BitFuFu Inc. (NASDAQ: FUFU) stands out as a major player in the Bitcoin-mining sector, scaling its infrastructure and investor visibility rapidly. From expanding hosting capacity to building out its cloud-mining platform, the company’s growth touches both retail users and institutional partners. For example, its increased hashrate capacity allows large-scale clients to access mining services without owning hardware. Meanwhile, U.S.-based retail users can purchase hosting contracts and monitor payouts directly via an app. This article dives into the latest statistics across key segments of BitFuFu’s business.

Editor’s Choice

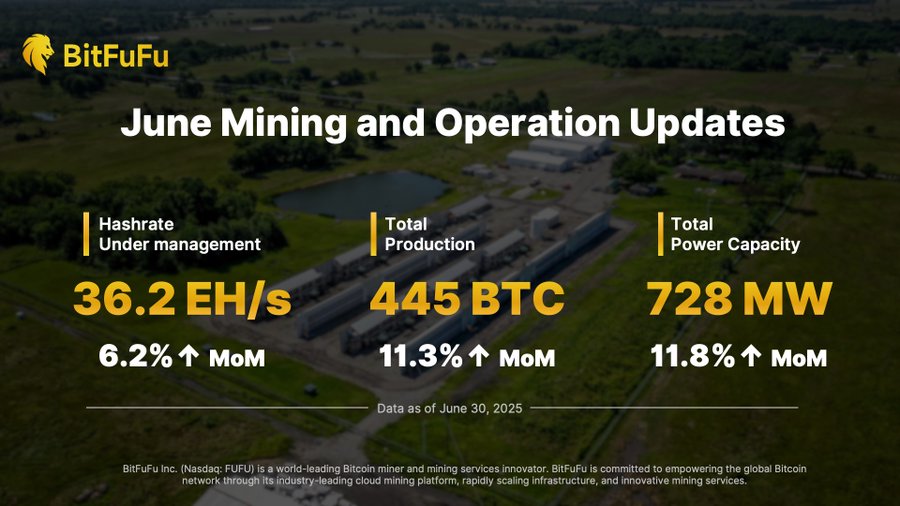

- BitFuFu managed a total hashrate of 36.2 EH/s as of June 30, 2025, up from 24.7 EH/s as of June 30, 2024.

- As of September 30, 2025, the company held 1,959 BTC, increasing by 60 BTC over the prior month.

- Average fleet efficiency improved to 17.3 J/TH in September 2025.

- In May 2025, BitFuFu produced 400 BTC, a 91.4% month-over-month increase from April.

- Total power capacity under management reached 651 MW as of May 31, 2025, a 15.0% rise month-over-month.

Recent Developments

- In January 2025, BitFuFu reported 20.2 EH/s of total hashrate under management as of January 31.

- Also January 2025, self-owned hashrate was 3.1 EH/s, and cloud/hosting was 17.1 EH/s.

- In August 2025, self-owned hashrate grew to 5.0 EH/s, up 31.6% month-over-month.

- Launch of the ANTMINER S21+ Hyd. (358 TH/s at 5,370 W) hosted mining service on October 27, 2025, with an advertised rate of $15.3/TH.

- Total power capacity under management reached 651 MW as of May 31, 2025, a 15.0% rise month-over-month.

