Citizenship by investment (CBI) has evolved into a significant global phenomenon, offering wealthy individuals an alternate passport in exchange for financial contributions that benefit host economies. These programs have real-world impact, from facilitating international business leadership mobility to enabling families to access broader educational and healthcare opportunities abroad. As global mobility patterns shift and economic diversification becomes vital, understanding CBI trends helps investors and policymakers alike navigate the landscape. Dive into the full set of statistics below to understand how CBI continues to shape international investment and migration.

Editor’s Choice

- Approximately 14 countries offer legally recognized citizenship by investment programs in 2025.

- Caribbean programs remain the top performers in global rankings for CBI attractiveness.

- Nauru’s citizenship by investment program, launched in 2025, is among the most affordable globally, with a minimum investment threshold estimated at approximately $100,000–$105,000.

- Around 50,000 people secure citizenship via investment annually, according to industry estimates.

- Caribbean programmes continue to maintain investor demand despite global shifts.

Recent Developments

- Malta CBI program terminated by ECJ ruling on April 29, 2025.

- Malta CBI generated over €1.4 billion in direct contributions since 2015.

- Malta CBI property investments exceeded €339 million in purchases.

- Grenada CBI applications plunged 45% in 2025 from 2024 levels.

- Grenada CBI revenue per approval reached a record EC$802,889 average.

- Grenada CBI H1 2025 revenue totaled EC$215.17 million.

- Nauru approved its first CBI application, with 20 more in the pipeline.

- São Tomé and Príncipe launched $90,000 minimum CBI program.

- St. Kitts and Nevis CBI ranked #1 globally 2025 CBI Index.

- Caribbean CBI minimum investments raised to $200,000 across programs.

Processing Time for Citizenship by Investment Programs

- Vanuatu offers the fastest processing time, with citizenship approvals in as little as 2 months.

- St Kitts and Nevis typically completes citizenship processing within 4 months, positioning it among the quicker Caribbean options.

- St Lucia, Dominica, and Antigua and Barbuda average around 6 months, balancing speed with extensive due diligence checks.

- Turkey and Grenada require approximately 8 months, reflecting more detailed application and verification procedures.

- Egypt has the longest processing timeline, often exceeding 10 months, due to enhanced regulatory and security reviews.

Number of Countries Offering Citizenship and Residence by Investment Programs

- 14 countries maintain active CBI programs globally.

- 5 Eastern Caribbean nations dominate CBI offerings.

- 44 countries operate active RBI programs worldwide.

- 11 CBI programs are active as of early 2025, before closures.

- 20+ jurisdictions historically offered investor immigration programs.

- 100,000+ CBI passports issued by Caribbean nations since 2014.

- 70,000 passports issued by Dominica and St Kitts & Nevis since 2015.

- 3 CBI programs closed in Europe, including Malta, Cyprus Montenegro.

- 40 active RCBI programs, including CBI and RBI schemes combined.

- 9 top CBI programs ranked in the 2025 CBI Index report.

Annual Volume of Citizenship by Investment Applications

- Industry estimates suggest about 50,000 citizenships are obtained annually via investment migration.

- Earlier annual volumes for Grenada reached over 1,500 new citizens in 2024.

- Some CBI programs report strong year-over-year fluctuations in application volumes.

- Caribbean programs together likely account for the majority share of global applications.

- New program entrants tend to see higher initial demand spikes.

- Annual application figures vary widely based on economic conditions and global mobility demand.

- EU-level changes to CBI frameworks influence application trends globally.

Minimum Investment Thresholds for Citizenship by Investment

- Jordan has the highest minimum entry point, requiring an investment of $750,000, positioning it at the premium end of CBI programs.

- Malta follows closely with a threshold of €690,000, reflecting its strong EU passport value and strict due diligence standards.

- Türkiye sets its citizenship investment requirement at $400,000, making it one of the most prominent mid-tier options.

- Egypt and St Kitts and Nevis both require a minimum investment of $250,000, aligning cost with faster processing and regional appeal.

