The payments landscape is evolving rapidly, and Braintree (a payments platform owned by PayPal Holdings, Inc.) stands at the crossroads of mobile, global, and e-commerce transactions. Its technology supports everything from subscription services to marketplace platforms. For example, a US-based SaaS firm may use Braintree to accept PayPal and credit-card checkouts, while a global retailer might integrate Braintree’s multi-currency gateway to expand into Europe. With adoption across hundreds of markets and billions in transaction volume, the platform’s scale and global reach matter. Let’s explore the full article to see how Braintree stacks up today.

Editor’s Choice

- 25 billion transactions annually on the Braintree platform.

- Braintree holds approximately 5.21% market share in the payments-processing category in 2025.

- The platform supports merchants in 200+ markets around the globe.

- In PayPal’s unbranded card-processing segment, which largely covers Braintree, volume growth slowed to 2% in Q4 2024.

- Braintree has an estimated 1.92% share in the payment-management market (2025 estimate).

Recent Developments

- In October 2025, Braintree introduced a new Network Release Guide outlining 10+ compliance and fee updates, covering card scheme adjustments and regulatory mandates.

- PayPal’s CFO confirmed in December 2024 that Braintree’s unbranded business will slow in volume growth to improve profit margins, marking a “value over volume” shift.

- Braintree’s unbranded payment volume growth declined from 11% in Q3 2024 to approximately 2% in Q4 2024 as PayPal strategically prioritized profit margins over volume growth through contract renegotiations with high-volume clients.

- The April 2025 fee update included Mastercard acquirer fee adjustments from 0.13% → 0.14%, impacting international settlement costs.

- Starting January 13, 2025, PayPal and Braintree raised fees on Advanced Credit/Debit Payments from 2.59% → 2.89% and BNPL to 4.99% + $0.49, citing growing demand.

- PayPal’s “Fastlane” checkout system, integrated through Braintree, boosts guest checkout conversion by 0.5 percentage points on average.

- Braintree’s redesigned API now automates card updates in vaults and reduces failed transactions by up to 15% through enhanced verification.

- Compliance improvements emphasize 3D Secure (PSD2) support through Braintree.js, ensuring stronger EU transaction authentication.

- Braintree’s profitability push raised transaction margins by 8% in Q2 2025, helping offset slower total processing volume.

- PayPal anticipates Braintree’s revenue baseline to reset in late 2025, stabilizing after intentional contract renegotiations with high-volume clients.

