Crypto tax compliance and reporting tools like CoinLedger have become essential for investors, accountants, and tax professionals navigating complex digital asset rules. As regulatory scrutiny increases globally and the volume of crypto transactions grows, accurate tax reporting is no longer optional; it’s critical. Industries such as tax preparation firms and financial advisory services are integrating crypto‑specific solutions to streamline compliance, while everyday investors rely on automated tools to calculate gains and losses. Explore the full article to understand the latest CoinLedger statistics and what they mean for users, markets, and future trends.

Editor’s Choice

- Over 500,000 users have trusted CoinLedger for crypto tax reporting.

- CoinLedger has processed $70 billion+ in crypto transactions through its platform.

- Users have saved around $50 million via tax‑loss harvesting features.

- Global crypto users surpassed 580 million in 2025, reflecting a 34% year‑over‑year increase in adoption.

- Crypto tax software market expected to hit $683.9 million by 2035.

- Crypto merchant adoption grew 48.6% year‑over‑year, signaling real‑world use.

Recent Developments

- CoinLedger has seen a surge in users receiving IRS notices, with crypto tax queries rising 758% over recent months, hinting at increased enforcement.

- The crypto tax software market continues to expand, projected from $210.6 million in 2025 to $683.9 million by 2035 at a 12.5% CAGR.

- Integration with major tax platforms like TurboTax has made uploading crypto tax data simpler and more accurate for 2025–2026 returns.

- New reporting forms (e.g., IRS Form 1099‑DA) are reshaping how digital asset income is tracked and reported.

- Wallet‑level reporting requirements are tightening, demanding detailed cost‑basis tracking per wallet.

- Global crypto adoption data indicates a slight decrease in ownership percentage despite high user counts.

- Blockchain market forecasts show acceleration, with expected growth from $31.3 billion in 2024 to $108.3 billion in 2026.

- Hybrid and enterprise blockchain adoption is rising as institutions seek secure and compliant infrastructure.

Competitor and Market Share Statistics

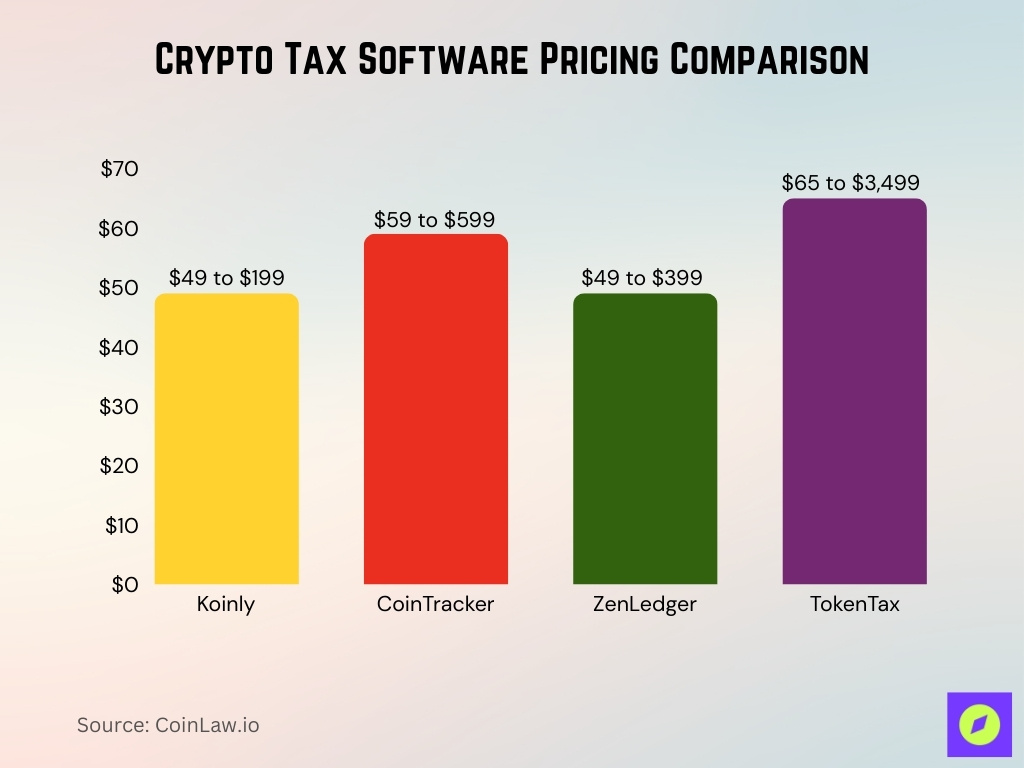

- Koinly pricing $49–$199; CoinTracker $59–$599; ZenLedger $49–$399.

