Coinbase statistics highlight not just growth but resilience in a shifting crypto landscape. In two real-world examples, major financial firms use Coinbase data to understand consumer trends, while regulators leverage its verified-user metrics to evaluate market exposure. These numbers cut through uncertainty with clarity, and now, readers are invited to dig deeper into the insights that follow.

Editor’s Choice

- Coinbase averages 38.3 million monthly website visits, with traffic up 11.52% month over month.

- Coinbase’s total monthly users reached 120 million, up 20% from 96 million the prior year.

- Quarterly revenue hit $1.86 billion, rising 25% quarter over quarter.

- Coinbase generated $1.0 billion in transaction revenue and $747 million from subscriptions and services in Q3.

- Stablecoin revenue contributed $355 million in Q3 as trading and on‑platform balances expanded.

- Assets under custody reached a record $300 billion, making Coinbase the largest crypto custodian globally.

- Coinbase now safeguards roughly $300 billion in institutional and retail assets as it pivots toward a global market‑operator role.

Recent Developments

- Coinbase became the first crypto‑native company in the S&P 500 in May 2025, replacing Discover Financial ahead of trading on May 19.

- Coinbase’s stock jumped nearly 15% on the S&P 500 inclusion news, with intraday gains reaching about 24% later in May.

- Coinbase acquired Deribit in one of crypto’s largest M&A deals, valued at roughly $2.9 billion in combined cash and stock consideration.

- Coinbase controls about 3.84 million ETH, equal to 11.42% of all staked Ether across roughly 120,000 validators.

- The cyberattack remediation bill is estimated between $180 million and $400 million, covering reimbursements and security upgrades.

- Coinbase refused the attackers’ $20 million ransom demand and instead posted a $20 million bounty for information leading to their capture.

Coinbase (COIN) Daily Price Performance Snapshot

- Coinbase (COIN) closed at $234.45, gaining +1.15% on the day, reflecting a short-term bounce after recent selling pressure.

- The stock traded between a daily low of $238.04 and a high of $248.80, highlighting elevated intraday volatility.

- Trading volume reached 34.3 million shares, signaling continued investor interest despite a broader downtrend.

- COIN is trading below its 50-day SMA ($243.75), indicating near-term bearish momentum remains intact.

- The price also sits well below the 200-day SMA ($267.02), confirming a longer-term downward trend.

- A descending resistance trendline from mid-2025 highs continues to cap upside moves near the $260–$270 range.

- Key support is forming around $230–$235, where buyers have recently stepped in to slow further declines.

- The stock remains far below its 2025 peak near $430–$440, underscoring the magnitude of the recent correction.

Assets on the Coinbase Platform

- Coinbase manages about 16% of the total global cryptocurrency market capitalization through assets on its platform.

- Coinbase remains the largest Bitcoin custodian, holding over 12% of all circulating Bitcoin on behalf of clients.

- The platform also secures around 11% of all staked Ether, reinforcing its leading role in Ethereum staking.

- Coinbase serves more than 108 million verified users as of the latest full‑year disclosure, up sharply from prior years.

- Coinbase supports over 270 tradable cryptocurrencies on its core platform and about 315 coins across roughly 460 trading pairs.

- On the institutional side, Coinbase Prime clients can custody over 420 assets across 52 chains through the platform.

- Coinbase captures around 60–65% of U.S. crypto exchange trading volume and about 6.9% of global exchange volume

Number of Coinbase Employees

- UnifyGTM and other trackers put the current headcount at roughly 4,300 employees, reflecting 7–8% year‑over‑year growth.

- Between January and mid‑2025, Coinbase made 598 hires and saw 305 departures, for a net gain of just under 300 employees.

- Coinbase plans to add around 1,000 new U.S. jobs in 2025, heavily concentrated in compliance and customer support.

- The Charlotte “Center of Excellence” is a 58,600 sq ft office expected to house 130+ employees in compliance and support roles.

- Roughly 95% of Coinbase’s 4,000+ staff work remotely under its remote‑first model.

- Revenue per employee as of mid‑2025 is approximately $1.57 million, with profit per employee near $0.67 million.

