In the early days of cryptocurrency, a few adventurous traders quietly moved Bitcoin across their laptops, never imagining a government official would take interest. Fast forward, and the crypto landscape has transformed. Governments around the world are racing to regulate, tax, and monitor digital assets. Investors now find themselves navigating an increasingly complex world of crypto taxation laws.

Whether you’re a seasoned crypto investor or a beginner dipping your toes into Bitcoin, understanding how different countries tax digital assets is essential in this evolving ecosystem. This article breaks down the latest crypto taxation statistics, offering a clear, data-driven look at how global policies are shaping the future of crypto investment.

Editor’s Choice

- The United States applies a short-term crypto capital gains tax of up to 37% for assets held less than a year in 2025.

- El Salvador and Portugal are among at least 5 countries with zero taxes on personal crypto gains in 2025.

- Crypto mining is taxed in 43% of countries globally, where mining is legal in 2025.

- Over 65% of US crypto investors use automated tax reporting tools like Koinly and CoinTracker in 2025.

- Crypto tax non-compliance penalties reach up to $250,000 in the US and €500,000 in Germany in 2025.

Percentage of Countries Taxing Cryptocurrency Income

- OECD data for 2025 shows 39% of countries apply personal income tax to crypto gains, while 17% use capital gains classification.

- 20% of nations treat crypto as business income, with higher tax rates applied, especially in Scandinavia and Western Europe, where rates can reach up to 52%.

- In Asia, 65% of countries have implemented crypto taxation by 2025, with India, China, and South Korea enforcing taxes up to 30%-45%.

- Africa remains the least regulated region, with only 12% of its nations having formal crypto tax laws in 2025.

- In North America, both the US and Canada enforce stringent tax reporting obligations as of 2025, while Mexico is gradually adopting crypto tax measures with an obligation to report profits at rates up to 35%.

- In Latin America, Argentina taxes crypto income at 35%, while Brazil requires crypto transaction declarations but does not tax gains under certain thresholds in 2025.

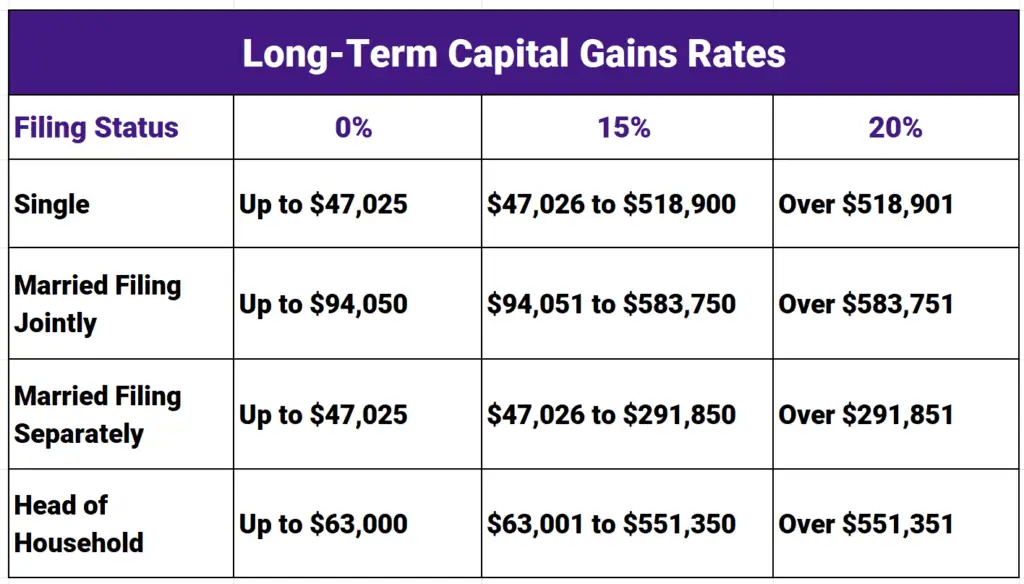

Long-Term Capital Gains Tax Brackets

- Single filers pay 0% on gains up to $47,025, 15% on gains from $47,026 to $518,900, and 20% on amounts over $518,901.