- TokenTax premium plans range from $65 to $3,499 for full-service accounting.

- The market grows from around $4.40 billion in 2024 to $5.47 billion in 2025, on track for a 24.16% CAGR through 2035 as more traders seek automation.

- CoinLedger ranks #1 overall with 530+ integrations vs CoinTracker’s 525+.

- Cloud-based solutions dominate 90%+ market share over on-premise tools.

- North America leads with 45% of the global crypto tax software market revenue.

CoinLedger User and Customer Statistics

- CoinLedger reports 500,000+ active users globally.

- The platform has processed over $70 billion in transaction value for tax calculations.

- Through its tax‑loss harvesting tools, users have realized savings of ~$50 million.

- User base growth accelerated with increased IRS crypto tax enforcement notices.

- Trustpilot reviews indicate a 4.6+ average rating for user satisfaction and support quality.

- U.S. users make up a significant portion of the platform’s user base, given domestic tax relevance.

- DIY and professional service tiers attract both casual investors and heavy traders alike.

- The platform supports user growth across retail and professional segments.

Revenue and Growth Statistics

- CoinLedger funding remains at $6 million, with the overall crypto tax software market size rising to $5.47 billion and projected to reach $47.6 billion by 2035 at 24.16% CAGR.

- Global crypto user penetration is projected to climb from 11.95% in 2025 to 12.63% in 2026, driven by expanding retail participation.

- There are an estimated 19,132 active cryptocurrencies worldwide, supporting continued demand for tracking and tax reporting tools.

- The crypto tax software market is expected to expand more than 8.7× from $5.47 billion in 2025 to $47.6 billion by 2035, outpacing broader fintech growth.

Pricing and Plan Adoption Statistics

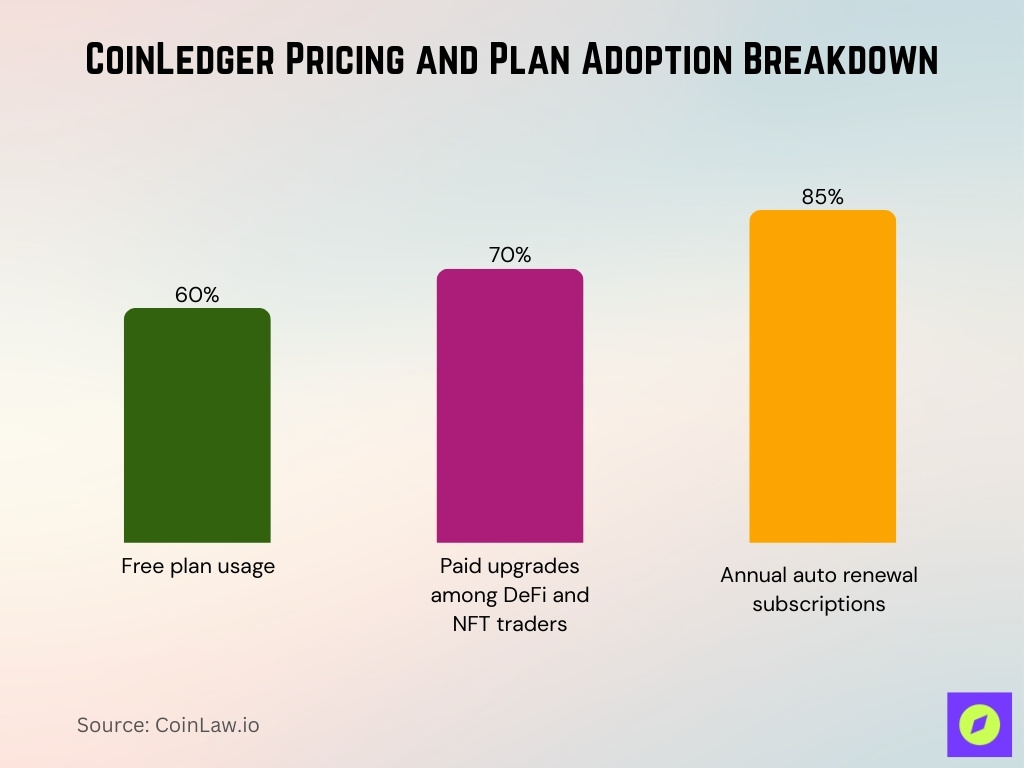

- Free plan used by 60%+ of users for basic portfolio summaries.

