In the fast-evolving world of digital assets and next-gen compute, Bitdeer Technologies Group (BTDR) is positioning itself at the intersection of Bitcoin mining and high-performance computing. As demand for processing power surges in both blockchain operations and AI workloads, Bitdeer is scaling its hardware, infrastructure, and service offerings to match. In one application, large-scale institutional miners use Bitdeer rigs for self-mining to increase exposure to Bitcoin, in another, data centre operators tap into its development of ASICs and AI-capable sites to support GPU-driven workloads. Read on to explore the full article, where you’ll uncover detailed statistics and trends.

Editor’s Choice

- $155.6 million revenue in Q2 2025, up ~56.8% year over year.

- External sales of SEALMINER A2s amounted to $69.5 million in Q2 2025.

- Self mining hashrate reached 35.0 EH/s as of September 2025, with a target of 40 EH/s by the end of October.

- Self-mined Bitcoins in September 2025: 452 BTC, up ~20.5% from the prior month.

- SEALMINER A3 series launched with power efficiency of ~12.5 J/TH (air cooled) in September 2025.

- Cash and cash equivalents as of June 30, 2025: $299.8 million.

Recent Developments

- In Q2 2025, Bitdeer reported revenue of $155.6 million, compared with $99.2 million in the same quarter last year.

- Gross profit in Q2 2025 was $12.8 million, down from $24.4 million in Q2 2024.

- Net loss widened to $147.7 million in Q2 2025 versus $17.7 million a year earlier.

- Adjusted EBITDA in Q2 2025 was $17.3 million, versus $23.5 million in the prior year quarter.

- In August 2025, Bitdeer announced a production and operations update. Self-mining hashrate increased to 30.0 EH/s, up ~35% from July.

- In July 2025 self self-mining output hit 282 BTC, up ~39% from June, driven by new rig deployment and site energisations.

- The company indicated it is in “advanced negotiations” for its expansion of HPC/AI infrastructure at its Clarington, Ohio, site.

- Product roadmap update, Achieved SEAL04 chip tape out with initial tests sub 10 J/TH in September 2025.

Bitdeer Stock Performance

- Bitdeer Technologies Group (BTDR) closed at $25.90 on October 15, 2025, marking a strong +28.73% gain for the day.

- The company’s stock climbed from roughly $20.12 to $25.90 over the 5-day period, reflecting a +29.82% increase.

- Pre-market trading on October 16 indicated continued strength, with BTDR priced at $26.02, up +0.46%.

- The 5-day price range spanned approximately $17.50 to $26.00, showing high investor activity and momentum.

- The chart shows a steady recovery and upward breakout after mid-week consolidation, indicating renewed market confidence.

- The strong rally followed growing optimism around Bitdeer’s AI and Bitcoin mining expansion, which likely influenced investor sentiment.

- Overall, the stock’s near-30% weekly surge positions Bitdeer as one of the top-performing crypto infrastructure stocks in October 2025.

Company Overview

- Bitdeer reported $368.4 million in total revenue for the year 2024.

- The company produced approximately 6,341 BTC via its self-mining operations in 2024.

- By mid-2025, Bitdeer controlled a total hashrate of 23.9 EH/s across all activities.

- Bitdeer’s managed mining capacity reached 895 MW by Q2 2025.

- The number of deployed mining servers exceeded 190,000 as of June 2025.

- Bitdeer’s U.S. mining site in Texas accounted for about 47% of the total company power capacity in 2025.

- The SEALMINER A1, Bitdeer’s flagship ASIC, achieves 23.0 J/TH energy efficiency.

- In Q2 2025, Bitdeer announced plans for a new 570 MW data center campus in Ohio.

- Jihan Wu, founder of Bitmain, has led Bitdeer since the 2020 launch and public NASDAQ listing in 2023.

- Bitdeer invested $100 million in Bhutan for hydro-powered mining and AI compute expansion by 2025.

Employee and Workforce Data

- As of 2023, Bitdeer Technologies Group reported approximately 211 employees, up from the 2022 level.

