BONK has become a standout Solana‑based meme token, attracting a lively community and soaring to a market cap measured in billions. It powers casual DeFi tools and NFT interactions, gaining traction in both trading and ecosystem use. From community burns to rapid exchange listings, BONK is gaining real-world presence. Dive into this article to discover how its numbers stack up, and why it matters.

Editor’s Choice

- Market cap around $960.65 million, illustrating BONK’s current scale amid the memecoin universe.

- Circulating supply roughly 87.9–88.0 trillion BONK, reflecting near-full issuance versus the ~88.87 trillion BONK capped supply.

- Max supply effectively fixed at about 88 trillion BONK, underscoring BONK’s hard upper limit.

- Recent 24-hour trading volume has fluctuated around $138.8 million, showing strong ongoing liquidity.

- BONK’s current price is near $0.0000109, keeping it among the more actively traded Solana memecoins by volume and market value.

Recent Developments

- BONK DAO’s approved 1 trillion BONK burn remains pending, with unique holders progressing toward the 1 million-wallet trigger milestone on Solscan.

- BONK.fun drove ecosystem revenue above $1.5 million in the first 11 days of January, averaging roughly $136,000 in daily revenue.

- Combined BONK burns now exceed hundreds of billions of tokens, with prior events driving short‑window rallies of roughly 15–70%.

- Bonk.fun previously generated over $37 million in monthly revenue, with around 50% directed to BONK burning and ecosystem rewards.

- The July 2025 burn of 500 billion BONK (around 50% of that month’s emissions) coincided with a roughly 158% short‑term price surge.

- Recent whale accumulation periods saw roughly 3 billion BONK absorbed by large wallets over 24 hours, alongside trading volume above $1.5 billion.

- Market commentators continue to flag a hypothetical $1 target as requiring an implausible multi‑trillion‑dollar market cap given BONK’s large supply base.

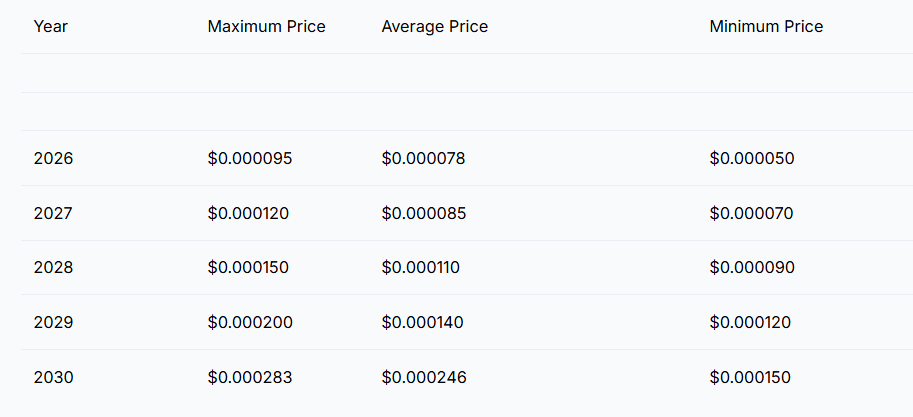

BONK Price Forecast Overview

- BONK’s maximum price is projected to rise from $0.000095 in 2026 to $0.000283 by 2030, showing strong long-term upside momentum.

- Average BONK prices are expected to grow steadily, increasing from $0.000078 in 2026 to $0.000246 in 2030, reflecting sustained market adoption.

- Minimum price levels trend upward each year, moving from $0.000050 in 2026 to $0.000150 in 2030, indicating improving downside support.

- 2028 marks a key inflection point, with the average price crossing $0.000110, signaling accelerated growth potential.

- Price volatility narrows over time, as rising minimum prices reduce the gap between downside and upside estimates.

- Long-term outlook remains bullish, with projected average prices in 2030 more than 3× higher than 2026 levels.

Token Burn Statistics

- A proposed 1 trillion BONK burn (about 1.24% of supply) is scheduled once unique holders surpass 1 million wallets on-chain.

