Bitget Wallet has emerged as a major force in the Web3 wallet space, expanding rapidly in users, features, and transparency. Its growth is evident not only in trading and DeFi realms, but also in real‑world payments and cross‑chain use cases. For example, crypto payments via Bitget Wallet are now being used in gaming and travel sectors, and its integration with Telegram’s TON ecosystem is helping onboard Web2 users into crypto. Below you’ll find a detailed breakdown of the key metrics shaping Bitget Wallet’s trajectory this year.

Editor’s Choice

- 12 million+ monthly active users (MAU) in August 2025, making Bitget Wallet the top‑downloaded Web3 wallet globally that month.

- Over 120 million total users in the Bitget ecosystem by Q1 2025, after adding nearly 19.9 million new users in that quarter.

- Spot trading volume surged 159% quarter-over-quarter in Q1 2025, reaching $387 billion.

- Bitget’s Protection Fund rose from $495 million in January to $514 million by March 2025.

- In September 2025, Bitget’s Proof of Reserves showed 30,753 BTC held against 9,395 BTC in user assets, a 327% reserve ratio for BTC.

- Bitget Wallet reached 80 million users globally, with more than 250 million transactions processed.

Recent Developments

- In August 2025, Bitget recorded $461.3 million in net inflows, ranking among the top 5 centralized exchanges.

- In July 2025, total token listings increased from 271 to 305, and copy trading followers rose to ~1.1 million.

- Q2 2025 saw the user base grow from ~100 million to ~120 million, a 20% QoQ jump.

- The number of new tokens listed in Q1 2025 surged, such as Story Protocol (IP) rising 165%, PLUME +90%, etc.

- In 2024, Bitget’s user base grew fivefold, adding ~100 million users by year’s end.

- In December 2024, daily average trading volume reached $20 billion, doubling over the prior year.

- The Proof of Reserves framework was publicly extended in September 2025 across BTC, ETH, USDT, and USDC with reserve ratios well above 100%.