- Indeed job listings show that in 2025, Bitdeer is hiring roles such as Senior Project Manager – AI Data, Quality Lead Engineer, and Analog IC Mixed Signal Engineer in multiple U.S. locations.

- The job postings indicate wage ranges of around $140,000-$250,000 for senior engineering roles in 2025.

- The company noted in a Nevada board packet that its manufacturing subsidiary plans to hire 41 employees within the first 2 years at its Sparks, Nevada, facility.

- Growth in the workforce appears tied to expansion of ASIC design, data centre builds, and AI/HPC operations, resulting in increased R&D and engineering staff.

Operational Statistics (Capacity, Hashrate, Sites)

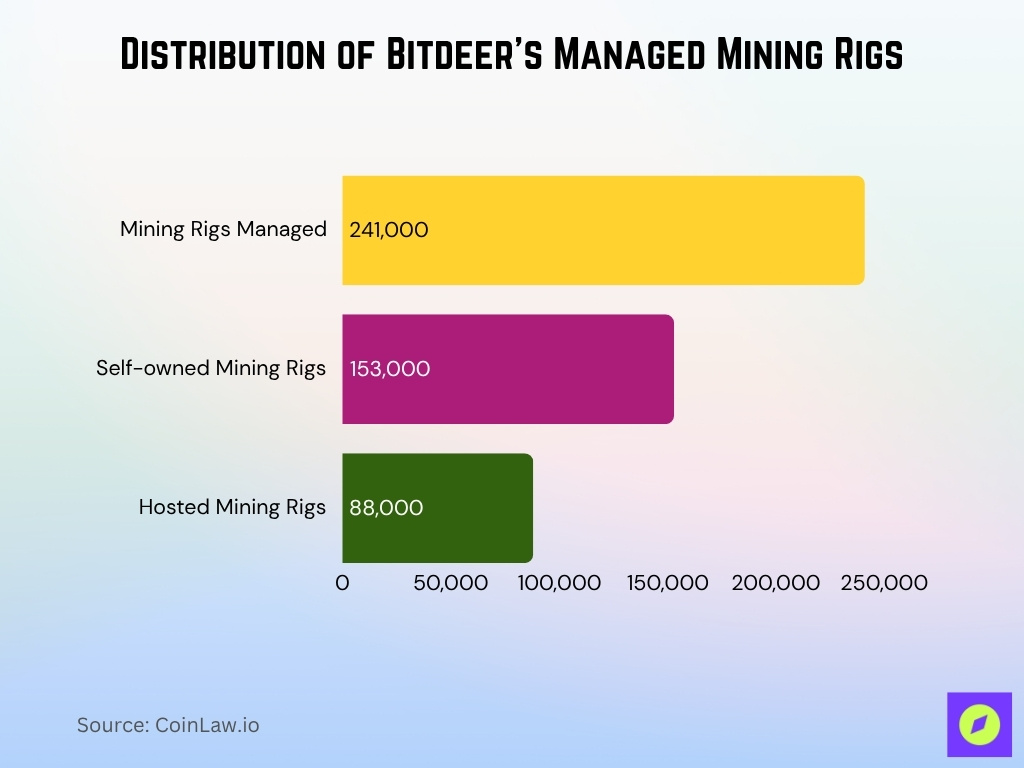

- The company managed 241,000 mining rigs at the end of September 2025, of which 153,000 were self-owned and 88,000 hosted for customers.

- At Q2 2025, Bitdeer had a total available electrical capacity of approximately. 1.3 GW year to date, with a target above 1.6 GW by year-end.

- In June 2025, the company reported energisation of 361 MW of data centre capacity for self-mining.

- As of September 2025, total hash rate under management reached 49.2 EH/s, with proprietary hash rate at 35.0 EH/s.

- Hosting business remained around 14.2 EH/s of hash rate in September 2025.

- In August 2025, the self-mining hash rate was reported at 30.0 EH/s, representing a ~35% increase from July.

