Imagine a world where your achievements in video games aren’t just for bragging rights but hold real-world value. That’s the reality that crypto gaming is beginning to shape. By leveraging blockchain technology, crypto gaming allows players to earn, trade, and own assets that exist beyond a single game’s boundaries. This evolution marks a powerful fusion of gaming and finance, drawing gamers, investors, and developers to explore the dynamic crypto-gaming market. As we step into 2025, it’s essential to understand the current landscape of crypto gaming, from growth trends and demographic profiles to market structures and technological advancements.

Key Takeaways

- 1The global blockchain gaming market is valued at $21.6 billion in 2025 and projected to hit $1,270 billion by 2033, growing at a CAGR of 63.4%.

- 254% of U.S. blockchain gamers now own cryptocurrency and 82% are interested in using it for in-game purchases.

- 3The global gaming population has climbed to 3.48 billion in 2025, with blockchain gamers reaching 102 million, up 72% year-over-year.

- 4Play-to-earn (P2E) titles still dominate, with Immutable surpassing $390 million in NFT trading volume in 2025.

- 5Blockchain gaming revenue stands at $21.6 billion in 2025, projected to grow to $328.4 billion by 2030 with a CAGR of 69.1%.

Market Size and Growth

- The global blockchain gaming market is projected to reach $85 billion in 2025, driven by a 52.1% CAGR.

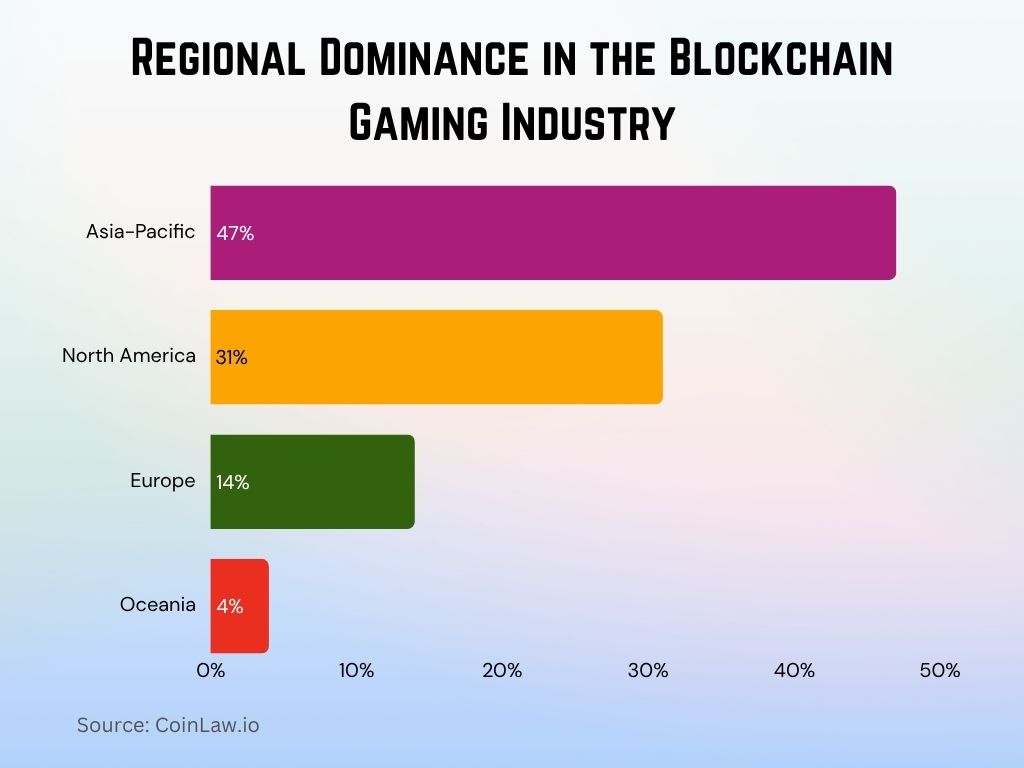

- Asia-Pacific leads with 47% market share in 2025, powered by rapid adoption in China, Japan, and South Korea.

- North America follows with 31% of the global share, boosted by strong infrastructure and crypto-savvy users.

- Europe accounts for 14% of the 2025 blockchain gaming market, driven by growth in Germany, France, and the UK, with a focus on regulation and innovation.

- Oceania, led by Australia and New Zealand, contributes 4% of the global share, showing strong per-capita engagement despite a smaller market size.