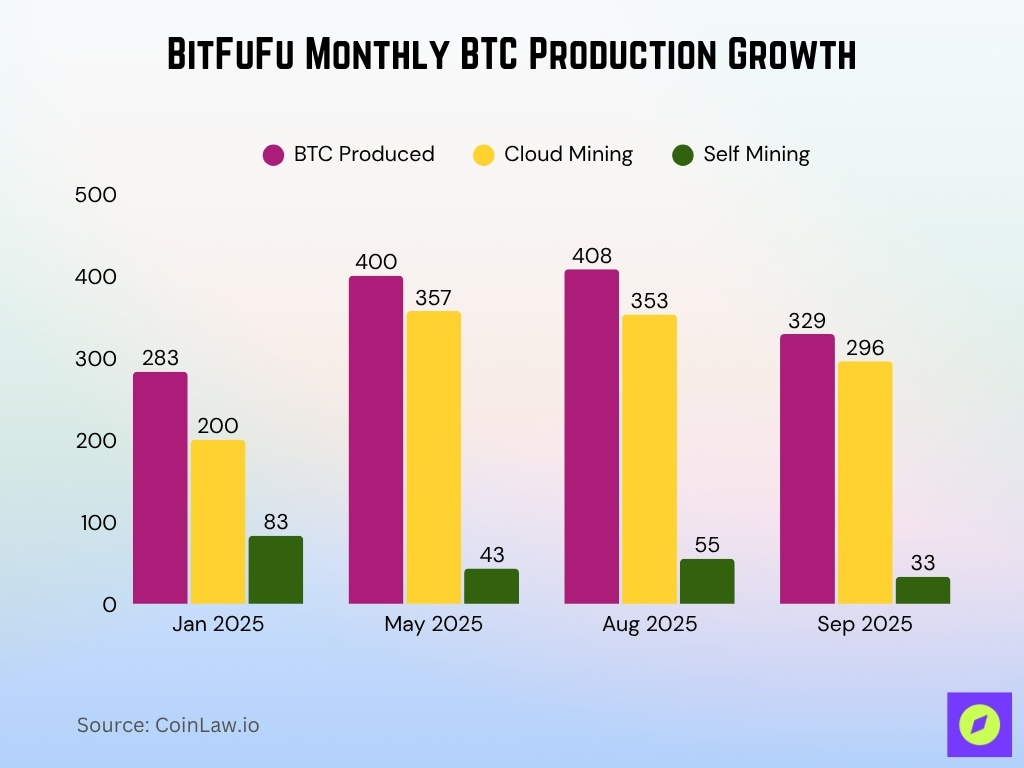

Total Bitcoin Mined

- In January 2025, self-mining produced 83 BTC, while cloud-mining customers produced 200 BTC.

- In May 2025, the company produced 400 BTC, including 357 BTC from cloud mining and 43 BTC from self-mining.

- In August 2025, the company produced 408 BTC, including 353 BTC cloud and 55 BTC self-mining.

- In September 2025, total production was 329 BTC, broken down into 296 BTC cloud and 33 BTC self-mining.

- As of September 30, 2025, BitFuFu held 1,959 BTC in its treasury.

- As of June 30, 2025, BTC holdings were 1,792 BTC, up from 1,721 BTC at June 30, 2024.

Self-Mining Performance

- In June 2025, the company’s self-mining (company-owned hardware) contributed 58 BTC, up 34.9% from May.

- As of June 30, 2025, BitFuFu held 1,792 BTC in its treasury, up from 1,721 BTC a year earlier.

- In August 2025, self-owned hashrate rose to 5.0 EH/s, representing a 31.6% month-over-month increase.

- Self-mining production in June was part of a total production of 445 BTC; the bulk came from cloud-mining customers.

- The company’s self-mining strategy appears focused on building a BTC treasury as well as scaling owned operations.

- In February 2025, self-mining production fell to 58 BTC (from higher levels earlier) due to miner fleet relocation.

