In the ever-evolving landscape of cryptocurrency mining, today presents significant developments shaped by fluctuating energy costs, rapid technological innovations, and dynamic regulatory environments. From the rise of more eco-friendly mining practices to shifts in global revenue sources, cryptocurrency mining has become a pivotal industry, transcending the realms of technology and finance. This article will dive into the latest statistics, offering insights into growth factors, revenue streams, and the driving forces behind one of the digital age’s most influential industries.

Editor’s Choice

- Bitcoin’s annualized electricity usage fluctuates between approximately 120–180 TWh, depending on network difficulty and market conditions, representing roughly 0.4–0.7% of global electricity demand.

- Leading 2026 rigs like Antminer S23 Hydro achieve around 9.5 J/TH, cutting energy use per terahash significantly.

- Mining one Bitcoin in 2026 requires roughly 854,400 kWh of electricity on average worldwide.

- Around 30% of Americans (about 70.4 million people) now own cryptocurrency.

- There are over 50 million issued cryptocurrencies, but only about 10,000–18,959 are active or significant.

- As of early 2026, total tracked cryptocurrencies on CoinMarketCap stand near 29.9 million, with about 620,000 new tokens created in just the first days of the year.

Recent Developments

- Hive Digital reported $93.1 million in Q3 FY2026 revenue, with $88.2 million from mining and 885 BTC mined.

- Phoenix Group achieved $107 million in Bitcoin mining revenue for 2024, up 236% YoY amid global expansion.

- Bitfarms secured a $128 million deal to convert the 18 MW Washington site to HPC/AI by December 2026.

- Russia plans permanent crypto mining bans in Buryatia and Zabaykalsky Krai starting in 2026, expanding to 10+ regions.

- Nebraska imposes a 2.5 cents/kWh excise tax on crypto mining over 1,000 kWh/year, targeting operations amid grid concerns.

- Hive Digital posted $45.6 million Q1 FY2026 revenue, up significantly with 8.7 EH/s hashrate.

- Bitfarms reports Q3 2025 revenue of $69 million from continuing ops, up 156% YoY before full pivot.

