Binance founder Changpeng Zhao has denied claims that he sold 35 million ASTER tokens, but the token still dropped more than 8 percent amid the confusion.

Key Takeaways

- Rumors claimed Changpeng Zhao sold $30.42 million in ASTER tokens, sparking panic in the crypto community.

- CZ publicly denied the allegations, calling them “fake news” on X and warning users not to trust the source.

- Blockchain analysis by EmberCN confirmed no such token sale occurred, identifying the transactions as internal Binance wallet transfers.

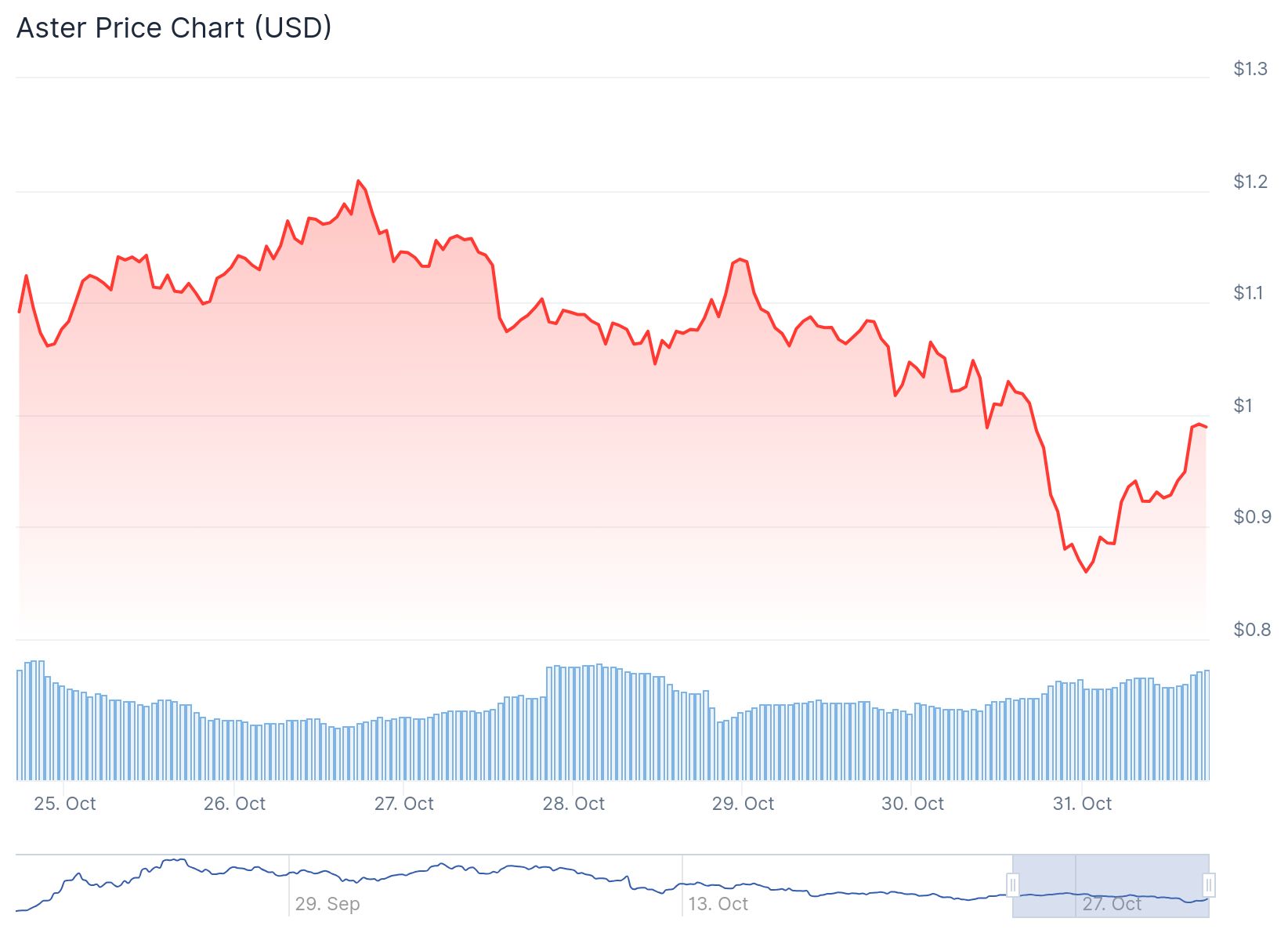

- Despite the clarification, ASTER’s price fell 8.81 percent, continuing a broader downward trend from its September peak.

What Happened?

Reports emerged online accusing former Binance CEO Changpeng Zhao (CZ) of selling 35 million ASTER tokens, valued at over $30 million. The claim originated from a Riyadh-based crypto influencer named Farzad and quickly went viral on X and other platforms. Given CZ’s status in the industry, the accusation caused immediate concern among traders.

CZ responded swiftly, labeling the claim as “Fake News” and urged his 10.4 million followers to “unfollow the guys posting fake news.”

4. Fake news!

— CZ 🔶 BNB (@cz_binance) October 31, 2025

Unfollow the guys posting fake news. pic.twitter.com/Os8dF0dSjh

CZ Refutes ASTER Selloff Claims

The rumors centered on a wallet address that was allegedly linked to CZ. The address was observed transferring large amounts of ASTER tokens, prompting speculation that Zhao had offloaded a significant portion of the asset.

Zhao denied any involvement, stating clearly on X that the reports were false. His prompt denial aimed to stem further panic and correct the narrative before it could escalate.

Blockchain Analysis Supports CZ’s Statement

A detailed investigation by blockchain analytics firm EmberCN later verified CZ’s denial. EmberCN’s on-chain analysis found no evidence that Zhao had sold any ASTER tokens.

Key findings from EmberCN included:

- No on-chain transactions matched the alleged $30 million sale.

- The wallet activity was linked to routine internal transfers within Binance hot wallets.

- A wallet address ending in 0x889 was mistakenly attributed to CZ, which was the root of the misunderstanding.

EmberCN clarified on X, stating that “there are no corresponding on-chain transfers” validating any ASTER sale and confirming that all movements were internal operations.

ASTER Price Slumps Despite Clarification

Even with clear evidence disproving the claim, ASTER’s price declined 8.81 percent in the 24 hours following the rumor. At the time of reporting, the token was trading at $0.9379, according to CoinGecko.

The price drop comes amid ongoing volatility surrounding ASTER, the native token of the decentralized exchange Aster. The token launched on September 17, 2025, with a TGE price of $0.02, and rapidly climbed following CZ’s public support, hitting an all-time high of $2.42 just one week later.

However, the token has since fallen more than 61 percent from that peak, highlighting its sensitivity to social media chatter and market sentiment.

Market Reaction Highlights Risk of Misinformation

The incident underscores how quickly unverified rumors can ripple through crypto markets, particularly when they involve well-known figures like CZ. Although the claims were publicly denied and disproven through blockchain analysis, they still triggered short-term price movement.

Despite the damage control, the rumor’s spread reflects a larger issue within the industry: the speed of misinformation often outpaces fact-checking and verification, especially on platforms like X where many investors get their updates.

CoinLaw’s Takeaway

Honestly, this situation shows just how fragile crypto market sentiment can be. I found it striking how one misattributed wallet address led to a $30 million rumor that tanked a token’s price. In my experience, even when facts surface quickly, the initial damage is often already done. This highlights the critical importance of verifying information before making investment decisions. CZ’s rapid denial and EmberCN’s blockchain audit were reassuring, but they also exposed how easily market movements can be manipulated by false reports. If you’re trading on headlines, be sure the data backs them up.