BlackRock stands as the world’s largest asset manager, steering financial markets with record‑shattering scale and influence. The company’s assets under management (AUM) crossed the trillion mark, showcasing its dominant role in global finance. Its footprint, from institutional investors to everyday retirement savers, underscores its impact on portfolios everywhere.

In practice, BlackRock’s iShares ETFs drive massive flow trends in the US and abroad, and its Aladdin platform supports risk analytics for major banks and pension funds worldwide. Explore the numbers below to understand why BlackRock remains central in markets and investment strategies.

Editor’s Choice

- $698 billion net inflows in 2025, exceeding previous annual peaks.

- iShares ETF assets surpassed $5 trillion in total.

- Revenue jumped ~19% year‑over‑year in 2025.

- Adjusted diluted EPS grew 10% in 2025.

- Quarterly dividend increased by 10% to $5.73 per share.

- Alternatives AUM hit $423.6 billion, up sharply from the prior year.

Recent Developments

- BlackRock reported its full‑year 2025 earnings with adjusted EPS of $48.09.

- Revenue for 2025 increased approximately 19%, driven by fee growth and market performance.

- The quarterly dividend was raised 10%, signaling confidence in cash flow.

- Net inflows in 2025 reached nearly $700 billion, the firm’s largest annual total.

- BlackRock expanded private markets exposure via acquisitions like HPS and GIP.

- Alternative assets AUM climbed from ~$290 billion a year earlier to $423.6 billion.

- iShares platforms continued strong ETF inflows, particularly in equity and fixed income.

- Job cuts affecting ~1% of workforce reported as part of annual review (early 2026).

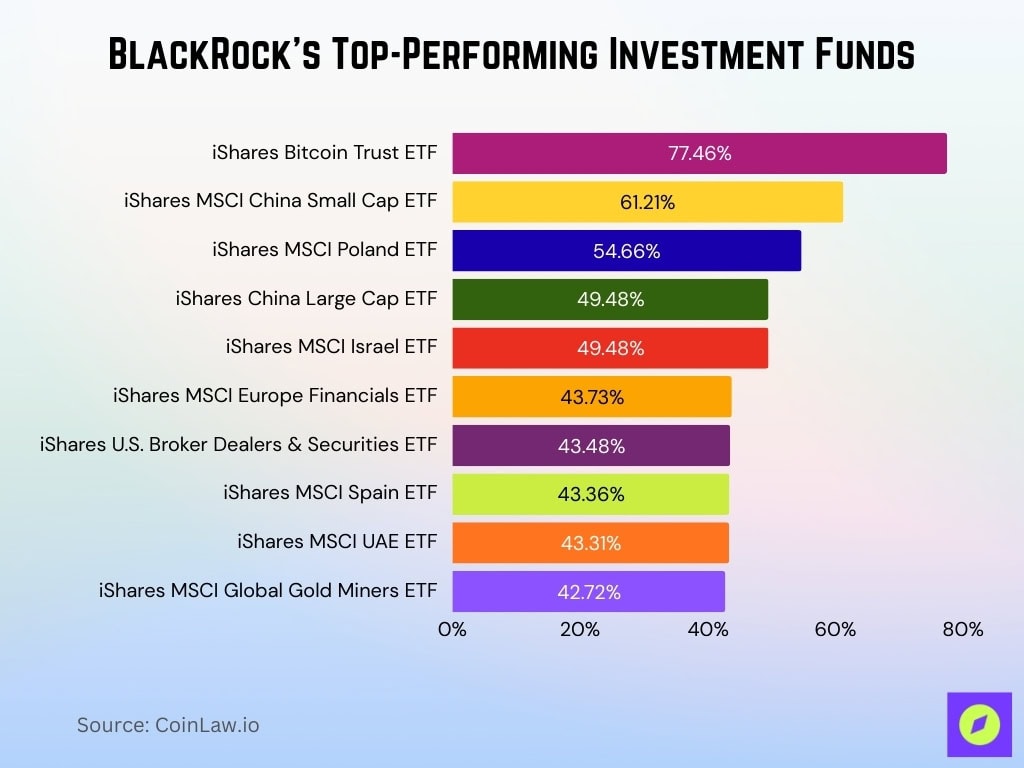

BlackRock’s Top-Performing Investment Funds

- iShares Bitcoin Trust ETF led all BlackRock funds with a 77.46% one-year NAV return, reflecting the strongest performance among global investment products.

