Imagine a bustling digital marketplace where billions of dollars change hands daily. But beyond the legitimate trades lies a shadow economy, cryptocurrency transactions used for scams, fraud, and laundering. This hidden world, powered by anonymity and decentralization, has created new challenges for law enforcement and regulators. Enter blockchain forensics, a growing field that combines technology and investigative techniques to trace these illicit transactions.

Blockchain forensics will no longer be just an option; it’s a necessity. As the crypto landscape evolves, so do the methods bad actors use to exploit it. Fortunately, blockchain forensics has advanced to keep pace, giving organizations and governments the tools to shine a light on these dark corners of the crypto economy.

Editor’s Choice

- $3.4 billion in cryptocurrency thefts recorded globally.

- North Korean hackers stole $2.02 billion, a 51% increase from 2024.

- Crypto scam revenue projected to exceed $12 billion.

- DeFi hacks caused losses of over $3.1 billion in the first half alone.

- The global digital forensics market is valued at $13.46 billion.

- Privacy coins are involved in 87% of illegal activity transactions.

- 23% of dark web human trafficking transactions used privacy coins.

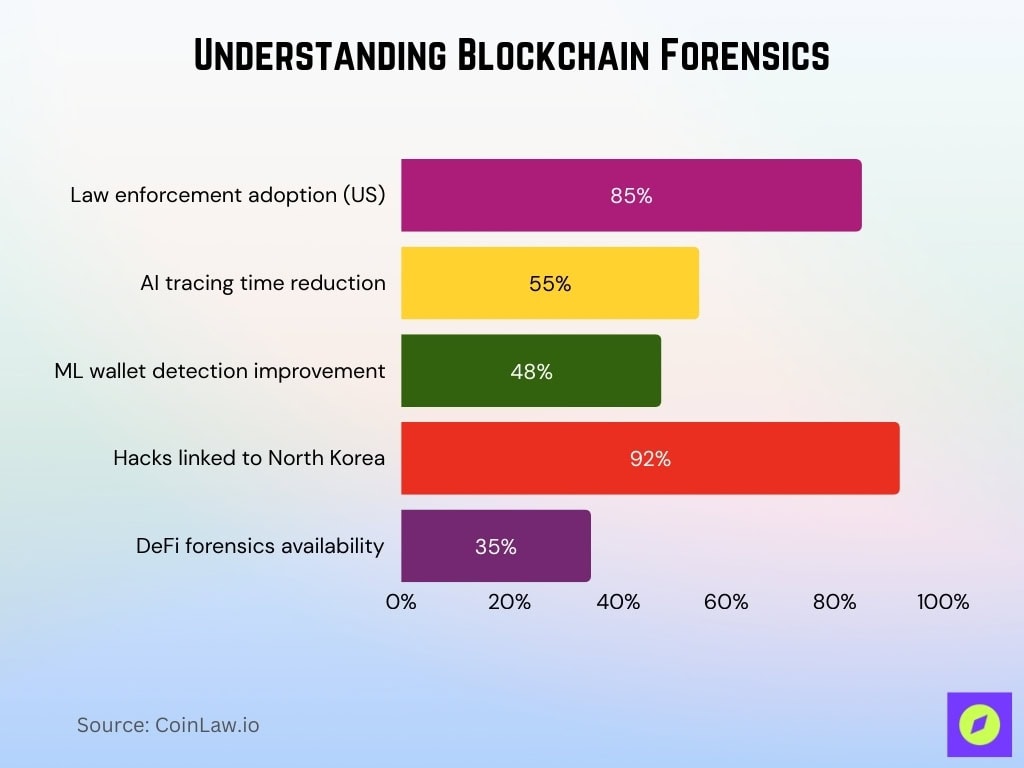

Understanding Blockchain Forensics

- Chainalysis Reactor and CipherTrace remain the most widely adopted forensic tools by US law enforcement.

- 85% of US law enforcement agencies use blockchain analytics tools in investigations.

- AI in blockchain analytics reduced transaction tracing time by 55%.

- Machine learning algorithms improved suspicious wallet detection by 48%.

- 92% of cryptocurrency exchange hacks traced to North Korean groups.

- 35% of blockchain forensic companies offer DeFi-specific services.

The Need for Blockchain Forensics

- $330 million in illicit assets frozen by the T3 Financial Crime Unit.

- $50 million in assets disrupted by Beacon Network.

- Cryptocurrency is used in 70% of cybercrime cases.

- 54% of financial institutions have blockchain forensic specialists on staff.

- 85% of US law enforcement agencies use blockchain analytics tools.

- $2.1 billion lost to cyber attacks in the first half.

- Illicit volume dropped to $45 billion, 0.4% of total crypto volume.

- Europol investigation identified crypto in child exploitation platforms.

- 97% of reported ransomware payments were made in Bitcoin.

