In the rapidly evolving Bitcoin-mining sector, Cipher Mining Inc. offers a clear lens into how scale, efficiency, and diversification shape performance. The company’s push into high-performance computing (HPC) hosting and its expansion of mining capacity exemplify industry-level shifts. For instance, large data center operators are increasingly combining Bitcoin mining with AI infrastructure, and energy providers are engaging with mining firms to stabilise grid demand. Read on to explore detailed statistics across key facets of Cipher’s business.

Editor’s Choice

- In Q2 2025, Cipher reported a net loss of approximately $46 million (-$0.12 per share).

- Cipher reported Q2 2025 revenue of $43.6 million with non-GAAP adjusted earnings of $30 million and a net loss of $46 million.

- Adjusted (non-GAAP) earnings in Q2 2025 were about $30 million (≈ $0.08 per share).

- At the end of September 2025, the company reported deploying around 114,000 rigs, with a month-end operating hashrate of ≈ 23.6 EH/s.

- As of late 2025, its pipeline of site capacity stood at roughly 2.6 GW.

- Cipher projects revenues of $696.2 million by 2028, assuming continued growth in HPC hosting, stable Bitcoin pricing above $50,000, and full utilization of its 2.6 GW development pipeline.

Recent Developments

- In Q1 2025, Cipher reported revenue of $49 million, up ~16 % quarter-over-quarter.

- The same quarter showed a GAAP net loss of approximately $39 million while adjusted earnings were ~$6 million.

- In Q2 2025, revenue (~$44 million) was slightly below analyst expectations (~$51.9 million) despite year-over-year growth.

- The company completed energizing operations at its Black Pearl Phase I Texas site and is targeting ~23.5 EH/s self-mining capacity by the end of Q3 2025.

- For September 2025, Cipher mined 251 BTC, sold 158 BTC, and held 1,500 BTC at month-end.

- The company achieved fleet efficiency of around 16.8 J/TH at month-end September 2025.

- Cipher signed a term sheet with Fortress Credit Advisors as a JV financing partner for the Barber Lake site.

- In Q4 2024, the firm acquired the 100 MW Stingray data-centre site and 337 acres adjacent to the Barber Lake site, bolstering its expansion pipeline.

Cipher Mining Stock Performance

- Cipher Mining’s stock price surged to $13.81 USD as of October 3, 2025.

- This marks a gain of +$11.50 over six months, representing a +497.84% increase.

- The stock traded at just $4.06 USD on June 10, 2025, highlighting a strong upward trajectory.

- Pre-market trading indicated a further rise to $14.10 (+2.10%), suggesting continued investor momentum.

- The rally began in mid-2025, accelerating through August and September 2025, with prices nearing $15 USD at the peak.

- The six-month surge reflects growing investor confidence, supported by expanded mining capacity and AI/HPC diversification strategies.

Company Overview & Business Model

- Cipher produced 5,358 BTC in 2024, a 41% increase year-over-year.

- The Odessa facility operates at 207 MW, making it one of the largest Bitcoin mining sites in the US.

- The company reported an average mining cost of $7,400 per BTC in 2024, among the lowest in the industry.

- Cipher’s total hashrate reached 7.5 EH/s in mid-2025, up from 5.7 EH/s in 2023.

- HPC hosting revenues accounted for 11% of total revenue in Q2 2025, up from less than 2% a year prior.

- Cipher’s pipeline offers 2.6 GW of development capacity, one of the largest among public miners.

- The company maintains over 219 exahash-days mined in 2024, placing it in the top tier of North American miners.

- Cipher held 1,500 BTC at the end of September 2025, with 251 BTC mined and 158 BTC sold during the month.

- 73% of Cipher’s sites are secured with multi-year, fixed price power purchase agreements for cost stability.

Net Income and Profitability

- In full-year 2024, Cipher’s net income was negative, roughly -$43.7 million based on operating income of –$43.7 million.

- Q2 2025 GAAP net loss: ~-$46 million or about -$0.12/share.

- In Q2 2024, net loss was about -$15.3 million, so the loss widened significantly in 2025.

- Adjusted (non-GAAP) earnings in Q2 2025: ~$30 million (~$0.08/share).

- In Q1 2025, adjusted earnings were ~$6 million vs a GAAP loss of ~-$39 million.

- The widening GAAP loss reflects increased depreciation (shorter useful lives for rigs), fair-value adjustments for power contracts, and other non-cash items.