- That 1 trillion BONK burn is valued near $22–23 million, based on recent BONK prices around $0.000022–$0.000023.

- April 2024’s 278 billion BONK burn (about 0.3% of supply) drove an immediate ~11–25% price jump within 24 hours.

- BURNmas 2024 removed about 1.69 trillion BONK worth roughly $53.5 million, shrinking supply by around 1.8% and lifting market cap roughly 75%.

- In July 2025, BONK DAO burned 500 billion BONK (around 0.5% of supply), tied to a monthly price surge of roughly 158%.

- Historical total burns now exceed 2.47 trillion BONK, valued at about $74.4 million, equal to roughly 2.6% of cumulative supply removed.

- Committee and community events in 2024 saw additional burns of about 2.78 trillion and 840 billion BONK, further reinforcing the deflationary trajectory.

- Analysts observe that burn‑driven rallies typically range from 15–70% in short windows, depending on market sentiment and concurrent news.

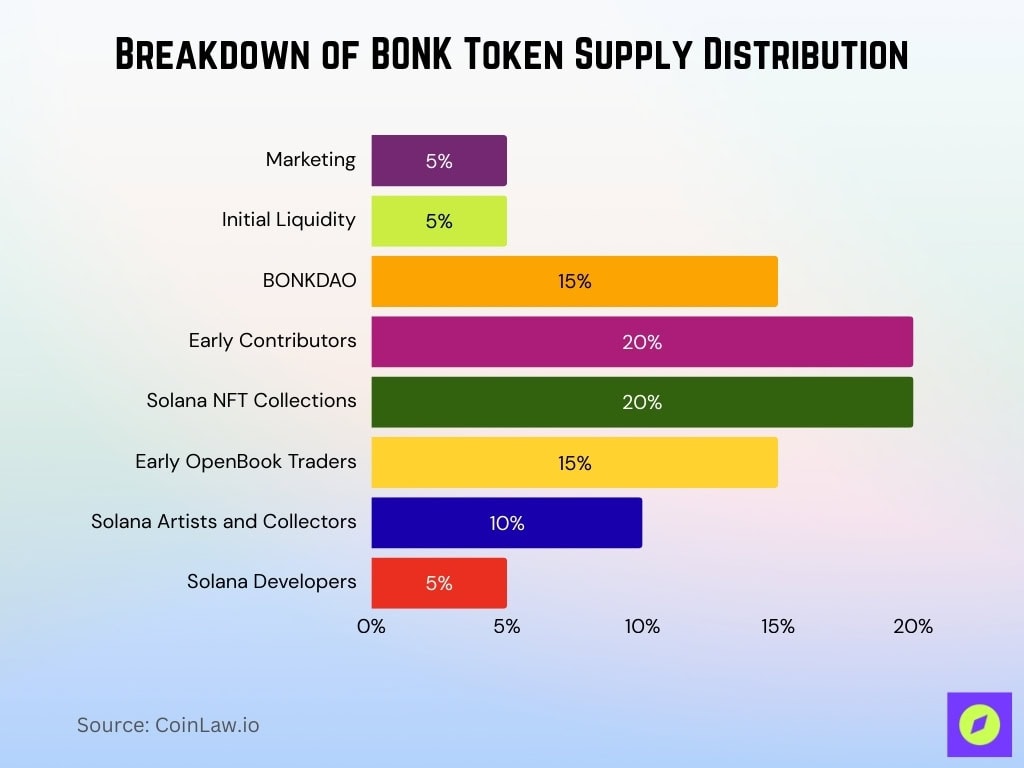

BONK Token Distribution

- Marketing receives 5% of the total BONK token supply.

- Initial Liquidity is allocated 5% to support trading and stability.

- BONKDAO controls 15%, ensuring governance and community decisions.

- Early Contributors hold 20%, rewarding initial supporters of the project.