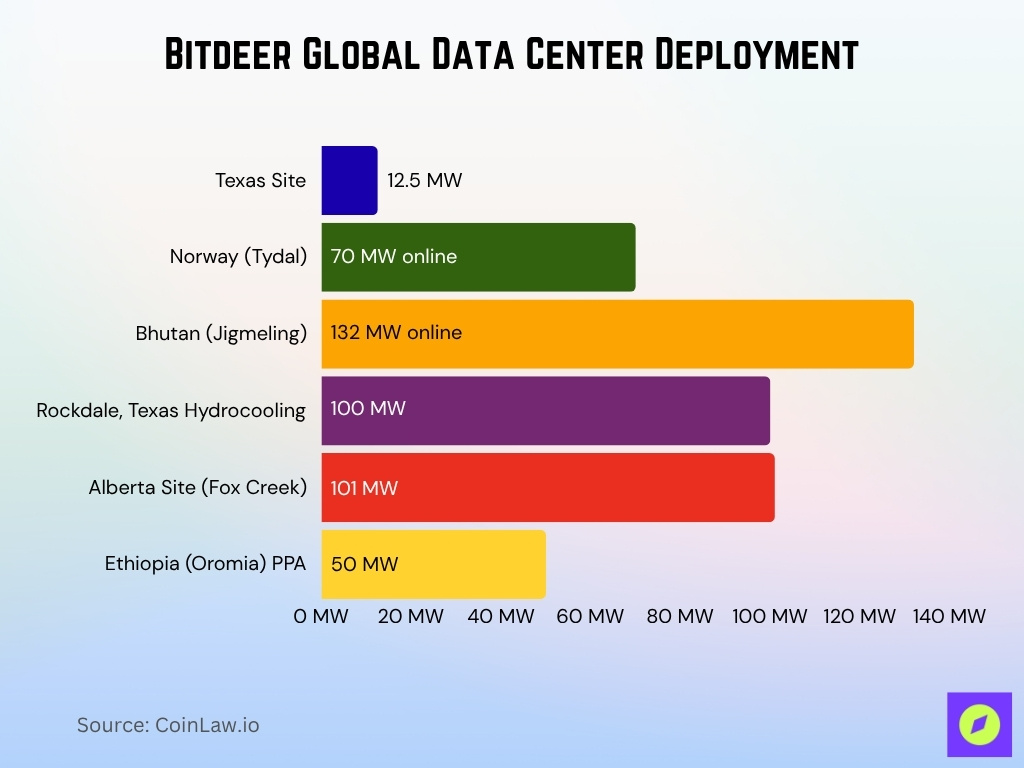

- Several build-out projects, e.g., Rockdale, Texas, hydrocooling conversion 100 MW, Tydal, Norway 161 MW online in mid-2025.

- Bitdeer publicly reported a goal to reach 40 EH/s of self-mining hash rate by the end of October 2025.

Earnings Per Share (EPS) Statistics

- Consensus estimates ahead of Q2 2025 expected EPS of around -$0.10.

- Actual EPS reported for Q2 2025 was approximately -$0.76, significantly below forecasts.

- The year-over-year decline in EPS reflects heavy investments and non-cash charges despite revenue growth.

- The previous quarter (Q1 2025) reported a gross margin of –4.6%.

- Adjusted loss in Q1 2025 was about $89.8 million.

- For Q2 2025, adjusted EBITDA of $17.3 million contrasts with EPS loss, underlining the gap between cash performance and GAAP accounting.

Bitcoin Mining Output

- In September 2025, Bitdeer self-mined 452 BTC, up ~20.5% month over month (from August).

- In August 2025, the company mined 375 BTC, up ~33% from July.

- In Q2 2025 (three months ended June 30) self self-mining output was 565 BTC, up from 628 BTC in the same quarter 2024, despite an increase in hashrate.

- The rising hashrate indicates increased production potential and improved fleet, contributing to higher output volumes.

- The company reported holding 2,029 BTC as of September 30, 2025, up from 1,934 at the end of August.

- Using proprietary hash rate, production per EH/s is gradually improving as more efficient rigs are deployed.

