into the full article for a detailed statistical comparison of CEXs versus DEXs across trading volume, liquidity, supported assets, and more.

Editor’s Choice

- ~20% of global spot crypto trading volume was handled by DEXs in Q3 2025, up from ~10% in 2024.

- Weekly DEX trading volume averaged $18.6 billion in Q2 2025, representing ~33% year‑on‑year growth.

- Total number of unique wallets interacting with DEXs by mid‑2025 exceeded 9.7 million, up from ~6.8 million a year earlier.

- Over 300‑500 tokens are now listed across many major exchanges by 2025, as platforms broaden their catalogs.

- In H1 2025, crypto thefts from exchange platforms and infrastructure reached over $2.17 billion, already eclipsing full‑year 2024 totals.

- There were over 559 million cryptocurrency owners globally in 2025, marking a 34% year-on-year increase.

Recent Developments

- In 2025, centralized exchanges show signs of recovery after a prolonged trust‑and‑liquidity decline period.

- On‑chain derivatives activity via DEXs surged, average monthly perpetual volume doubled from Q1 to Q3 2025, surpassing $1 trillion in October.

- Many DEXs deployed multichain support, tapping layer‑2 networks like Arbitrum and Base, boosting institutional engagement.

- DEX spot‑vs‑CEX volume ratio rose to ~0.23 in Q2 2025.

- Market‑wide infrastructure innovation, such as MEV analysis and liquidity‑algorithm research, improved transparency in exchange operations.

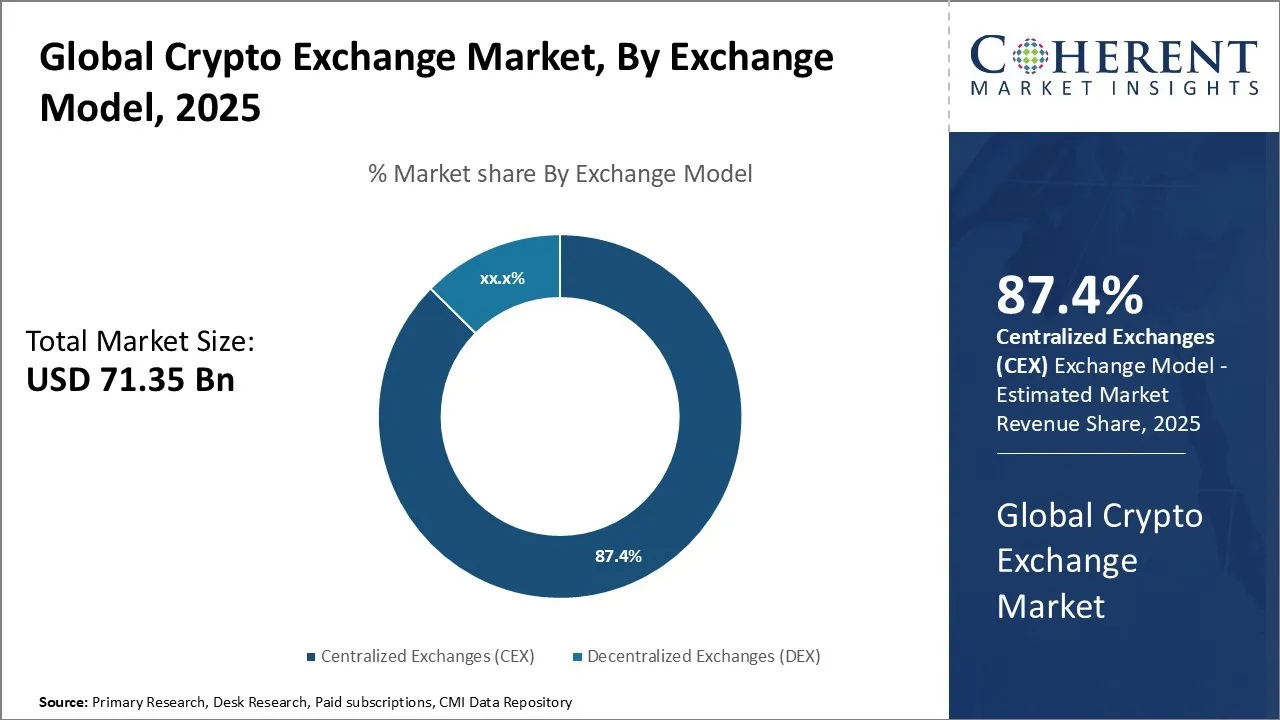

Global Crypto Exchange Market Share

- The total crypto exchange market is valued at $71.35 billion in 2025.