- 40 Solana NFT Collections share 20%, strengthening ties with NFT ecosystems.

- Early OpenBook Traders receive 15%, incentivizing trading adoption.

- Solana Artists and Collectors are given 10%, promoting cultural and creative growth.

- Solana Developers hold 5%, fostering continued development and innovation.

Transaction Statistics

- BONK on‑chain transaction volume spiked to about 2.9 trillion tokens during early‑July burn‑driven trading frenzies.

- A late‑2022 airdrop distributed roughly 50 trillion BONK to around 297,000 wallets, seeding early network participation.

- That initial airdrop was followed by an estimated 7,303% price surge between January 3–10, 2023, creating multiple early “BONK millionaires.”

- A mid‑August 2025 spike saw about 574.8 billion BONK traded in 24 hours, lifting the price roughly 1.9% in a single day.

- Daily trading volumes now routinely exceed $300 million, supporting deep liquidity across exchanges.

- Coinbase records 2,114 BONK trades in the last 24 hours, involving 1,307 buyers and 873 sellers.

- Over the last 30 days, BONK logged about $4.155 billion in trading volume, averaging roughly $138.5 million per day.

- Recent metrics show 24‑hour trading volume near $988 million, coupled with a 3.8% daily price increase and 1.3% weekly gain.

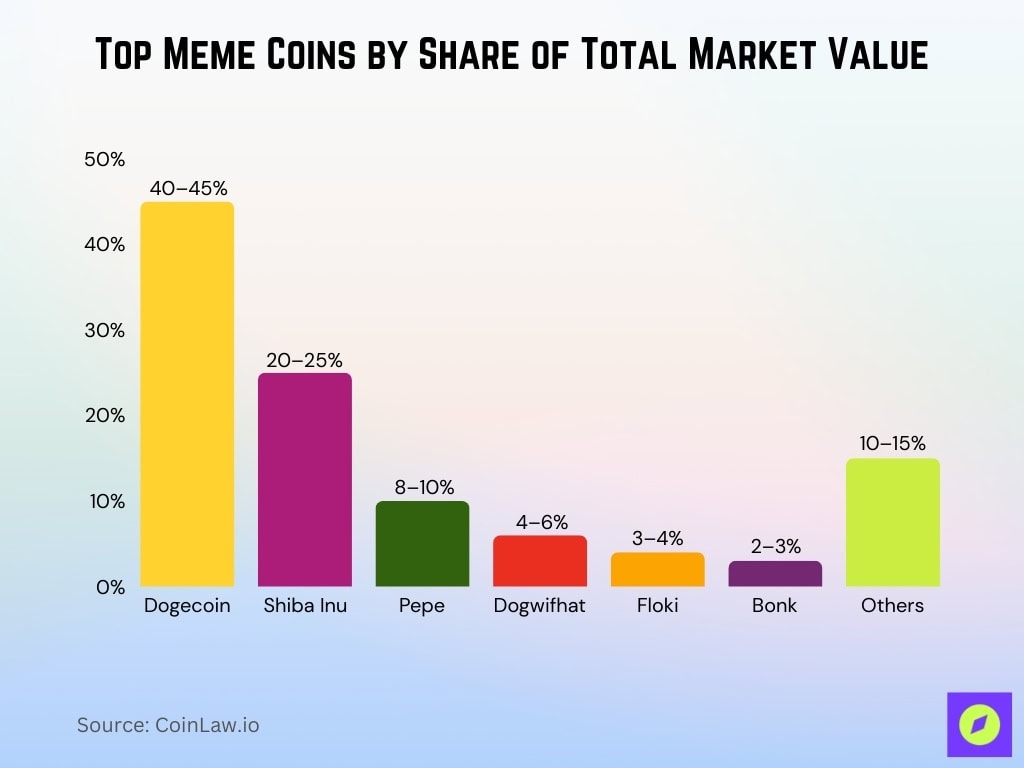

Dominance of Top Meme Coins in the Sector

- Dogecoin (DOGE) leads with roughly 40–45% of aggregate large‑cap meme coin market value, maintaining its position as the top meme coin.