- Cambodia, St Lucia, Grenada, and Antigua and Barbuda cluster between $230,000 and $245,000, offering relatively affordable Caribbean and Asia-Pacific pathways.

- Dominica, North Macedonia, and Austria maintain entry thresholds of $200,000 or €200,000, balancing affordability with program stability.

- Vanuatu stands out as a low-cost option at $130,000, often combined with one of the fastest processing timelines globally.

- Nauru offers the lowest investment threshold at just $105,000, making it the most accessible citizenship by investment option in 2025.

Approval and Rejection Rates for Citizenship by Investment Programs

- Grenada CBI rejection rate reached 13% in H1 2025.

- Grenada Q1 denial rate increased to 14.37% from 5.67% the prior year.

- Jordan CBI program maintains a 50% historical rejection rate.

- Grenada processed 268 approvals against 191 applications in H1.

- Caribbean CBI programs report average rejection rates under 6% annually.

- Grenada approvals totaled 191 from 309 processed applications H1.

- Grenada CBI approvals represent 87% of processed cases H1.

Economic Impact of Citizenship by Investment on Host Countries

- Grenada’s CBI H1 revenue reached EC$215.17 million, strengthening overall fiscal stability.

- Per approval, Grenada’s CBI revenue averaged a record EC$802,889, reflecting higher-value inflows.

- In Dominica, CBI contributed 37% of GDP in FY2022/23, equivalent to $232 million.

- In contrast, St Kitts’ CBI share declined to 8% of GDP, down from 22% previously.

- Against this backdrop, Grenada’s CBI financing supported a 2.8% primary deficit tied to infrastructure and Beryl recovery.

- In turn, these inflows lifted Grenada’s GDP growth projection to 4.4%.

- Historically, St Kitts’ CBI reliance peaked at 65% of GDP in its early years.

- Meanwhile, Dominica directed CBI revenues toward climate-resilient housing and geothermal energy projects.

- Alongside public funding, Grenada’s CBI-backed real estate investments totaled EC$112 million in H1, generating construction employment.

