Coinbase stands as one of the largest cryptocurrency exchanges in the U.S. Its services range from trading and custody to staking and app‑based spending. In finance, institutional investors depend on Coinbase’s robust infrastructure, while retail users benefit from its intuitive mobile app to access crypto markets. Now, let’s explore the full article, where the data reveals how Coinbase shapes digital asset trends today.

Editor’s Choice

- 120 million total monthly users across 2025.

- 8.7 million monthly transacting users (MTUs) in Q2 2025.

- $6.71 billion trailing twelve‑month revenue as of 2025.

- 108 million verified users reported in 2024.

- 3.2 million Coinbase Wallet monthly active users in 2025.

- Coinbase manages $404 billion in assets by the end of 2024.

- $237 billion quarterly trading volume (latest available figure).

- Coinbase holds over 12% of all Bitcoin and 11% of staked Ether.

Recent Developments

- In Q2 2025, total monthly users reached 120 million, up 20% from 96 million in 2024.

- The SEC is probing whether Coinbase overstated “verified users”, a metric it stopped reporting over two years ago.

- In May 2025, Coinbase disclosed a cyberattack affecting under 1% of its MTUs, with an estimated remediation cost: $180–$400 million.

- Coinbase became a member of the S&P 500 in May 2025.

- It acquired Deribit in May 2025 for approximately $2.9 billion (cash + stock).

- The company is now Ethereum’s largest node operator, controlling 11.42% of staked ETH.

- It manages 245,000 ecosystem partners across 100+ countries.

Verified Users (historical and latest figures)

- Q4 2022: 110 million verified users (tracked via email/phone confirmation).

- Q4 2021: 89 million verified users.

- Q1 2022: 98 million, Q2 2022: 103 million, Q3 2022: 108 million.

- Growth from Q4 2021 to Q4 2022: added 21 million verified users.

- Q4 2020 through Q4 2021 shows a jump from 43 million to 89 million users, nearly doubling.

- SEC investigation focuses on possible inflation of this metric, as verification may not reflect active unique users.

- As of 2024, the company reports 108 million users in its annual data.

Monthly Transacting Users (MTUs)

- Q2 2025: 8.7 million MTUs.

- Q1 2025: 9.7 million MTUs.

- Q4 2024: 7.0 million MTUs.

- Q3 2024: 7.8 million, Q2 2024: 8.2 million, Q1 2024: 8.0 million.

- Historical: Q4 2023: 7.0M, Q3 2023: 6.7M, Q2 2023: 7.3M.

- Earlier: Q4 2022: 8.3M, Q3 2022: 8.5M, Q2 2022: 9.0M, Q1 2022: 9.2M.

- Downtrend from the in‑2022 peak, recovery in late 2024–2025 marked by mid‑single‑digit millions.

- Shift in reporting from general active users toward MTUs reflects greater focus on genuine platform engagement.

User Growth Over Time

- Q1 2018: MTUs were 2.7 million, growing to 11.4 million by Q4 2021.

- Verified users rose from 23 million in Q1 2018 to 110 million by Q4 2022.

- MTU volatility: peaked late 2021, dipped in 2023, and partially recovered through 2025.

- Verified users nearly quintupled between 2018 and 2022.

- In 2024, total users jumped from 96 million to 120 million, a 20% increase.

- Verified‑to‑transacting user ratio suggests a significant portion signs up but may not transact monthly.

Coinbase Wallet Monthly Active Users

- In 2025, Coinbase Wallet reached 3.2 million monthly active users.

- This figure reflects growing interest in self‑custody and DeFi access using Coinbase’s wallet.

- Wallet users account for a substantial minority of Coinbase’s broader user base of 120 million.

- Growth in wallet users parallels institutional expansion of staking and DeFi services.

- Indicates diversification beyond custodial exchange services.