- Married filing jointly benefits from a 0% rate up to $94,050, a 15% rate from $94,051 to $583,750, and 20% if gains exceed $583,751.

- Married filing separately sees 0% up to $47,025, 15% between $47,026 and $291,850, and 20% above $291,851.

- Head of household taxpayers enjoy 0% up to $63,000, a 15% bracket from $63,001 to $551,350, and 20% if they earn above $551,351.

VAT and Sales Taxes on Crypto Transactions

- Australia removed GST from crypto purchases, but capital gains tax applies to disposals, and business use events in 2025, with personal purchases under $10,000 exempt from CGT.

- Japan abolished its 8% consumption tax on crypto transactions in 2017, but crypto is taxed as miscellaneous income at progressive rates up to 55% in 2025.

- South Africa does not impose VAT on crypto exchanges but applies VAT to goods and services bought with crypto, while crypto profits attract capital gains tax up to 18% or income tax up to 45% in 2025.

- India requires an 18% GST on crypto exchange services as of July 2025, applicable to both CEX and DEX platforms.

- Argentina applies a 21% VAT on crypto-related services, including exchange operations, in 2025.

- United Arab Emirates exempts all crypto transactions from VAT in 2025, but related services and businesses may be subject to general 5% VAT if supplies are made to UAE customers.

- Mexico imposes a 16% VAT on services by crypto exchanges as of 2024, making exchange platform services taxable under its digital services law.

Crypto Mining Taxation Statistics

- 43% of countries where crypto mining is legal impose income or corporate tax on mining rewards in 2025.

- Russia legalized crypto mining, with corporate entities taxed at 25% and individuals facing progressive tax rates up to 15% starting January 2025.

- Kazakhstan’s digital mining tax is set at 2 tenge per kilowatt-hour used, with rates varying by energy source and reaching as high as 25 tenge/kWh for non-renewable energy in 2025.

- Iran applies a business tax of up to 35% for legal entities and a capital gains tax ranging from 10–25% for individuals on mining profits in 2025.

- China continues its mining ban in 2025, with illegal operations subject to criminal penalties, including fines up to ¥1 million and equipment seizure.

- Germany exempts hobby miners from taxes under €256 annual profit, but professional mining operations are taxed at income rates up to 45% in 2025.

- Venezuela imposes a 15% tax on gross income from registered mining activities, with mandatory SUNACRIP registration in 2025.