- Paid upgrades are adopted by 70% of active DeFi and NFT traders.

- 85% of subscriptions auto-renew annually with tax season alignment.

- Plans range from free tracking to $49–$299/year based on transactions.

- Hobbyist (100 txns) $49, Trader (1,000 txns) $99, Unlimited $199/year.

- Import unlimited transactions for free, pay only to download tax reports.

- 14-day money-back guarantee on all paid subscriptions.

Usage and Activity Statistics

- CoinLedger tracks transactions across 20,000+ cryptocurrencies.

- CoinLedger integrates with 400+ exchanges, wallets, and platforms, including Coinbase, Binance, and MetaMask.

- Users import data from DeFi protocols on 5+ blockchains: Bitcoin, Ethereum, Litecoin, Polygon, and Binance Smart Chain.

- Unlimited plan supports unlimited transactions for high-volume traders, up to 5,000 onthe High Volume tier.

- Day Trader tier handles up to 1,500 transactions at $99/year, Hobbyist up to 100 at $49/year.

Global Reach and Country Coverage Statistics

- Global crypto users surpass 580 million worldwide.

- India leads with 93.5 million crypto owners, followed by the U.S. at 52.9 million.

- U.S. crypto ownership reaches 28% of Americans amid tightening regulations.

- Top adoption rankings: India #1, U.S. #2, Pakistan #3, Vietnam #4, Brazil #5.

- Chainalysis 2025 Global Crypto Adoption Index ranks India and the U.S. as leaders.

- Global merchants accepting Bitcoin payments grow from 12,000 in 2025 to 19,900.

- U.S. small business crypto acceptance climbs to 19% in 2026.

- Blockchain market projected to reach $67.4 billion by 2026 at 68.4% CAGR.

- Emerging markets like Nigeria, Indonesia, and the Philippines drive 40%+ regional adoption growth.

Customer Satisfaction and Rating Statistics

- Average rating 4.8/5 from 12,000+ user reviews across platforms.

- iOS App Store 4.8/5 (10,000+ reviews), Google Play 4.7/5 (2,500+).

