Imagine a world where buying a cup of coffee or paying your rent happens seamlessly using cryptocurrency. While this was once a futuristic fantasy, the global adoption of cryptocurrency has made it a reality. Over the past decade, digital assets have transformed from niche investment options to mainstream financial instruments. The statistics behind cryptocurrency adoption are not only compelling but also offer a glimpse into how technology is reshaping economies and societies. Let’s dive into the latest data that highlights this evolving landscape.

Editor’s Choice

- The global crypto market cap reached $3.6 trillion in 2025, reflecting a strong recovery and expansion.

- Bitcoin dominance stands at ~44.5% in 2025, reaffirming its leading role among digital assets.

- 11.42% of all ETH is staked via Coinbase in 2025, highlighting Ethereum’s staking momentum.

- Global crypto ownership in 2025 is estimated to be around 12% to 15%.

- The adoption of cryptocurrency as a payment method grew by ~45% in 2025, with businesses increasingly accepting Bitcoin and stablecoins.

- 65% of millennials and Gen Z now view cryptocurrency as a preferred investment over traditional stocks in 2025.

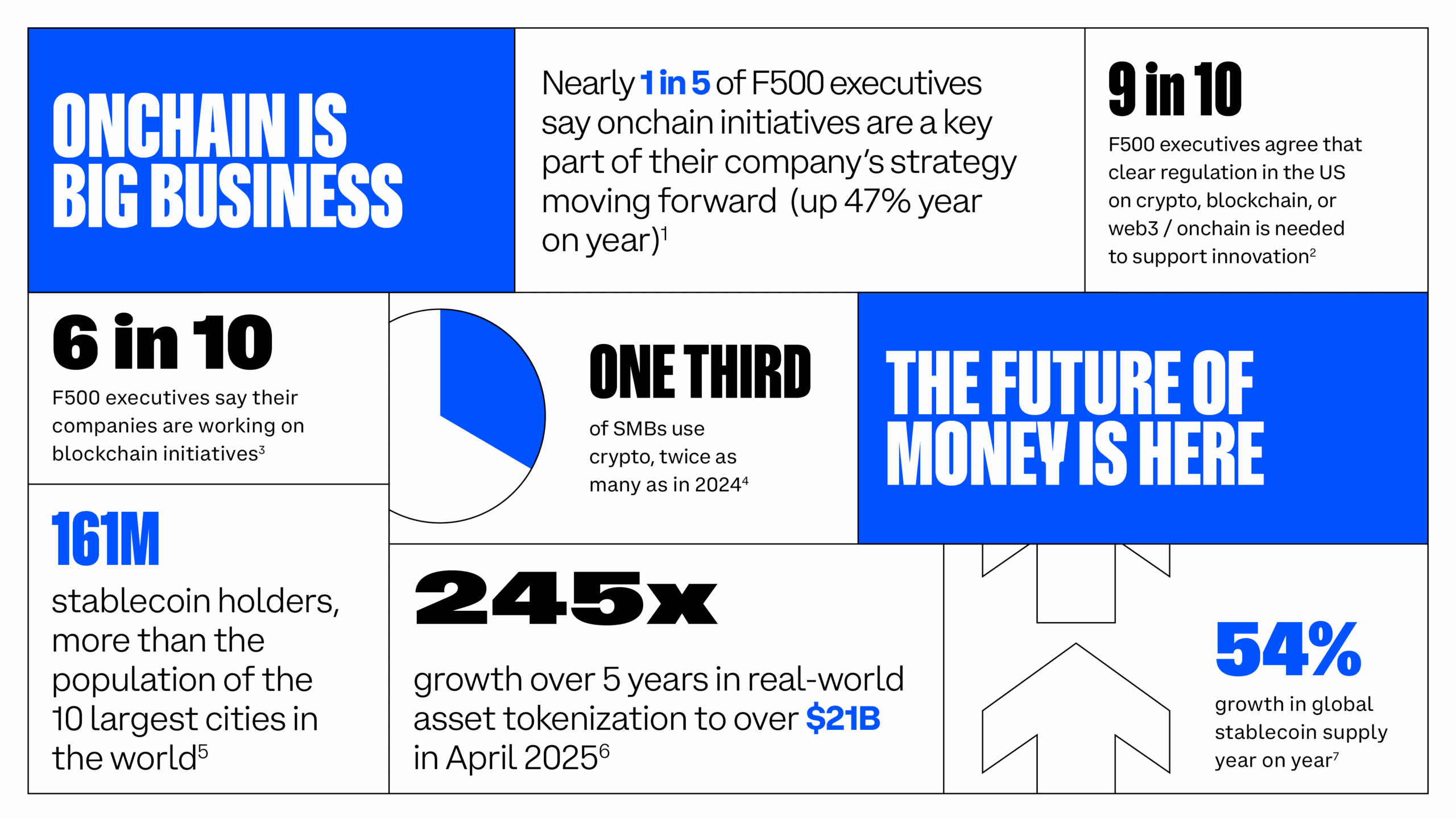

Onchain and Blockchain Adoption Highlights

- 1 in 5 F500 executives now see on-chain initiatives as a key part of company strategy, marking a 47% year-on-year increase.