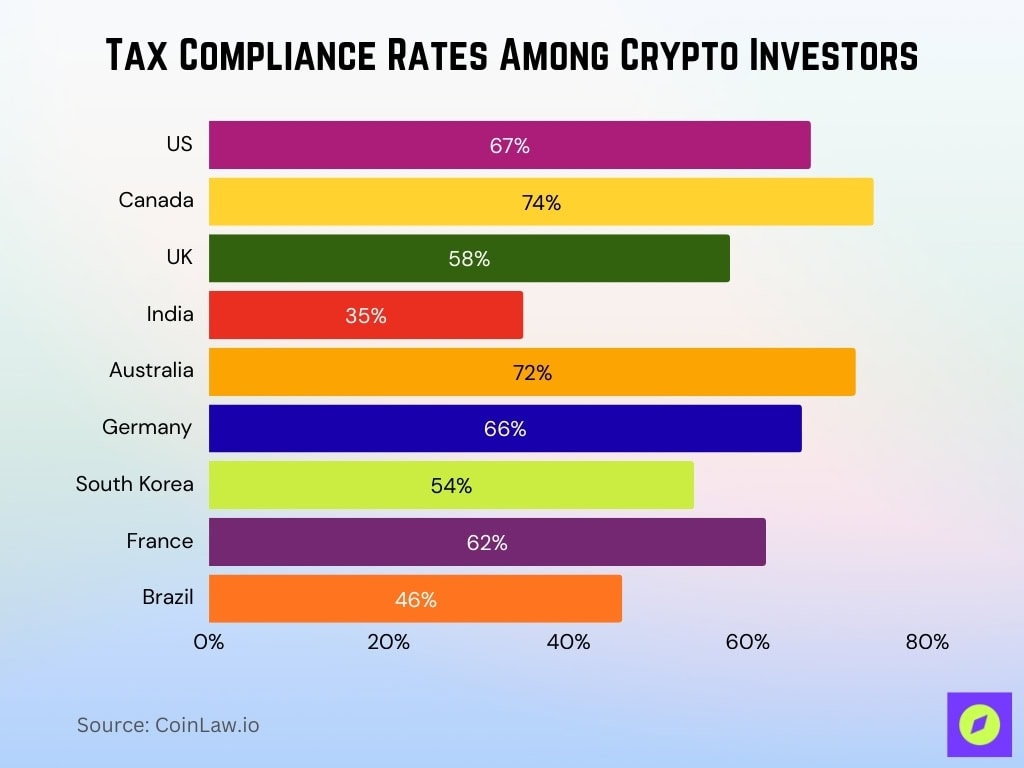

Tax Compliance Rates Among Crypto Investors

- 67% of US crypto investors reported income on IRS forms in 2025, up from 65% in 2024.

- 74% of Canadian crypto investors declared gains and losses with the CRA in 2025, after stricter enforcement.

- 58% of UK crypto investors reported digital asset transactions to HMRC in 2025, up from 45% in 2023.

- India’s crypto trader compliance rate is just 35% in 2025 despite heavy penalties and monitoring.

- In Japan, 41% of crypto holders filed tax returns reflecting digital asset profits in 2025, a 5% year-on-year increase.

- 72% of Australian crypto investors accurately reported crypto activity in 2025 using ATO-mandated software.

- Compliance among German crypto investors stood at 66% in 2025, climbing from 59% in 2024.

- South Korea reached a 54% crypto tax compliance rate in 2025 as real-time reporting became standard.

- France saw crypto investor reporting jump to 62% in 2025 after introducing simplified filing rules.

- Brazil’s crypto tax compliance is 46% in 2025, with regulators predicting a rise once exchange data integration launches in 2026.

Penalties and Fines for Crypto Tax Evasion

- The United States imposed penalties of up to $250,000 and potential prison for intentional crypto tax evasion in 2025.

- Germany fines crypto tax evaders up to €500,000 and may enforce prison sentences for severe cases.

- Japan sets penalties of up to 35% of undeclared crypto income, plus surcharges for late payments in 2025.

- The United Kingdom fines evaders 100% of unpaid tax, plus interest and prosecution risk in 2025.

- Australia’s ATO applies fines up to 75% of the tax owed for non-disclosure, with extra interest penalties in 2025.

- India issued a 200% penalty on unpaid crypto tax and up to 7 years imprisonment for willful evasion in 2025.

- France imposed fines of up to 80% of unpaid taxes and additional penalties for unreported accounts and fraud in 2025.

- Canada levies fines up to 50% of unpaid taxes and possible criminal charges for gross negligence in 2025.

- South Korea charges fines up to 40% of unpaid taxes, with possible asset seizure and criminal prosecution for evasion in 2025.

- Italy’s 2025 rules set penalties up to 240% of unpaid crypto taxes, with administrative and criminal consequences.