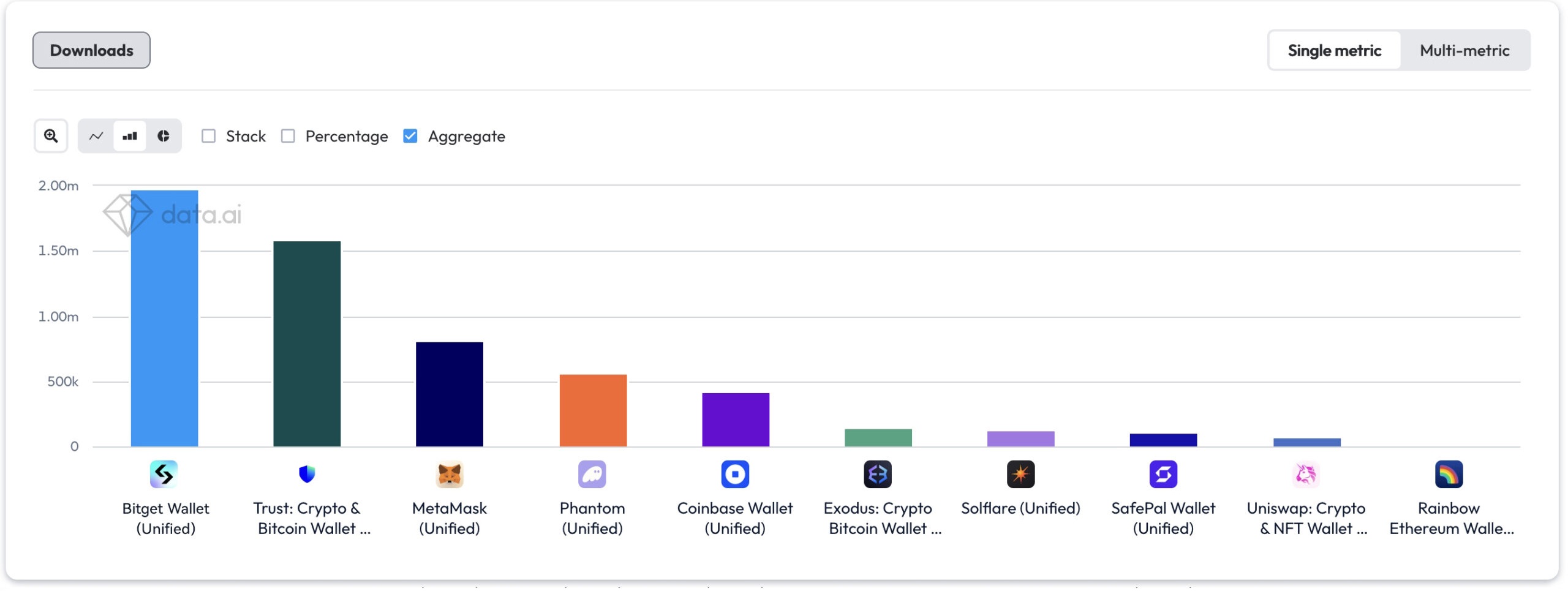

Most Downloaded Wallets for Memecoin Traders

- Bitget Wallet leads with 1.9 million downloads, making it the most downloaded wallet among memecoin-friendly platforms. Its Telegram integration and memecoin trading features help boost adoption.

- Trust Wallet follows with 1.6 million downloads, offering wide token support, including memecoins like PEPE, DOGE, and SHIB across multiple chains.

- MetaMask saw 900,000 downloads, remaining a popular choice for Ethereum-based memecoin traders due to its seamless browser extension and DeFi integrations.

- Phantom Wallet reached 600,000 downloads, capitalizing on the growing memecoin activity within the Solana ecosystem.

- Coinbase Wallet was downloaded 400,000 times, offering memecoin access through DEXs and the safety of a trusted brand.

- Exodus Wallet and Solflare Wallet each attracted ~200,000 downloads, with growing memecoin interest on alternative chains like Avalanche and Solana.

- SafePal Wallet recorded 100,000 downloads, popular among Binance Smart Chain users trading BNB-based memecoins.

- Uniswap Wallet saw ~70,000 downloads, serving the Ethereum DEX crowd and niche memecoins listed only on Uniswap.

- Rainbow Wallet had ~50,000 downloads, targeting users who prioritize aesthetic UX and simplicity, often favored by newer memecoin holders.

Bitget Wallet Overview

- Bitget Wallet is a non‑custodial, self‑key wallet where users manage private keys integrated into the broader Bitget ecosystem.

- As of mid‑2025, it supports over 130 blockchains and millions of tokens.

- The wallet has processed more than 250 million transactions in its lifecycle.

- A built‑in DApp browser and cross‑chain aggregation tools allow seamless interaction with decentralized applications.

- Bitget Wallet integrates with PayFi payment solutions to allow crypto usage in real‑world purchases.

- The wallet offers “lite” or simplified modes, such as login via email, Google, Apple ID, or Telegram to lower onboarding friction.

- It is backed by a $300+ million protection fund intended to safeguard user assets in extreme conditions.

User Base and Global Growth

- In Q1 2025, Bitget and Bitget Wallet added 19.89 million new users, pushing the total to over 120 million.

- In 2024 alone, the ecosystem recorded a 400% growth, increasing from ~20 million to ~100 million users.

- Bitget Wallet’s user base crossed 60 million by early 2025.

- By mid‑2025, the wallet itself claimed 80 million users.

- Monthly active users (MAU) exceeded 12 million in August 2025.

- The wallet app downloads in that same month (August 2025) hit 2 million, ranking it #1 among Web3 wallets globally.

- The ecosystem’s growth remains global, with localized expansions in emerging markets like Southeast Asia, Africa, and Latin America.

- Bitget also reports accelerating growth in regions such as Japan, the Philippines, Thailand, India, Nigeria, Russia, etc.