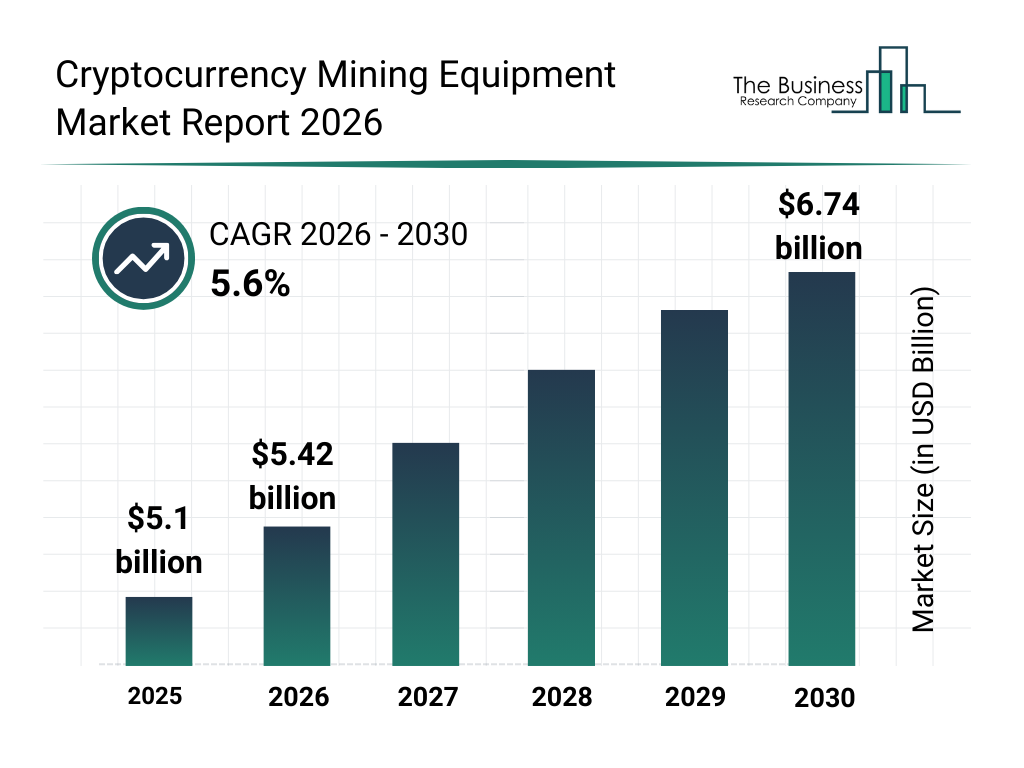

Cryptocurrency Mining Equipment Market Growth Outlook

- The market reached about $5.1 billion in 2025, showing strong demand for mining hardware.

- It is expected to grow to around $5.42 billion in 2026, indicating steady expansion.

- The market may climb to roughly $5.7 billion in 2027 as mining activity increases.

- By 2028, the market could approach $6.0 billion, driven by new equipment upgrades.

- In 2029, the market may hit about $6.35 billion, reflecting continued adoption.

- The market is projected to reach $6.74 billion by 2030, marking solid long-term growth.

- Overall, the industry is forecast to grow at a 5.6% CAGR from 2026 to 2030.

- This steady rise shows ongoing investment in crypto mining infrastructure worldwide.

Growth Factors in Cryptocurrency Mining

- Global demand for digital assets is projected to rise 20% in 2026, fueled by institutional adoption and stablecoin growth.

- Bitcoin miners currently earn around $20 million daily or $600 million monthly in revenue.

- Next-gen ASICs boost hashrate to 1.7 EH/s network by end-2026, up significantly with efficiency gains.

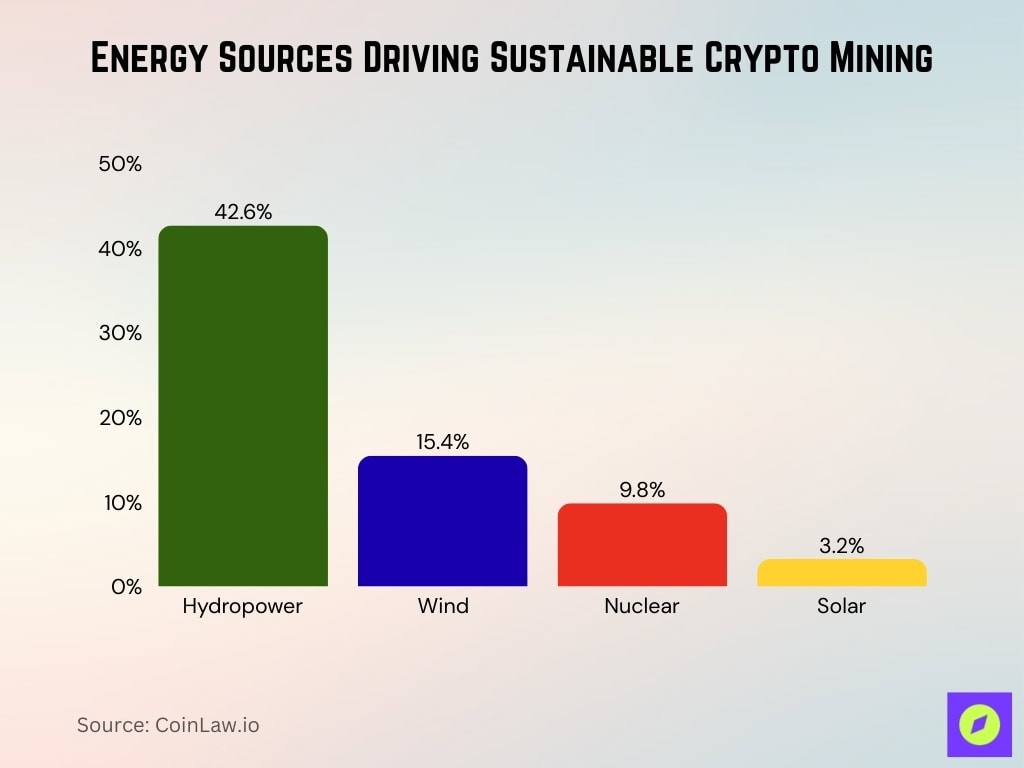

- 15.4% of mining energy from wind, 9.8% nuclear, and 3.2% solar, advancing renewables.