- The April 2025 update reported self-mined 166 BTC, a 45.6% jump from March.

- Production metrics reflect not only rig deployment but also power cost optimisation and site energisation timing.

Bitdeer Technologies (BTDR): Latest Valuation Overview

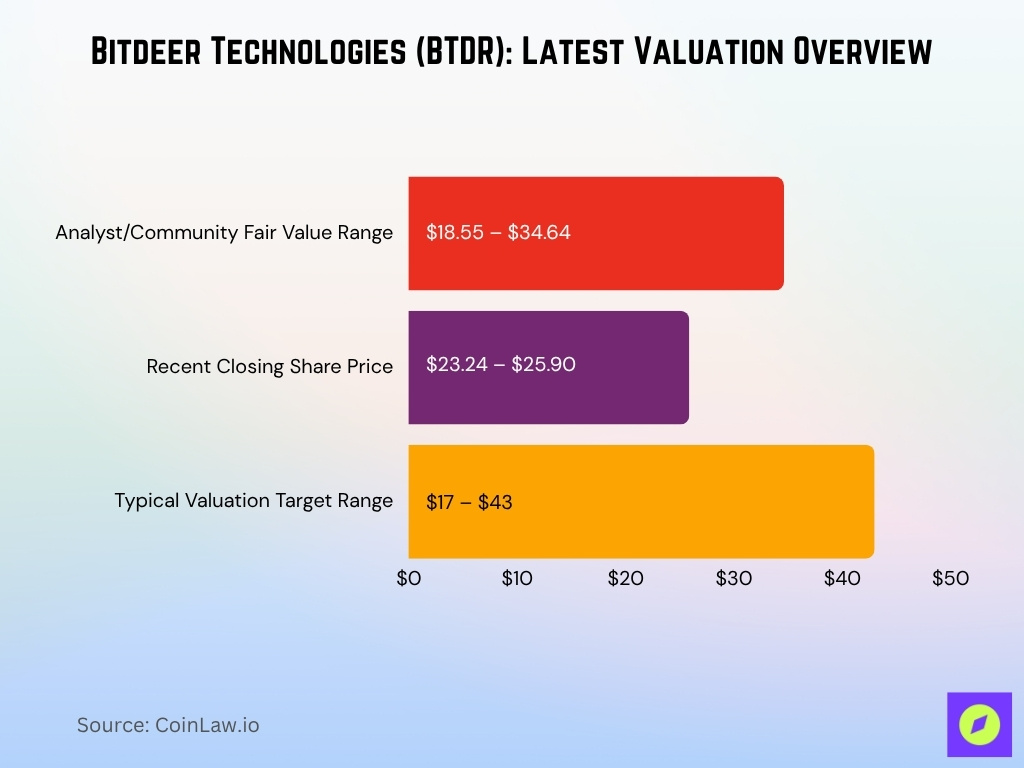

- The current consensus fair value estimate is $18.55 – $34.64 for October 2025, reflecting a blend of analyst targets and community valuation discussions.

- The latest closing prices for BTDR on the NASDAQ are between $23.24 and $25.90 for the period from October 15 to October 24, 2025.

- The company is tracked by approximately 7 to 15 analysts on most leading finance and IR platforms.

- Recent analysis from major platforms places BTDR’s valuation targets in the $17 – $43 range for October 2025.

AI and High-Performance Computing (HPC) Expansion

- Bitdeer has publicly stated its intention to deploy over 200 MW of AI data centre load by late 2026.

- As of September 2025, the company reported its AI cloud business reached $8 million ARR with 584 GPUs running at ~86% utilization.

- The site in Clarington, Ohio, is confirmed for full 570 MW of electrical capacity by the end of Q3 2026.

- Bitdeer’s product roadmap includes advanced ASIC rigs (SEALMINER A3, A4) and dedicated AI/HPC infrastructure enabling transition from pure mining to compute services.

- The company is pivoting from previous cloud hash rate contracts (ended) to direct ownership and operation of HPC sites, enhancing margin potential.