- Shiba Inu (SHIB) holds around 20–25% of the large‑cap meme segment by market value, firmly ranked as the second‑largest meme asset.

- Pepe (PEPE) accounts for about 8–10% of leading meme coin capitalization, reflecting strong viral traction and recent price gains.

- Dogwifhat (WIF) now captures roughly 4–6% of the top meme coin market value, anchored by a market cap above $1.5 billion.

- Floki (FLOKI) represents close to 3–4% of the upper‑tier meme sector, supported by a market cap above $1 billion.

- Bonk (BONK) controls around 2–3% of the large‑cap meme coin market cap, reflecting its growing role as a leading Solana‑based meme asset.

- Other emerging meme tokens collectively make up roughly 10–15% of sector capitalization, indicating a long tail of smaller speculative projects.

Max Supply

- CoinMarketCap now lists BONK’s max supply at 88.87 trillion, forming the upper bound of current cap estimates.

- Coinbase confirms a hard cap of 88.872 trillion BONK, used in its FDV and circulating‑percentage calculations.

- Bybit and TradingView round max supply to roughly 88.87 trillion BONK, aligning with on‑chain limits.

- Crypto.com and several price‑tracking dashboards cite a max supply of about 88.872 trillion BONK.

- Across major aggregators, max‑supply estimates consistently cluster between 88 trillion and 88.872 trillion BONK.

- At recent prices, this max‑supply band implies an FDV in the $900 million–$1.1 billion range rather than earlier $2.0–$2.02 billion projections.

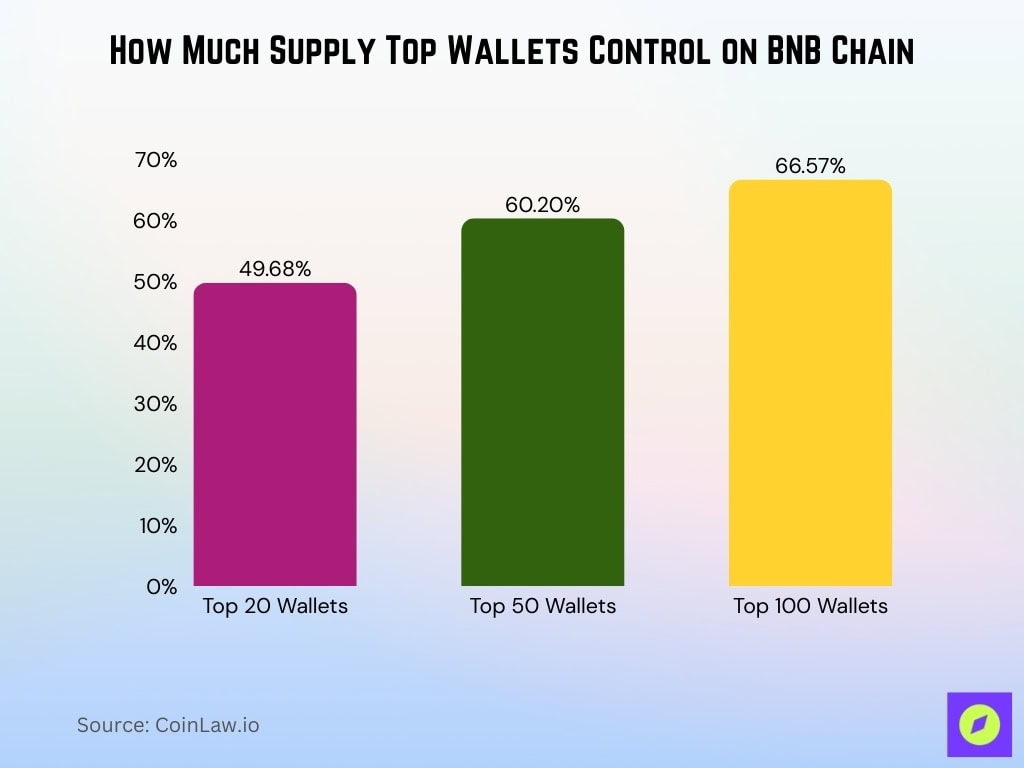

Wallet Distribution

- Top 20 wallets hold 49.68%, while top 50 own 60.20%, and top 100 possess 66.57% of the supply on BNB Chain.

