BlackRock has transferred more than $200 million worth of Bitcoin and Ethereum to Coinbase, raising questions about institutional strategy amid ongoing ETF outflows.

Key Takeaways

- BlackRock moved 2,201 Bitcoin and 7,557 Ethereum to Coinbase Prime, totaling over $214 million in crypto assets.

- The transfers follow $435 million in net outflows from BlackRock’s flagship Bitcoin ETF and continued Ethereum ETF withdrawals.

- The move came just as $27 billion in crypto options were set to expire, a moment typically linked to market volatility.

- Since October 10, crypto ETPs have recorded $3.2 billion in outflows, reflecting increased investor caution.

What Happened?

In late December, BlackRock sent over 2,200 Bitcoin worth $192 million and more than 7,500 Ethereum valued at $22 million to Coinbase Prime, according to data from Arkham Intelligence. The combined transfer surpassed $214 million, with the crypto coming from wallets tied to the asset management giant.

These movements coincided with $446 million in net outflows from exchange traded crypto products (ETPs) in the same week and a broader trend of investors pulling capital from digital assets. BlackRock’s move landed just ahead of a $27 billion options expiry event, intensifying speculation around institutional motives and short-term market impacts.

🚨BlackRock just moved $192 million worth of Bitcoin and $22.12 million worth of $ETH to Coinbase.

— Ash Crypto (@AshCrypto) December 29, 2025

Pray for our portfolios. pic.twitter.com/lVy6uRLWst

BlackRock’s Transfers Raise Eyebrows

Institutional watchers were quick to note the timing and scale of BlackRock’s crypto transfers. Such moves often suggest preparation to sell rather than long-term holding. While BlackRock has not made any public comment confirming its intent, the market interprets on-chain behavior like this as significant, especially when paired with persistent ETF outflows.

