BitMine has added another 46,255 ETH to its treasury, reinforcing its position as the world’s largest corporate holder of Ethereum.

Key Takeaways

- BitMine acquired 46,255 ETH worth $201 million through three wallets linked to BitGo.

- Total ETH holdings now exceed 2.126 million tokens, valued at nearly $9.3 billion.

- The firm is pursuing a goal to accumulate 5 percent of Ethereum’s total supply.

- BitMine’s stock has surged over 700 percent in six months, reflecting growing investor confidence.

What Happened?

BitMine Immersion Technologies has quietly added $201 million worth of Ethereum to its corporate treasury. This latest move strengthens its already leading position in ETH holdings and signals its long-term strategic bet on the Ethereum network.

BitMine’s Ethereum Strategy Intensifies

According to data from blockchain analytics platform Onchain Lens, BitMine received 46,255 ETH from a BitGo wallet across three addresses. Only one of those addresses is officially marked as belonging to BitMine, but Onchain Lens has linked the other two to the company through forensic tools and internal algorithms. BitMine has not publicly confirmed the acquisition yet.

Bitmine (@BitMNR) has received 46,255 $ETH, valued at $201M, from #Bitgo.

— Onchain Lens (@OnchainLens) September 11, 2025

They now hold a total of 2,126,018 $ETH, worth $9.24B.https://t.co/1fruGR1zWxhttps://t.co/YoyQAmK0Duhttps://t.co/1vbYSuHbap pic.twitter.com/3FeJD1QoFD

With this new addition, BitMine’s Ethereum treasury now stands at 2,126,018 ETH, worth close to $9.3 billion. This marks a significant jump from the previously reported 2.069 million ETH just days earlier.

The aggressive accumulation is part of BitMine’s goal to control 5 percent of Ethereum’s total supply, a target referred to internally as the “alchemy of 5 percent.” As Thomas Lee, BitMine’s chairman, stated, “The power law benefits large holders of ETH, hence, we pursue the ‘alchemy of 5 percent’ of ETH.”

Not Just Ethereum: A Bigger Bet on Blockchain

BitMine is not limiting itself to Ethereum alone. On the same day the ETH acquisition was reported, BitMine also announced a $20 million strategic investment in Eightco Holdings (OCTO). This investment is part of a broader $270 million PIPE deal that backs Eightco’s plan to make Worldcoin (WLD) its primary treasury asset.

The move shows BitMine’s broader ambition to influence the future of digital asset treasuries beyond just Ethereum.

Stock Market Cheers the Strategy

BitMine’s bold crypto strategy is not going unnoticed by investors. On Wednesday, BitMine’s stock (BMNR) rose 2.24 percent to close at $45.6 on the New York Stock Exchange. Over the past six months, the company’s shares have skyrocketed by 714.3 percent, driven by its growing Ethereum NAV per share and strategic diversification in the digital asset space.

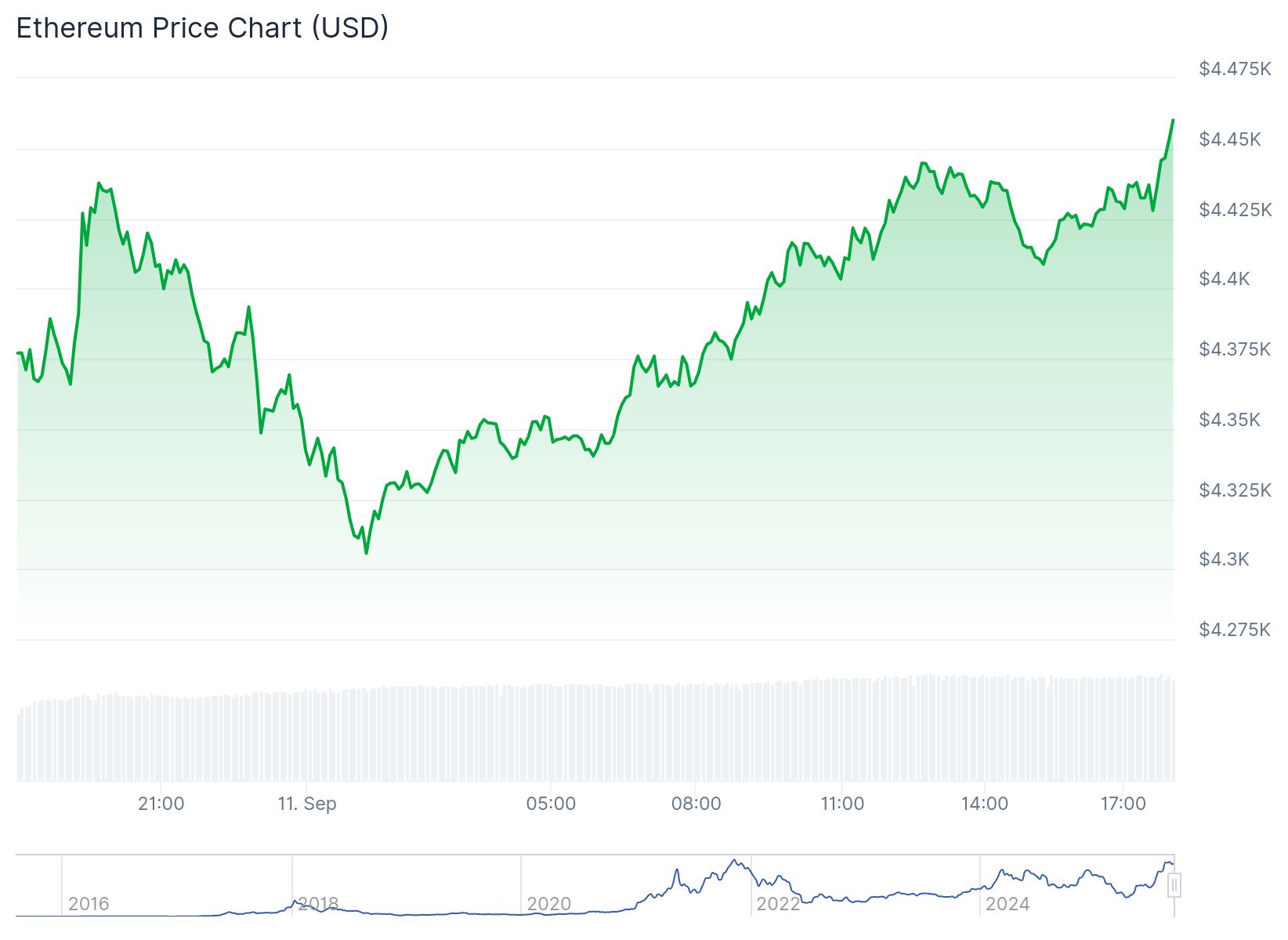

Despite Ethereum’s price volatility, institutional interest appears to be rising. Social chatter points to large withdrawals like BitMine’s as bullish signals, since they reduce liquid supply on exchanges. Ethereum itself has gained 1.9 percent in the past 24 hours and is currently trading just above $4,460.

CoinLaw’s Takeaway

I see BitMine’s aggressive accumulation of Ethereum as more than just a treasury move. It is a strategic positioning to influence the broader Ethereum ecosystem. In my experience, when firms go all-in like this, they often help shape market behavior and investor sentiment. The 5 percent supply goal is not just symbolic, it is economic power in a decentralized future. I found it especially bold that they are pairing ETH with investments like Worldcoin through Eightco. That shows a forward-looking playbook. The market seems to agree, judging by the stock surge.