- 83% of institutional investors plan increased crypto exposure, 76% targeting tokenized assets.

- Mining operations concentrate in North America, such as Texas, reducing reliance on Asia and Russia.

- Global mining hardware investment hits $4.5 billion, up 12.5% amid infrastructure scaling.

- Mining pool participation grew 17%, enabling smaller ops to share rewards effectively.

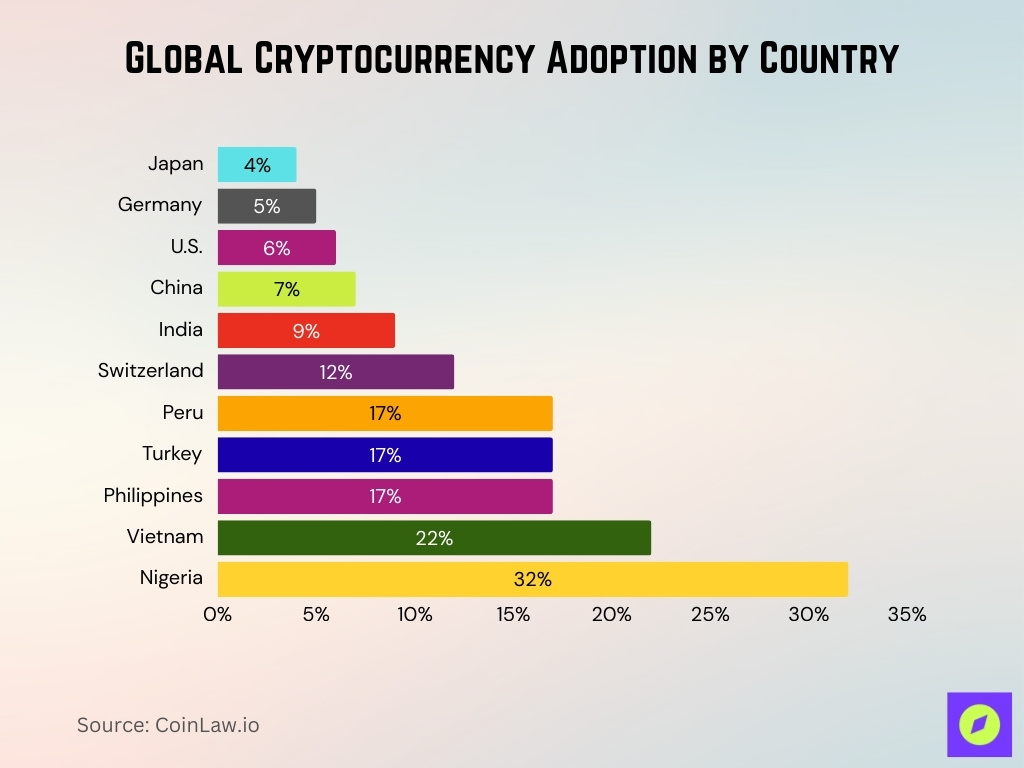

Global Cryptocurrency Adoption by Country

- Nigeria leads with the highest adoption rate at 32%, showing very strong crypto use.

- Vietnam follows with 22%, indicating rapid growth in digital asset adoption.

- Peru, Turkey, and the Philippines each report 17% adoption, highlighting strong interest in emerging markets.

- Switzerland records 12%, reflecting steady uptake in a developed financial hub.

- India reaches 9%, showing growing participation despite regulatory uncertainty.

- China stands at 7%, indicating limited but present crypto usage.

- The U.S. reports 6% adoption, suggesting moderate consumer involvement.

- Germany shows 5%, slightly below the U.S. level.

- Japan has the lowest rate at 4%, indicating cautious adoption compared to other countries.

- Overall, adoption is much higher in developing economies than in many advanced markets.

Global Cryptocurrency Mining Revenue

- Bitcoin mining accounts for 66% of global revenue, estimated at $14.8 billion yearly.

- Ethereum staking rewards deliver 3.5–4.2% APY, generating billions for validators network-wide.