- Revenue growth has not yet translated into positive GAAP profitability in 2025, indicating high capital intensity and cost pressures despite scale-up.

Cipher Mining: Latest Self-Mining Hashrate Data

- 3Q 2024 Estimate: Cipher Mining targeted a self-mining hashrate of 9.3 EH/s for the third quarter of 2024, reflecting ongoing fleet upgrades and site expansions.

- Year-End 2024 Achieved: By December 2024, Cipher Mining successfully reached a self-mining hashrate of 13.5 EH/s as confirmed in official operational updates and end-of-year filings.

- Latest Actual (September 2025): As of September 2025, Cipher Mining’s actual operational self-mining hashrate stood at approximately 23.6 EH/s, based on the company’s September operational update and corroborated by industry outlets.

- Year-End 2025 Target: The company maintains a notable target of 35.0 EH/s for year-end 2025, highlighted in both press releases and executive communications as Cipher’s strategic goal for capacity expansion.

Operational Milestones

- As of August 2025, Cipher Mining Inc.’s Black Pearl Phase I site now contributes nearly 40 % of its monthly Bitcoin-mining output.

- In May 2025, the company reported mining 179 BTC, selling 64 BTC, and holding 966 BTC on its balance sheet.

- To support growth, Cipher was targeting a self-mining hashrate of approximately 23.5 EH/s by Q3 2025.

- As part of its expansion, Cipher deployed around 75,000 mining rigs by May 2025.

- Operating efficiency improved, the company noted lower energy intensity and higher uptime at new facilities.

- The company’s site portfolio includes acquisitions like the 100 MW “Stingray” site and the 300 MW “Barber Lake” site in West Texas.

- Site flexibility improved, and new builds were designed to switch between crypto mining and HPC/AI workloads, reflecting an operational shift.

Data Center Expansion

- Cipher entered a 10-year AI hosting agreement with Fluidstack (backed by Google’s $3 billion investment) projected to generate $300 million in annual revenue.

- That agreement potentially rises to ~$7 billion in contract value if two five-year extension options are exercised.

- The site itself sits on ~587 acres and has expansion potential to add an additional ~500 MW of capacity.

- Cipher is raising $800 million (with an option to increase to $920 million) via convertible senior notes to fund data-centre expansion and HPC build-out.

- Additional reporting indicates a $1.1 billion convertible note financing aimed at accelerating build-out across its data-centre portfolio.

- The move positions Cipher to be “a major AI data-centre developer” alongside its crypto-mining roots.

- Cipher Mining’s Barber Lake AI hosting expansion costs average $9–11 million per MW, according to its September 2025 Fluidstack agreement.

