Cardano founder Charles Hoskinson proposed a $100 million ADA DeFi allocation as the network reinforces its security standards following FluidTokens’ audit.

Key Takeaways

- 1Charles Hoskinson proposed a $100M ADA treasury allocation to support DeFi projects and stablecoin liquidity in the Cardano ecosystem.

- 2The proposal came amid a community-wide discussion on hot wallet security following several phishing scams.

- 3Cardano-based FluidTokens published a 106-page audit of its lending V3 protocol, emphasizing transparency and security.

- 4Hoskinson cited the Monero 51% attack to showcase why Cardano’s security infrastructure, like the Minotaur protocol, is critical.

What Happened?

After a security-focused conversation in the Cardano community, founder Charles Hoskinson unveiled a bold proposal to allocate $100 million in ADA to boost decentralized finance (DeFi) and stablecoin liquidity. This announcement closely followed FluidTokens’ public release of a full audit for its V3 lending protocol, underscoring Cardano’s growing emphasis on security and transparency.

Hoskinson’s $100M DeFi Vision

In a surprising move during a community security discussion, Charles Hoskinson proposed directing $100 million worth of ADA from the Cardano Foundation’s treasury into the network’s DeFi ecosystem. The informal plan aims to enhance adoption of Cardano-native stablecoins such as USDM, USDA, and IUSD, as well as allocate part of the treasury into Bitcoin.

- The strategy would be developed in collaboration with leading DeFi projects.

- The execution would depend on operational readiness and deployment feasibility.

- Hoskinson noted that Dan Singleman, Chief Investment Officer of the Hoskinson Family Office, and other foundation leaders are reviewing the proposal.

The Cardano founder stressed that such a large-scale investment would not disrupt the ADA market. He proposed using time-weighted average price (TWAP) strategies and over-the-counter (OTC) channels to minimize any impact on trading volume.

“The token has deep liquidity and can handle gradual selling over 30 to 90 days,” said Hoskinson in a YouTube video.