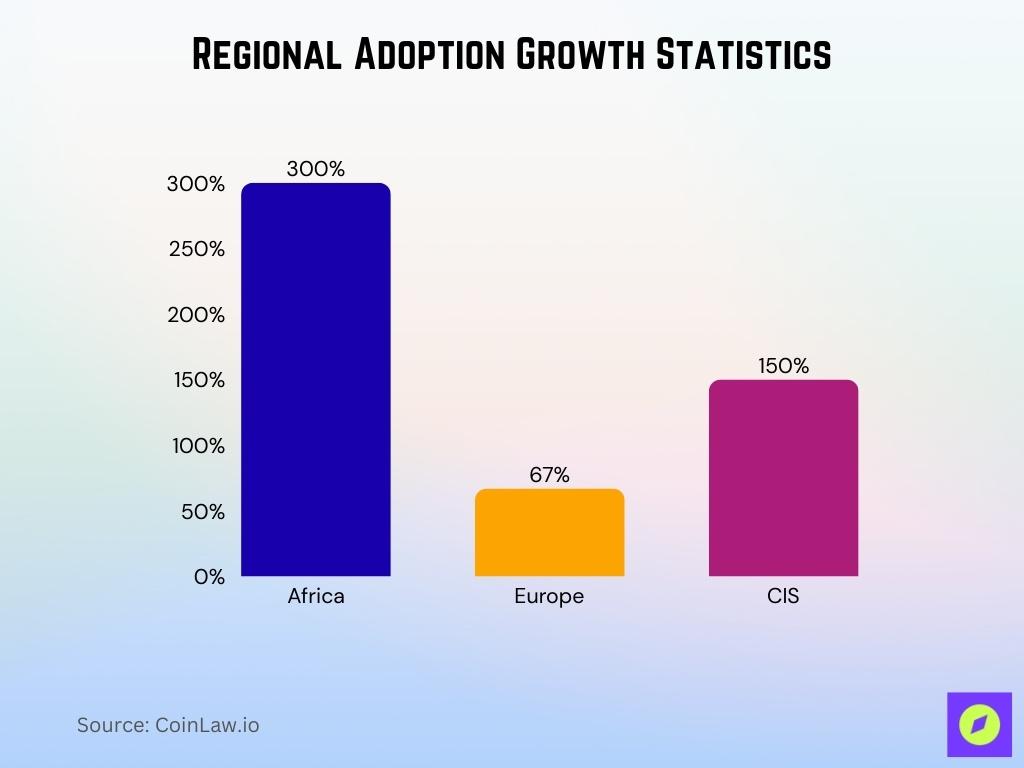

Regional Adoption Statistics

- Africa saw over 300% growth in its user base from 2021 to 2024.

- European users increased by ~67% in that same timeframe.

- Latin America and the Middle East demonstrated double‑digit growth year over year through 2024.

- The CIS region saw ~150% user base growth.

- Localized growth in the Philippines, India, Nigeria, and Russia reportedly multiplied several times vs. the prior baseline.

- Bitget now offers localized services and compliance efforts across 168+ countries and regions.

Supported Blockchains and Tokens

- Bitget Wallet now connects with over 130 public blockchains, enabling users to transact across a wide network.

- The wallet includes a “one-click cross-chain” function covering 27 chains.

- It supports gas fee abstraction on several chains, reducing user UX friction.

- Mainnets supported include BTC, ETH, BNB Chain, Solana, Polygon, Base, Berachain, Blast, Linea, and Tron.

- It is extending support to the Base chain, with gas‑free features in certain contexts.

- The wallet supports many emerging ecosystems to allow early user access to new chains.

- Its DApp module integrates token discovery and seamless transitions across chains.

Asset Listings and Trading Pairs

- Bitget lists over 800 tokens on its spot markets.

- It offers more than 900 spot trading pairs.

- In Q1 2025, new token listings included Story Protocol (+165%), PLUME (+90%), and others via Launchpool.