- Centralized Exchanges (CEXs) dominate with 87.4% of the market share.

- This translates to an estimated $62.34 billion in revenue for CEX platforms.

- Decentralized Exchanges (DEXs) account for the remaining 12.6% of market share.

- DEXs generate approximately $9.01 billion in annual revenue.

- CEXs continue to lead due to liquidity, regulatory integration, and user onboarding.

- However, DEXs are gaining traction, especially among self-custody advocates and DeFi-native traders.

Trading Volume Comparison

- DEX monthly average spot volume, approximately $395 billion in Q1 2025, dropped to ~$332 billion in Q2, then surged to ~$480 billion in Q3.

- In 2024, DEXs accounted for approximately 10‑15% of total crypto spot volume; prior years were significantly lower.

- CEX volumes remain dominant, though growth has slowed and volatility affects daily totals, e.g., >50% drop in one day for some CEXs.

- Weekly DEX volume in Q2 averaged ~$18.6 billion, demonstrating steady growth.

- DEX derivative (perpetual) volumes in Q3 2025 grew by over 100% compared with Q1, crossing $1 trillion in a single month.

- Liquidity concentration on major exchanges impacted volume spreads; the largest few platforms account for the majority of CEX volume.

Liquidity Statistics

- As of Q2 2025, Uniswap’s Total Value Locked (TVL) was approximately $4.5 billion.

- PancakeSwap’s TVL stood near $2.47 billion by mid-2025.

- DEX liquidity provider participation grew, with PancakeSwap recording 7.4 million unique users in Q2 2025.

- The DEX-to-CEX trading volume ratio rose to 0.23 in Q2 2025, while CEX spot volume dropped nearly 28%.

- On major platforms, stablecoin pairs represent 60-70% of liquidity listings.

- PancakeSwap’s June 2025 trading volume hit a record $325 billion.

Crypto Exchange Development Costs

- Spot/Crypto-Fiat Exchanges cost $30,000–$150,000+ for basic builds and up to $500,000+ for custom platforms.

- Margin Exchanges range from $70,000 to over $200,000 in development expenses.

- P2P Exchanges require $50,000–$400,000+, depending on features like escrow, chat, and dispute systems.

- Decentralized Exchanges (DEXs) start at $60,000–$150,000+ for an MVP and can go up to $300,000 for a full-scale platform.

- Futures Exchanges are the most capital-intensive, ranging from $150,000 to $320,000+, due to advanced matching engines and compliance systems.

Number of Supported Cryptocurrencies

- Many exchanges now support 300‑500+ tokens by 2025, including niche Layer‑1s and DeFi governance tokens.

- Top PoS chains show staking participation of 56‑59% in supported ecosystems, reflecting broad token listing and utility.

- Stablecoin pairs (USDT/USDC) account for ~60‑70% of token listings volume on major exchanges.

- There are 258 spot exchanges being tracked in 2025 across multiple assets and markets.

- Growth in new tokens listed, real‑world asset tokens (fractional bonds, real estate, commodities) are increasingly included in exchange catalogs.

- On the DEX side, over 1,097 decentralized exchanges were tracked with millions of volume metrics, seeing bigger footprints.

- The breadth of supported assets correlates with global user base expansion, reflecting higher token variety attracting non‑traditional users.

- Delisting of low‑liquidity or high‑risk tokens increased in 2025, as compliance and risk management matured.

Fiat Support vs. Crypto‑Only Models

- As of 2025, approximately 67% of top-50 centralized exchanges (ranked by volume) offer fiat-to-crypto trading pairs, while fewer than 12% of active DEXs support direct fiat gateways.

- Among DEXs, crypto‑only models dominate; over 90% of DEX trading activity involves crypto‑to‑crypto pairs.

- CEXs that dropped fiat support (due to regulatory cost) saw trading volumes decline by 12‑15% year‑on‑year.

- Regions with stronger fiat‑gateway infrastructure (North America, Europe) show higher adoption of fiat‑supported CEXs than in regions with crypto‑only access.