- Altcoin mining revenue exceeds $3.2 billion, led by Litecoin, Kaspa, and Monero protocols.

- Mining pool participation surges 20%, enabling 85% of the hashrate via shared models.

- Market size valued at $3.7 billion in 2026, projected to grow at 9.7% CAGR to 2032.

- Global hardware investment hits $4.8 billion, up 12.5% amid efficiency upgrades.

- Industrial miners capture $100K+ yearly per optimized farm with low-cost power.

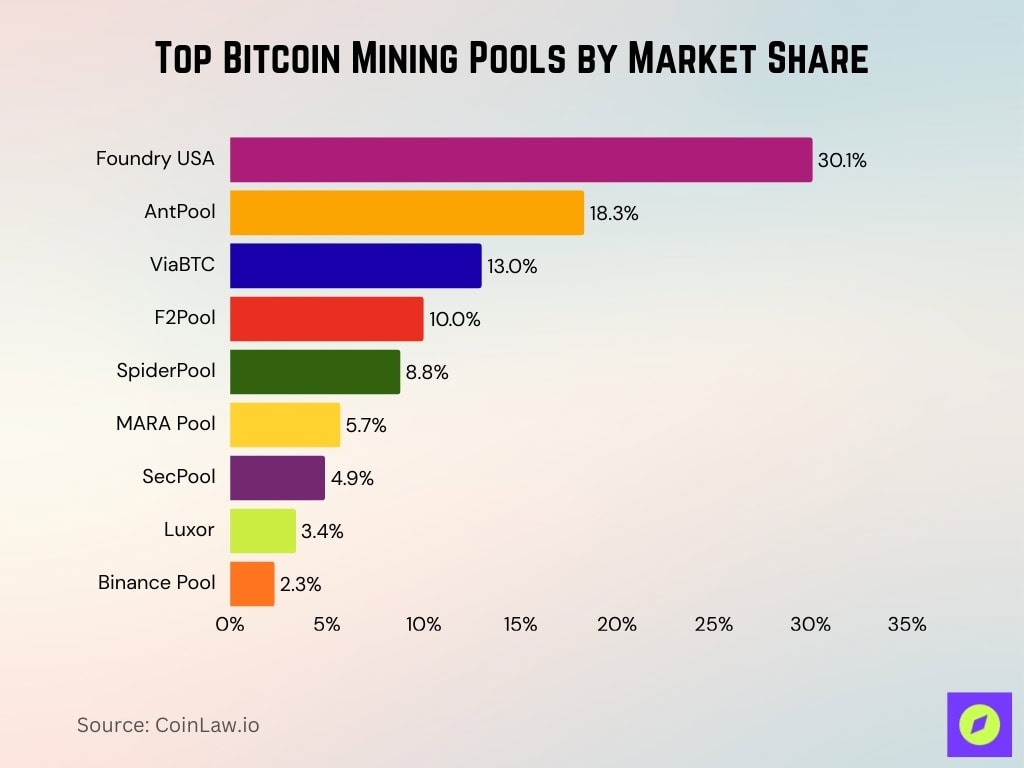

Top Bitcoin Mining Pools by Market Share

- Foundry USA leads with 30.1% share at 299 EH/s.

- AntPool holds 18.3% with 211 EH/s hashrate.

- ViaBTC captures 13.0% market share via 145 EH/s.

- F2Pool secures 10.0% with 113 EH/s contribution.

- SpiderPool rises to 8.8% share at 98 EH/s.

- MARA Pool contributes 5.7% with 64 EH/s.

- SecPool takes 4.9% of the hashrate at 55 EH/s.

- Luxor accounts for 3.4% share with 38 EH/s.

- Binance Pool maintains 2.3% at 26 EH/s.

Mining Technologies: ASIC, GPU, and Cloud Services

- ASIC miners like Antminer S23 Hydro reach 9.5 J/TH efficiency at 1,000 TH/s per unit.

- NVIDIA RTX 5090 GPUs deliver 250 MH/s on Ravencoin, dominating altcoin GPU mining.

- Cloud mining platforms grew 22%, with NiceHash processing $1.2 billion in hashrate rentals.