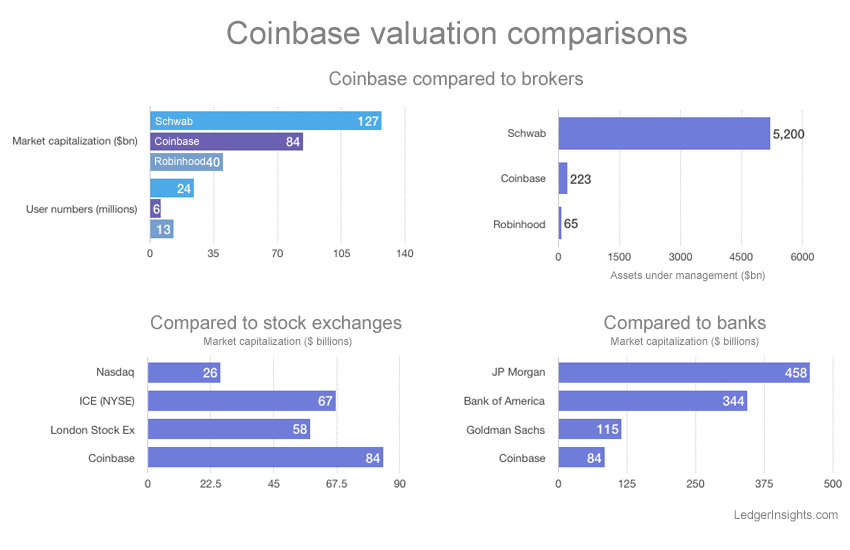

Coinbase Valuation Comparisons

- Schwab market cap $127 billion vs Coinbase $84 billion and Robinhood $24 billion.

- User numbers show Coinbase at 13 million, compared to Schwab at 6 million and Robinhood at 40 million.

- Assets under management reach $5.2 trillion for Schwab, $223 billion for Coinbase, and $65 billion for Robinhood.

- Against stock exchanges, Coinbase $84 billion market cap surpasses Nasdaq $26 billion, London Stock Exchange $58 billion, and ICE’s (NYSE) $67 billion.

- Compared with banks, JP Morgan leads at $458 billion, followed by Bank of America $344 billion, Goldman Sachs $115 billion, while Coinbase stands at $84 billion.

Coinbase One Subscribers

- In 2025, Coinbase One reached approximately 1 million subscribers.

- Another estimate puts current paying subscribers at 600,000.

- The service offers zero trading fees, appealing to active traders.

- Plans start at $4.99/month or $29.99/year for membership tiers.

- Higher tiers include perks like unlimited account protection, staking rewards boost (up to +15%), and 24/7 priority support.

- Subscribers also access 4% bitcoin back on every purchase, coming fall 2025.

- The subscription model contributes to the Subscription & Services revenue, which grew 9% QoQ to $698 million in Q1 2025.

- Coinbase One represents a strategic shift toward recurring revenue and deeper engagement.

Geographic & Demographic Insights

- Coinbase serves about 120 million users globally, with its strongest presence in the U.S., Canada, and Western Europe.

- It operates in over 70 countries, with expansion underway in Latin America and the Asia-Pacific region.

- The platform operates across 100+ countries, including institutional services.

- Demographically, the core user base skews ages 18–45, particularly concentrated in the 25–35 age group.

- Historically, usage leaned heavily male, but targeted campaigns like “Crypto is for Everyone” have aimed to improve gender balance.

- Segmentation also extends to income, education, behavior, and psychographics, aiding tailored marketing efforts.

- Geographic targeting ensures product relevance and regulatory compliance across regions.

- Behavioral data informs when and how users trade, helping refine UX and promotional strategies.

Coinbase Earnings and Key Highlights

- $1.5B total revenue reported in Q2 2025.

- $1.4B net income recorded for the quarter.

- $512M adjusted EBITDA delivered.

- $33M adjusted net income achieved.

- $656M subscription & services revenue generated.

- $9.3B USD resources held.

- 700K+ users on the waitlist for the Base App.

- Base Chain median fees dropped to $0.0005 with block times at 200 ms.

- USDC payments on Base Chain are now integrated into Shopify Payments.

- $332M stablecoin revenue, up 12% QoQ.

- $13.8B average USDC holdings, a 13% QoQ increase.

- $1.8B crypto assets held for investment.

- $245B+ assets under custody for institutions.