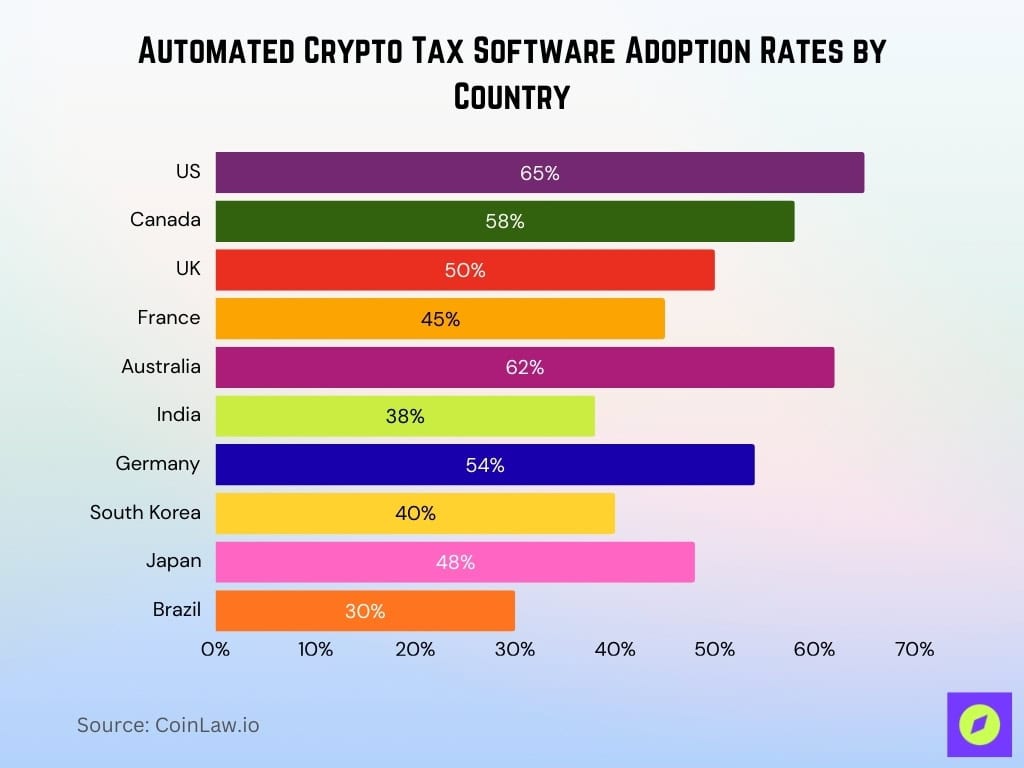

Adoption of Automated Crypto Tax Reporting Tools

- 65% of US crypto investors use automated tax software like CoinTracker and Koinly for 2025 tax reporting.

- 58% of Canadian crypto holders leverage CryptoTaxCalculator to manage tax filings this year.

- 50% of UK investors now use Recap.io or Accointing for automated crypto tax calculations in 2025.

- 45% adoption rate for crypto tax reporting tools in France, with Waltio seeing rapid growth in 2025.

- 62% of Australian crypto users rely on CryptoTaxCalculator and Koinly, both ATO-compliant, for 2025 filings.

- India’s automated crypto tax tool adoption surged to 38% in 2025, with platforms like ClearTax and KoinX expanding features.

- German crypto investors report a 54% usage rate for tax automation via tools like Blockpit and Koinly in 2025.

- 40% of South Korean crypto traders use integrated tax software solutions provided by exchanges in 2025.

- In Japan, automated tax software adoption reached 48% in 2025, with Guardian and Aerial serving most users.

- Brazil’s adoption rate for crypto tax tools is 30% in 2025, with incentives to boost uptake next year.

Third-Party Service Providers (Crypto Tax Calculators)

- CoinTracker had over 3 million users globally in 2025, making it the most popular US crypto tax software.

- Koinly supports tax reporting in 30+ countries and saw a 42% global user growth from 2024 to 2025.

- CryptoTaxCalculator achieved 55% user growth in 2025, expanding from Australia to Canada, the UK, and India.

- TokenTax reported a 33% increase in enterprise users, especially for DeFi and NFT tax filing in 2025.

- Waltio is France’s top platform with over 50+ integrations and processed over €1 billion in crypto transactions in 2025.