- Bitdeer disclosed that the Tydal (Norway) and Jigmeling (Bhutan) sites are being configured to support AI workloads, not just mining.

- The strategic move into AI/HPC is expected to diversify revenue away from just Bitcoin and mining equipment sales, aligning with broader compute demand trends.

- Management commentary emphasises that the AI pivot underpins the company’s long-term growth thesis and investor sentiment.

Geographic Footprint and Data Center Locations

- Bitdeer lists 27.4 E global data centres and claims a clean energy usage proportion of 67%.

- Key deployment sites include Washington (USA, 12.5 MW), Texas (USA), Tennessee (USA), Molde & Tydal (Norway), and Bhutan.

- In the June 2025 update, Jigmeling, Bhutan site – 132 MW online of the planned 500 MW, Tydal, Norway site – 70 MW online of 175 MW planned.

- Rockdale, Texas, hydrocooling conversion of 100 MW underway as of June 2025.

- The company’s globally available electrical capacity is over 2.6 GW based on recent updates (August 2025, ~1,424.5 MW online + pipeline).

- The Alberta, Canada site (Fox Creek) of 101 MW capacity is fully licensed, with energisation expected by Q4 2026.

- A 50 MW project in Oromia Region, Ethiopia, has been signed with a local partner and PPA for ~$0.036/kWh power cost, expected energisation Q4 2025.

Product and Service Offerings

- SEALMINER A3 series launched in September 2025 with models including A3 Air, A3 Pro Air, A3 Hydro, and A3 Pro Hydro. The Pro Hydro model offers 660 TH/s hashrate and improved power efficiency (~12.5 J/TH) for large-scale mining operations.

- The company’s “MinerStore” online platform sells mining rigs, accessories, and cloud mining plans, supporting direct hardware sales as well as hosting services.

- “Minerplus” miner management system boasts an average miner uptime of more than 98%, according to public site data.

- Cloud mining and hash rate hosting services remain part of the offerings, although the company signals a strategic shift toward self-mining and AI compute infrastructure.

- AI Cloud services, the website mentions “Train your AI now!” with pricing from $2.99 per hour, leveraging GPU-based workloads.

- Data centre support services, equipment procurement, transport logistics, and design and build of data centres are offered to institutional customers.

- Product roadmap, the SEAL04 chip is targeted to achieve sub-10 J/TH efficiency, reflecting ongoing advancement in hardware design.

- Hardware deployment breakdown (August 2025): 27.8 EH/s of SEALMINER A2 rigs manufactured, 18.0 EH/s deployed for self mining, 6.0 EH/s shipped to external customers.

Business Model and Vertical Integration

- In September 2025, Bitdeer held 2,029 BTC in inventory, up from 1,934 BTC in August.

- About 38% of Bitdeer’s revenue in Q2 2025 came from hosting/data centre services.

- Rig sales contributed approximately $79 million to total annual revenue in 2024.

- The company’s self-mining hash rate target is 40 EH/s by October 2025.

- By mid-2025, SEALMINER rigs accounted for over 65% of the internally deployed fleet.

- Hosting customers managed by Bitdeer operated a combined 8.1 EH/s as of Q2 2025.

- Data centres in Norway and Bhutan achieved >60% renewable energy usage in 2025.

- The lower margin hosting segment averaged 19% gross margin in 2024.

- The company increased AI/HPC revenue share to 14% in Q2 2025.

- Planned scaling supports reaching 240,000 mining rigs under management by the end of 2025.

Strategic Partnerships and Growth Initiatives

- The Bhutan government partnership enabled a $500 million green mining fund by Q2 2025.

- Bitdeer has deployed over 180 MW of power capacity with GPU/AI partners for cloud/HPC by mid-2025.

- Development of the Clarington, Ohio site will add 570 MW combined mining and AI data center capacity by late 2026.

- The Tydal (Norway) and Jigmeling (Bhutan) centers saw 3 new phases energized in 2025.

- Bitdeer targets 200 MW of AI-specific IT load deployed by the end of 2026.