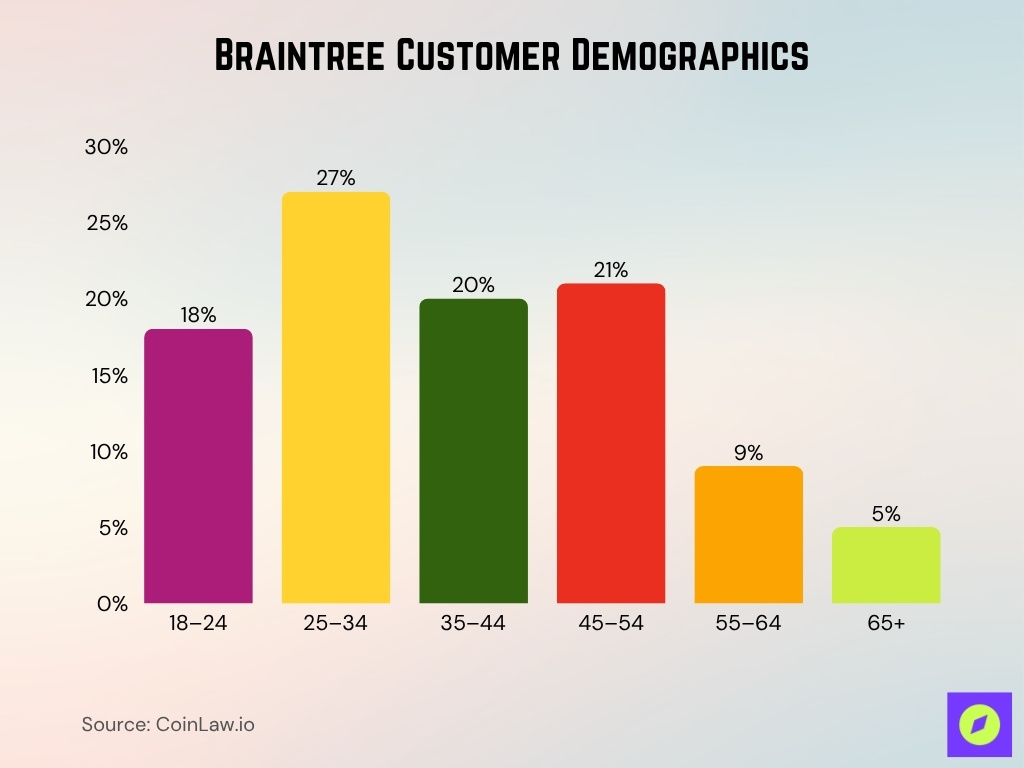

Braintree Customer Demographics

- Around 27% of users on Braintree-supported websites are aged 25–34, while 20% fall within the 35–44 age group. Another 18% are aged 18–24, showing strong engagement among younger adults.

- Users aged 45–54 make up 21% of the total, followed by 9% in the 55–64 range. Only 5% are aged 65 and above, indicating lower participation among older users.

- The gender split shows about 55% male and 45% female users. This highlights a slightly higher male user base across Braintree-supported platforms.

Payment Methods Accepted

- Merchants can enable PayPal, Apple Pay, Google Pay, and, for U.S. merchants, Venmo, directly through Braintree’s SDK integrations.

- The platform processes credit and debit cards as credit transactions online, simplifying authorization flows for merchants.

- Local Payment Methods (LPMs) include BLIK, Bancontact, Multibanco, and OXXO, each available only in specific countries and currencies.

- OXXO payments in Mexico allow customers up to 3 days to complete offline cash payments before expiration.

- Prices for standard U.S. merchants are 2.59% + $0.49 for cards and 3.49% + $0.49 for Venmo transactions, with 0.75% for ACH direct debit.

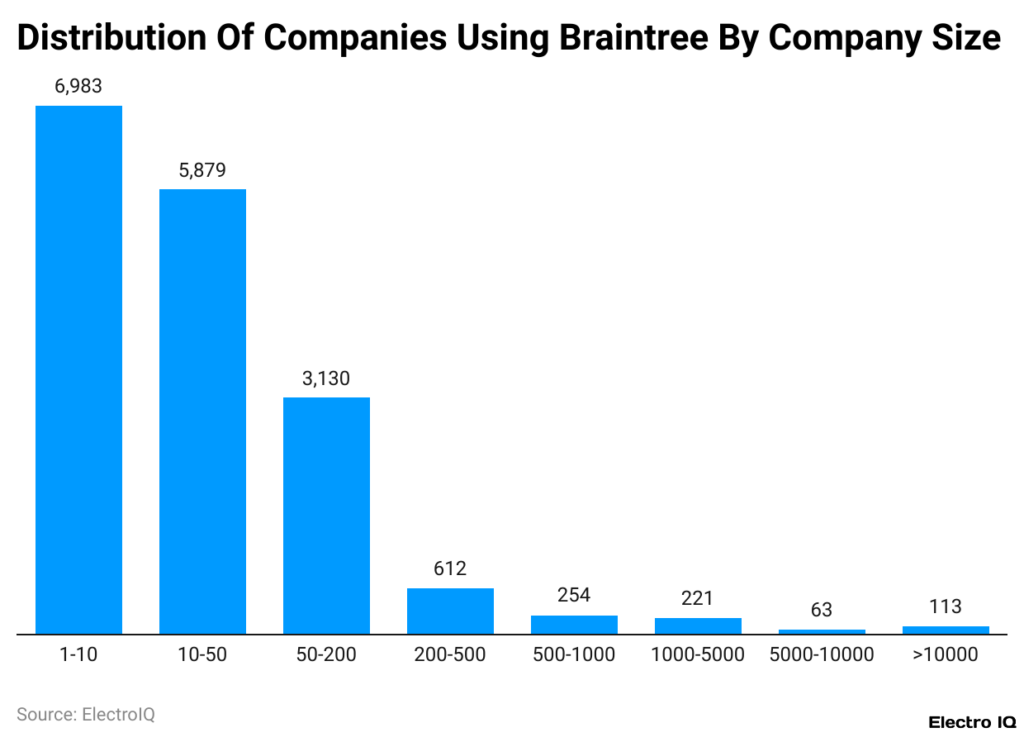

Distribution of Companies Using Braintree by Company Size

- Small businesses dominate Braintree’s user base, with 6,983 companies having 1–10 employees.