- Over 73% of blockchain games in 2025 are developed for mobile platforms, enabling mass accessibility and user growth.

- Play-to-earn (P2E) games make up 62% of blockchain gaming revenue in 2025, continuing to attract players seeking monetizable gameplay.

- Monthly blockchain-based in-game transactions exceeded $620 million in 2025, reflecting sustained user activity and spending.

- Ethereum hosts 38% of blockchain games, followed by BNB Chain at 30% and Polygon at 17%, leading the sector in developer adoption.

- Metaverse elements are now featured in 37% of blockchain games in 2025, enriching user experience with virtual environments and social interaction.

Blockchain Gaming Market Ecosystem

- Ethereum, BNB Chain, and Flow remain top protocols, collectively powering 86% of blockchain games in 2025 thanks to smart contract depth and dev support.

- Decentralized marketplaces like OpenSea and Rarible now handle 78% of all gaming NFT sales, acting as core platforms for asset exchange.

- Cross-chain interoperability via Enjin, Polkadot, and LayerZero is gaining traction, projected to cover 24% of market transactions in 2025.

- In 2025, about 93% of blockchain games support wallet integration, with MetaMask and Phantom still dominating player access and security.

- Game-specific tokens are now used in 45% of blockchain games, reinforcing unique, self-contained economies within each title.

- DAOs drive governance in 57% of new blockchain gaming projects in 2025, empowering players to influence development, rules, and updates.

- DeFi mechanics such as staking and yield farming are embedded in 35% of blockchain games, blending finance with gameplay and enhancing engagement.

User Demographics and Engagement

- 71% of blockchain gamers in 2025 are aged 18 to 34, drawn by earning potential, ownership, and gamified crypto experiences.

- Female participation in crypto gaming rose to 34% in 2025, up 4 percentage points from last year, narrowing the gender gap further.

- Retention rates remain high, with 52% of players still active after 90 days, driven by ownership of in-game NFTs and tokens.

- The United States, India, and China together account for 62% of global blockchain gamers in 2025, reflecting massive user bases and mobile access.

- 32% of players now earn over $100/month, while top earners surpass $600 monthly through P2E games and NFT trading in 2025.

- Over 83% of blockchain gamers are active in Discord, Telegram, or Reddit communities, fueling collaboration, trading, and updates.

- The average blockchain gamer in 2025 spends 12–16 hours per week in-game, driven by asset value accumulation and real-time social play.

Key Companies & Market Share Insights

- Axie Infinity remains a top blockchain game, generating over $1.4 billion in revenue in 2025, fueled by its strong P2E economy and NFT trading.

- Decentraland earned more than $275 million in 2025 from virtual land and digital assets, capturing 19% of blockchain gaming’s virtual real estate market.

- The Sandbox holds around 16% market share in 2025, powered by user-generated content and its creator-first, voxel-based world-building model.

- Immutable X now hosts 22% of blockchain games launched in 2025, thanks to its gas-free trading and developer-friendly Ethereum scaling.

- Gala Games commands 13% of revenue-based market share in 2025, driven by multigenre titles and robust token infrastructure.

- Enjin accounts for 11% of blockchain game transactions in 2025, leading in interoperable assets and cross-game NFT support.

- Ubisoft expanded its blockchain division in 2025, achieving a 7% increase in revenue from NFTs and tokenized game features.