- The rate of new listings accelerated in H1 2025 compared to the same period in 2024.

- Spot markets often pair new tokens with USDT, USDC, BGB, BTC, and ETH.

- Some tokens get featured via Launchpad events, encouraging early participation.

- The diversity of trading pairs helps boost cross‑pair liquidity and arbitrage opportunities.

Top Global Crypto Wallet Use Cases

- 48% of users use crypto wallets for sending crypto, making it the most common use case globally.

- An equal 48% also rely on wallets for trading crypto, highlighting a strong interest in active market participation.

- 46% of respondents use their wallets to earn rewards, such as airdrops and promotional token distributions.

- 40% use wallets for paying with crypto, signaling a shift toward real-world crypto utility.

- 37% engage in yield generation through staking and farming, showing adoption of passive income strategies.

- 35% of users use wallets to check prices or monitor trends, indicating that wallets serve as info hubs, not just transaction tools.

- 33% hold crypto long-term, positioning wallets as secure storage solutions for HODLers.

- Another 33% explore and discover new tokens, showing strong curiosity and speculative activity among wallet users.

- 31% use wallets to explore decentralized apps (DApps), connecting wallets to broader Web3 engagement.

Trading Volume and Market Share

- In Q1 2025, Bitget recorded $2.08 trillion total trading volume.

- Spot trading volume rose 159% quarter-over-quarter, reaching $387 billion.

- In mid‑2025, daily 24‑hour volumes hovered around $2.8 – $3 billion.

- Derivatives volume (Nov 2023–June 2025) hit $11.5 trillion.

- August 2025 derivatives volume was $750 billion.

- Bitget ranks as #1 in ETH & SOL liquidity, and #2 in BTC spot depth.

- BTC, ETH, and BGB made up ~44% of total spot volume in H1 2025.

- In May 2025, Bitget attained a 5.2 % market share in spot trading.

Copy Trading Statistics

- In Q1 2025, copy trading volume was $9.2 billion, up ~36% QoQ.

- Copy trading followers exceeded 900,000 by mid‑2025.

- Over 100 million trades have been executed under copy trading.

- Copy trading spans both spot and derivatives strategies.

- Bitget provides ROI, PnL, and filters to evaluate traders.

- Some elite traders show performance history and drawdowns.

- Copy trading is a key driver in user engagement.

Popular Tokens and Trading Pairs

- BTC remains the most traded asset.

- ETH is also among the top tokens with deep liquidity.

- BGB rose to become the third most traded token.

- BTC/USDT and ETH/USDT pairs dominate in liquidity.

- Emerging token pairs often bootstrap via USDC or BGB.

- Cross-chain swaps allow pairs across different blockchains.

- Copy trading pairings favor less volatile midcap tokens.