- iShares MSCI China Small-Cap ETF delivered a robust 61.21% return, highlighting renewed momentum in Chinese smaller-company equities.

- iShares MSCI Poland ETF posted a solid 54.66% gain, benefiting from Eastern Europe’s improving economic outlook.

- iShares China Large-Cap ETF and iShares MSCI Israel ETF each recorded 49.48% returns, showing balanced strength across large emerging and developed markets.

- iShares MSCI Europe Financials ETF achieved a 43.73% return, supported by higher interest rates and stronger bank profitability.

- iShares U.S. Broker-Dealers & Securities ETF followed closely with a 43.48% gain, reflecting resilience in U.S. capital markets.

- iShares MSCI Spain ETF and iShares MSCI UAE ETF generated 43.36% and 43.31% returns, respectively, underscoring regional diversification benefits.

- iShares MSCI Global Gold Miners ETF returned 42.72%, driven by elevated gold prices and renewed interest in defensive assets.

Company Overview Statistics

- Founded in 1988, headquartered in New York City.

- BlackRock operates in over 100 countries worldwide.

- As of 2025, the firm employed over 21,000 professionals globally.

- BlackRock is a component of both the S&P 500 and S&P 100 indices.

- The company’s key services include asset management, risk solutions (Aladdin), and financial advisory.

- iShares ETFs form a major subsidiary, offering ETFs across asset classes.

- BlackRock is ranked among the top global asset managers with the highest AUM.

- The firm has consistently pursued acquisitions to broaden its investment suite.

BlackRock Global Footprint and Clients

- BlackRock manages $12.5 trillion in assets for clients that include institutional investors, governments, and individuals worldwide.

- The firm operates 70 offices across 30 countries, providing on-the-ground presence in major financial centers.

- Clients are located in over 100 countries, reflecting a highly diversified global client base across regions and segments.

- Roughly 80% of assets are managed for institutional clients such as pension funds, sovereign wealth funds, insurers, and corporations.

- Millions of individual investors access BlackRock through mutual funds and over 1,300 iShares ETFs across global markets.

- BlackRock also serves central banks and public institutions, with more than one‑third of AUM sourced from investors outside the US and Canada.

- The firm is a leading participant in retirement markets, with US defined contribution and similar channels representing over $3 trillion of its AUM

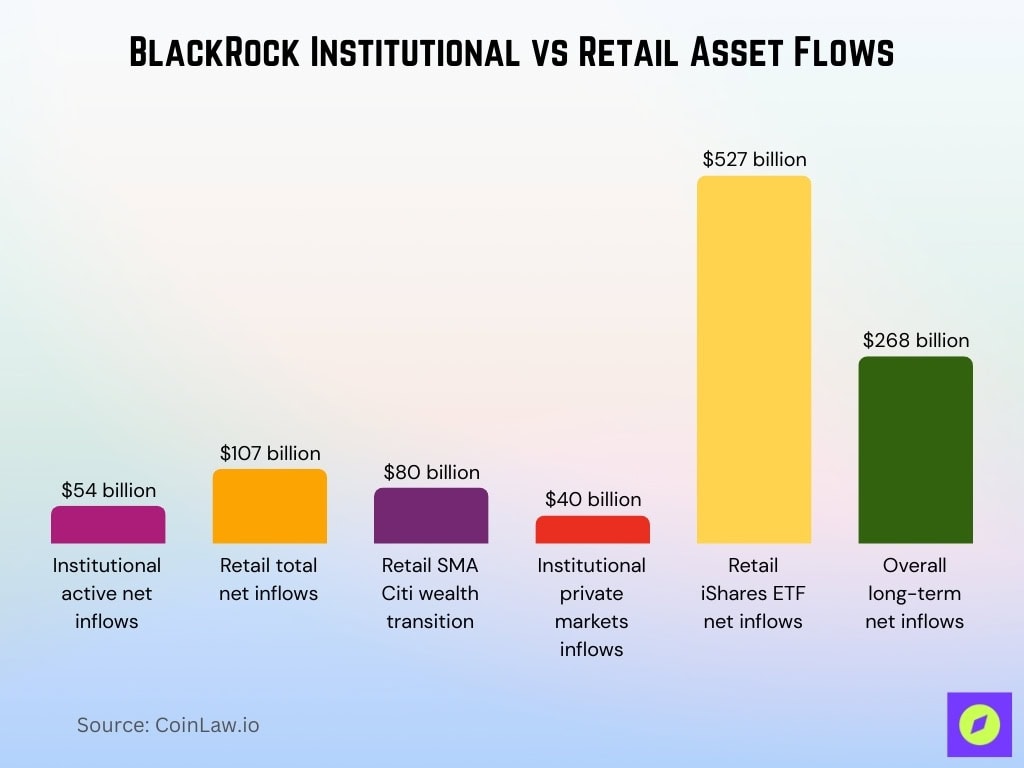

Institutional vs Retail Client Assets

- BlackRock’s institutional active franchise generated $54 billion in net inflows in 2025, driven by outsourcing mandates and private markets.

