South Korea’s Bitplanet has officially begun its Bitcoin treasury strategy, becoming the first public firm in the country to buy the cryptocurrency through a fully regulated channel.

Key Takeaways

- Bitplanet purchased 93 BTC on October 26, initiating a daily Bitcoin buying program aimed at building a 10,000 BTC treasury.

- The company says it is the first regulated Bitcoin acquisition by a publicly listed Korean firm.

- Backed by $40 million in new capital, Bitplanet plans to position itself as Korea’s leading Bitcoin treasury company.

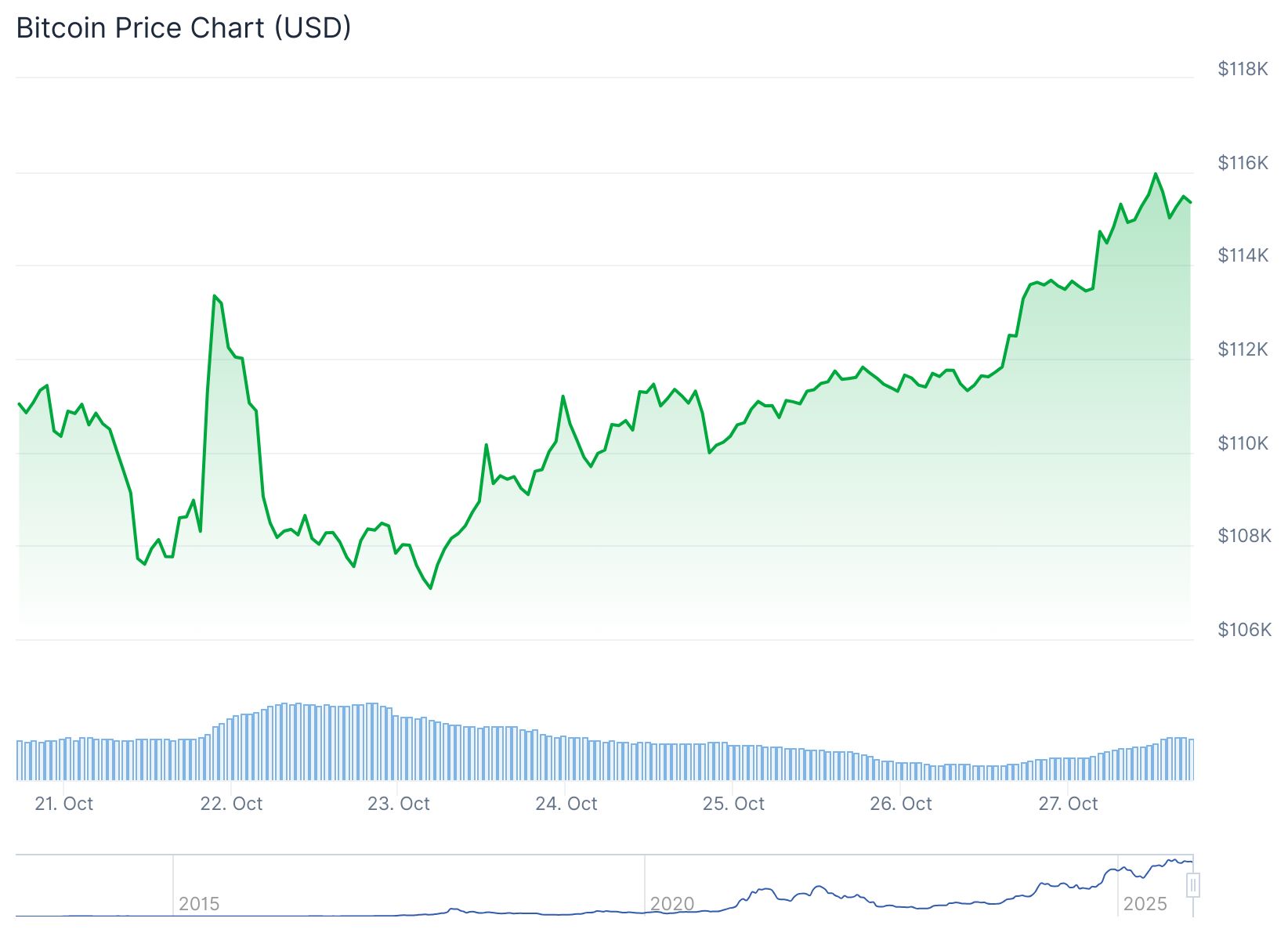

- The announcement comes as Bitcoin rebounds to $115,200, helped by ETF inflows and hopes of a U.S. Fed rate cut.