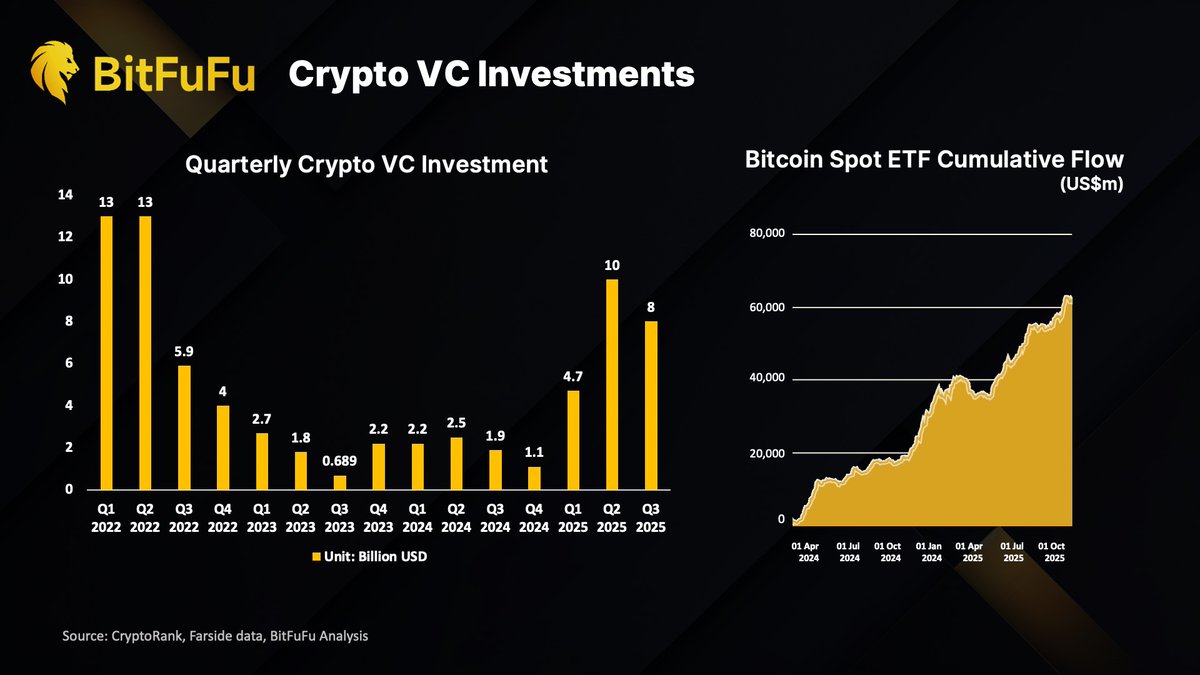

Crypto VC Investments and Bitcoin ETF Flows

- Crypto VC funding rebounded strongly in 2025, reaching $10 billion in Q2 and $8 billion in Q3, signaling renewed investor confidence.

- Investment levels were minimal in 2023–2024, averaging only $1–2.5 billion per quarter after the market downturn.

- Peak activity was recorded in early 2022, when quarterly investments reached $13 billion in both Q1 and Q2.

- VC activity bottomed out in Q3 2023 with just $0.689 billion, showing how far the sector had declined before its recovery.

- Bitcoin Spot ETF cumulative inflows hit nearly $70 billion by October 2025, up from zero in April 2024, reflecting massive institutional adoption.

- ETF inflows accelerated sharply from mid-2024, passing $40 billion by October 2024 and $60 billion by mid-2025.

- Together, VC funding and ETF inflows illustrate a strong return of capital to crypto markets as institutional and venture investors re-enter the space.

Security and Compliance

- BitFuFu enforces KYC/AML verification for every user before they buy mining products.

- The platform is trusted by more than 636,000 users worldwide.

- BitFuFu delivers 99.99% platform availability and 99.9999% data reliability, minimizing downtime risks.

- The Aladdin system maintains over 95% miner uptime and operational stability for cloud mining.

- Daily Bitcoin payouts are verifiable via on-chain transactions for enhanced transparency.

- BitFuFu separates hash rate fees and service fees for clear cost breakdowns to users.

- 98% of hash rate fluctuations stay within just a 3% range, demonstrating high system reliability.

- BitFuFu is publicly listed on NASDAQ (FUFU), subject to rigorous governance and disclosure rules.

- Security protocols include 2FA, wallet change alerts, and official channels usage for added protection.

- BitFuFu bans service to 13+ restricted countries, managing compliance across global jurisdictions.