- Firms with 10–50 employees account for 5,879 users, showing strong adoption among growing startups.

- Mid-sized companies (50–200 employees) represent 3,130 users, indicating solid traction in the SME segment.

- Only 612 companies have 200–500 employees, suggesting fewer mid-tier enterprise integrations.

- Large organizations (500–1,000 employees) make up 254 users, reflecting limited enterprise-scale use.

- Around 221 companies with 1,000–5,000 employees use Braintree, highlighting selective corporate adoption.

- Very large firms with 5,000–10,000 employees account for just 63 users.

- The largest enterprises (>10,000 employees) total 113 users, showing Braintree’s niche presence in global-scale corporations.

- Overall, the data shows that over 80% of Braintree’s client base comes from small and mid-sized businesses, reinforcing its reputation as a developer-friendly payment solution for agile companies.

Currency Support Statistics

- Supported currencies include USD, GBP, EUR, CAD, AUD, JPY, and many emerging-market options like BRL, INR, and ZAR.

- Braintree automatically converts payments made in foreign currencies into the merchant’s default settlement currency, applying standard exchange markups.

- Transactions made in non-USD currencies are subject to an additional 1% international fee, with possible 3% conversion charges for different currencies.

- Merchants can request dedicated accounts for high-volume currencies such as USD, GBP, and EUR for better settlement rates.

- Cross-border card transactions incur an extra 1% fee when issued outside the merchant’s home country.

- Currency acceptance depends on PayPal merchant region setup, meaning some currencies may require approval or custom settlement mapping.

- Multi-currency accounts allow merchants processing over £50,000 per month (UK) or €60,000 per month (EU) to qualify for lower rates.

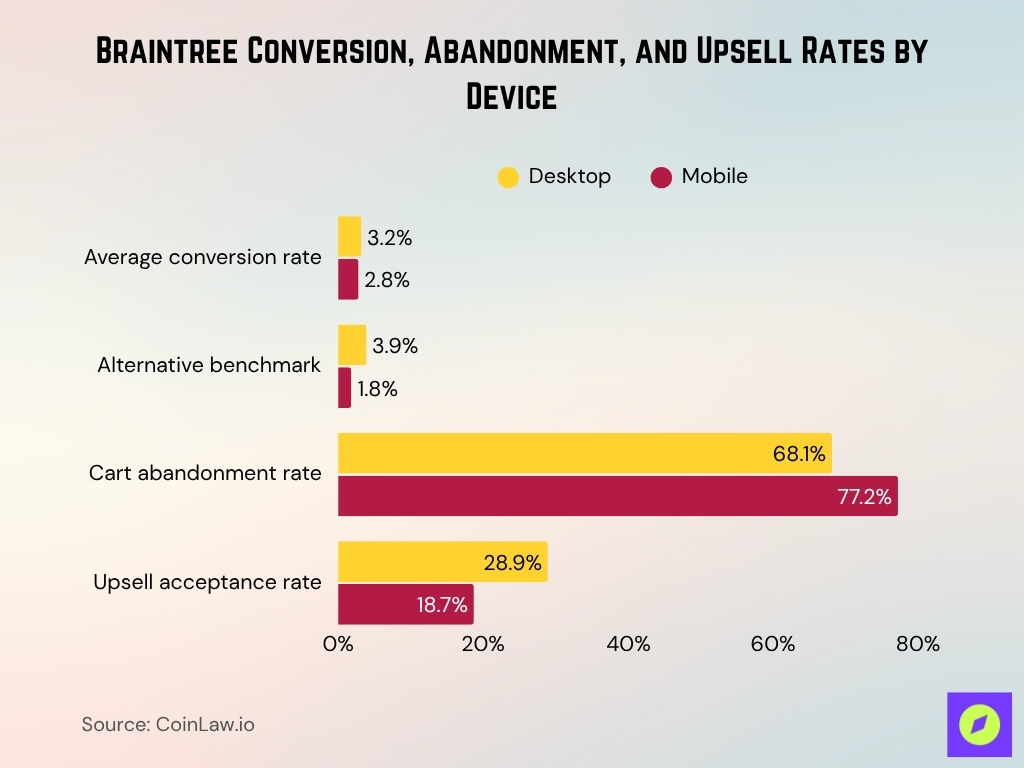

Conversion Rates and User Behavior

- Global e-commerce conversion rates in 2025 range from 2%–4%.

- Desktop conversion averages around 3.2%, mobile ~2.8%.