- Recap.io’s new DeFi tax estimation drew 25,000+ active users in the UK for 2025 filings.

- ZenLedger saw a 60% YoY increase in users in 2025, boosted by its TurboTax partnership for US taxpayers.

Crypto Taxes from the IRS Point of View

- The IRS collected over $42 billion in crypto-related taxes in 2025, up 10% from 2024.

- In 2025, the IRS expanded John Doe Summons actions targeting 8 major crypto exchanges for transaction disclosures.

- Form 1040 now requires explicit reporting of all digital asset transactions, including NFTs and DeFi income, in 2025.

- Operation Hidden Treasure resulted in 1,200+ investigations and recovered over $400 million in crypto taxes since 2023.

- Publication 544 updated treatment of airdrops, forks, and wrapped tokens for 2025 tax returns.

- The Crypto Compliance and Enforcement Task Force recovered more than $2.3 billion from offshore crypto accounts in 2025.

- IRS Notice 2025-12 and related rules require 1099-DA filings for crypto transactions exceeding $600.

- The IRS expanded NFT and DeFi FAQ guidance in 2025 with new yield farming taxation examples.

- IRS crypto audits increased by 52% from 2024 to 2025, focusing on high-net-worth digital asset holders.

- Penalty rates for crypto noncompliance in 2025 range from $10,000 to $250,000 per violation, with interest and prosecution possible.

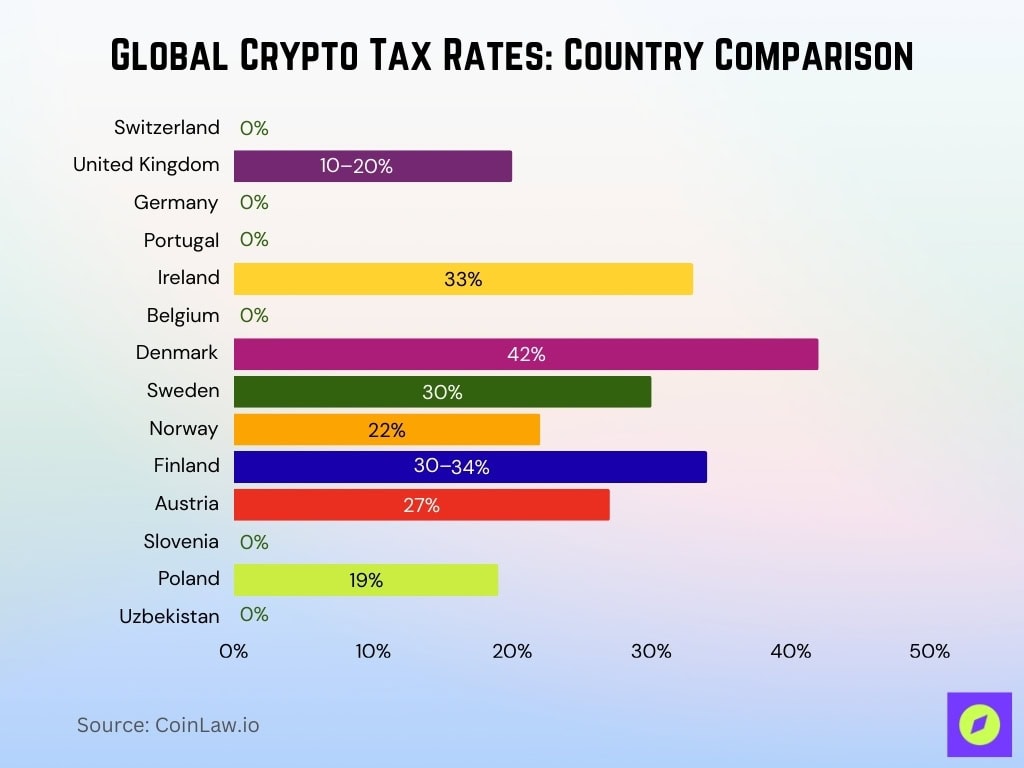

Global Crypto Tax Rates: Country Comparison

- Switzerland, Germany, Portugal, Belgium, Slovenia, and Uzbekistan offer a 0% crypto tax rate, making them among the most crypto-friendly jurisdictions.