- Retail net inflows totaled $107 billion in 2025, primarily led by diversified retirement and wealth management clients.

- Retail SMA assignments included the $80 billion Citi wealth transition, onboarded in Q4 2025 to boost flows significantly.

- Institutional flows featured strong demand for private markets, delivering $40 billion in net inflows, led by private credit and infrastructure.

- Retail demand propelled iShares ETFs to a record $527 billion in net inflows in 2025, serving as a key growth engine.

- Institutional net outflows in indexed products reflected client shifts toward higher-fee active and private market solutions.

- Overall long-term net inflows reached $268 billion in Q4 2025 alone, underscoring sustained client allocations across channels.

Assets Under Management (AUM)

- BlackRock’s total AUM surpassed $14 trillion by the end of 2025.

- This compares with $11.55 trillion a year earlier, reflecting robust growth.

- Net inflows for the year reached approximately $698 billion.

- Fourth‑quarter 2025 inflows alone were about $342 billion.

- iShares ETF segment saw roughly $181 billion in Q4 inflows.

- BlackRock’s AUM has grown more than 20% year‑over‑year.

- Alternative asset classes now contribute heavily to total AUM.

- ETF assets are a large component, exceeding $5 trillion.

Revenue and Earnings

- 2025 revenue rose ~19%, driven by margin gains and fee growth.

- Adjusted diluted EPS increased by 10% in 2025.

- BlackRock returned $5 billion to shareholders through buybacks and dividends.

- Dividend per share increased by 10% to $5.73.

- Total revenue in 2025 was approximately $24.2 billion.

- Net income showed variation due to noncash expenses.

- Q4 revenue reached about $7 billion, exceeding expectations.

- Expenses rose as the business scaled its operations.