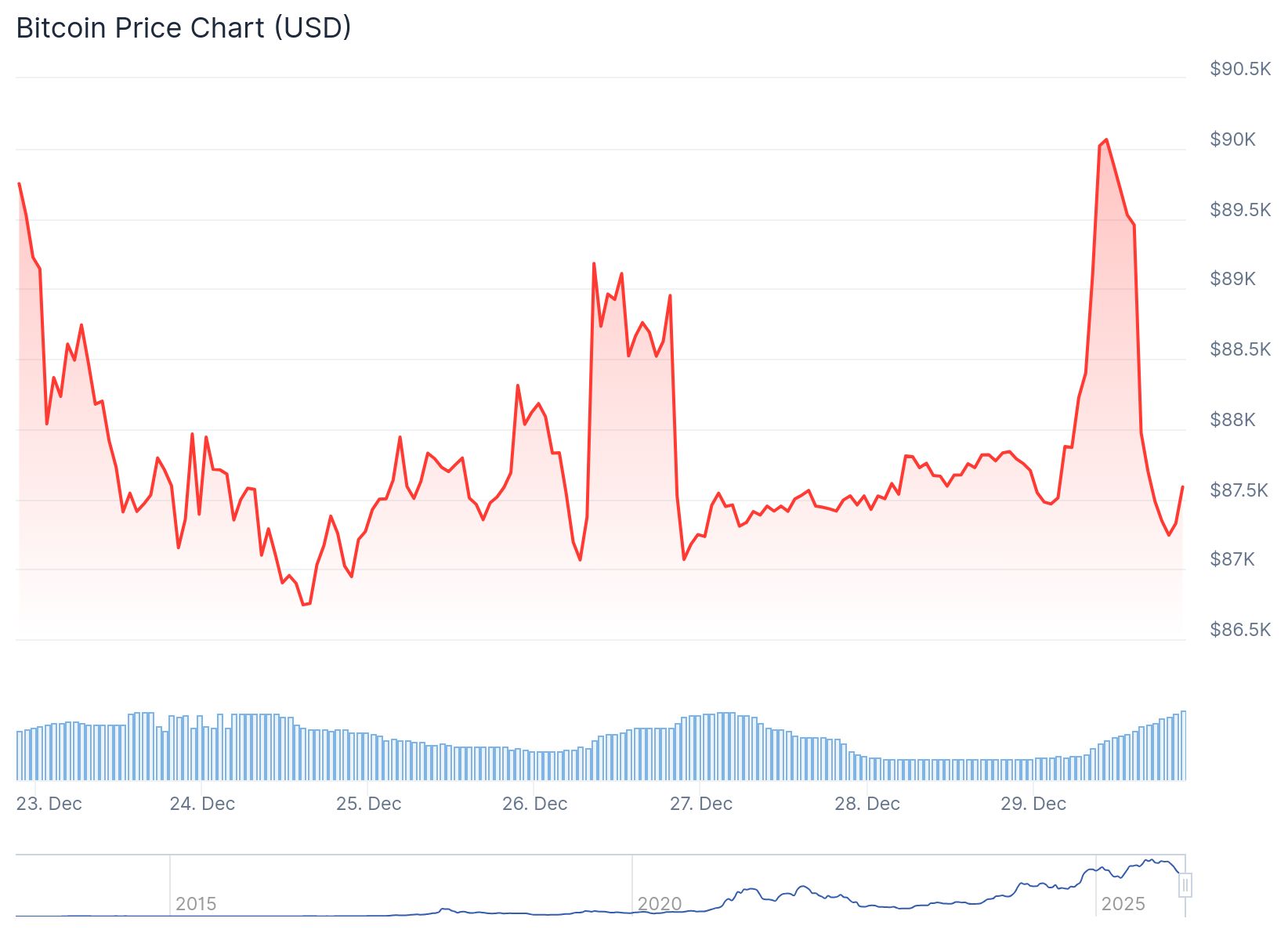

The transactions also coincided with a period of heightened market activity. Bitcoin briefly rose above $90,000 before pulling back to the $87,000 range, while Ethereum dropped below $3,000 after earlier gains. These swings came just as the crypto options market braced for a major expiry involving Bitcoin, Ethereum, Solana, and XRP contracts.

ETF Outflows Suggest Growing Institutional Caution

BlackRock’s crypto ETFs have experienced sustained investor withdrawals in recent weeks. The company’s IBIT Bitcoin ETF lost $435 million in one week, while the ETHA Ethereum ETF shed $69 million. These are not isolated events. According to CoinShares, cumulative outflows from crypto ETPs have reached $3.2 billion since a market dip in early October.

CoinShares’ head of research, James Butterfill, highlighted that despite year-to-date inflows of $46.3 billion, the overall increase in assets under management has only been 10%. He added that after accounting for redemptions, investor gains have been limited, reflecting a cautious stance in the final quarter of the year.

Interestingly, not all crypto products are seeing outflows. Solana and XRP-linked ETPs recorded $70.2 million and $7.5 million in inflows, respectively, while Bitcoin and Ethereum funds bore the brunt of redemptions.

Market Reacts to Institutional Signals

The combination of ETF outflows, large-scale fund transfers to exchanges, and major options expiry created a cocktail of uncertainty for traders. Institutional moves like BlackRock’s increasingly ripple through crypto markets faster than ever. With no public announcement yet from the firm, the transfers themselves become the message.

Analysts warn that while such moves do not always precede a selloff, they tend to signal liquidity events or risk management shifts, especially near volatile moments like options expirations.

CoinLaw’s Takeaway

In my experience, institutional wallet movements are some of the most revealing signals in the crypto space. When BlackRock moves over $200 million in digital assets to an exchange, it is not just business as usual. It is a message, intentional or not, to every trader and investor paying attention. Combine that with billions in ETF outflows and an options expiry, and we have a market that feels both unstable and incredibly sensitive to big moves. I found this episode a classic reminder of how intertwined traditional finance has become with crypto volatility. This isn’t retail-driven anymore. The big players are steering the ship.