- Another benchmark shows desktop at 3.9%, mobile at 1.8%.

- Cart abandonment on mobile is ~77.2%, desktop ~68.1%.

- Digital wallets and tokenisation help improve mobile conversion.

- Desktop upsell acceptance ~28.9%, mobile ~18.7%.

- Repeat buyer conversion improves with tokenised payments.

- Payment method performance influences conversion.

- Conversion benchmarks are indicative for Braintree merchants.

Braintree vs Stripe Comparison

- Stripe leads with ~34.8% of the global payment-management software usage market, while Braintree holds around 1.92%.

- In payments processing, Braintree is used by approximately 33,400+ websites globally, while Stripe is on over 1 million websites.

- Braintree pricing: 2.59% + $0.49, Stripe: 2.9% + $0.30.

- Braintree supports more than 45 countries, and Stripe supports about 34.

- Stripe focuses on developer-first APIs, Braintree on enterprise payments, and PayPal integration.

- Stripe processed ~$1.4 trillion in 2024; Braintree is slower-growing.

- Stripe fits fast-scaling platforms, Braintree suits established businesses.

- The competitive gap is significant, but both serve unique niches.

Top Competitors and Alternatives

- PayPal’s overall digital payments market share stands at 45%, with Braintree representing its enterprise-level, unbranded processing arm.

- Braintree’s unbranded payment processing grew 30% year-over-year, outperforming PayPal-branded checkout growth of 6.5%.

- Competing platforms include Stripe (~34.8%), Shopify Pay (~66.85%), PayPal (~31.65%), Adyen (5.49%), and Venmo (~9.49%) by usage segments.

- Stripe and Braintree both serve enterprise-level developers, but Stripe maintains roughly 10× more active users globally.

- Braintree ranks around 7th among U.S. payment gateways for SMBs, trailing platforms like Shopify Pay and Stripe in adoption rate.

- Across sectors, 41.15% of Braintree users are U.S.-based, with an increasing presence in the UK (6.5%) and India (5.4%).

- Adyen processes between €800 billion and €900 billion annually, positioning it significantly ahead of Braintree in global volume terms.

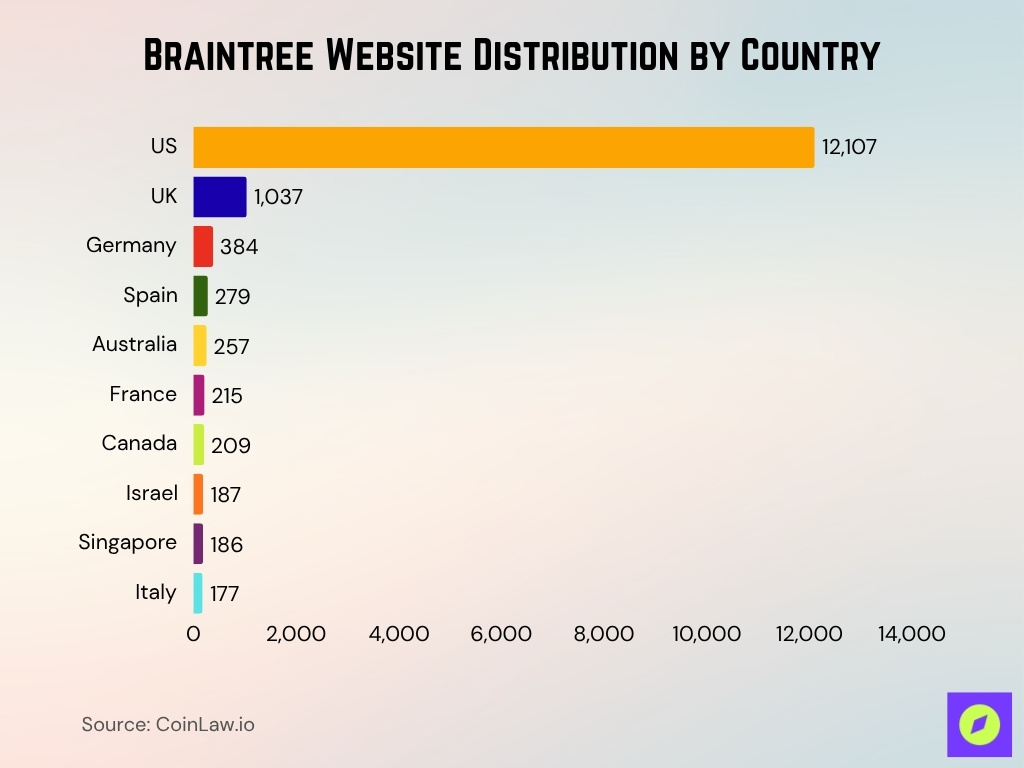

Total Number of Braintree Websites by Country

- The United States leads all countries with 12,107 websites using Braintree, reflecting the platform’s strong dominance in the North American e-commerce and digital payments market.