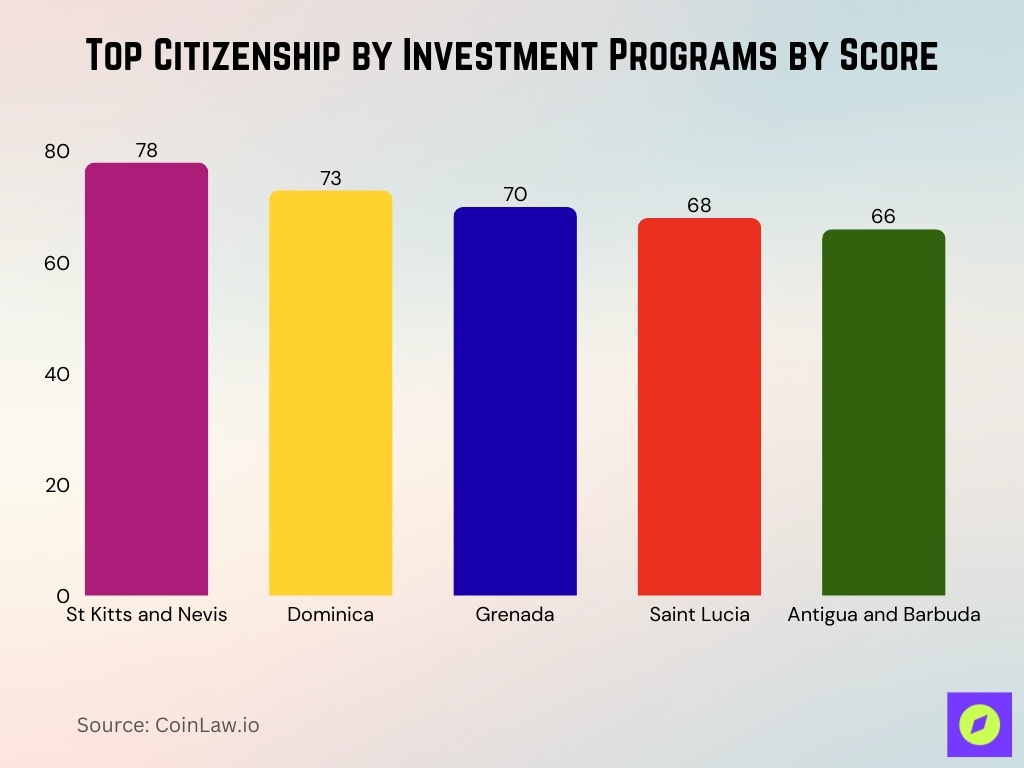

Program Rankings and Scores from Major CBI Indexes

- The CBI Index 2025 places St. Kitts and Nevis at the top with a score of 78, highlighting its robust framework and modern due diligence infrastructure.

- Dominica ranks second with 73 points, demonstrating resilience and continued investor appeal.

- Grenada holds a third position with 70 points, reflecting strong compliance and strategic value.

- Saint Lucia secures fourth place with 68 points as its application efficiency improves.

- Antigua and Barbuda ranks fifth with 66 points, notable for family‑friendly features.

- The Caribbean dominates global rankings, affirming regional consistency in program quality and investor reception.

- Rankings increasingly weigh due diligence practices and visa‑free access scores as critical evaluation pillars.

- While some European programs have exited the landscape, Caribbean programs sustain high scores, underscoring stability and demand.

Contribution of Citizenship by Investment to Government Revenues

- Grenada CBI inflows contributed EC$29.1 million directly in Q1, reinforcing early-year fiscal intake.

- Grenada IMA revenues account for 12% of total government income, forming a steady revenue base.

- Antigua CBI revenue reached $80.4 million, making up 60% of non-tax revenue.

- St Kitts CBI revenue declined 48.3% year-over-year, signaling reduced inflows.

- Across the ECCU CBI-5, programs averaged 6.5% of GDP from 2019–2023.

- Dominica CBI inflows stabilized at 15.75% of GDP, maintaining consistent fiscal support.

- Antigua CBI generated 15% of annual government revenue, strengthening budget capacity.

- Grenada CBI H1 revenue totaled EC$215.17 million, underscoring midyear momentum.

- St Kitts CBI fell to 8% of GDP from 22% in the prior year, reflecting a sharp contraction.

Sectoral Allocation of Investment Funds (Real Estate, Funds, Donations, Business)

- In Grenada, real estate approvals made up 69% of H1 processing activity.

- Alongside this, Grenada NTF donations accounted for 30% of approvals, totaling EC$55.1 million.

- Correspondingly, Grenada’s real estate investments delivered EC$112 million in H1 inflows.

- In Antigua, NDF donations dominated, representing 83% of H1 2024 applications.

- By contrast, the real estate option in Antigua was chosen by 15% of CBI applicants.

- In total, Antigua NDF contributions reached 611 applications out of 739 received.

- Meanwhile, St Lucia provides four investment routes, spanning bonds and enterprise projects.

- In Dominica, the real estate threshold stands at $200,000 with a three-year holding period.

- Notably, Grenada’s Significant Investment category recorded one approval for the first time.

Visa‑Free and Visa‑On‑Arrival Access Scores by Citizenship Program

- Dominica’s CBI passport typically offers access to 145+ visa‑free destinations for investors.

- St. Lucia investors gain access to roughly 147+ countries without a visa requirement.

- St. Kitts and Nevis passports permit visa‑free travel to 157+ destinations as of 2025.

- Grenada’s CBI option, with its U.S. E‑2 treaty advantage, also provides 146+ visa‑free entries.

- Antigua and Barbuda’s passport typically grants visa‑free or visa‑on‑arrival access to 151+ countries.

- Emerging programs like Vanuatu offer access to 113+ countries, distinct from Caribbean peers.

- Visa‑free scores remain a top priority for applicants, influencing program rankings and demand patterns.

Applicant Demographics by Region and Country of Origin

- Grenada CBI saw Chinese nationals account for 13% of H1 applications, remaining a key source market.