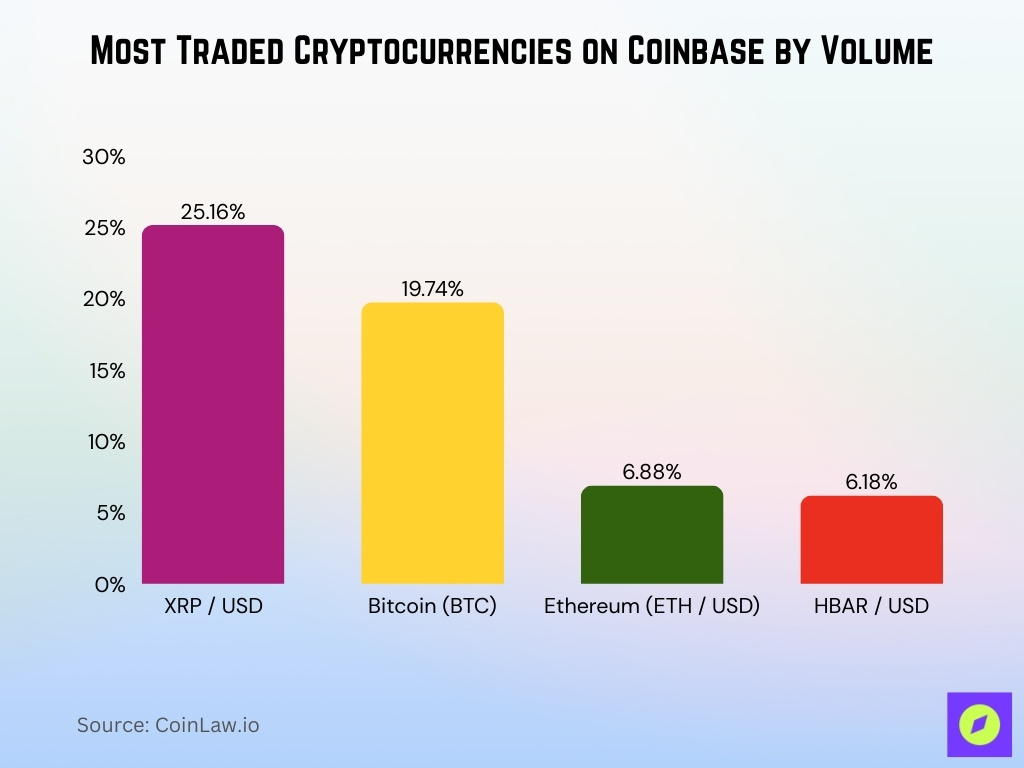

Most Held Currencies on Coinbase

- Bitcoin accounts for 19.74% of Coinbase spot trading volume by pair, down from the earlier 34% share of total platform volume.

- XRP/USD is now the single largest market on Coinbase, contributing 25.16% of total trading volume.

- Ethereum’s share stands at 6.88% of volume via ETH/USD markets, reflecting steady but reduced dominance versus prior years’ 12% platform share.

- HBAR/USD has emerged as a core altcoin market, representing 6.18% of Coinbase’s total trading volume.

- Coinbase supports over 270 cryptocurrencies and about 315 coins across 460 trading pairs, enabling broad diversification beyond the top majors.

Retail Trading Volume

- In Q2, consumer (retail) trading volume was $43 billion, down 45% quarter‑over‑quarter and representing about 6.6% of total platform volume.

- Q2 consumer transaction revenue was $650 million, a 41% Q/Q decline from $781 million in Q1.

- Total Q2 transaction revenue reached $764 million, down 39% Q/Q as overall platform trading volume fell to $237 billion.

- In Q1, total spot trading volume was approximately $393.1 billion, before sliding into Q2 softness.

- Q2 institutional trading volume was $194 billion, with institutional transaction revenue of $61 million, both down 38% Q/Q.

- Q3 consumer trading volume rebounded to $59 billion, up 37% from Q2’s $43 billion.

- Q3 retail transaction revenue climbed to $844 million, marking around 30% Q/Q growth versus Q2’s $650 million.

- Coinbase processes roughly $425 billion in total trading volume per quarter on average, across both retail and institutional segments.

Institutional Trading Volume

- Q2 institutional trading volume was $194 billion, accounting for about 82% of Coinbase’s total platform trading activity.

- Q2 institutional transaction revenue totaled $61 million, down 38% quarter‑over‑quarter in line with volume declines.

- Coinbase Prime highlights $194 billion in quarterly institutional trading volume and 420+ assets available for institutional trading.