- In 2025, fiat‑on‑ramps (card/bank deposit) accounted for approximately 40% of first‑time CEX users in the US.

- DEXs are increasingly integrating wrapped fiat‑stablecoins (e.g., USDC/USDT) to mimic fiat pairs, and such pairs now represent 30%+ of DEX volume.

- CEXs offering both fiat and crypto‑only models achieved an average 25% higher active user retention than fiat‑only or crypto‑only peers.

- Shift toward crypto‑only on‑ramps is stronger in APAC and LATAM markets due to regulatory or banking limitations.

- In 2025, among the top 10 CEXs ranked by volume, 8 still list USD, EUR, or JPY fiat pairs; among the top 10 DEXs, only 2 integrate any form of fiat gateway.

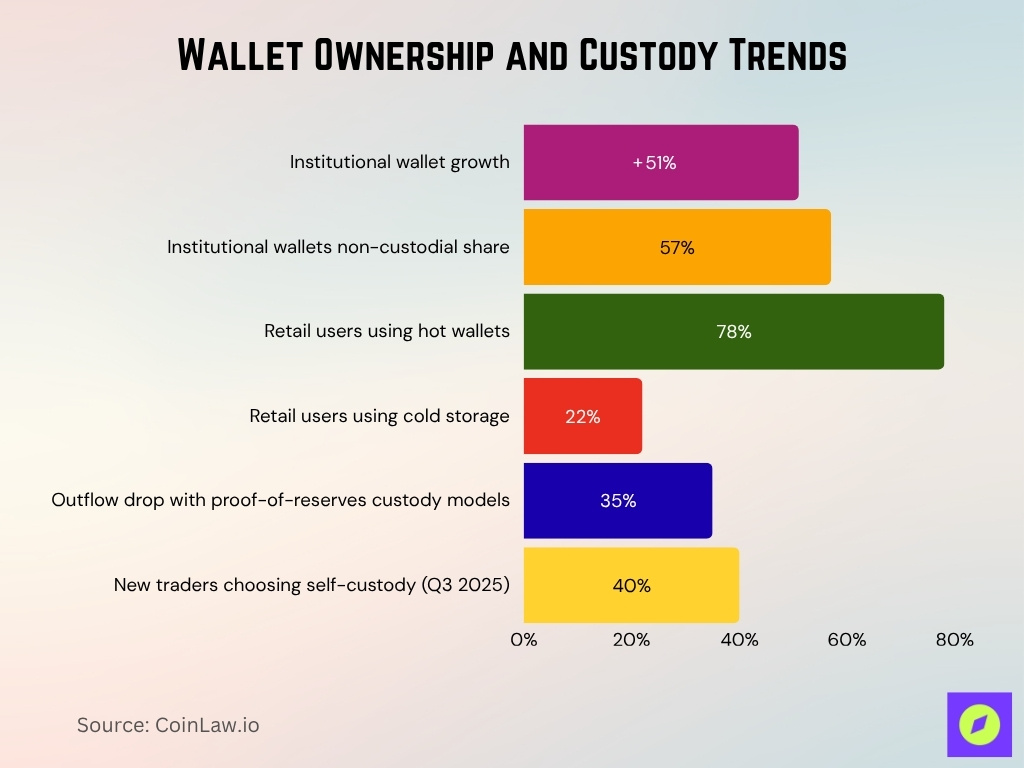

Custody of User Assets

- In 2025, institutional wallet ownership grew by 51%, reaching over 31 million wallets, of which 57% are non‑custodial (user‑controlled).

- Among retail users in 2025, 78% still use hot‑wallets as their primary access point, while only 22% hold assets in cold storage.

- Custody models that disclose proof of reserves had 35% lower user outflow during market stress events.

- Non‑custodial DEXs continue to rise; over 40% of new trader sign‑ups in Q3 2025 opted for self‑custody wallets.

- The global crypto custody tool market is valued at $2.17 billion in 2025 and projected to grow to about $4.9 billion by 2029.

- CEXs that provide self‑custody options (or partnerships with non‑custodial wallets) report up to 18% higher deposit inflows than pure custodial models.

- For CEXs, assets under custody (AUC) for digital assets in the US alone exceeded $500 billion by mid‑2025.

- Among institutional investors, 86% surveyed in early 2025 either hold or plan to hold digital assets under professional custody services.