- Meanwhile, U.S. applicants rose to a 12% share, reflecting growing interest from North America.

- In contrast, Nigerian participation eased to 10%, marking a relative pullback.

- At the same time, applicants from Pakistan, Vietnam, Uzbekistan, and India each represented roughly 6–9%.

- More broadly, Antigua processed 739 applications in H1, drawing demand from a wide global base.

- Notably, no single nationality exceeded 15% of Grenada’s total applications, indicating diversification.

- Collectively, other nationalities made up 38% of Grenada’s applicant mix.

- Consistent with this spread, Indians, South Africans, Turks, and Russians remain prominent participants in the Grenada program.

Applicant Profiles by Net Worth, Profession, and Family Status

- CBI programs target HNWIs with a minimum $100,000 investable assets.

- 70% St Lucia CBI applicants chose real estate, indicating HNWI status.

- Jordan CBI’s average investment reached $7 million per applicant.

- Entrepreneurs represent the primary CBI applicant profession group.

- 85% St Lucia CBI applications included family dependents.

- Antigua CBI covers families up to 5 members at $230,000 base.

- St Kitts expanded dependents to age 30 regardless of education status.

- 62% Vincentians support CBI for job creation, benefiting professionals.

- CBI attracts 130,000 HNWIs relocating globally, targeting the Caribbean.

Primary Motivations for Citizenship by Investment Applicants

- 70% CBI applications from Middle Eastern entrepreneurs seek mobility.

- 62% executives cite military conflict and political unrest as the primary driver.

- Visa-free access to 140+ countries ranks top for Caribbean CBI seekers.

- 80% programs emphasize family education and healthcare opportunities.

- Tax optimization attracts HNWIs from high-tax jurisdictions.

- Political instability drives 85% demand from volatile regions.

- Business diversification motivates 12% annual industry growth.

- Security concerns influence tens of thousands of annual applicants.

Demand Trends by World Region (Asia, Middle East, Africa, Europe, Americas)

- Asia applicants comprise 13% Grenada CBI H1, primarily Chinese.

- Nigerian applicants hold 10% Grenada CBI market share.

- Americas US applicants surged to 12% Grenada CBI applications.

- Pakistan, Vietnam, Uzbekistan, and India each capture 6-9% Grenada CBI.

- Antigua CBI applications rose 205% from North America, Asia Middle East Africa.

- 38% Grenada CBI applications are from diverse other nationalities.

- No region exceeds 15% single nationality dominance in the Grenada program.

- Caribbean CBI demand sustained across all world regions post-price hikes.

- Europe’s demand shifted to the Caribbean after Malta’s closure.

Due Diligence Intensity and Third-Party Screening Statistics

- St Kitts CBI earned a perfect 10/10 due diligence score in the CBI Index.

- Caribbean CBI programs mandate multi-layer third-party background checks.

- 88,000 Eastern Caribbean CBI passports require enhanced FIU screening.

- St Kitts processing timelines extended to several months for deeper vetting.

- Biometric verification is mandatory for all new Caribbean CBI applicants.

- Regional CBI regulator enforces shared denial lists across jurisdictions.

- Digital identity tools, including facial scans integrated into vetting.

- Grenada CBI rejection rate rose to 13% reflecting stricter screening.

- Dominica perfect due diligence score sixth consecutive year.

Frequently Asked Questions (FAQs)

Roughly 14–15 CBI programs are available globally in 2025.

Portugal’s program recorded 12,718 main applicants to date.

CBI passports from top Caribbean countries typically deliver visa‑free access to 140+ countries.

Conclusion

Citizenship by investment will remain a dynamic segment of global migration and investment strategy, with strong regional demand patterns, enhanced due diligence controls, and competitive mobility scores shaping its evolution. Caribbean nations continue to lead in both investor interest and program quality, supported by robust rankings and solid visa‑free access. Applicants from Asia, the Middle East, Africa, Europe, and the Americas weigh mobility, security, and lifestyle in their decisions, making data‑driven insights essential for confident choices.