- Institutional assets under custody reached $245 billion, reinforcing Coinbase’s role as a leading global crypto custodian.

- Institutional business represents roughly 80–82% of total Coinbase trading volume versus less than 20% for retail.

- Coinbase custodies 9 of 11 spot Bitcoin ETFs and 8 of 9 spot Ether ETFs, capturing the majority of U.S. ETF flows.

- U.S.-listed Bitcoin and Ether ETFs custodied by Coinbase attracted more than $34 billion in combined net inflows, boosting institutional balances.

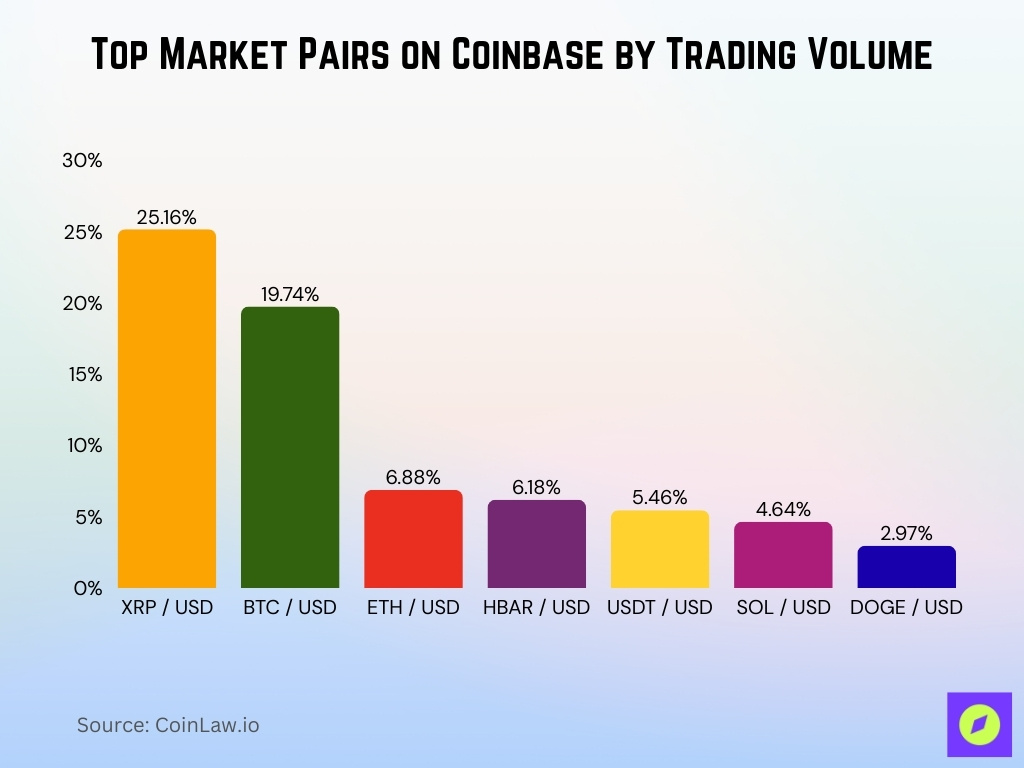

Coinbase Exchange Statistics (Volume by Market Pair)

- XRP/USD leads with 25.16% of total Coinbase trading volume.

- BTC/USD follows with 19.74% of overall market activity on Coinbase.

- ETH/USD accounts for 6.88% of Coinbase’s spot trading volume.

- HBAR/USD represents 6.18% of trading volume, reflecting growing Hedera demand.

- USDT/USD contributes 5.46% of total trading volume on the exchange.

- SOL/USD holds a 4.64% share of Coinbase trading activity.

- DOGE/USD captures 2.97% of platform trading volume.

Most Traded Currencies

- Bitcoin accounts for 34% of total Coinbase trading volume, remaining the single most traded asset on the platform.

- Ethereum’s share holds around 12% of Coinbase trading volume, placing it third behind BTC and XRP in recent quarters.

- XRP contributes roughly 13% of trading volume and up to 16% of transaction revenue over the first half of the year.

- Solana captures as much as 11% of platform trading volume during peak quarters, making it a top altcoin on Coinbase.

- Together, BTC, ETH, and XRP account for about 59% of Coinbase’s consumer transaction revenue in Q2.

- BTC’s share of transaction revenue is about 34% in Q2 and 29% across the first half of the year.