- 9 in 10 F500 executives agree that clear US regulations on crypto, blockchain, or Web3 are needed to drive innovation.

- 6 in 10 F500 executives say their companies are actively working on blockchain initiatives in 2025.

- One third of SMBs use crypto in 2025, which is double the adoption rate compared to 2024.

- There are 161M stablecoin holders, exceeding the combined population of the 10 largest cities in the world.

- Real-world asset tokenization has grown 245x in 5 years, surpassing $21 billion by April 2025.

- The global stablecoin supply recorded a 54% year-on-year growth, underscoring its rising adoption.

Cryptocurrency Adoption is Growing Worldwide

- The crypto remittance market is booming with cross‑border payments via digital assets, estimated at $25 billion annually in 2025.

- The DeFi market cap expanded to $98.4 billion in 2025, showing resilience and innovation despite regulatory challenges.

- In 2025, 50% of SMEs globally began accepting cryptocurrency payments.

- India leads in global cryptocurrency ownership with ~150 million users in 2025, followed by the US and Nigeria.

- Blockchain gaming adoption grew by 30% in 2025, driven by the popularity of play‑to‑earn platforms.

Demographic Insights

- ~60% of crypto investors are now aged 25 to 34 in 2025, reflecting youth dominance in the space.

- The average cryptocurrency investor allocates ~12% of their portfolio to digital assets in 2025.

- 61% of investors are male in 2025, although female participation continues to rise.

- ~80% of crypto users live in urban or metropolitan areas as of 2025.

- The majority of crypto holders in 2025 work in tech, finance, or creative industries, reinforcing a tech‑savvy user base.

- 58% of crypto users consider themselves long‑term investors in 2025, while 42% engage in trading.

- ~72% of crypto investors hold a college degree or higher in 2025.

Country‑Wise Adoption Statistics

- India leads in 2025 with ~119 million cryptocurrency users.

- Nigeria’s adoption reaches ~42% of its population engaging in crypto.

- The United States counted ~65 million active crypto users in 2025.

- Vietnam sees ~21% of its population owning digital assets in 2025.

- In China, ~10 million people continue to hold crypto via decentralized platforms in 2025.

- Brazil records ~16 million crypto users amid a 50% growth in adoption in 2025.

- Russia reports ~17 million crypto holders in 2025, driven by economic pressures.

Regional Adoption Trends

- Asia‑Pacific now accounts for ~37.6% of the global crypto market share in 2025.

- Africa saw ~19.4% year‑on‑year growth in crypto adoption in 2025.

- Europe’s crypto adoption rose to ~8.9% of the adult population in 2025.

- North America reached ~16% crypto ownership in 2025.

- Latin America’s average national crypto adoption climbed to ~15.2% in 2025.

- The Middle East had ~11.3% of adults holding digital assets in 2025.

- Oceania maintains steady growth with ~10% involvement in crypto by 2025.

Most Popular Currencies

- Bitcoin (BTC) commands ~59.3% dominance in 2025.

- Ethereum (ETH) holds about 21% of the market share in 2025.

- Binance Coin (BNB) maintains a ~5% market share in 2025 within its ecosystem.

- Tether (USDT) leads in stablecoin usage with a circulating market cap of ~$112 billion in 2025.

- XRP surged ~30% in 2025 following regulatory clarity.

- Cardano (ADA) supports ~1,200 active projects in 2025.

- Solana (SOL) achieved a 50% rise in NFT transactions in 2025.

Fiat Trade Volume

- The US Dollar (USD) led fiat trade with $832 billion, remaining the dominant currency in global crypto trading.

- The South Korean Won (KRW) followed closely at $663 billion, showing its strong influence in Asian crypto markets.

- The Euro (EUR) accounted for $205 billion, highlighting steady participation from European traders.

- The Turkish Lira (TRY) recorded $83 billion, reflecting significant adoption despite local economic volatility.

- The British Pound (GBP) contributed $16 billion, representing moderate but notable trade activity.

- The Brazilian Real (BRL) reached $12 billion, signaling Latin America’s growing presence in fiat-to-crypto transactions.

- The Mexican Peso (MXN) and Australian Dollar (AUD) both posted $3 billion, marking their role as emerging contributors.

- The Swiss Franc (CHF) logged $2 billion, showing limited but stable activity in Switzerland’s market.

- The Argentine Peso (ARS) came last with $1 billion, reflecting challenges in adoption due to inflationary pressures.

Institutional Adoption and Investment

- BlackRock and Fidelity now manage over $100 billion in crypto assets as of 2025.

- ~59% of institutional investors plan to allocate over 5% of their AUM to digital assets in 2025.