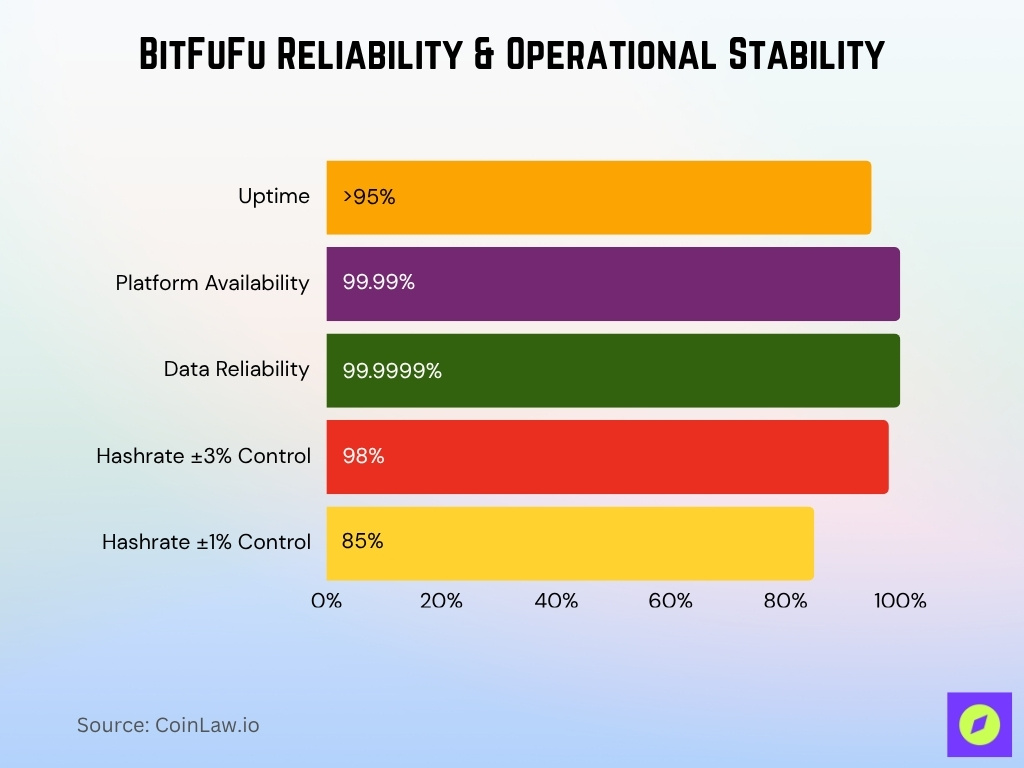

Uptime and Reliability Metrics

- BitFuFu reports over 95% uptime, platform availability of 99.99%, and data reliability of 99.9999%.

- The proprietary “Aladdin” system reportedly keeps 98% of the hashrate fluctuations within ±3% range and 85% within ±1%.

- As of August 31, 2025, total managed hashrate was 35.6 EH/s, against which uptime and reliability figures are measured.

- Real-time tracking of hashrate, uptime, and BTC output is provided via observer links as part of the platform’s transparency initiatives.

- BitFuFu claims that “more than 95% uptime” applies across its global operations, not just individual sites.

- The very high availability metrics (99.99%) place BitFuFu among the more stable operators in cloud-mining platforms.

- The data reliability metric of 99.9999% suggests minimal disruption in data delivery and reporting.

- These reliability figures help support user confidence in daily payouts and contract fulfillment.

Geographic Presence

- BitFuFu Inc. reports power-capacity management and mining operations across multiple continents, including Africa, North America, and Asia.

- In February 2025, it acquired majority ownership of a 51 MW facility in Oklahoma, U.S., marking a strong U.S. presence.

- The company expects to reach 1 GW (1,000 MW) of secured power capacity by the end of 2026, signalling further expansion globally.

- In Asia, the company maintains its headquarters in Singapore and serves global users in over 130 countries via a cloud-mining platform.

- In Europe and the Middle East, the company is exhibiting at international industry events, for example, Dubai’s Blockchain Life 2025, to showcase its global presence.

- The mix of facility types (hydropower in Ethiopia, grid power in the U.S.) demonstrates geographic diversification of energy sourcing and risk management.