- FinCEN mandates transaction monitoring for VASPs, including forensic tools.

Key Blockchain Forensics Tools and Technologies

- Chainalysis Reactor is used by over 150 government agencies worldwide.

- CipherTrace Armada is used by 45% of top-tier crypto exchanges.

- TRM Labs reported a 75% reduction in illicit activity detection time.

- Crystal Blockchain tracks over 2,800 crypto assets for Interpol.

- Elliptic Lens detects suspicious wallets with a 95% accuracy rate.

- Chainalysis helped seize over $12.6 billion in illicit funds.

- TRM Labs supports analytics across 33+ blockchains and 70 million assets.

- Maltego integrations for blockchain forensics rose by 50% YoY.

- QLUE by Blockchain Intelligence Group supports Monero tracing.

Key Challenges in Crypto Forensics

- Privacy coins are involved in 87% of illegal activity transactions.

- 23% of dark web human trafficking transactions used privacy coins.

- Monero accounts for 87% of privacy coin illicit transactions.

- Ransomware payments using privacy coins rose 27%.

- Layer-2 solutions see 35% of illicit transactions evade traditional tools.

- DeFi protocol laundering increased by 72%.

- 47% of forensics teams lack real-time transaction data access.

- Skilled professional shortage impacts 53% of crypto forensics organizations.

- 65% of cases require complex cross-border cooperation.

- Chain-hopping tactics are present in 68% of laundering schemes.

Percentage of Crypto Transactions Linked to Illicit Activities

- Illicit activity represented 0.14% of total on-chain transaction volume.

- $40.9 billion received by illicit addresses, estimated to reach $51 billion.

- Stablecoins accounted for 63% of all illicit transaction volume.

- Bitcoin’s share in illicit transactions dropped to 20% from 70%.

- Privacy coins held steady at 10% of illicit transactions.

- Illicit volumes on track to meet or exceed $51 billion total.

- $2.17 billion was stolen from services in the first half.

- 5% of known illicit wallet addresses accounted for 65% of volume.

- Crypto exchanges with weak KYC processed 68% of illicit outflows.

Most Common Types of Crypto Crimes (Fraud, Scams, Ransomware, etc.)

- $2.17 billion was stolen from services in the first half, led by $1.5 billion Bybit hack.

- Investment scams caused $3.5 billion in losses in the first half through 29,169 cases.

- $939 million paid in cryptocurrency from investment fraud victims.

- DeFi hacks exceeded $3.1 billion in losses in the first half.

- Ransomware payments dropped 35.82% to $813.6 million total.

- Rug pulls accounted for 34% of DeFi fraud losses over $2.9 billion.

- Pump and dump schemes caused $740 million in losses on Telegram/Discord.

- AI deepfake scams surged 900%, impersonating crypto influencers.

- Personal wallet compromises represent 23.35% of all stolen funds.

- Social media is linked to 53% of crypto fraud schemes.

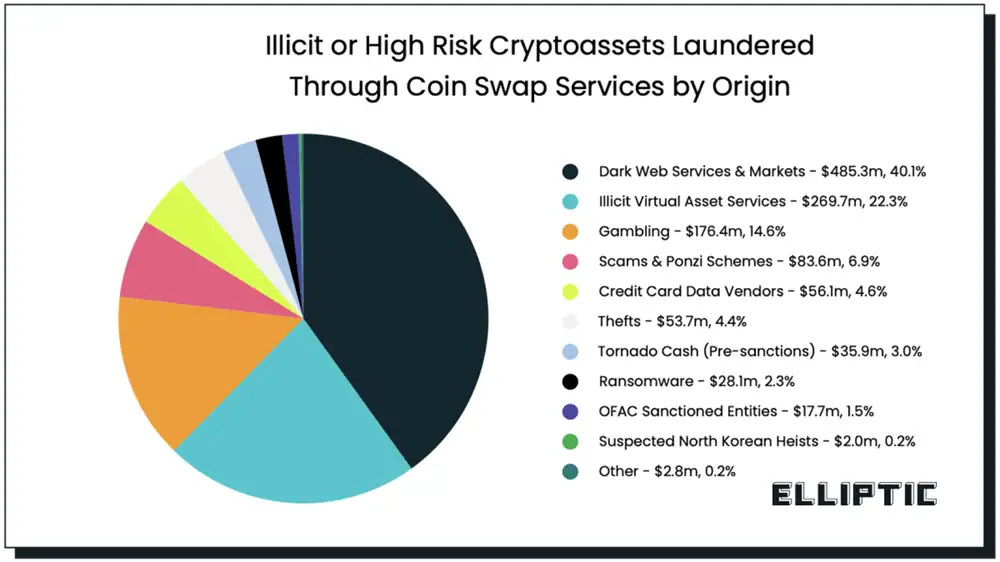

Illicit or High-Risk Cryptoassets Laundered via Coin Swaps

- Dark web services and markets dominate, accounting for 40.1% ($485.3 million) of illicit crypto laundered through coin swap services.