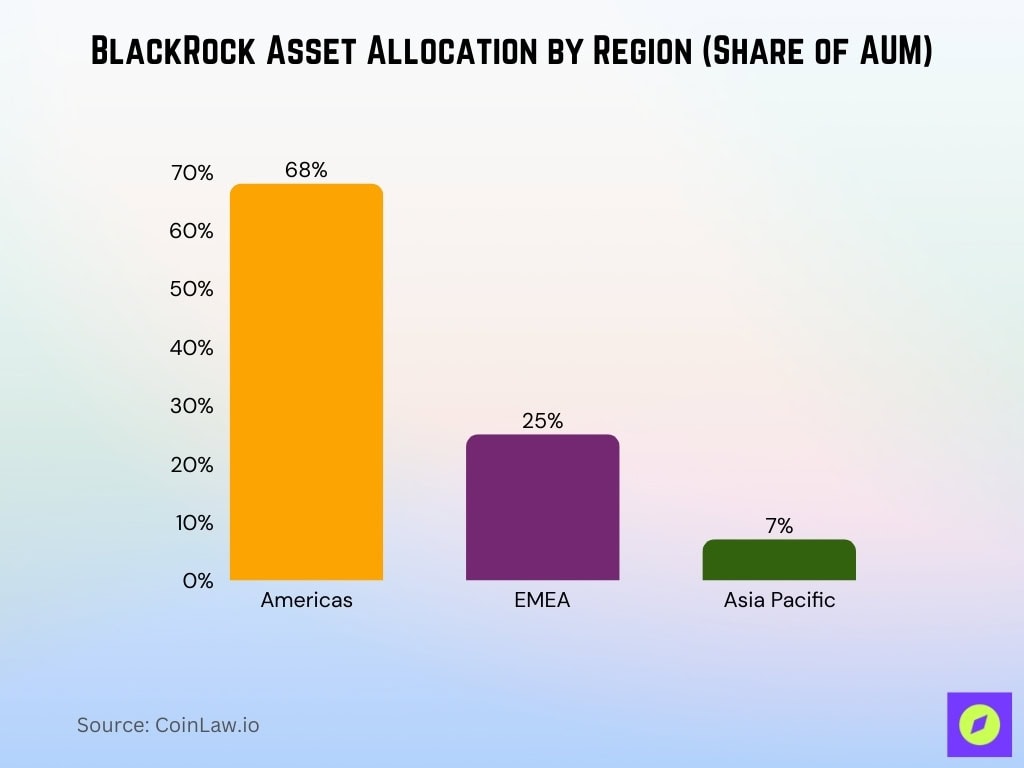

Geographic Distribution of Assets

- Americas accounted for 68% of BlackRock’s AUM, leading with a dominant share of long-term net flows across all regions.

- EMEA represented 25% of total AUM, with ETF net inflows reaching $136 billion in 2025.

- Asia-Pacific contributed 7% of AUM, showing expanded retail engagement via digital platforms like Jio BlackRock JV.

- Europe ETF retail flows outpaced 2024 levels by 50%, driven by individual investors and monthly savings plans.

- EMEA iShares ETFs captured 34% market share of regional inflows, totaling $91.1 billion across Europe, the Middle East, and Africa.

- Americas continued to lead net long-term flows, supported by strong US retirement and wealth channels.

- Asian markets grew through institutional and retail engagement, with emerging demand in India offsetting volatility.

Profitability and Margins

- BlackRock’s operating margin expanded to ~45% in Q4 2025, showing improved cost efficiency.

- For full‑year 2025, the company recorded strong base fee growth of ~9%, driven by net inflows and market performance.

- Adjusted diluted EPS for 2025 reached $48.09, roughly 10% higher than the prior fiscal year.

- BlackRock posted Q4 EPS of $13.16, beating the consensus estimate of $12.44.

- Fourth‑quarter revenue climbed ~23% to $7 billion YoY, signalling stronger profitability.

- Some quarters saw net income declines due to acquisition‑related costs, such as in late 2025.

- Operating income rose by approximately 18% YoY in the latest reported quarter.

- Share repurchases and dividend increases helped sustain shareholder return metrics in 2025.

Product and Service Mix

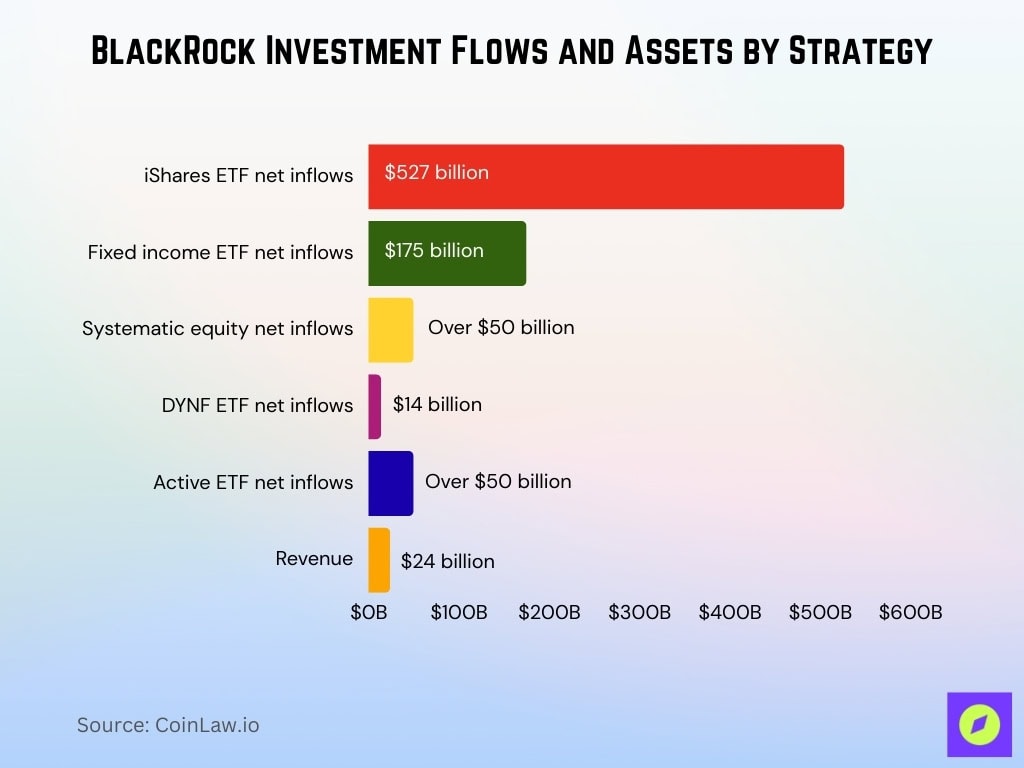

- iShares ETFs remained a core growth engine, with net inflows exceeding $527 billion in 2025.