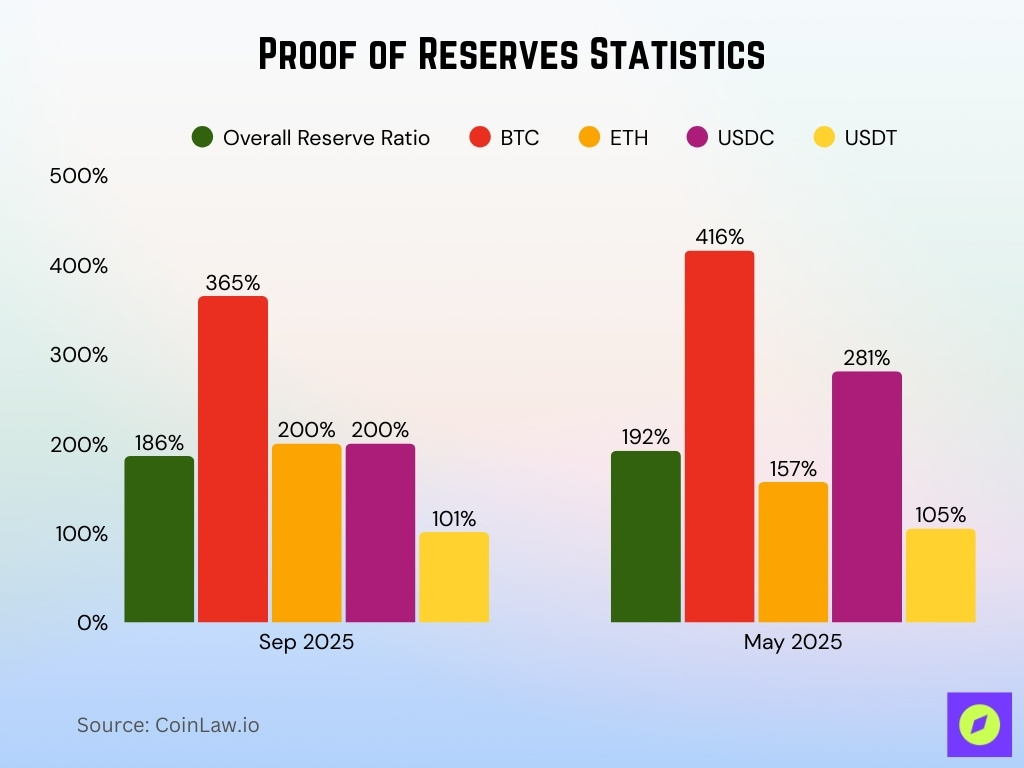

Proof of Reserves Statistics

- In September 2025 total reserve ratio was 186%.

- BTC reserve ratio was 365%, ETH 200%, and USDC 200%.

- USDT had ~101% coverage.

- May 2025 ratios were: overall ~192%, BTC 416%, ETH 157%, USDC 281%, USDT 105%.

- Proof of Reserves uses Merkle tree proofs.

- Monthly updates are publicly verifiable.

Protection Fund and Security Measures

- Bitget maintains a $300+ million Protection Fund.

- By July 2025, the fund was estimated at ~$779.7 million.

- The fund covers losses or exploits.

- Bitget uses cold storage, multi‑sig wallets, and allowlists.

- 2FA, phishing codes, and device control enhance account safety.

- Proof of Reserves is published monthly.

- Users can verify balances via Merkle tree tools.

- In August 2025, the BTC reserve ratio was 365%.

Tokenomics and BGB Token Utility

- Maximum supply is 2 billion tokens.

- 800 million BGB burned in Dec 2024.

- Q2 2025 burn was 30 million BGB, ≈$138 million.

- BGB utility includes trading discounts and access perks.

- BGB is used for payments and gas in the Morph chain.

- Daily trading volume is ~$114 million, market cap ~$3.6 billion.

- 2024 price rose ~860%.

- Since Dec 2024, BGB has appreciated by over 320%.

- The future includes migration to Morph and governance use.

Payments and Real-World Adoption

- Over 40 million transactions processed in payments.

- Merchants receive fiat while users pay in crypto.

- Mastercard cards are accepted at 150 million merchants.

- Card rolled out in the UK, EU, and later LATAM, ANZ.

- Stablecoins are seen as financial infrastructure.

- Morph / PayFi powers Bitget payments.

- Real‑world payments include travel, gaming, and e‑commerce.

- Enables cross‑border payments.

- Bridge to fiat commerce improves adoption.

Frequently Asked Questions (FAQs)

Over 12 million MAU.

186 % overall reserve coverage.

19.89 million new users.

$2.08 trillion in total trading volume.

Over 35 % of users.

Conclusion

Bitget Wallet is no longer just a wallet; it’s a central node in a broader crypto infrastructure. Through transparent tokenomics, strong partnerships, regulatory alignment, and payment real‑world deployments, it is shaping a model for how crypto can bridge into mainstream finance. BGB’s increasing utility and burn dynamics demonstrate how the token is deeply woven into the platform’s incentives. As the Mojo of crypto payments tightens, Bitget’s products and infrastructure may well serve as a template for future Web3 ecosystems integrating finance, payments, and identity.