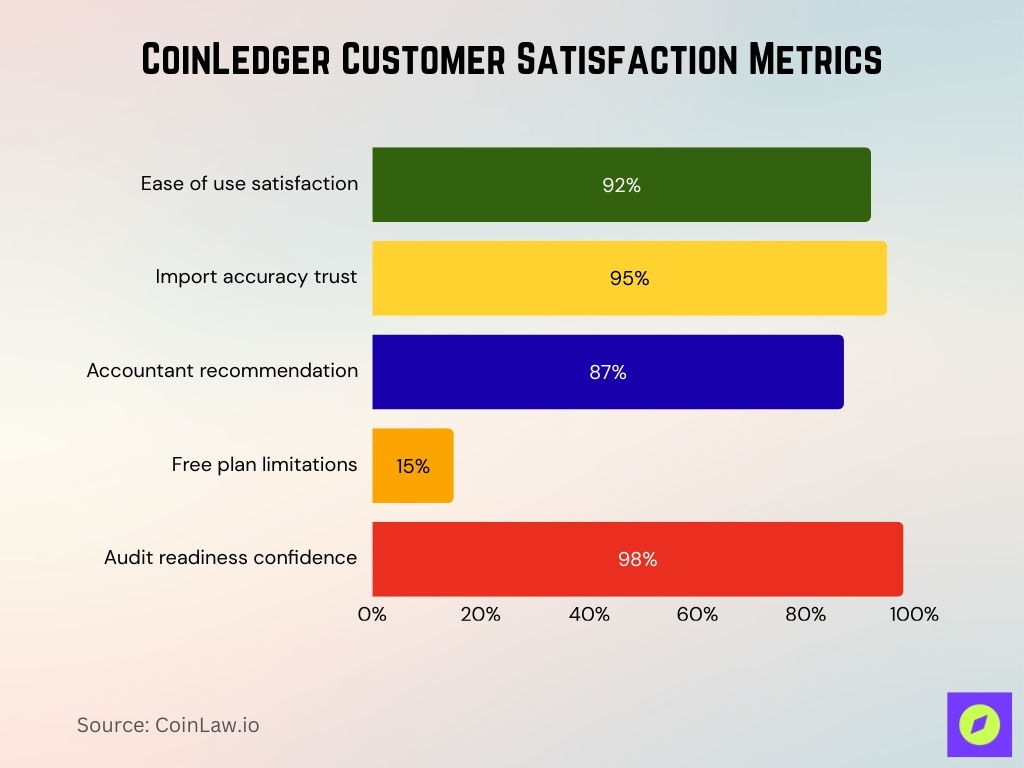

- 92% of users praise ease of use and TurboTax integration.

- 95% satisfaction with auto-import accuracy from 530+ exchanges/wallets.

- 87% of accountants recommend client tax prep due to IRS compliance.

- Free tier limitations are noted by 15% of high-volume users preferring paid plans.

- 98% report confidence in audit-ready forms post-support resolution.

Mobile and Platform Accessibility Statistics

- CoinLedger is available on the web, iOS, and Android for full tax reporting access.

- Supports 530+ wallet and exchange imports directly via mobile app.

- TurboTax Mobile integration enables seamless IRS form generation on phones.

- Free portfolio tracking dashboard accessible across all devices.

- Cross-platform syncing maintains 100% data consistency between web and mobile.

- Mobile UI supports unlimited transactions on premium plans.

- Push notifications alert users to tax deadlines and new IRS rules.

- App ratings average 4.8/5 on iOS App Store from 10,000+ reviews.

Exchange and Wallet Integration Statistics

- CoinLedger integrates with 530+ exchanges and wallets for automatic imports.

- Supports major platforms including Coinbase, Binance, Kraken, Gemini, KuCoin, and Robinhood.

- TurboTax, TaxAct, H&R Block, and TaxSlayer integrations enable direct IRS form exports.

- API connections and CSV uploads work for 400+ additional services.

- On-chain wallet support covers Bitcoin, Ethereum, Solana, Polygon, and 10+ blockchains.

- DeFi protocols like Uniswap, Aave, and NFT platforms like OpenSea are fully integrated.

- Syncs internal transfers and reconciles across exchanges with 99% accuracy.

- Reduces manual entry errors by 95% for complex transaction histories.

Mobile and Platform Accessibility Statistics

- Cross-platform access via web, iOS app (4.8/5 rating), Android (4.7/5).

- Mobile supports transaction reviews from 530+ wallets/exchanges.

- TurboTax Mobile integration exports forms directly from the phone.