- XRP’s transaction revenue share reached 13% in Q2 and 16% for H1, surpassing Ethereum’s 12% in Q2 and 11% in H1.

- Post‑Deribit acquisition, Coinbase’s European derivatives volume reached about $12.7 billion in Q1, underscoring rising perp and futures activity.

Supported Cryptocurrency Assets

- Coinbase supports 270+ cryptocurrencies across its retail and wallet platforms.

- Coinbase Exchange lists about 315 coins across roughly 460 trading pairs.

- Coinbase Prime offers 250+ tradable digital assets for institutions.

- Coinbase Custody and Prime together support 420+ assets for institutional cold‑storage custody.

- Q2 total trading volume was $237 billion, down 40% quarter‑over‑quarter.

- Global spot crypto volumes fell 31%, while U.S. spot markets declined 32% over the same period.

- Consumer spot trading volume dropped to $43 billion, a 45% Q/Q decrease.

- Consumer trading revenue slid 41% to $650 million on lower spot and stablecoin pair activity.

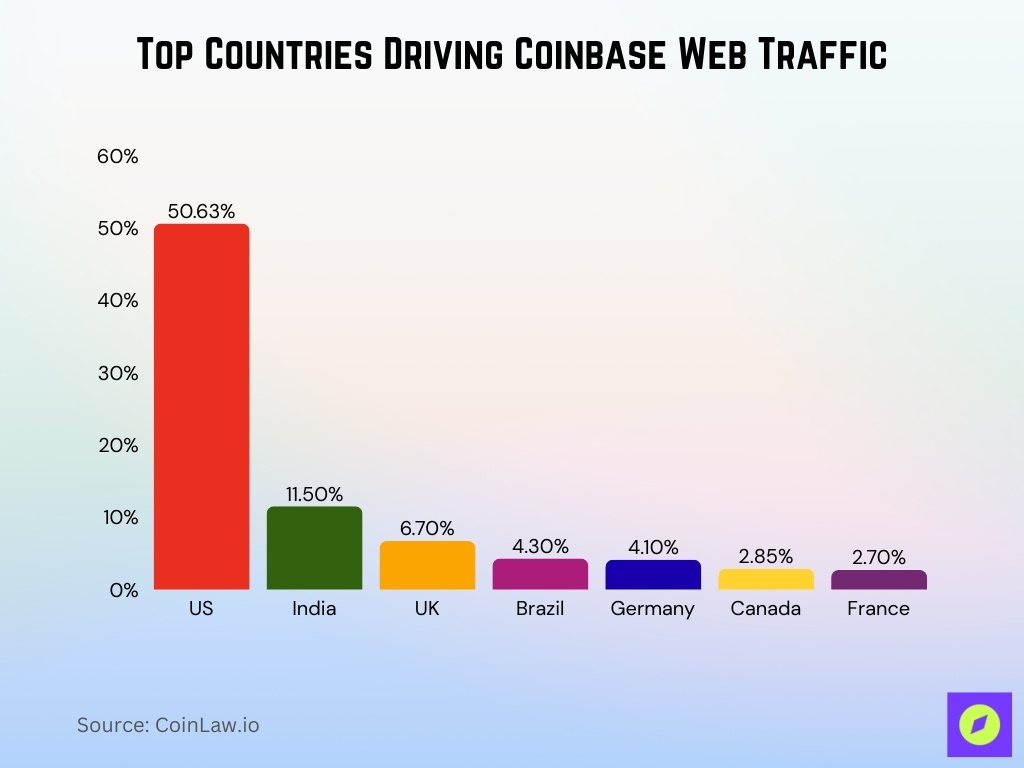

Top Traffic Countries

- Coinbase operates in 100+ countries, with the U.S. accounting for about 50.63% (18.09M) of monthly visits.

- The U.K. contributes roughly 6.7% (~2.4M) of visits, making it Coinbase’s second‑largest web audience.

- Germany accounts for about 4.1% (~1.46M) of monthly traffic to coinbase.com.

- Canada sends around 2.85% (~1.02M) of visits, while France generates 2.7% (~964K).

- India at 11.5% and Brazil at 4.3%, confirming a diversified global audience.

Subscription and Services Revenue

- Q2 subscription and services revenue was $656 million, down 6% quarter‑over‑quarter and representing about 44% of net revenue.