- 80%+ of U.S. BTC and ETH ETF assets are custodied with Coinbase.

- 120K+ advocacy emails sent to policymakers via Stand With Crypto.

- The GENIUS Act, the first U.S. federal digital assets legislation, was signed into law in July 2025.

- Launched 24/7 trading for BTC, ETH, SOL, and XRP futures.

- Announced the acquisition of crypto options exchange Deribit.

Trading Volume Statistics

- In Q1 2024, Coinbase processed a trading volume of $312 billion per quarter.

- As of 2025, quarterly trading volume for Coinbase stands at $312 billion.

- Platform assets under management peaked at $334.7 billion in Q1 2024, up from $197 billion in Q4 2023.

- Retail trading volume in Q1 2024 rebounded to $56 billion, up from $29 billion in Q4 2023.

- Coinbase continues to hold ~65% of the U.S. exchange market share in 2025.

- Coinbase remains the world’s largest Bitcoin custodian, holding over 12% of all Bitcoin and 11% of staked Ether.

- The institution manages $404 billion in digital assets as of 2024.

- Trading volume reflects resilience amid market swings and regulatory shifts.

Trading Volume by User Type (Retail vs Institutional)

- Exact breakdowns between retail and institutional volumes are not typically public.

- Q1 2025 Subscription & Services revenue of $698 million hints at growing institutional demand, as stablecoin services often target businesses.

- Institutional users likely contribute significant trading volume through large, OTC, and institutional channels.

- Retail volume surged notably to $56 billion in Q1 2024, indicating a sharp recovery among everyday traders.

- Institutional strategies likely involve staking, custody, and derivatives, especially post-Deribit acquisition.

- Given the platform’s $404 billion in assets, both retail and institutional holdings drive engagement.

- Market segmentation and customer behavior studies suggest institutional activity is rising alongside retail.

Coinbase Crypto Assets Transaction Revenue Trends

- Bitcoin revenue share was 31% in Q2’24, peaked at 35% in Q3’24, dipped to 27% in Q4’24 and 26% in Q1’25, before rebounding to 34% in Q2’25.

- Ethereum made up 17% in Q2’24 and 16% in Q3’24, but fell to 10% in both Q4’24 and Q1’25, with a slight recovery to 12% in Q2’25.

- Solana contributed 10% in Q2’24 and 11% in Q3’24, but its share was negligible in later quarters.

- XRP began contributing in Q4’24 with 14%, rose to 18% in Q1’25, then declined to 13% in Q2’25.

- Other crypto assets remained dominant at 42% in Q2’24, eased to 38% in Q3’24, spiked to 49% in Q4’24, dropped to 36% in Q1’25, and recovered to 41% in Q2’25.

Cryptocurrency (Trading Volume)

- Bitcoin accounted for 34% of total trading volume in Q2 2025.

- The exchange supports over 270 cryptocurrencies.

- Holdings include a diversified mix; Bitcoin, Ether, and stablecoins dominate.

- Retail trading volume in Q1 2024 was $56 billion, likely split across top major coins.

- Institutional trades likely focus on crypto derivatives, especially after the Deribit acquisition.

- Coinbase is the largest Ethereum node operator, controlling 11.42% of staked ETH.

- Volume in alternative coins and stablecoins also likely reflects growth in DeFi and staking services.

Asset Holdings on Coinbase

- Coinbase held $404 billion in assets at fiscal year-end 2024.

- In Q1 2024, assets under management reached $334.71 billion.

- That marks a steep recovery from lows around $197 billion in late 2023.

- The platform’s holdings include Bitcoin, Ethereum, stablecoins, and various altcoins.

- Coinbase’s staking operations include 11% of all staked Ether globally.

- It remains the largest bitcoin custodian globally.

- AUM growth signals increasing user trust and institutional adoption.

Net Income Statistics

- Q2 2025 net income was $1.43 billion, a dramatic leap from $36 million in Q2 2024, an increase of about 3,853% year‑over‑year.

- The twelve months ending June 30, 2025, saw net income of $2.86 billion, up 92.9% YoY.