Global Blockchain Gaming Market Forecast

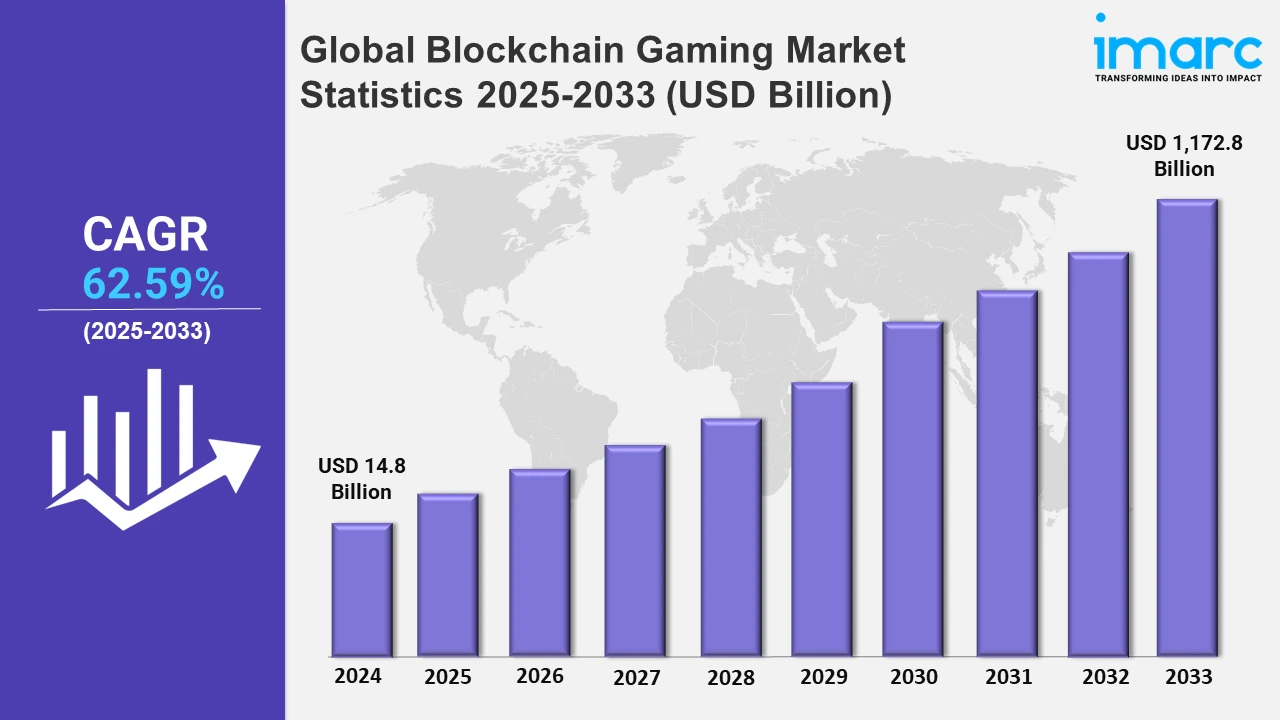

- The global blockchain gaming market is projected to grow at an impressive CAGR of 62.59% from 2025 to 2033.

- By 2033, the market is expected to reach a staggering $1,172.8 billion.

- The data indicates a massive expansion fueled by blockchain adoption, NFT integration, and increased gamer engagement.

- Asia-Pacific and North America are anticipated to be the leading regions in this growth.

Technological Innovations and Game Development

- Layer 2 scaling solutions like Polygon and Immutable X have cut transaction costs by 74% in 2025, making blockchain gaming more affordable and scalable.

- 46% of new blockchain games in 2025 now use AI-driven systems, enabling adaptive gameplay, smarter NPCs, and real-time content personalization.

- 82% of blockchain games have adopted enhanced security protocols in 2025, including multi-signature wallets and zero-knowledge authentication.

- Cross-chain compatibility is supported by 39% of games in 2025, thanks to solutions like Polkadot, LayerZero, and Axelar, enabling fluid asset transfers.

- Advanced smart contracts are now used by 64% of blockchain games, boosting automation, fairness, and fraud prevention in virtual economies.

- AR integration features in 28% of new blockchain titles in 2025, blending immersive real-world interaction with in-game blockchain elements.

- DAOs are built into 55% of 2025 blockchain gaming projects, empowering communities to vote on updates, governance, and in-game policies.

Blockchain Gaming Market Trends

- Mainstream Partnerships: Partnerships between blockchain gaming companies and traditional gaming studios surged by 35%, with major companies exploring blockchain to enhance user experience and attract new audiences.

- Sustainable Gaming: Eco-friendly solutions are gaining traction, with 25% of blockchain games now implementing energy-efficient protocols or using eco-conscious blockchain networks to minimize environmental impact.

- Rise of Virtual Real Estate: Virtual real estate transactions grew 50%, with games like Decentraland and Sandbox spearheading this trend. Virtual land purchases are now a significant revenue stream, with some plots selling for as much as $500,000.

- GameFi Expansion: GameFi (Game Finance) continues to merge gaming with decentralized finance, with 40% of blockchain games incorporating DeFi elements, such as token staking and yield farming, allowing players to maximize earnings.

- Increasing Female Player Base: Crypto gaming has seen a 15% increase in female player participation, reflecting more inclusive marketing strategies and a growing variety of game genres catering to diverse audiences.