- Grayscale Bitcoin Trust (GBTC) controls approximately $14 billion+ in Bitcoin holdings in 2025.

- Goldman Sachs’ crypto trading desk now facilitates $2 billion+ in annual transactions in 2025.

- MicroStrategy (Strategy Inc.) holds ~499,096 BTC on its balance sheet in 2025.

- Tesla retains 10,725 BTC in 2025, signaling continued corporate belief in crypto.

- Hedge funds allocate an average of ~7% of their portfolio to cryptocurrencies in 2025.

Retail Investors and Crypto

- ~78% of retail investors entered the crypto market between 2021 and 2025, showing growing accessibility.

- Robinhood and Coinbase dominate the US retail crypto scene with a combined user base of ~130 million in 2025.

- Surveys show ~58% of retail investors view cryptocurrency as a long‑term investment in 2025.

- Crypto wallets like MetaMask and Trust Wallet reached ~258 million active users globally in 2025.

- Play‑to‑earn games and NFTs fueled a ~35% increase in new retail investors in 2025.

- Average crypto transaction costs dropped to ~0.20% globally in 2025, drawing more retail users.

- Educational platforms saw a ~65% rise in traffic as retail interest surged in 2025.

Cryptocurrency Across Industries

- The e‑commerce sector saw ~75% in crypto payments in 2025 compared to previous years.

- The gaming industry in 2025 had ~35% of games incorporating crypto or NFTs.

- Healthcare firms in 2025 reported ~25% running blockchain pilot programs.

- Real estate crypto transactions reached ~$4.2 billion in 2025, with Bitcoin frequently used in property deals.

- Travel and tourism bookings made with crypto jumped ~42% in 2025.

- Crypto transactions in the food and beverage industry totaled ~$3 billion in 2025.

- The automotive sector used blockchain widely in 2025 for supply chain transparency across major brands.

Adoption of Cryptocurrency for B2B Payments

- In 2025, ~35% of small businesses in the US accept cryptocurrency for B2B transactions.

- XRP (Ripple) processes cross‑border payments in ~4 seconds on average in 2025.

- Major firms like IBM and Oracle offer enterprise blockchain payment solutions in 2025.

- Over 1,500 global suppliers accept Bitcoin and Ethereum as payment in 2025.

- Crypto invoice settlements rose by ~50% in 2025, especially in tech and logistics.

- BaaS (Blockchain‑as‑a‑Service) from Microsoft and AWS drives enterprise crypto adoption in 2025.

- Asia‑Pacific leads in B2B crypto adoption, accounting for ~35% of global B2B crypto transactions in 2025.

Cryptocurrency Concerns

- Regulatory uncertainty remains a major barrier, with ~58% of businesses in 2025 citing it as a challenge.

- Mining’s environmental impact is under scrutiny, though global mining emissions dropped ~9.5% in 2025.

- Security risks persist as over $2.17 billion has already been stolen in crypto‑related hacks and scams in 2025.

- Volatility still deters usage with assets frequently fluctuating by 10‑20% daily in 2025.

- ~45% of small business owners report insufficient education about crypto in 2025, slowing adoption.

- Interoperability issues between blockchains continue to hinder seamless transactions in 2025.

- The emergence of CBDCs presents both competition and opportunity for traditional cryptocurrencies in 2025.

Recent Developments

- Ethereum’s Shanghai Upgrade enabled staked ETH withdrawals and sparked renewed activity across validators in 2025.

- The Bitcoin Lightning Network reached a capacity of ~14,350 BTC in 2025, improving scalability and microtransaction throughput.

- Hong Kong legalized retail crypto trading in 2025, aiming to become a major global crypto hub.

- The US Congress passed new regulations in 2025 focusing on stablecoins and anti‑money laundering frameworks.

- The SEC approved spot Bitcoin ETFs in early 2025, opening doors for broader institutional participation.

- Elon Musk proposed adding Dogecoin payments to X in 2025, reigniting interest in meme coins.

- Binance expanded its Proof of Reserves program in 2025 to enhance transparency and trust among users.

Frequently Asked Questions (FAQs)

Estimates in 2025 suggest that between 400 and 600 million people globally have used or owned cryptocurrencies, though user counts vary based on definitions of “use.”

The stablecoin supply reached $227 billion in early 2025.

Fiat on‑ramps into Bitcoin totaled $4.6 trillion, the highest among all crypto inflows.

Over $2.17 billion has been stolen from cryptocurrency services in 2025 (mid‑year).

Conclusion

Cryptocurrency adoption continues to grow, bridging gaps between individuals, businesses, and technology. From enabling financial inclusion to transforming industries, digital assets are reshaping the global economic landscape. As we navigate the challenges and opportunities, one thing is clear: the crypto revolution is far from over. Whether it’s Bitcoin’s dominance or Ethereum’s innovations, cryptocurrencies remain at the forefront of digital transformation, paving the way for a more decentralized and connected world.