BitMine Immersion Technologies has cemented its position as the largest corporate holder of Ethereum, with its treasury now valued at $10.7 billion.

Key Takeaways

- BitMine now holds over 2.15 million ETH, valued at nearly $10.7 billion, making it the top Ethereum treasury globally.

- The company’s $214 million stake in Worldcoin-linked Eightco represents a 10x return from its initial investment.

- BitMine’s treasury also includes 192 BTC and $569 million in cash, reflecting a diversified and aggressive crypto strategy.

- Chairman Tom Lee says BitMine aims to acquire 5% of all Ethereum in circulation, citing a long-term macro trade thesis.

What Happened?

BitMine Immersion Technologies, a Nasdaq-listed digital asset treasury firm, has rapidly grown its Ethereum holdings to over 2.15 million ETH, worth approximately $9.7 billion. In addition to this aggressive Ethereum strategy, the company scored a massive return on its early investment in Eightco, a fellow crypto treasury company tied to the Worldcoin project. BitMine’s equity position in Eightco has grown from $20 million to $214 million, reflecting a high-risk, high-reward bet that paid off.

🧵

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) September 15, 2025

1/6

BitMine provided its latest holdings update:

$10.771 billion in total crypto + “moonshots”

– 2,151,676 ETH at $4,632 per $ETH tokens

– 192 $BTC coins

– $214 million Eightco stake (NASDAQ-$ORBS)

– unencumbered cash $569 million

Keep reading 📕

Link…

Ethereum-Led Growth Strategy

BitMine, led by Fundstrat Managing Partner Tom Lee, has transitioned from a traditional mining and financial services firm to a full-blown Ethereum treasury. The company reported its total assets at $10.77 billion, with the bulk held in Ethereum, supplemented by 192 Bitcoin (valued at nearly $22 million), a $214 million equity stake in Eightco, and $569 million in unencumbered cash.

- Last week alone, BitMine added 82,000 ETH to its balance sheet.

- The latest increase in holdings marks a $1.87 billion gain from the previous week’s treasury value.

- BitMine trails only Strategy Inc., which holds $73 billion in Bitcoin, as the second-largest public crypto treasury in the world.

Tom Lee compared the firm’s Ethereum-centric strategy to pivotal shifts in financial history, referencing the collapse of the Bretton Woods system. He stated that “the convergence of Wall Street moving onto the blockchain and AI creating a token economy is creating a supercycle for Ethereum.”

Market Impact and Institutional Backing

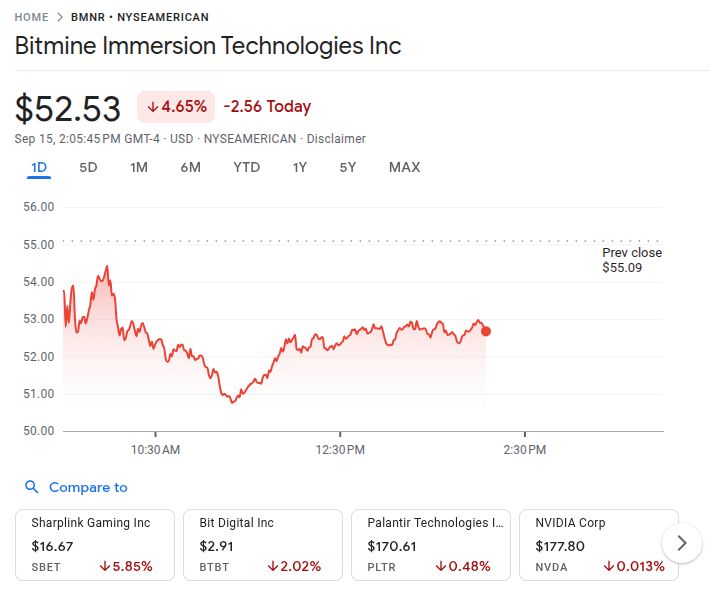

BitMine’s aggressive accumulation has not gone unnoticed in the markets. Its stock (BMNR) closed at $52.51, gaining over 15 percent in a single day and marking a 25 percent rise over five days. While the stock remains down 18 percent over the past month, it has skyrocketed over 1,133 percent since June.

This growth is supported by institutional backing from major players like ARK Invest, Galaxy Digital, Founders Fund, and Pantera Capital, signaling broad confidence in BitMine’s strategic pivot.

BMNR is now the 28th most traded equity in the United States, with an average daily turnover of $2 billion, placing it ahead of Arista Networks and just behind Eli Lilly.

Aiming for 5% of Ethereum Supply

Lee revealed that BitMine’s long-term goal is to own 5 percent of the total Ethereum supply, signaling the company’s deep conviction in Ethereum’s role in future financial systems.

“We continue to believe Ethereum is one of the biggest macro trades over the next 10 to 15 years,” Lee said. “Wall Street and AI moving onto the blockchain should lead to a greater transformation of today’s financial system. And the majority of this is taking place on Ethereum.”

CoinLaw’s Takeaway

Honestly, this is one of the boldest crypto moves I’ve seen in years. BitMine isn’t just dabbling in Ethereum; they are all in. From my experience, when a firm makes a 10x on a side investment while doubling down on a major asset like ETH, it’s not luck – it’s strategy. Their play feels like a serious bet on Ethereum becoming the core of the next-gen financial system. And with heavy hitters like Tom Lee and support from Wall Street’s finest, BitMine might just be rewriting the crypto playbook for public companies. I’ll be watching closely to see if they can really hit that 5 percent supply target.