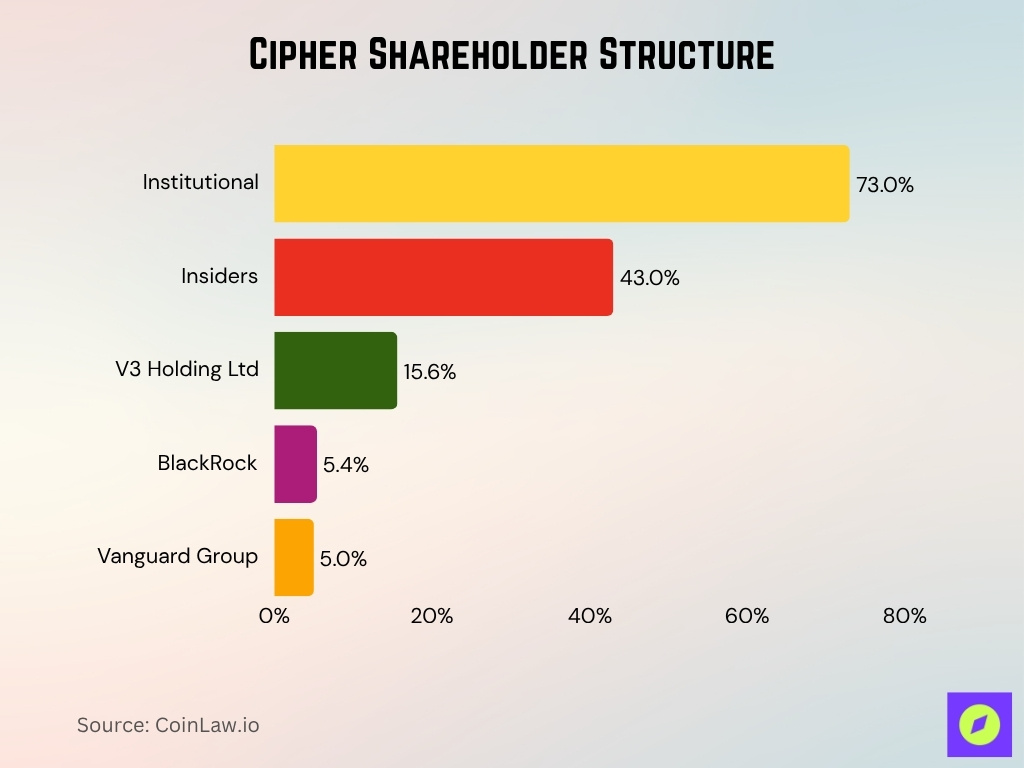

Shareholder & Insider Holdings

- Institutional investors currently own approximately 73% of Cipher Mining’s shares, while insiders directly control about 43% and top holders include V3 Holding Ltd (~15.6%), BlackRock (5.4%), and Vanguard Group (approx. 5%).

- Institutional investors include ~411 firms, with about 326 million shares held long, representing ~82.9% of the float per one dataset.

Analyst Ratings and Price Targets

- The latest analyst average 12-month price target for Cipher Mining is $18.68, with forecasts ranging from $8.00 to $27.00.

- Nine analysts with a “Strong Buy” consensus and an average price target of $16.83, suggesting a potential downside of ~18.5 % from current levels.

- Average price target of ~$17.61 over the past three months, with 24 Buy ratings and 6 Hold ratings, and no Sell ratings.

- One-year target of $9.27/share, ranging from $6.56 to $18.90, representing a ~26.7 % projected drop from a recent ~$12.65 share price.

- Analysts highlight that the pivot into AI/HPC hosting may justify valuations, but also note the dependency on execution and Bitcoin price.

- Some firms (e.g., Arete) have assigned a price target of ~$24 for Cipher, citing rising AI demand in bitcoin-miner peers.

- Despite high forecasts in some cases, the spread among price targets remains wide, reflecting uncertainty in business model transition and industry cycle.

Revenue Diversification (AI & HPC Hosting)

- Under the Fluidstack agreement, the 10-year contract delivers ~$3 billion of revenue in its initial term, with extension potential up to ~$7 billion.

- This represents a shift from purely Bitcoin-mining revenue toward hosting high-performance computing (HPC) and AI infrastructure workloads.

- The company’s site portfolio and structure allow “compute switching” between mining and HPC, which supports diversification of revenue streams.

- Traditional crypto-mining margins are under pressure, and the AI/data-centre pivot is a strategic hedge.

- Cipher states that data centre hosting under the Fluidstack agreement could yield NOI margins between 80–85%, depending on sustained power cost hedges, facility uptime, and AI/HPC client workload densities.

- The expansion into AI/HPC enables Cipher to appeal to institutional clients beyond crypto, broadening its commercial addressable market.

- While still early in this segment, the hosting business positions Cipher for longer-term recurring contracted revenues rather than variable Bitcoin production.