- Creator Economy: The creator-driven economy has flourished, with 30% of blockchain games supporting player-generated content and customization, allowing gamers to design, sell, and profit from in-game assets.

- Token-Driven Rewards Systems: Token-based reward systems continue to evolve, with 45% of blockchain games rewarding players in native tokens for achievements, enhancing both player retention and engagement.

Regional Insights

- North America accounts for 31% of the global blockchain gaming market in 2025, with the U.S. hosting 47% of blockchain gaming companies and leading in metaverse development.

- Asia-Pacific dominates with 46% of global revenue in 2025, driven by China, Japan, and South Korea, supported by tech-forward policies and mobile gaming penetration.

- Europe holds a 19% market share in 2025, with Germany, the UK, and France at the forefront, and 38% of European gamers now prefer eco-conscious blockchain games.

- Latin America experienced 28% year-over-year growth in 2025, led by Brazil and Argentina, where P2E gaming has become a source of income for younger players.

- Middle East and Africa showed 21% growth in 2025, with rising interest in P2E platforms offering alternative income streams amid economic uncertainty.

- India now has over 14 million blockchain gamers in 2025, driven by its youthful population and rapid mobile internet expansion.

- Australia and New Zealand represent 5.2% of global market share in 2025, with strong engagement in virtual world-building and land-based metaverse games.

Global Games Market Forecast

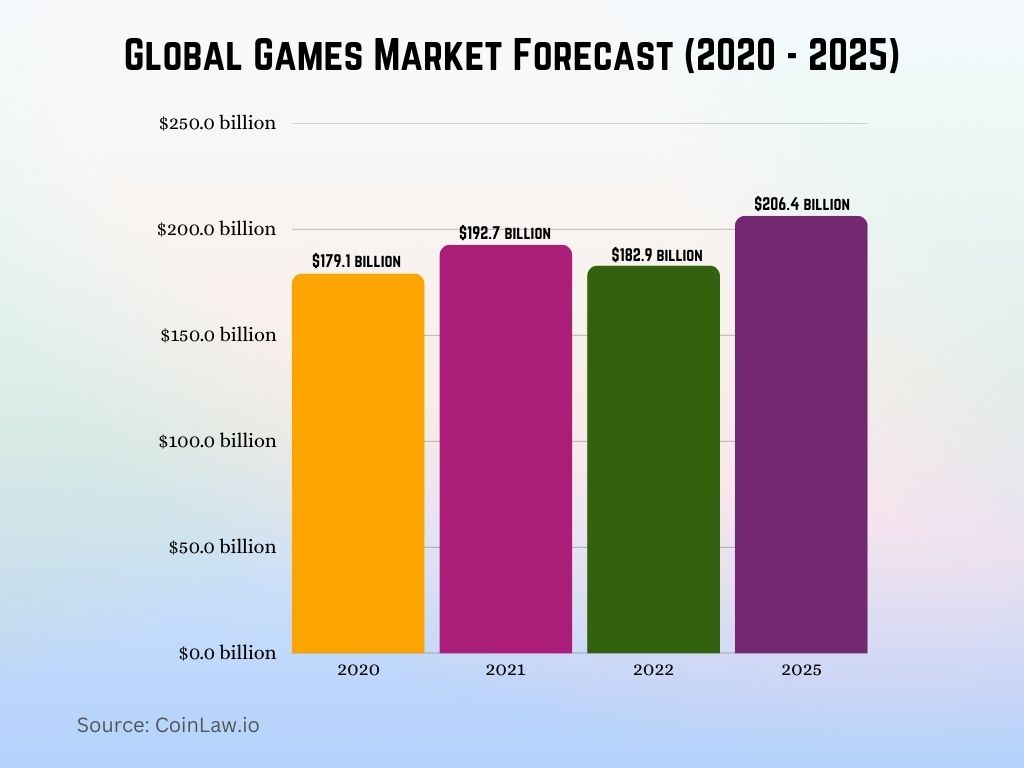

- In 2020, the global games market was valued at $179.1 billion.

- The market grew to $192.7 billion in 2021.

- In 2022, the market declined slightly to $182.9 billion.

- By 2025, the market is projected to reach $206.4 billion.

- This represents a Total Market CAGR of +2.9% through 2025.

Advantages and Challenges of Blockchain Gaming

- Ownership of In-Game Assets: One of the biggest advantages is the true ownership of in-game assets. Players can buy, sell, and trade items freely, leading to 30% higher player engagement compared to traditional games.