- Alternatives and systematic strategies contributed to diversified product flows.

- Active ETFs added more than $50 billion in net inflows in 2025.

- Retail cash management products drew significant demand, with $74 billion in net inflows in Q4.

- Institutional active franchise reported ~$54 billion in full‑year 2025 net inflows.

- A scaled private markets platform delivered about $40 billion of new capital.

- BlackRock’s technology and data services saw 31% ACV growth YoY.

- Europe ETF net inflows climbed roughly 50% above 2024’s level.

Investment Performance Metrics

- BlackRock’s iShares ETFs recorded $527 billion in net inflows in 2025, outperforming benchmarks amid broad market rallies.

- Fixed income strategies attracted $175 billion in ETF net inflows, supported by tight spreads and sustained demand.

- Systematic equity franchise raised over $50 billion in net inflows, with DYNF ETF leading at $14 billion.

- Active ETFs drove more than $50 billion in net inflows, nearly tripling assets with strong risk-adjusted returns.

- Organic base fee growth hit 12% annually, amplified by higher AUM from strong stock market performance.

- Performance fees rose significantly from private markets growth, contributing to 45.5% adjusted operating margin.

- Revenue grew 19% year-over-year to $24 billion, reflecting diversified returns across asset classes.

Exchange‑Traded Funds (iShares) Statistics

- iShares assets remained a dominant product with large ETF flows in 2025, a key driver of AUM growth.

- Total iShares net flows in 2025 slightly exceeded $527 billion.

- In the fourth quarter alone, iShares net inflows were about $181 billion.

- Equity ETF flows, particularly broad U.S. equity exposures, remained strong.

- Fixed income ETFs saw approximately $175 billion in 2025 net inflows, reflecting strong demand for bond exposures across BlackRock’s ETF platform.

- Retail demand for diversified ETF exposures continued to underpin flows.

- ETF demand from European investors showed record momentum in early 2025.

- ETF products accounted for a significant share of the firm’s long‑term net inflows.

Inflows and Outflows

- Record total net inflows reached approximately $698 billion in 2025, including both long‑term investment funds and cash‑management products.

- Fourth-quarter net inflows totaled $342 billion, marking the strongest quarter on record for BlackRock.

- iShares ETFs captured $527 billion in net inflows, representing the majority of total new capital flows.

- Long‑term investment funds, including ETFs and other strategies, generated about $268 billion in net inflows in Q4 2025, led by strong demand for diversified equity and fixed income products.

- Institutional index strategies generated $119 billion in net outflows, contrasting with active franchise gains.

- Retail channels delivered $107 billion in net inflows, bolstered by SMA transitions and ETF demand.

- Private markets platform attracted $40 billion in net inflows, fueled by private credit and infrastructure.

- Cash management solutions saw traction globally, with about $131 billion in 2025 net inflows across multiple regions, providing stability amid equity‑market volatility.

Balance Sheet and Capital Structure

- BlackRock’s total assets expanded as its AUM hit record levels, reinforcing balance sheet strength.

- Forecasts show free cash flow increasing substantially in 2026 vs prior years, reflecting stronger internal liquidity.

- In 2025, BlackRock maintained a positive net debt position with strong liquidity buffers.

- Free cash flow margin was forecast at ~27.86% in 2025 and rising in 2026, indicating efficient operations.

- Cash flow per share rose to $41.19 in 2025, a key funding source for dividends and buybacks.

- The dividend per share was forecast at $20.83 in 2025 before growth in 2026.

- BlackRock’s ROA (return on assets) was about 5.51% in 2025, showing solid asset productivity.

- Forecast data projected increasing ROE (return on equity) through 2026‑27.

- Debt/EBITDA ratios remained low, suggesting minimal leverage risk in capital structure.

BlackRock Share Price Statistics

- BlackRock’s share price traded in a 52‑week range of approximately $774 to $1,220 as of early 2026, reflecting strong performance into the Q4 2025 earnings release.

- The stock showed year‑over‑year market cap growth of roughly 7% by January 2026, with market value rising from about $158.77 billion to $169.50 billion.