- Custody insurance rates for crypto assets (third‑party indemnity) increased by 22% year‑on‑year.

Security Incidents and Hacks

- In 2025, mid‑year thefts from crypto platforms already exceeded the full‑year losses of 2024, totaling over $2.17 billion.

- Blockchain‑based money‑laundering volume rose by 23% from 2023 to 2024.

- Among the top‑10 hacks in 2025, CEXs accounted for about 70% of total value stolen, with DEXs making up the remaining 30%.

- Exchanges disclosing open‑source proof‑of‑reserves experienced, on average, 17% fewer security‑related outflows than those that did not.

- In the first half of 2025, one major hack resulted in over $1.4 billion being stolen from a CEX.

- DEX protocols have concentrated ~80% of their risk in smart‑contract exploits rather than custodial breaches.

- Platforms that switched to multi‑signature, threshold‑signature schemes reduced incident rates by 30% relative to legacy custody models.

- User‑asset losses due to phishing on account takeover still compose roughly 45% of all incidents in 2025.

- Regulatory actions requiring timely breach disclosures (within 24 h) grew from 54% compliance in 2024 to 79% in 2025 among major CEXs.

KYC/AML Compliance Rates

- Adoption of blockchain‑based AML/KYC solutions increased from 62% in 2023 to approximately 90% in 2025.

- In 2025, 75% of regulated CEXs now report geo‑location mismatch screening as part of their KYC onboarding.

- Among DEXs integrating KYC‑on‑ramp modules, only 28% meet the highest available risk rating standards for AML controls.

- Phishing and scam‑related flows identified through AML tooling increased by 34% from 2024 to 2025.

- Platforms that automate sanctions screening see 40% faster user onboarding compared to manual‑only processes.

- The crypto AML/KYC market for compliance solutions is forecasted to grow at a 13.8% CAGR during 2025‑2035.

- U.S. and European VASPs were found to have 12% fewer suspicious activity reports (SARs) per dollar volume than unlicensed platforms.

- The average KYC‑compliance cost for mid‑tier exchanges rose to $3.4 million per year in 2025, up ~18% from 2024.

Geographic Distribution of Users

- Global crypto adoption reached about 9.9% of the total internet population in 2025, equating to approximately 559 million users worldwide.

- Europe saw the highest year‑on‑year growth in crypto ownership, and in the UK, the rate rose from 18% to 24% in 2025.

- South Asia became the fastest-growing region for crypto adoption as of July 2025, surpassing 45% growth compared to the previous year.

- In markets with high fiat‑on‑ramp friction, such as Africa, DEX usage reached 35%+ of local trading volume, compared with ~12% in North America.

- U.S. users constitute roughly 22% of global registered exchange accounts by mid‑2025.

- Emerging markets such as LATAM and Southeast Asia accounted for ~38% of new crypto users in 2025.

- In the U.S., crypto adoption among adults rose from 20% in 2024 to 22% in 2025.

- Tier‑2 and tier‑3 cities in India now contribute up to 40% of some major exchange user bases, up from about 25% in 2023.

Most Popular Exchanges (CEX vs. DEX)

- In Q2 2025, DEX spot trading volume reached approximately $876.3 billion, up more than 25% quarter‑on‑quarter, while CEX spot volume fell to about $3.9 trillion.

- The top spot exchange by volume processed roughly $1.8 trillion in Q3 2025.

- Among the top 5 DEXs, one platform handled nearly 50% of all DEX activity in Q2 2025.

- The ratio of DEX to CEX volume in spot markets hit ~0.23 in mid‑2025.

- Derivatives trading on DEXs surged faster than spot, with perpetual swap activity growing 120%+ year‑on‑year.

- CEXs continue to dominate in liquidity depth, with average bid-ask spreads around 0.04%, while top DEX pools show spreads near 0.12%.

- User preference surveys show that 34% of new traders selected a DEX as their first platform in 2025, up from ~22% in 2024.

Regulatory Oversight and Jurisdiction

- In 2025, 99 jurisdictions implemented or actively rolled out the Travel Rule for virtual asset service providers.

- Approximately 90% of centralized exchanges report full KYC compliance in 2025, up from roughly 85% in 2024.

- The GENIUS Act was signed into U.S. law on July 18, 2025, establishing safeguards for payment stablecoins.