- Illicit virtual asset services represent 22.3% ($269.7 million), highlighting major compliance gaps in unregulated platforms.

- Gambling platforms contribute 14.6% ($176.4 million), showing continued misuse of betting services for laundering.

- Scams and Ponzi schemes make up 6.9% ($83.6 million) of laundered funds via coin swaps.

- Credit card data vendors account for 4.6% ($56.1 million), linking crypto laundering to broader cybercrime ecosystems.

- Theft-related activity represents 4.4% ($53.7 million) of high-risk assets moved through swap services.

- Tornado Cash pre-sanctions usage still accounts for 3.0% ($35.9 million) of laundering volume.

- Ransomware payments contribute 2.3% ($28.1 million), reflecting growing preference for swap services to obfuscate flows.

- OFAC-sanctioned entities represent 1.5% ($17.7 million) of detected laundering activity.

- Suspected North Korean heists account for 0.2% ($2.0 million), underscoring persistent state-linked threats.

- Other sources collectively represent 0.2% ($2.8 million) of total laundered crypto.

Geographic Distribution of Illicit Blockchain Activities

- Eastern Europe accounts for 18% of global illicit crypto transaction volume.

- North Korea’s Lazarus Group stole $1.5 billion from the Bybit exchange.

- North Korean hackers are responsible for 61% of the total stolen crypto.

- Sub-Saharan Africa saw a 42% increase in crypto-based scams.

- United States largest originator of ransomware payments at 38%.

- North America recorded 3,259 ransomware incidents.

- Russia is home to 21% of crypto darknet market transactions.

- Cambodia-based Huione Group processed over $70 billion of illicit inflows.

- Southeast Asia experienced a 37% surge in crypto fraud.

- Latin America saw a 35% increase in crypto money laundering.

Role of Decentralized Finance (DeFi) in Illicit Transactions

- DeFi protocols saw a +370% increase in stolen fund flows post-hack.

- $3.1 billion lost to DeFi hacks in the first half alone.

- $21 billion laundered through cross-chain DeFi bridges.

- Cross-chain bridges are used to launder over $7 billion of illicit funds.

- DEXs without KYC are linked to 68% of rug pulls.

- Flash loan attacks amplified 70% of high-value DeFi hacks.

- Liquidity pool drains caused $103 million in stolen assets.

- Oracle manipulation accounted for 13% of DeFi exploits.

- Reentrancy bugs led to $325 million in stolen DeFi assets.

- Stablecoins are used in 63% of all illicit transaction volume.

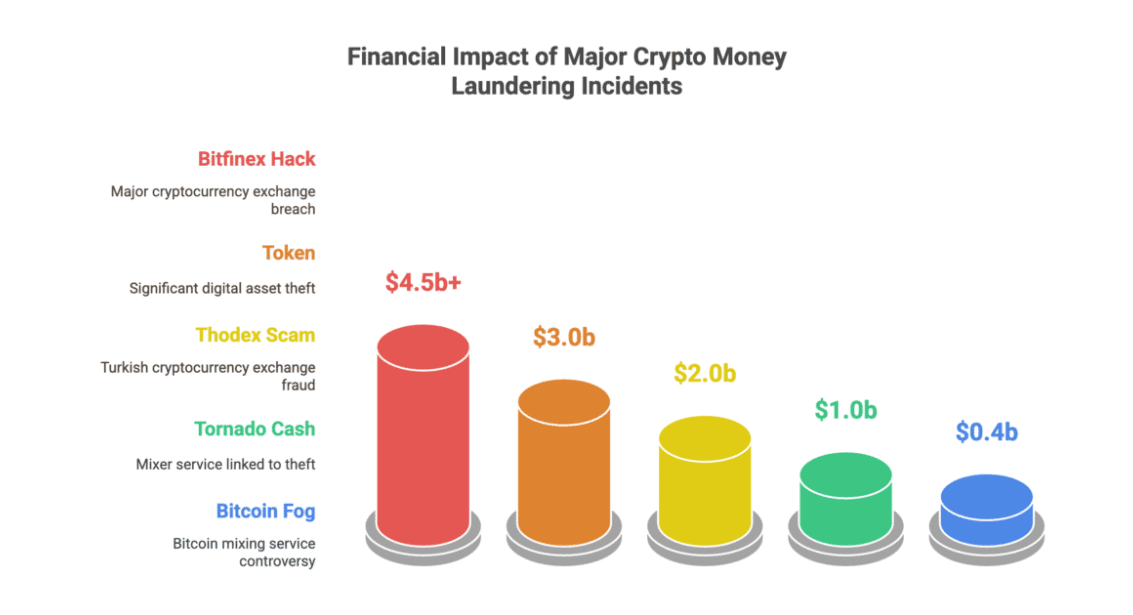

Financial Impact of Major Crypto Money Laundering Incidents

- Bitfinex Hack remains the largest case, with $4.5 billion tied to a major cryptocurrency exchange breach.