- The company reported $68.9 million invested in new AI/HPC infrastructure for growth in H1 2025.

- Fox Creek (Alberta) hosting and build-out will provide an additional 101 MW capacity.

- Oromia (Ethiopia) power purchase agreement signed for 50 MW in 2025.

- SEALMINER manufacturing reached 27.8 EH/s output by August 2025.

- Negotiated HPC partnerships cover 115 MW of partner-financed data center expansion.

Technical Innovation and R&D Metrics

- SEALMINER A3 Pro Hydro achieves 12.5 J/TH power efficiency and 660 TH/s hashrate.

- SEALMINER A3 Air models deliver 260–290 TH/s with 12.5–14 J/TH efficiency.

- The hydro-cooled SEALMINER A3 Hydro provides 500 TH/s at 13.5 J/TH.

- SEAL04 chip project aims for 5 J/TH efficiency, with initial samples already below 10 J/TH by September 2025.

- Cumulative output of SEALMINER A2 rigs reached 27.8 EH/s by August 2025.

- In September 2025, Bitdeer’s self-mining hashrate surged from 30.0 EH/s to 35.0 EH/s, powered by new SEALMINER rigs.

- MinerPlus platform supports an average uptime of over 98% across deployed hardware.

- Hydro-cooling models like A3 Hydro and A3 Pro Hydro have max power draws of up to 8,250W for large-scale sites.

- Bitdeer’s infrastructure build-out includes rapid modular/AI data centre deployment, with more than 30+ centres since 2013.

Major Shareholders and Ownership Structure

- As of 2025, the investment company Tether Holdings S.A. holds approximately 21.58% of shares outstanding in Bitdeer Technologies Group.

- Founder and Executive Chairman/CEO Jihan Wu owns roughly 22.9% of the company’s shares, aligning executive and shareholder interests.

- Institutional Ownership, Approx 11.31% of the company’s shares are held by institutional investors, with the remainder (~87.2%) by public companies or individual investors.

- Major institutional holders include BlackRock, Inc. (~3.83%) and other large asset managers such as Barclays and UBS.

- From MarketBeat data, as of August 2025, Bank of America held ~$72.8 million worth of shares (~5.66% of the company).

- Over the past year, dilution of shares outstanding has been noted (~43.7% growth in shares).

Analyst Ratings and Price Targets

- According to MarketBeat, 13 analysts covering the stock of Bitdeer have a consensus price target of $27.58, with a range from $17.00 to $50.00.

- StockAnalysis reports 10 analysts rate the company as “Strong Buy” with an average target of $26.70 (+~14.9% upside) and a high end of $50.00.

- On Oct. 16, 2025, Needham maintained a Buy recommendation and a one-year target of $25.00 (range $17.17-$42.00), suggesting limited near-term upside from that specific forecast.

- A recent B. Riley upgrade boosted the target to $32 on strong AI/HPC demand.

- The highest individual target of $50 comes from Cantor Fitzgerald and reflects an optimistic view tied to AI/data centre expansion.

- A conservative view, one analyst expects a potential ~3.5% downside from the current price (~$25.90) based on $25 target.

- Rating changes highlight that investor optimism is largely predicated on the successful execution of a dual mining + AI strategy and achieving key milestones (e.g., 200 MW AI load, 40 EH/s hash rate).

Frequently Asked Questions (FAQs)

Approximately 200,000 rigs.

132 MW.

30.6 EH/s.

Roughly 22.9%.

Conclusion

Bitdeer Technologies Group stands at the crossroads of two transformative sectors, Bitcoin mining and AI/HPC compute infrastructure. The company’s vertical integration, from proprietary rigs through to global data centres, sets the stage for potential growth across multiple revenue streams. Its transition from purely mining toward AI data centre services offers diversification and access to higher margin opportunities.

That said, execution risks remain, including achieving key efficiency targets, energising planned sites, and converting infrastructure into commercially productive AI load. For investors and industry observers alike, Bitdeer’s metrics serve as a real-time case study of how infrastructure, power strategy, and compute demand converge.