- As of mid‑January 2026, BlackRock’s market cap was around $169–$170 billion.

- Trading metrics reflect a P/E ratio in line with financial industry norms, indicating investor confidence.

- The share price rose roughly 5.4–5.9% immediately after the Q4 2025 earnings release, reflecting positive investor sentiment.

- BlackRock shares delivered double‑digit annual performance (~13.5% gain) entering 2026.

- The stock’s performance remained tied to inflows, ETF demand, and net inflow growth.

- Volatility in share price reflected broader market shifts and macroeconomic factors.

Market Capitalization and Valuation

- BlackRock’s market capitalization stands at $169.50 billion as of mid-January 2026.

- Market cap rose from $158.77 billion in January 2025 to $169.50 billion in January 2026, up approximately 7%.

- The 12-month high market cap reached $189.21 billion on October 15, 2025.

- Market cap low stood at $120.01 billion on April 7, 2025, during early-year selloffs.

- BlackRock ranks as the world’s 98th most valuable company by market cap.

- Trailing P/E ratio measures 28.10, with forward P/E at 20.33 reflecting a strong earnings outlook.

- PEGY ratio of 1.98 indicates favorable valuation versus peers on a growth-adjusted basis.

- Shares outstanding total 155.10 million, supporting the recent stock price near $1,080-$1,151.

Dividend and Shareholder Returns

- In 2025, BlackRock increased its quarterly dividend by ~10% to $5.73 per share.

- The dividend yield of approximately ~1.99% positioned BlackRock attractively vs broader indices.

- The company returned ~$5 billion to shareholders in 2025 via dividends and buybacks.

- Share repurchases continued with 7 million additional shares authorized in 2025.

- Dividend history shows consistent annual increases, reinforcing long‑term shareholder value.

- BlackRock targets a 40–50% dividend payout ratio as part of its capital allocation strategy.

- Shareholder returns are tied to strong free cash flow and balance sheet discipline.

- Dividends are payable quarterly, supporting income‑focused investors.

Technology and Aladdin Platform Metrics

- Aladdin platform oversees $21 trillion in assets across 250+ institutional clients worldwide.

- Technology services revenue surged 26% to $499 million in Q2 2025, driven by Aladdin demand.

- Aladdin generated $1.6 billion in revenue in 2024, maintaining double-digit growth into 2025.

- Technology services and subscriptions grew 28% year-over-year in Q3 2025, reflecting strong adoption.

- Preqin acquisition added $60 million to quarterly technology revenue, enhancing private markets analytics.

- Aladdin clients increased 20% year-over-year in 2025, boosting recurring subscription income.

- The platform integrates with over 200 institutions, including JPMorgan and UBS, for risk and portfolio management.

- Annual capex of $800 million invested in Aladdin data, AI, and cloud infrastructure expansions.

ESG and Sustainable Investing Statistics

- BlackRock manages over $1 trillion in sustainable and transition assets across more than 500 strategies.

- Enhanced sustainability features applied to 135 funds totaling $185 billion in AUM to meet ESMA guidelines.

- The platform includes 500+ sustainable and transition investment strategies for clients globally.

- Global sustainable fund assets reached $3.7 trillion, supported by market gains despite Q3 outflows.

- Q3 2025 saw $55 billion net outflows from sustainable funds, led by European BlackRock products.

- ESG funds invested an average of $2.3 billion annually in fossil-fuel majors from 2023 to 2025.

- iShares MSCI EMU ESG Enhanced ETF allocated $160 million to fossil-fuel assets in Q1 2025.

- BlackRock engaged on climate issues in over 500 stewardship activities in Q2 2025.

Frequently Asked Questions (FAQs)

As of January 16, 2026, BlackRock’s market cap was approximately $169.5 billion.

BlackRock aims to raise $400 billion in private markets assets by 2030.

BlackRock’s ETF business saw about $181.5 billion in net new ETF inflows in Q4 2025.

Conclusion

BlackRock’s performance underscores its continued leadership in global asset management. With record AUM, rising dividends, expanding private markets strategy, and robust inflows, the firm reinforces its scale and adaptability. Its balance sheet remains solid, shareholder returns are strong, and valuation metrics are supportive of further growth. Technology platforms like Aladdin and ESG integration continue to differentiate BlackRock in a competitive landscape. As the company pursues ambitious fundraising goals and market cap expansion into 2030, these statistical trends reveal a dynamic and evolving financial powerhouse.