- The United Kingdom applies a variable tax of 10–20%, depending on income and capital gains thresholds.

- Ireland enforces a high flat crypto tax rate of 33%, among the steepest in Europe.

- Denmark tops the chart with the highest tax at 42% on crypto gains, significantly impacting investor returns.

- Sweden imposes a 30% tax, aligning closely with Scandinavian norms on capital gains.

- Norway charges a 22% crypto tax, slightly lower than its Nordic peers.

- Finland levies between 30–34%, depending on individual income brackets.

- Austria has a competitive mid-range tax rate of 27% on digital asset profits.

- Poland applies a 19% tax, offering a lower but still notable rate within the EU.

Impact of Crypto Taxation on Investor Behavior

- 72% of US crypto investors say tax rules now influence their holding periods, with a shift to long-term for lower rates in 2025.

- 58% of Canadian investors cut back on day trading, focusing on staking and yield farming to improve tax efficiency.

- 49% of European crypto users weigh offshore hubs like Malta and Portugal for favorable tax treatment in 2025.

- 33% of Australian traders reduced transaction frequency after the ATO’s tougher reporting rules this year.

- In Japan, 45% of investors moved assets to DeFi platforms to avoid stricter 2025 reporting rules.

- Germany reports a 40% uptick in long-term holding as investors take advantage of the one-year capital gains tax exemption.

- India recorded a 22% drop in exchange usage post-implementation of TDS and gains taxes, driving peer-to-peer swaps.

- Brazil saw a 35% increase in crypto-to-crypto swaps in 2025 to defer tax events.

- France had a 20% rise in staking participation on DeFi products thanks to favorable tax guidance and reforms in 2025.

Recent Developments

- In 2025, the OECD’s Crypto-Asset Reporting Framework (CARF) became the global tax standard with 58 countries agreeing to share crypto tax data automatically.

- The EU’s MiCA regulation enforces that 90% of centralized exchanges report customer crypto transactions, raising tax compliance rates by 45% since 2024.

- The US Treasury finalized the Digital Asset Broker Rule in 2025, mandating reporting of all user transactions by brokers and exchanges starting with 2025 trades.

- The UK’s HMRC introduced real-time reporting for large crypto transfers, improving transparency for all transactions above £10,000 in 2025.

- Canada now requires mandatory reporting for crypto transactions over CA$50,000, targeting cross-border activity as of 2025.

- India’s Finance Ministry introduced an 18% GST on all crypto and DeFi services in July 2025, creating a unified tax structure.

- Japan eased corporate crypto tax, exempting unrealized gains on tokens not transferred and moving toward a flat 20% capital gains tax in 2025 to foster startups.

Frequently Asked Questions (FAQs)

66% of German crypto investors filed accurate tax returns in 2025.

France applies a flat 30% tax on crypto capital gains, which includes social charges in 2025.

Over 12 countries maintain official tax-free or low-tax status for crypto assets as of 2025.

43% of countries where mining is legal impose specific mining or corporate tax on mining rewards in 2025.

Conclusion

The crypto taxation landscape is more complex and far-reaching than ever before. Regulatory bodies worldwide are tightening reporting requirements, increasing tax rates, and introducing penalties for non-compliance. At the same time, progressive jurisdictions offer favorable conditions that attract long-term investors and crypto businesses. Whether you’re an individual trader or managing a corporate crypto portfolio, understanding and complying with these evolving tax laws is non-negotiable.

As global standards emerge and countries align their tax regimes, staying informed will remain critical. Automated tax software and professional advice are no longer optional; they are essential tools for navigating the intricate web of crypto taxation laws.