- Transparency and Security: Blockchain’s transparency provides a secure environment for transactions, reducing fraud by 40% in games that employ smart contracts and decentralized data storage.

- Monetization Opportunities: Blockchain games offer additional monetization avenues, such as token staking and NFT trading, enabling 25% of players to generate income from their gameplay.

- Cross-Platform Integration: Blockchain allows for interoperability across platforms, letting players move assets between games. Approximately 20% of blockchain gamers take advantage of cross-platform asset transfers.

- Community Governance: Decentralized governance models empower players, with 50% of new blockchain games integrating DAOs to give communities a voice in game updates, fostering deeper player loyalty.

- Environmental Concerns: Despite advancements, blockchain gaming faces challenges with energy consumption. High-energy blockchains increase environmental impact, though 30% of developers are now migrating to more eco-friendly blockchains like Tezos and Flow.

- Complexity and Accessibility: Blockchain games often require players to set up wallets and understand cryptocurrency, posing a barrier for 40% of potential users and highlighting the need for more user-friendly onboarding solutions.

Crypto Subsector Market Cap Comparison

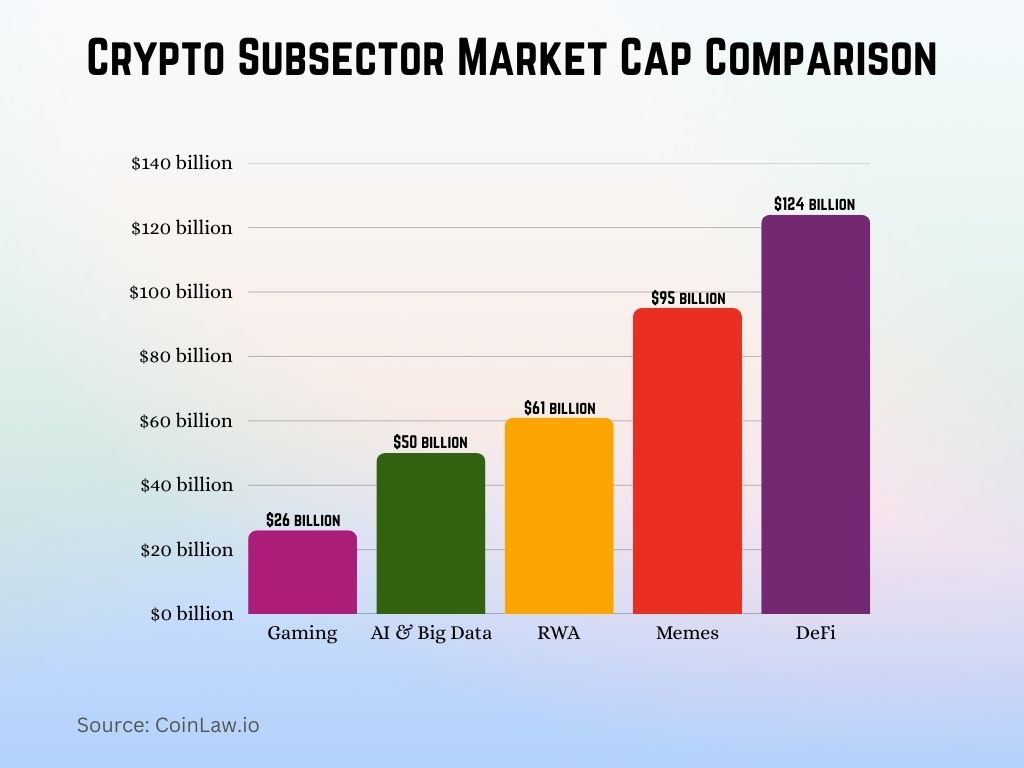

- The Gaming subsector has a total market cap of $26 billion, making it one of the smallest segments in the crypto industry.

- AI & Big Data hold a combined market cap of $50 billion.

- The RWA (Real World Assets) subsector is valued at $61 billion.

- Memes have surged to a market cap of $95 billion, showing strong investor interest.

- DeFi (Decentralized Finance) leads the space with a total market cap of $124 billion.

Regulatory Landscape and Compliance

- 28% of blockchain gaming companies in 2025 have undergone regulatory scrutiny, mainly related to asset classification and user data compliance.

- In-game assets and NFTs are under review in several countries, with the SEC evaluating 33% of top U.S. gaming tokens for potential financial asset classification.