- On the BNB chain, the top 10 wallets control 41.03% of the total BONK supply.

- BONK has roughly 51,806 holders on BNB Chain (BEP‑20), indicating moderate distribution on that network.

- Across tracked markets, BONK counts about 117,000 holders, with Solana alone nearing 975,058 addresses.

- BONK surpassed the 1 million‑holder milestone in mid‑2025, marking a key distribution threshold for the ecosystem.

- As of the latest rich‑list data, the largest BNB Chain wallet controls just over 7% of BONK’s BSC supply, down from earlier double‑digit shares.

- Holder concentration trends show a gradual dilution from whales to smaller wallets, with the top‑10 share slipping a few tenths of a point from prior 41.0% levels.

Recent Market Movements

- BONK rose ~85% in July 2025, fueled by token burn announcements and Solana‑linked ETF speculation.

- That rally was accompanied by a sharp volume spike to about 2.9 trillion tokens over a short span.

- Recently trading around $0.000022, reflecting roughly a ~25% increase over the past year.

- Daily price action has included pullbacks of around –4% to –6%, underscoring still‑fragile short‑term sentiment.

- DigitalCoinPrice quotes BONK near $0.0000255, up about 15.69% over 24 hours with $932.97 million in trading volume.

- Changelly tracks a +1.09% 7‑day gain and market cap near $962.21 million, signaling modest but positive momentum.

- Over the last 30 days, BONK has logged triple‑digit percentage gains above 100%, outpacing many rival meme assets.

Market Share within Ecosystem

- BONK’s 24‑hour trading volume recently reached about $988 million, accounting for roughly 13–15% of all Solana meme‑coin activity by volume.

- With a market cap near $944–1,000 million, BONK ranks among the top 3 Solana‑native meme tokens and around #100–#110 overall by market cap.

- Solana’s meme sector market cap is closing in on $6.7 billion, with BONK estimated to represent roughly 14–16% of that total.

- MEXC data pegs BONK’s market cap around $779.82 million, supported by $158.71 million in 24‑hour trading volume.

- KoinBX cites average daily volume of about $767.04 million for BONK, underscoring its status as one of Solana’s most‑traded assets.

- Analytics Insight notes BONK trading near $0.00001119 with a 7.33% 24‑hour gain and market cap around $1 billion, calling it “one of the most structurally important coins on Solana.”

- Bybit lists BONK’s market cap at roughly $944.51 million, placing it around #107 among all cryptocurrencies by size.

- letsBONK.fun’s first week of 2026 revenues, with single‑day fees peaking at $352,793, generated “millions of dollars” in BONK buybacks, reinforcing BONK’s role as a core settlement asset in the Solana ecosystem.

Frequently Asked Questions (FAQs)

The circulating supply of BONK is approximately 88 trillion tokens.

BONK’s all‑time high approximately reached $0.000059 per token.

BONK’s historical lowest price was around $0.00000009197.

BONK once surged ≈81 % in two weeks amid ETF speculation.

Conclusion

BONK has firmly cemented its position as a leading Solana‑based meme coin. Its tokenomics and community breadth set it apart. Holder concentration remains notable, but growing distribution and real usage gradually dilute centralization. Volume surges and ETF-linked speculation offer momentum, yet familiar volatility reminds readers that gains come with risks. Still, BONK’s DeFi and NFT utility provide context beyond speculation, suggesting a more tangible future. Watch how token burns, ecosystem adoption, and market sentiment evolve.