- Token-related digital asset thefts account for $3.0 billion, reflecting large-scale exploitation of token ecosystems.

- Thodex Scam resulted in $2.0 billion in losses, marking one of the biggest cryptocurrency fraud cases in Turkey.

- Tornado Cash is linked to $1.0 billion in illicit funds, highlighting the role of mixer services in laundering operations.

- Bitcoin Fog handled approximately $0.4 billion, underscoring the continued use of mixing services to obscure transaction trails.

NFT-Related Fraud and Illicit Activity

- NFT marketplaces without KYC processed 73% of illicit NFT sales.

- $120 million in fraudulent activity on NFT marketplaces, up 30%.

- Wash trading accounted for 58% of suspicious NFT marketplace activity.

- $25 million from counterfeit NFT collections on OpenSea and others.

- High-value NFTs like BAYC are linked to $10 million money laundering.

- Over $45 million worth of NFTs via phishing and malware attacks.

- Rug pulls in NFT projects caused $120 million in losses.

- $100 million in illicit funds linked to NFT-related fraud.

- NFT Ponzi schemes defrauded investors, including $1.3 million Frosties case.

Growth in Law Enforcement Adoption of Blockchain Analytics Tools

- 85% of US law enforcement agencies use blockchain analytics tools.

- Europol reported a 42% increase in blockchain forensics training participants.

- Interpol expanded the Crypto Crimes Unit with 40 new analysts.

- Australia Federal Police seized $300 million in assets using crypto tools.

- Canada’s RCMP invested $10 million in Chainalysis Reactor and Elliptic Lens.

- Germany’s BKA dismantled 20 dark web marketplaces using TRM Labs.

- Japan’s NPA increased its blockchain analysis budget by 35%.

- India ED uncovered $1 billion in crypto money laundering schemes.

- South Africa FIC assisted in 12 major investigations with real-time monitoring.

- The French Gendarmerie recovered €75 million via the Crypto Crime Task Force.

Challenges in Tracing Privacy Coins and Mixing Services

- Monero accounted for 87% of privacy coin illicit transactions.

- Privacy coins are involved in 87% of illegal activity transactions.

- 23% of dark web human trafficking used privacy coins.

- Ransomware payments using privacy coins rose 27%.

- Chain-hopping is present in 68% of laundering schemes.

- Layer-2 rollups are used in 22% of laundering cases.

- TRM Labs reported 30% fewer successful tracings with mixers.

- Only 15% of jurisdictions enforce mixer compliance rules.

- Decentralized mixers facilitated $500 million in anonymized transactions.

- Sinbad mixer processed $1.5 billion in illicit funds before shutdown.

Recent Developments in Blockchain Forensics

- AI-enhanced analytics reduced tracing times by 55%.

- Chainalysis KYT monitors over 250 cryptocurrencies.

- Elliptic Discovery profiles 1,000+ global VASPs.

- Crystal Blockchain flagged $300 million suspicious DeFi transactions.

- Nansen AI traced $50 million in stolen NFT and DeFi assets.

- CipherTrace Armada increased cross-chain detection by 40%.

- Interpol database catalogs 500+ criminal wallet addresses.

- CertiK and SlowMist prevented $2 billion smart contract exploits.

- Solidus Labs HALO saw 300% growth in DeFi AML adoption.

- Quantum computing tests showed privacy coin breakthroughs.

Frequently Asked Questions (FAQs)

Illicit crypto transactions account for about 0.4% of total global crypto volume, down from 0.9% the previous year.

Illicit entities hold nearly $15 billion, while downstream wallets connected to them hold over $60 billion in on-chain value.

Global illicit cryptocurrency transaction volume recently exceeded $24.2 billion, representing a 37% year-on-year increase at that time.

Scams represent roughly 54% of all crypto-related crime, making them the single largest category of illicit activity.

Conclusion

As blockchain technology continues to reshape the financial landscape, so too does the complexity of illicit activities within this space. The rise of sophisticated crypto crimes, from ransomware and DeFi exploits to NFT fraud, has made blockchain forensics an indispensable tool in the fight against financial crime. Advancements in analytics, AI, and regulatory frameworks are enabling law enforcement and forensic experts to trace illicit transactions more effectively than ever before.

Yet, challenges remain, especially in dealing with privacy coins and decentralized platforms. Moving forward, collaboration between governments, regulators, and technology providers will be crucial to staying ahead of bad actors in the evolving world of cryptocurrency.