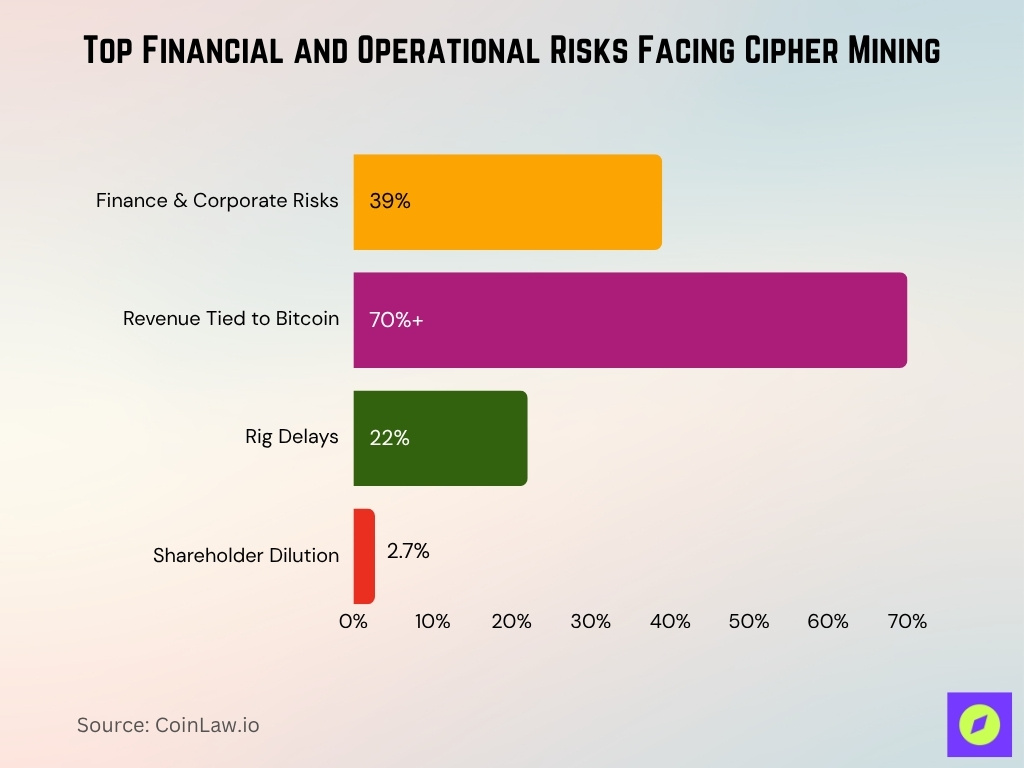

Risks and Challenges

- Cipher listed 80 risk factors in its Q2 2025 filings, with 39% flagged as Finance & Corporate risks.

- Over 70% of revenue relies directly on the Bitcoin price, exposing the firm to crypto-market volatility.

- Rig delivery delays affected 22% of planned deployments in Q2 2025, citing logistics bottlenecks.

- Debt-equity conversions from 2030 Notes resulted in 2.7% dilution for common shareholders in 2025.

- AI/HPC hosting contracts added 9 new operational risk categories to Cipher’s disclosures this year.

- Capital expenditures surged 56% year-over-year due to infrastructure expansion, straining short-term cash flows.

- Regulatory proceedings and ESG disclosures caused a 14% increase in compliance costs since 2024.

- Mining permit delays impacted operation start dates at 2 major sites in West Texas during 2025.

Debt, Cash, and Funding Statistics

- As of 2024, total liabilities for Cipher were approximately $173.49 million, up ~131.9% versus 2023.

- As of recent filings, the company had about $62.70 million in cash and equivalents and roughly $189.29 million in debt, giving a net cash (net debt) position of –$126.58 million.

- The debt-to-equity ratio stood at around 22.3%, with total debt ~$167.1 million and equity ~$748.9 million.

- In the past 12 months, the company reported operating cash flow of –$138.98 million and capex of –$469.18 million, resulting in free cash flow of –$608.16 million.

- Despite large funding, the company’s cash runway depends on rapid scaling and contract execution of its data-centre segments.

Competitors and Industry Ranking

- As of September 2025, public-miner realised hashrate totals reached about 326 EH/s, up from ~150 EH/s a year prior, illustrating rapid consolidation.

- In that ranking, MARATHON Digital Holdings, CleanSpark, and Cango remained the top tier, while companies like this one posted ~152 % growth in realised hashrate.

- The company was listed among the “leading Bitcoin mining companies in 2025”, alongside Marathon, CleanSpark, and others.

- Its net margin was around -96.95 %, with return on equity ~-21.7 %, contrasted with comparable miner HIVE Digital Technologies at -17.47 % net margin.

- Beta volatility is high; the company’s beta (2.87) shows its share price moves ~187 % more than the S&P 500 baseline.

- The company’s expansion into AI/HPC hosting may help differentiate it from pure-play miners, which some competitors still dominate.

- Despite growth, the company remains a “mid-tier” public miner in terms of scale, implying a gap remains before top-tier leader status.

Frequently Asked Questions (FAQs)

Approximately 39% of production.

Approximately −84.5% operating margin.

About 2.6 GW of pipeline capacity.

Cipher Mining reached an operating hashrate of 23.6 EH/s with 114,000 deployed rigs as of September 2025.

Conclusion

The company stands at a pivot, from a large-scale Bitcoin miner toward a hybrid model that blends crypto mining with AI/HPC hosting. Its rapid hash rate expansion, emerging hosting contracts, and strategic land/site pipeline support growth potential. Yet the profitability gap, heavy dependence on Bitcoin price, and infrastructure/dilution risks remain material. For investors and stakeholders, the central question is whether execution can catch up to ambition.