- Leading ASICs achieve 600 TH/s at 15 J/TH, tripling prior-gen output per watt.

- AMD RX 8900 XTX GPUs mine Ergo at 220 MH/s, powering ETC and Flux networks.

- FPGA adoption rose 28% for niche algos like RandomX, balancing ASIC resistance.

- CGMiner 5.0 and AI-optimized suites boost hashrate 20% via dynamic tuning.

- Decentralized protocols like DeFiHash tokenized 15 EH/s of distributed power.

- Rental platforms enable 85% uptime with auto-switching across 50+ coins.

Sustainability and Green Mining Initiatives

- Hydropower dominates renewables at 42.6% of sustainable mining energy.

- Wind contributes 15.4%, nuclear 9.8%, and solar 3.2% to the mining mix.

- Carbon-neutral pledges cover 52% of major firms targeting net-zero by 2030.

- Immersion cooling boosts efficiency 22%, cutting energy and emissions.

- Texas solar farms offset 2,400 tons of CO2 yearly, expanding 23%.

- Green grants up 17% in Norway/Iceland for 100% renewable facilities.

- Refurbished hardware use rose 18%, reducing e-waste among small miners.

Mining Profitability and Transaction Fees

- Bitcoin mining profitability averages $0.03/TH/day at $0.05/kWh power cost.

- Ethereum staking yields range 3.5–4.2% APY amid compressed rewards.

- Altcoin profitability is strong for Scrypt coins like Litecoin at $94.53 and Dogecoin at $0.158.

- Bitcoin average transaction fee stands at $0.31 as of late February.

- Foundry USA leads block production at 30%, optimizing fee capture.

- Mining investments in efficiency tech exceed $1.5 billion yearly.

- Network difficulty hits 144.398 T, pressuring daily profits to 14-month lows.

- Litecoin merge-mining boosts returns 25% via dual rewards.

End-User Insights in the Mining Industry

- Individual miners contribute 10% of the global hash rate via accessible ASICs and GPUs.

- U.S. hobbyist miners grew 14%, favoring cloud and mobile-managed setups.

- Cloud mining subscriptions rose 21% among individuals, led by Genesis Mining and BitDeer.

- Reddit crypto forums spiked 30% in mining discussions for community education.

- European users represent 17% of global cloud mining demand despite high power costs.

- GPU resale volumes increased 19% post-Ethereum PoS for Kaspa and Ergo mining.

- Staking deposits among retail users surged 38%, dominated by Coinbase, Kraken, and Binance.

- The cloud mining market hit $12 billion in Q1 2025 with 45% YoY growth.

Top Public Bitcoin Mining Companies by Hashrate

- MARA leads with an energized hashrate of about 57.4 EH/s, up 82% YoY.

- CLSK operates around 50 EH/s operational hashrate, averaging 42.6 EH/s in January.

- IREN met its target with 31 EH/s realized hashrate.

- RIOT expanded to roughly 28–30 EH/s, maintaining a top-tier position.

- BITF grows toward the mid-tier group with about 12 EH/s capacity.

- CIFR operates near 13 EH/s, contributing meaningfully to the public miner share.

- CORZ reports around 15 EH/s, rebuilding post-restructuring.

- HIVE runs approximately 6 EH/s, focusing on efficiency and diversification.

- HUT8 maintains about 5 EH/s, aided by its merger footprint.

Frequently Asked Questions (FAQs)

Global investment in mining hardware is set for 12.5% annual increase, reaching $4.5 billion.

CleanSpark (CLSK) averages 42.6 EH/s with targets near 50 EH/s.

Sustainable energy sources power 56.7% of Bitcoin mining operations.

Conclusion

The cryptocurrency mining industry is a dynamic field, shaped by technological advancements, regulatory developments, and a growing emphasis on sustainability. From end-user trends to global revenue streams, mining is evolving to meet the demands of an increasingly digital world. As regions’ sustainable practices and efficiency through cost-effective energy solutions, the sector reflects a global shift toward innovation and green initiatives.

The years ahead hold potential for even greater changes, especially as new technologies and practices emerge to address the pressing need for both profitability and environmental responsibility in cryptocurrency mining.