Partner Integrations

- BitFuFu signed a two-year agreement with BITMAIN to buy up to 80,000 S-series miners for expansion.

- BitFuFuPool reached 20 EH/s hashrate in July 2025, ranking in the top 11 global mining pools.

- BitFuFuPool can generate 10 BTC daily (worth about $1.18M) from confirmed pool operations.

- The platform held 1,959 BTC as of September 2025, increasing by 60 BTC month-over-month.

- BitFuFu’s proprietary OS (BitFuFuOS) controls over 600,000 managed mining units, allowing centralized monitoring.

- BitFuFu’s cloud mining has over 641,526 registered users worldwide, as of September 2025.

BitFuFu Mining Performance

- Hashrate under management reached 36.2 EH/s as of June 30, 2025, marking a 6.2% month-over-month increase in operational scale.

- Total Bitcoin production hit 445 BTC in June 2025, representing an 11.3% MoM growth in output efficiency.

- Power capacity expanded to 728 MW, up 11.8% MoM, showcasing BitFuFu’s continuous infrastructure buildout.

- The company’s steady monthly growth across hashrate, BTC output, and power usage underscores its strong operational momentum in mid-2025.

- BitFuFu’s sustained efficiency gains highlight its role as one of the fastest-scaling Bitcoin mining platforms globally.

Mining Hardware and Technology

- BitFuFu ordered and deployed new S-series miners (S21 XP and S21 Pro) from BITMAIN under the 80,000-unit framework deal.

- As of August 31, 2025, the company reported a self-owned hashrate of 5.0 EH/s, up 31.6% month-over-month, partially due to fleet upgrades.

- The infrastructure includes the “Aladdin” system, comprised of FuFu Sentry, FuFu Proxy, and FuFu Dispatcher for large-scale hash power management.

- Hosting customers gain access to advanced “overclocking and underclocking” capabilities via BitFuFuOS, allowing power or performance scaling to fit conditions.

- The hardware procurement includes deferred payments and equity-based compensation to maintain flexibility and sourcing stability.

Industry Ranking and Competitors

- Average fleet efficiency for BitFuFu was 17.3 J/TH in September 2025, keeping pace with leading industry benchmarks.

- BitFuFu ranked as a top 2 global cloud-mining platform, cited for scale and hardware access in 2025 market reviews.

- The company’s Q2 2025 revenue reached $115.4 million, representing 47.9% growth over the prior quarter.

- BitFuFu was included in the Bitwise Bitcoin Standard Corporations ETF as a top-10 holding, representing 4.03% of assets with 1,800 BTC held as of February 2025.

- ECOS and BeMine are competitor platforms, but BitFuFu differentiates itself by integrating hosting, hardware supply, and self-mining capabilities.

- BitFuFu announced target purchases of 80,000 miners through BITMAIN agreements, signaling hardware-led growth ambitions.

- Nearly 90% of BitFuFu’s mining contracts focus on Bitcoin, with limited altcoin diversification compared to some rivals.

Frequently Asked Questions (FAQs)

In Q2 2025, the company generated $94.3 million from cloud-mining solutions (an increase of 22.3% year-over-year).

The offered rate was $15.3 per TH/s for the ANTMINER S21+ Hyd hosted mining offering.

The company held 1,959 BTC as of September 30, 2025 (an increase of 60 BTC from August).

BitFuFu reported 641,526 registered users of its cloud-mining platform as of September 30, 2025.

Conclusion

BitFuFu charts a clear path of expansion and capability development. It has established a global footprint, integrated deep partner relationships (particularly with BITMAIN), deployed next-generation mining hardware and software, and taken a strong position among its industry peers. For U.S.-based and global investors alike, the company illustrates how a mining services firm is building scale, efficiency, and service diversity. Looking ahead, monitoring its progress toward the 1 GW power-capacity target, hardware deployment, and user-growth metrics will be key to assessing its momentum. Explore the full article for the full statistical breakdown of each facet of BitFuFu’s operations.