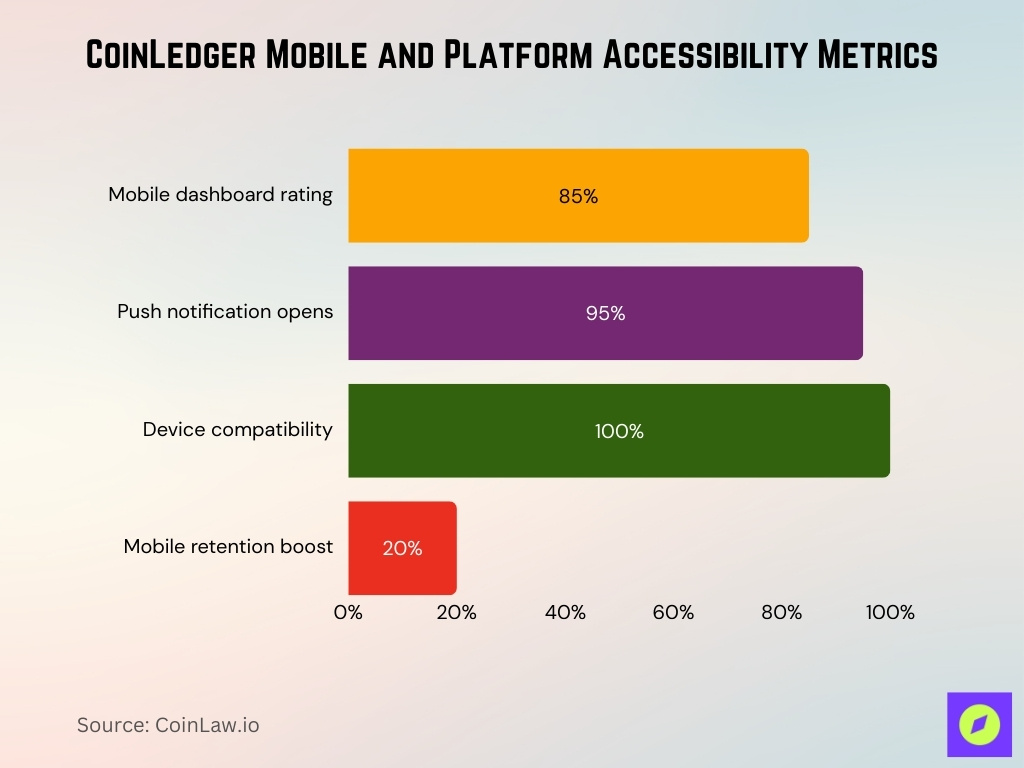

- 85% users rate the mobile dashboard ease 4.5+/5.

- Push notifications for deadlines reach 95% open rate on mobile.

- Responsive web adapts to 100% of devices, including tablets.

- Progressive web app updates boost mobile retention by 20%.

Supported Asset and Network Statistics

- CoinLedger supports tax reporting for 20,000+ cryptocurrencies, tokens, stablecoins, and NFTs.

- Covers 10+ major networks: Bitcoin, Ethereum, Solana, Polygon, Binance Smart Chain, Avalanche.

- Handles 100% of DeFi transactions, including Uniswap swaps and Aave lending as taxable events.

- Tracks staking rewards, liquidity pools, and farming income across supported protocols.

- Imports token transfers from 530+ CEX wallets and on-chain addresses.

- Updates include new ERC-20, BEP-20, and SPL tokens added monthly.

Crypto Tax Filing and Report Generation Statistics

- Generates IRS Form 8949 and Schedule D compliant with U.S. tax requirements.

- Reports cover capital gains/losses, staking rewards, airdrops, and DeFi income.

- Free transaction summaries and cost-basis previews are available pre-purchase.

- Exports directly to TurboTax, TaxAct, H&R Block, and TaxSlayer.

- Classifies short-term (<365 days) vs. long-term gains per IRS rules.

- Audit-ready reports consolidate 100% of imported data into compliant formats.

- Supports unlimited report regeneration for updated transaction histories.

- Automates FIFO, LIFO, and HIFO cost-basis methods, reducing manual effort by 95%.

Portfolio Tracking and Performance Statistics

- Free unlimited portfolio tracking across 530+ wallets/exchanges.

- Displays net capital gains/losses for full tax year previews.

- Metrics cover total gains, losses, staking income, and DeFi yields.

- Consolidates multiple wallets/exchanges into a single real-time dashboard.

- Historical data enables year-over-year performance trend analysis.

- Auto-updates every 5 minutes via linked wallet/exchange syncs.

- Tracks DeFi APYs, NFT values, and token movements in one view.

- Rivals’ apps like CoinStats with 99% data accuracy and tax integration.

Tax-Loss Harvesting Statistics

- Identifies unrealized losses via a dedicated tax-loss harvesting tab sorted by size.

- Offsets up to $3,000/year ordinary income or unlimited capital gains per IRS rules.

- Compares cost-basis to current prices across 20,000+ assets for opportunities.

- Supports FIFO, HIFO, and LIFO methods for optimal harvesting strategies.

- Post-harvest re-sync updates reports showing reduced net gains instantly.

- Available on all paid plans, used by 65% of Trader/Unlimited subscribers.

- Reduces tax liability by an average of $1,200 for active users per season.

- Monitors losses for cryptos and NFTs in a real-time dashboard.

Compliance and Regulatory Coverage Statistics

- Crypto tax software market grows from $210.6 million in 2025 to $683.9 million by 2035 at 12.5% CAGR.