What Happened?

Bitplanet Inc., a KOSDAQ-listed company, confirmed the start of its Bitcoin accumulation plan with a purchase of 93 BTC. The move is part of a larger strategy to acquire up to 10,000 BTC over time using a rules-based, compliant approach. The company says it will make daily Bitcoin buys through a regulated platform, overseen by Korea’s Financial Services Commission, to ensure transparency and minimize market timing risks.

For the past month, @Bitplanet_KR has been quietly building the most reliable and compliant Bitcoin treasury infrastructure in Korea — culminating in becoming the first public company to purchase Bitcoin directly through a licensed domestic crypto exchange. As of October 26,… pic.twitter.com/hEmpvh9fUL

— Bitplanet Inc. (@Bitplanet_KR) October 26, 2025

Bitplanet’s Strategy to Become Korea’s Bitcoin Treasury Pioneer

Bitplanet, formerly known as SGA Co., Ltd., rebranded earlier this year to align with its new crypto-focused mission. The company announced its Bitcoin treasury plans during Bitcoin Asia 2025 in August and raised $40 million to support ongoing acquisitions.

According to Co-CEO Paul Lee, the plan is “not a one-off buy” but a long-term, rules-based strategy to incorporate Bitcoin as a core strategic treasury reserve asset.

- Daily Bitcoin purchases are designed to reduce timing risk.

- Acquisitions are disclosed through a compliance monitoring platform.

- Operates under guidance from Korea’s financial authorities.

Bitplanet’s treasury roadmap is backed by both crypto and traditional finance investors. Names include Metaplanet CEO Simon Gerovich, Sora Ventures, AsiaStrategy, UTXO Management, Kingsway Capital, ParaFi Capital, and KCGI. These partnerships add credibility to Bitplanet’s push to become a regional model for Bitcoin treasury operations.

Bitcoin Buys Come as Market Shows Strength

Bitplanet’s move comes during a period of renewed optimism in the crypto market. Bitcoin prices recently rebounded from early October’s sharp correction, climbing 6.7% over the past week to reach $115,200, up from lows near $107,000.

Key market drivers include:

- Softer-than-expected U.S. inflation data.

- Growing speculation of a Federal Reserve rate cut in December.

- Over $600 million in inflows to Bitcoin and Ethereum ETFs last week, reversing a prior trend of outflows.

These conditions have created a favorable environment for Bitplanet’s initial crypto acquisition, signaling confidence in Bitcoin’s medium-term outlook.

From IT Services to Bitcoin Treasury

Founded in 1997, Bitplanet originally operated in Korea’s IT and cybersecurity sector. The company reported ₩75.5 billion (US$55 million) in revenue and ₩4.7 billion (US$3.4 million) in net income over the past year, reflecting a solid foundation as it shifts into the Bitcoin space.

With its rebranding and strategic pivot, Bitplanet is positioning itself as a publicly traded Bitcoin treasury company, following in the footsteps of firms like MicroStrategy but with a strong regulatory framework specific to Asia.

The move also comes ahead of the implementation of South Korea’s Digital Asset Basic Act, which will take effect in 2027. Bitplanet says it is already operating under a stricter interpretation of current guidance to ensure full compliance when the law is enforced.

CoinLaw’s Takeaway

I find Bitplanet’s strategy both bold and well-structured. They are not just chasing headlines but laying down a serious, institutional-grade foundation for crypto treasury management in Asia. By adopting daily buys, transparency, and regulatory oversight from day one, Bitplanet is positioning itself as a trustworthy leader in the space. In my experience, that kind of foresight matters more than splashy one-time buys. It shows commitment. And with Bitcoin’s recent rebound, their timing couldn’t be better.