- Annual net income for 2024 was $2.579 billion, rebounding strongly from $95 million in 2023.

- In 2022, Coinbase posted a net loss of –$2.625 billion before turning profitable in 2023.

- Net income in Q1 2025 was modest at $66 million, reflecting early-year softness before the Q2 surge.

- Adjusted net income in Q2 2025, after stripping out $1.5 billion pre‑tax gains and investment reversals, was $33 million.

- The company’s improved profitability underscores a strong recovery in crypto markets and strategic investment returns.

Platform Engagement Metrics

- In 2024, 10.8 million users were active on Coinbase’s platform more than once a month.

- Daily app downloads are estimated at ~18,333, up from a 30‑day average of 17,547.

- Wallet installs have surpassed 15 million globally, with 35% of new installs coming from outside the U.S.

- The strong app engagement reflects both trading demand and interest in custody and DeFi services.

- Coinbase continues refining its mobile experience through the 2025 account restriction improvements roadmap, featuring in‑app EDD, voice calling logs, and enhanced 2FA.

- Institutional users benefit from Coinbase International Exchange, offering access to over 80 perpetual futures and spot markets.

- Behavioral analytics from recurring active use drive personalization and help shape product development.

Coinbase App Usage Statistics

- As noted, 10.8 million active users interacted with the Coinbase platform monthly in 2024.

- The high app usage rate, over double the average monthly, indicates strong retention and multi‑session engagement.

- Daily app downloads averaging 18,333 suggest sustained interest and user acquisition momentum.

- The app powers trading, staking, earning, and education tools, anchoring user journeys.

- It also functions as a customer service channel and notification hub, improving responsiveness.

- Engagement spans both casual retail users and high-frequency institutional traders through advanced tools like Coinbase One and Coinbase Advanced.

Number of Supported Countries

- Coinbase operates in over 100 countries, offering compliance-based services across major jurisdictions.

- It restricts access in sanctioned regions such as Russia, Iran, and others under U.S. sanctions.

- Staking and USDC services are available in over 110 countries, highlighting product expansion beyond basic trading.

- Coinbase One initially rolled out in the U.S., then expanded to 38 countries by 2023.

- Regulatory approval in markets like Spain, France, Singapore, and Bermuda dates back to 2023.

- Institutional services extend across the Americas, Europe, and emerging markets.

- The 100+ country footprint supports both global reach and adherence to local legal frameworks.

Number of Assets Listed

- Coinbase lists over 150 crypto assets, including top tokens like BTC, ETH, ADA, SOL, USDC, DOGE, and MATIC.

- This mix includes major, mid-tier, and emerging altcoins, offering breadth for different investor profiles.

- Listings align with regulatory reviews and internal risk assessments.

- Diversified listings aid in user retention and trading volume.

- The growing catalog reflects Coinbase’s evolving stance on token curation and regulatory openness.

- Support spans both trading and staking eligible coins.

Coinbase Market Share

- As of mid‑2025, Coinbase holds 6.9% of the global crypto exchange market by trading volume, ranking sixth globally.

- In the U.S., it retains a dominant over 50% share of spot trading volume.

- Earlier data notes Coinbase U.S. market share approaching 65%, compared to just 2% for Binance.US.

- Throughout 2025, its global share slipped from 7.0% to 5.8%, though July saw strong volume growth (+82.6% MoM).

- Intensifying competition from Binance, Kraken, Robinhood, and others puts pressure on domestic and global dominance.

- Yet, Coinbase’s U.S. scale remains unmatched and may shape broader regulatory outcomes.

Conclusion

Coinbase is navigating a pivotal moment, marked by a stark profitability rebound, expanding product adoption, and deepening global reach. Net income surged to $1.43 billion, while global operations span 100+ countries and over 150 listed assets. App engagement continues strong, with 10.8 million active users monthly and over 15 million wallet installs. Still, global competition and regulatory complexity challenge its lead, even as it maintains over 50% U.S. market share. As Coinbase balances innovation, compliance, and efficiency, its trajectory offers a window into the future of institutional and retail crypto engagement. Thanks for exploring the full article. Feel free to dive deeper into any section or request more context.