- The European Union moved MiCA into implementation phases in 2025, tightening oversight on token‑issuance and service providers.

- The Philippines SEC introduced a PHP 100 million minimum capital requirement for crypto service provider licensing in 2025.

- Cross‑border crypto regulation continues to face gaps, prompting increased risk warnings from global financial authorities.

- Major exchanges now commonly hold multi‑jurisdictional licenses, which strengthens compliance and user trust.

Trading Speed and Infrastructure

- By 2025, infrastructure providers will handle over 158 billion monthly requests, with an average latency of about 80 ms under full load.

- Institutional‑grade CEXs now process tens of thousands of transactions per second, far above 2023 capabilities.

- Layer‑2 supported DEX platforms often achieve sub‑second settlement on many swap transactions.

- Hybrid CEX plus DEX exchange structures improved execution speed and system scalability.

- Exchange infrastructure optimized for peak loads achieved up to 62.5× improvement in response times in testing.

- Congestion-related complaints from users dropped by approximately 30% year‑on‑year among major platforms.

Asset Listing Requirements

- Coinbase listing applications have an average review timeline of 1-8 weeks, depending on asset complexity.

- The U.S. approved generic listing standards for commodity-based spot ETPs in September 2025, reducing listing delays by over 60%.

- Over 70% of CEXs now require tokens to have at least three months of transaction history before listing.

- Regulatory compliance audits are mandatory for 85% of tokens listed on major centralized exchanges.

- Delistings due to low liquidity or non-compliance increased by 22% in 2025 across major CEXs.

- DEX token listings face minimal barriers, but new pool launches dropped by 15% in 2025 due to rug pull concerns.

- Internal compliance teams reduced listing review times by approximately 20% year-on-year on top CEXs.

- Accelerated listing programs now represent around 25% of new tokens listed on Tier-1 exchanges.

- Major centralized exchanges add between 300-500 new tokens annually, though growth slowed by 12% in 2025.

Innovation and Technology Adoption Rates

- Research shows that blockchain application adoption boosts innovation output and operational performance across enterprise trading functions.

- Hybrid exchange models that merge CEX order books with DEX automated market makers saw 30‑40% growth in 2025.

- Deployment of AI and machine learning for fraud detection, surveillance, and risk scoring increased by 45% in 2025.

- Layer‑2 scaling solutions significantly lowered transaction cost and latency, increasing global DEX participation.

- Tokenized real-world assets reached under 10% of new listings in 2025, showing early but accelerating adoption.

- User onboarding flows using Web3 identity tools and embedded fiat ramps expanded across emerging markets.

- Nearly 60% of new exchange architectures adopted modular, plug-in-based structures in 2025.

Future Market Projections

- DEXs are expected to capture 30‑35% of spot volume by 2030 as infrastructure and preference shift toward on-chain models.

- Hybrid exchanges may represent 40% of new exchange volume by the end of the decade.

- Regulatory harmonization could double the number of licensed global exchanges by 2028.

- Infrastructure advances may reduce settlement latency to below 10 ms by 2030.

- Token listing procedures may become globally standardized, cutting review times by 50%.

- Self-custody adoption may shift 40‑50% of total assets into user-controlled wallets by 2030.

- Regions with high mobile penetration, especially Africa and parts of LATAM, could experience 50%+ annual growth in new exchange users.

Frequently Asked Questions (FAQs)

Adoption rose from about 62% in 2023 to approximately 90% in 2025.

The DEX segment is forecasted to grow at a compound annual growth rate (CAGR) of about 26.37% from 2024 to 2029.

Perpetuals trading volume on DEXs reached around $1.8 trillion in Q3–2025.

The global TVL reached approximately $123.6 billion in Q2–2025, and Ethereum contributed about 63% (~$78.1 billion).

Conclusion

This year marks a turning point for the crypto exchange ecosystem. Regulatory frameworks are maturing, infrastructure is accelerating, and listing standards now emphasize safety, transparency, and governance. At the same time, innovation across both centralized and decentralized models is expanding user access and improving market function. Despite persistent challenges, including jurisdictional gaps and security concerns, the overall trajectory points toward a more resilient and well-defined exchange landscape. Both CEXs and DEXs are set to evolve into distinct but complementary roles as adoption grows, technology advances, and global markets seek greater reliability and choice.