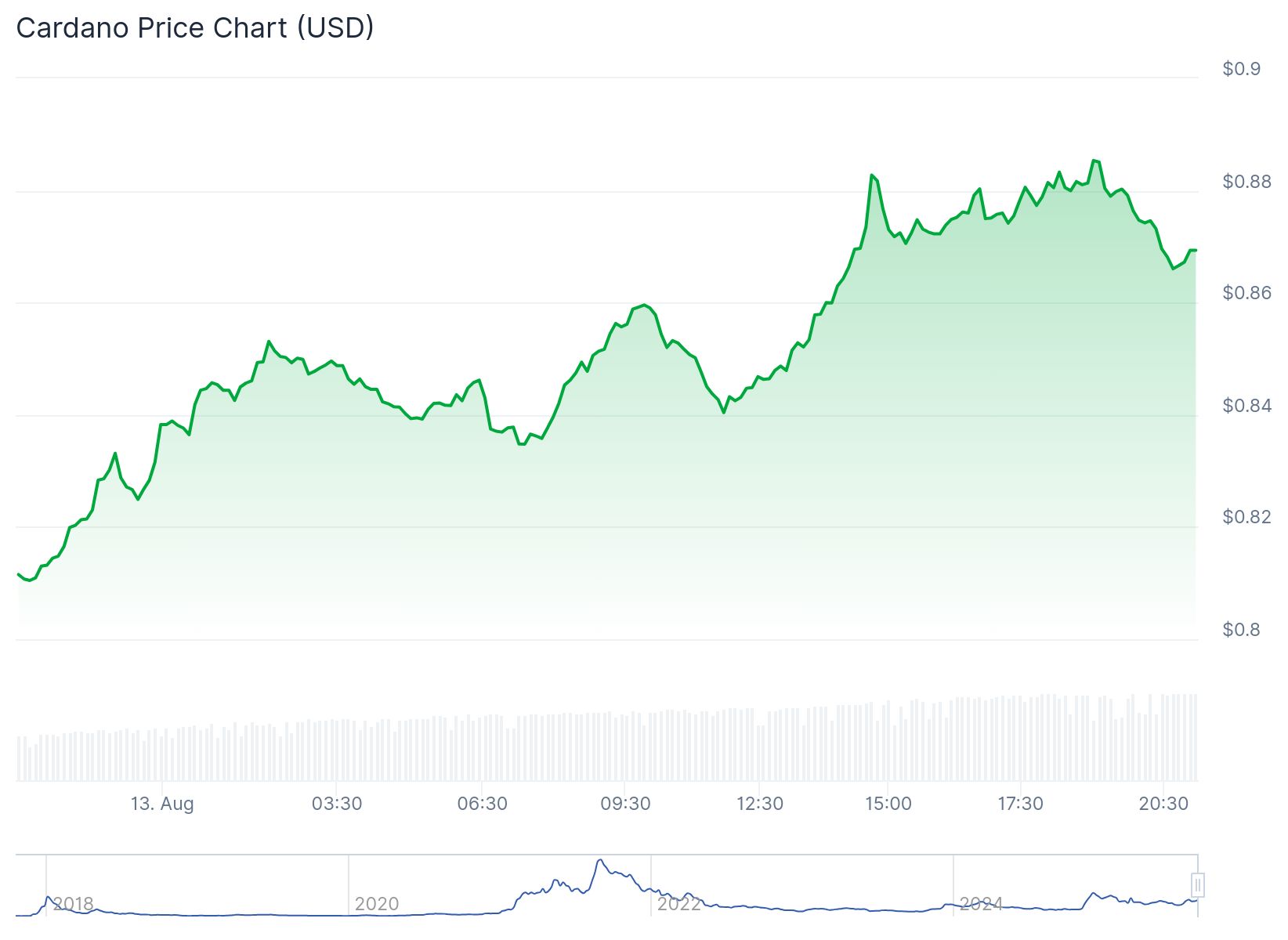

At the time of writing, ADA traded at $0.8691, marking a 7.1% increase in the past 24 hours, though still significantly below its all-time high of $3.10.

Security First: FluidTokens Publishes Full Audit

Alongside funding ambitions, the Cardano ecosystem is showcasing its security commitment. FluidTokens, a Cardano-based lending platform, released a comprehensive 106-page audit of its V3 protocol. The audit was conducted by Vacuumlabs, a respected blockchain engineering firm known for working across both Cardano and Ethereum ecosystems.

Screw it, here’s the full FluidTokens lending V3 Audit. All 106 pages. pic.twitter.com/IJGNW10Cwa

,FluidTokens (@FluidTokens) August 12, 2025

- The full report was shared publicly via FluidTokens’ official X account.

- This move contrasts with many crypto projects that withhold internal audits.

- The platform emphasized user safety and transparency.

FluidTokens’ decision was widely praised by community members and Charles Hoskinson himself, who cited the audit as a benchmark for Cardano-based project integrity.

Monero Attack Underscores Cardano’s Defensive Design

The recent 51% attack on the Monero network served as a cautionary tale that fueled Hoskinson’s security emphasis. Blockchain project Qubic temporarily took control of Monero’s network through its mining power, causing chain reorganizations and orphaning blocks.

This is another reason we built minotaur for Midnight. Multi-resource consensus ensures checks and balances for the consensus providers using different resources from work to stake. Thus no one attack can take over the network https://t.co/NluXl1vxrP

,Charles Hoskinson (@IOHK_Charles) August 12, 2025

In response, Hoskinson highlighted Cardano’s proactive architecture, especially the Minotaur protocol, designed for the privacy-focused Midnight sidechain.

- Minotaur combines proof-of-work (PoW) and proof-of-stake (PoS) models.

- The goal is to prevent any single entity from controlling the network.

Hoskinson framed this technology as a critical measure that distinguishes Cardano’s ecosystem from others vulnerable to similar attacks.

CoinLaw’s Takeaway

This story hits at the core of what makes Cardano different. I’m impressed by how Hoskinson responded swiftly and boldly to both security concerns and community engagement. The $100 million ADA proposal, while still informal, shows a clear vision for scaling the network’s DeFi capabilities. At the same time, the public release of the FluidTokens audit sends a strong message: security and transparency are not optional. If Cardano wants to lead the next era of decentralized finance, this blend of long-term investment and strong security practices is exactly the way to do it.