- AML and KYC protocols are now in place on 48% of blockchain gaming platforms in 2025, especially those enabling high-value NFT transactions.

- Data privacy remains critical, with 53% of developers in 2025 integrating encrypted ID systems and secure player verification mechanisms.

- 22% of U.S. blockchain gamers reported earnings in 2025, making them subject to capital gains or income tax, as countries refine crypto tax laws.

- 11% of global blockchain gamers are impacted by regional bans or restrictions, leading studios to adopt localization strategies and compliance filters.

- The EU’s MiCA framework, now in force in 2025, directly affects 32% of European blockchain games, standardizing crypto asset governance and user protections.

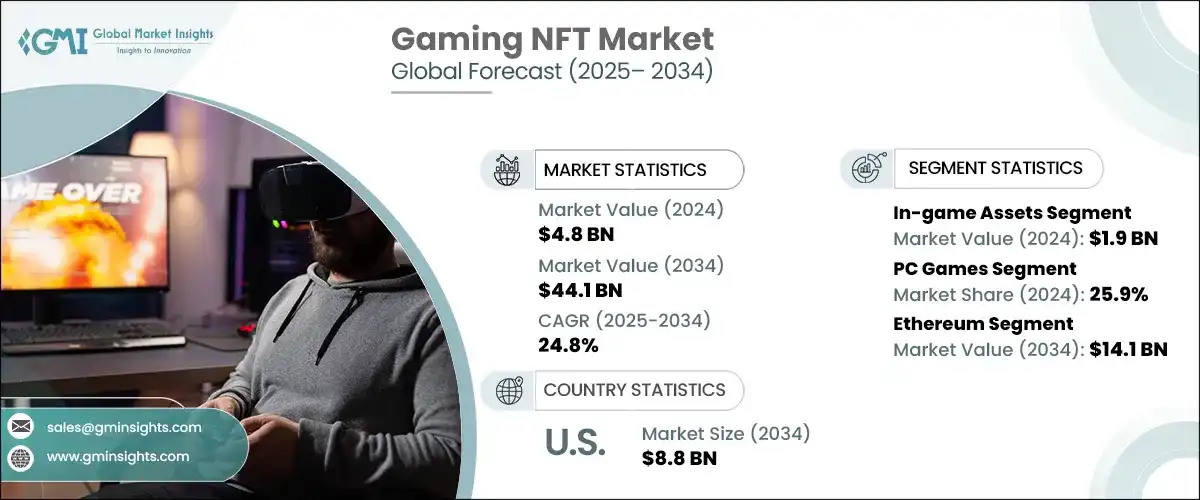

Gaming NFT Market: Global Forecast

- The Gaming NFT Market is projected to grow to $44.1 billion by 2034.

- This represents a CAGR of 24.8% over the forecast period of 2025 – 2034.

- The U.S. market alone is expected to reach $8.8 billion by 2034.

🔹 Segment Insights

- The In-game Assets Segment is valued at $1.9 billion in 2024.

- PC Games Segment holds a 25.9% market share as of 2024.

- The Ethereum Segment is forecasted to reach $14.1 billion by 2034.

Recent Developments

- In January 2025, blockchain gaming saw over 7 million daily unique active wallets (UAW), marking a 386% increase compared to the same month last year.

- Despite the rise in user activity, the market capitalization of blockchain gaming tokens decreased by 19.3%, falling from $27.6 billion to $22.3 billion in January 2025.

- The number of active blockchain games reached 1,697 in January 2025.

- A recent survey indicates that 73.2% of respondents in the blockchain gaming industry hold upper management positions, reflecting a trend toward a more top-heavy organizational structure.

- The global blockchain gaming market is projected to grow at a CAGR of 67.7% between 2025 and 2034, indicating strong future expansion.

Conclusion

As blockchain gaming continues to evolve, 2025 stands to be a pivotal year for the industry, bringing together technology, finance, and entertainment in ways that empower both players and developers. The blending of gaming and blockchain is reshaping the gaming economy, creating opportunities for players to own, earn, and control their assets in a decentralized environment. However, the road ahead includes challenges, from navigating regulatory landscapes to addressing environmental concerns. Yet, with a strong focus on innovation, collaboration, and sustainability, the future of blockchain gaming looks promising. This exciting convergence of worlds could soon redefine how we experience and value digital interactions, making the gaming industry a trailblazer in the broader adoption of blockchain technology.