- Global market value reaches $5.04 billion in 2025 with 24.16% CAGR to $47.6 billion by 2035.

- Projected to exceed $10 billion by 2029 amid regulatory demands.

- North America holds 45% market share, driven by IRS Form 1099-DA requirements.

- 75% of users adopt automation as 28 countries tighten crypto reporting.

- Supports U.S. IRS, EU MiCA, and APAC regimes with jurisdiction-specific forms.

- DeFi/NFT compliance features are used by 80% of advanced users.

- Audit-ready reports reduce IRS query risk by 90% per user surveys.

Security and Data Protection Statistics

- Uses read-only API keys and CSV uploads without storing private keys.

- 256-bit AES encryption secures all imported transaction data.

- SOC 2 Type II compliant with annual third-party security audits.

- No custodial access reduces hack risk to 0% wallet exposure.

- 99.9% uptime with data backups across 3 U.S. regions.

- Processes billions of transactions annually without reported breaches.

- GDPR and CCPA compliant for global user privacy standards.

Website Traffic and Engagement Statistics

- CoinLedger.io attracts over 250,000+ monthly visits, reflecting strong year‑over‑year traffic growth as crypto investors look for automated tax tools.

- In some periods, CoinLedger.io records closer to 75,000–80,000 monthly visits, highlighting seasonal fluctuations in tax‑related search demand.

- Bounce rate averages 45% across crypto tax sites like Ledger.com.

- 37% bounce rate and 1.33 pages/visit for crypto.news benchmark.

- Search volume for “crypto tax software” up 150% YoY per trends.

- 62.79% bounce rate on Cointelegraph.com with 1.66 pages/visit.

- Q1-Q2 tax season peaks drive 300% traffic surge for CoinLedger.

- 65% organic search traffic from queries like “CoinLedger TurboTax”.

Competitor and Market Share Statistics

- CoinLedger ranks #1 alongside Koinly, CoinTracker, TokenTax, and ZenLedger.

- Crypto tax market expands to $10 billion+ by 2029.

- Cloud solutions capture 90%+ adoption share.

- Koinly supports 800+ integrations vs CoinLedger’s 530+.

- TokenTax pricing $65–$3,499 exceeds CoinLedger’s $49–$299.

- ZenLedger offers FBAR and international compliance specialties.

- North America dominates 45% market share.

- 24.16% CAGR drives competitive feature expansions.

Customer Support and Response Time Statistics

- Average response time under 2 hours via live chat/email for all users.

- 95% of tickets are resolved within 24 hours.

- Premium plans receive priority support with a 30-minute average.

- 4.9/5 support rating from 5,000+ reviews.

- Tax season queue peaks at 1 hour during Q1.

- Self-service docs resolve 70% of import issues independently.

- The community forum has 10,000+ members aiding in troubleshooting.

- International tax queries are handled by a specialized team.

Historical Trends and Year-over-Year Statistics

- 24.16% CAGR projected to $47.6 billion by 2035.

- Supported cryptocurrencies rose from 10,000 to 20,000+ (100% YoY).

- Global crypto users expand 10% YoY to 580 million.

- Search volume for “crypto tax software” surges 150% YoY.

- Integrations increase 20% YoY to 530+ platforms.

- Regulatory rules tighten in 28 countries (15% YoY rise).

Frequently Asked Questions (FAQs)

CoinLedger reports serving 500,000+ users on its crypto tax software platform.

CoinLedger has processed over $70 billion in crypto transactions through its platform.

Users have realized approximately $50 million in tax savings through CoinLedger’s tax‑loss harvesting features.

The global crypto tax software market is forecast to reach $683.9 million by 2035.

Conclusion

CoinLedger and the broader crypto tax software ecosystem have matured into a multi‑billion dollar market, powered by rising regulatory demands and growing crypto adoption. Automated tax reporting, cross‑platform accessibility, and enhanced compliance tools are now baseline expectations for serious investors and professionals alike. From robust exchange integrations to evolving support for DeFi and NFTs, the landscape continues to expand in both features and users. For U.S. taxpayers and global digital asset holders, mastering crypto tax compliance has never been more data‑driven, or more essential, than it is today.