- The United Kingdom ranks second with 1,037 websites using Braintree, demonstrating substantial adoption across British e-commerce businesses and enterprises.

- Germany hosts 384 websites on Braintree, making it the third-largest market and highlighting the platform’s penetration into Europe’s largest economy.

- Spain emerges as a growing market with 279 websites, showing Braintree’s expansion into Southern European e-commerce sectors.

- In the Asia-Pacific region, Australia leads with 257 websites, followed by Singapore with 186 websites, indicating strong adoption in developed APAC markets.

- France accounts for 215 websites using Braintree, while Canada has 209 websites, showing comparable adoption rates in both French-speaking and North American markets.

- Israel has emerged as a notable market with 187 websites, reflecting the country’s strong fintech and tech startup ecosystem, adopting Braintree’s payment solutions.

- Italy rounds out the top ten countries with 177 websites using Braintree, demonstrating the platform’s steady presence in Southern Europe.

- The geographic distribution shows Braintree’s strongest concentration in North America and Europe, with emerging adoption in Asia-Pacific and Middle Eastern markets like Israel and Singapore.

Braintree Drives PayPal Growth

- PayPal Q2 2025 TPV reached $443.5 billion, up 6% YoY.

- Transaction margin dollars grew 8% to ~$3.5 billion.

- Unbranded processing, including Braintree, is slowing to improve margins.

- Braintree renegotiations may cause a ~5-point revenue growth headwind in 2025.

- Unbranded growth slowed to ~2% in Q4 2024.

- PayPal aims to grow profit over volume through Braintree.

- Braintree contributes meaningfully to PayPal’s margin expansion.

- It is now part of PayPal’s value-over-volume strategy.

Technology Integrations and Partnerships

- PayPal’s 2025 Verifone partnership integrates Braintree to unify in-store and online payments under the PayPal Open umbrella, expanding global omnichannel coverage.

- The joint PayPal–Verifone network supports enterprise merchants across retail, grocery, and hospitality, covering 50+ markets with localized payment routing.

- Braintree integrates with PayPal, Venmo, Apple Pay, Google Pay, and hundreds of third-party tools, including Shopify, NetSuite, and Zuora.

- The new omnichannel framework helps merchants increase authorization rates by up to 15% through dynamic routing and acquirer optimization.

- Through Magestore’s Braintree POS, merchants gain a unified checkout system supporting BOPIS, BORIS, and in-store refunds, bridging online and offline experiences.

- Braintree’s Vault tokenization secures customer data across multiple channels, compliant with PCI DSS Level 1 standards for enterprise merchants.

- The integration ecosystem exceeds 200+ prebuilt connectors, including ERP, CRM, and accounting platforms, enabling streamlined data synchronization.

- PayPal’s new Fastlane integration, developed alongside Braintree, boosts guest checkout speed by 36%, enhancing conversion rates for merchants.

Revenue and Transaction Volume

- PayPal’s Q2 2025 TPV hit $443.5 billion, revenue $8.29 billion.

- Braintree renegotiations are expected to reduce 2025 revenue growth by ~5 points.

- Growth slowed from 29% to ~2% in one year.

- Higher-margin contracts are now prioritized over raw volume.

- ~$6 billion in share buybacks supported by payment business cash flows.

- Operating margins rose to ~19.8% aided by the payments business.

- Braintree’s impact lies in strategic enterprise alignment.

Frequently Asked Questions (FAQs)

Braintree handles approximately 25 billion transactions annually.

Its market share is around 5.21% in the payments‑processing category in 2025.

Braintree is available in more than 45 countries for merchants.

About 62.0% of stores using Braintree operate on the Magento e‑commerce platform.

Conclusion

As we’ve seen across these data-driven sections, Braintree occupies a nuanced position in the global payments ecosystem. On one hand, it offers broad currency support, global reach, enterprise integrations, and access through its parent company, PayPal. On the other hand, it competes in a fiercely contested space, with competitors like Stripe far larger in volume and market share.