- Q1 subscription and services revenue was $698 million, up 9% sequentially.

- Stablecoin revenue in Q2 totaled $332–332.5 million, growing 12% Q/Q and 38% year‑over‑year.

- Q3 subscription and services revenue rose to $747 million, a 14% Q/Q increase from Q2.

- Q3 stablecoin revenue reached $355 million, up 7% Q/Q on average USDC balances of $15 billion.

- July transaction revenue was approximately $360 million, supporting guidance for higher Q3 subscription and services income.

- For Q3, Coinbase guided subscription and services revenue to $665–$745 million, implying about 8% Q/Q growth at the midpoint.

- For full‑year 2025, subscriptions and services are projected at $2.9 billion, around 41% of total revenue, with stablecoins contributing about $1.4 billion.

Global Website Traffic

- Coinbase properties receive about 120 million combined monthly visits, up 25% from 96 million the prior year.

- Coinbase.com logged 35.74 million visits in December, down 10.3% from 39.84 million in November and 43.94 million in October.

- Another tracker estimates 53.94 million webpage visitors in March, versus 63.53 million in February and 78.70 million in January.

- Recent Similarweb data shows around 38.3 million monthly visits, with traffic up 11.52% month‑over‑month.

- Coinbase holds about 6.9% of global exchange trading volume, ranking 6th worldwide and 1st among U.S. exchanges.

- Coinbase’s U.S. audience accounts for roughly 51% of site visits, with the U.K. at 6.7%, Germany 4.1%, Canada 2.9%, and France 2.7%.

- Direct visits make up 72.89% of desktop traffic, while 14.24% arrives via Google search.

- Organic search sends about 12.55 million visits monthly, while paid search contributes roughly 9,690 visits.

Audience Demographics

- Monthly transacting users (MTUs) stood at 8.7 million in Q2, down from a Q1 peak of 9.7 million.

- Coinbase platforms receive around 120 million monthly visits, up roughly 20% from about 96 million the prior year.

- Coinbase Wallet counts about 3.2 million monthly active users, equal to roughly 2.7% of the broader user base.

- Around 10.8 million users were active on Coinbase’s platform more than once per month in 2024.

- Coinbase operates in 70–100+ countries, with the strongest presence in the U.S., Canada, and Western Europe.

- Demographically, the core audience skews ages 18–45, heavily concentrated in the 25–35 bracket.

- Prior SEC scrutiny focused on whether “verified users” metrics overstated 108–110 million accounts versus genuinely active users.

Compliance and Security Statistics

- A May breach impacted 69,461 users (under 1% of customers) and is expected to cost $180–$400 million in remediation and reimbursements.

- Exposed data included customer names, addresses, emails, phone numbers, partial SSNs, and ID images, but no passwords, private keys, or login credentials.

- Attackers demanded a $20 million ransom; Coinbase refused and instead posted a $20 million bounty for information leading to their arrest.

- Coinbase terminated compromised overseas contractors, centralized support in a new U.S. hub, and rolled out stricter ID checks and scam‑warning prompts for high‑risk withdrawals.

- The firm is investing in enhanced insider‑threat detection, automated fraud monitoring, and regular attack simulations to harden defenses.

- In 2023, the Dutch central bank fined Coinbase €3.3 million (≈$3.6 million) for operating without proper registration under AML rules.

- Regulators in Ireland later imposed a record €21.5 million AML fine, adding to Coinbase’s European compliance costs.

- Earlier, New York’s DFS ordered Coinbase to pay $100 million (including a $50 million penalty and $50 million in remediation) over AML and KYC deficiencies.

Frequently Asked Questions (FAQs)

About 10.8 million active monthly traders use Coinbase.

Coinbase Global’s market capitalization was about $68 billion.

In Q3 2025, stablecoin revenue reached $355 million and subscription revenue hit $747 million.

Coinbase reported $516 billion in assets on its platform.

Conclusion

Coinbase remains a cornerstone in the crypto landscape. The company’s strength in custody, handling billions in assets, combined with thousands of employees, expansion into Charlotte, and institutional focus, reflects strategic depth.

Still, security challenges, including a costly cyberattack and past regulatory fines, underscore the importance of robust safeguards. Through acquisitions such as Deribit and partnerships with JPMorgan and PNC Bank, Coinbase continues evolving into a full-service crypto hub.