Bitcoin has captured the world’s attention since its inception, becoming the most recognized cryptocurrency globally. From humble beginnings to reaching historic price peaks, Bitcoin’s journey has been filled with both high volatility and remarkable adoption. Today, as the digital asset landscape continues to evolve, understanding Bitcoin’s key statistics becomes crucial for investors, regulators, and enthusiasts. This article dives into the current state of Bitcoin, providing a detailed analysis of its market performance, user demographics, and future outlook.

Editor’s Choice

- Bitcoin’s market capitalization stood at $1.78 trillion on January 28, 2026, down 12.2% from a year earlier.

- Bitcoin’s spot price hovered around $88,900 in late January 2026, after hitting an intraday high near $90,700 earlier in the month.

- Bitcoin set a new all-time high above $97,000 on January 15, 2026, before pulling back into the high $80,000s.

- Analysts project Bitcoin will trade in a high-volatility band between $75,000 and $150,000 in 2026, with a “gravity” level near $110,000.

- Bitcoin briefly dropped below $85,000 on January 29, 2026, marking its lowest level of the year amid a broader risk-off selloff.

- Forecast models see Bitcoin’s average January 2026 trading price near $88,900, with a projected monthly range between about $88,600 and $89,200.

Recent Developments

- U.S. listed Bitcoin ETFs hold over $135 billion in AUM as of late January, after net inflows above $1.1 billion in the first two trading days of the year.

- U.S. Bitcoin spot ETFs recorded a single-day net inflow of about $695 million on January 5, the largest in roughly three months.

- U.S. Bitcoin spot ETFs also saw a $348.1 million net outflow on January 1, reflecting continued volatility in institutional positioning.

- Analysts expect global Bitcoin ETF assets to reach $180–$220 billion this year as major banks broaden distribution to wealth-management clients.

- Projections suggest total Bitcoin ETF AUM could follow a structural path toward $400 billion as allocations from advised wealth rise.

- Bitcoin’s Lightning Network now channels over 5,200 BTC (around $10 billion) in capacity, underscoring renewed growth in layer-2 payments.

- Recent data show Lightning Network capacity setting records above 5,600–5,637 BTC, driven largely by institutional and exchange adoption.

- Wrapped Bitcoin currently has about 132,500 WBTC in circulation, with a live market cap near $11 billion at a price around $89,000 per token.

Bitcoin-to-Gold Ratio Forecast Scenarios

- Previous ATH on the BTC-to-Gold ratio chart is 37.46.

- Base case for 2026 is a retest of the 37.5 level.

- A bullish scenario targets a move to ~52.5.

- This represents a ~25% gain from the previous ATH.

- A neutral path implies a ~50% bounce from recent lows.

- A bearish outcome projects a drop to ~15.4.

- This would reflect a ~25% decline from current levels.

- 0.786 Fibonacci level is marked at 27.06.

- 0.618 Fibonacci level is set at 21.66.

- 0.382 Fibonacci level acts as support near 15.44.

Bitcoin Market Capitalization

- Bitcoin’s total market cap is $1.78 trillion as of January 28, accounting for about 59% of the global crypto market.

- Bitcoin’s market cap is down 12.2% year-over-year from roughly $2.03 trillion in late January last year.

- Since January 1, Bitcoin’s market cap has risen from $1.76 trillion to $1.78 trillion, adding about $23 billion in less than a month.

- During January, Bitcoin’s market cap peaked near $1.93 trillion on the back of new all-time-high prices above $97,000.

- Bitcoin dominance is hovering around 59%, with altcoins collectively representing roughly 41% of total crypto capitalization.

- Ethereum’s live market cap is about $339 billion, keeping it at roughly 19% of Bitcoin’s valuation.

- Ethereum’s market cap has fluctuated between roughly $344 billion and $370 billion in late January, mirroring volatility across majors.

- Forecasters see Bitcoin’s market cap trading in a wide band between roughly $1.7 trillion and $2.7 trillion this year, depending on ETF flows.

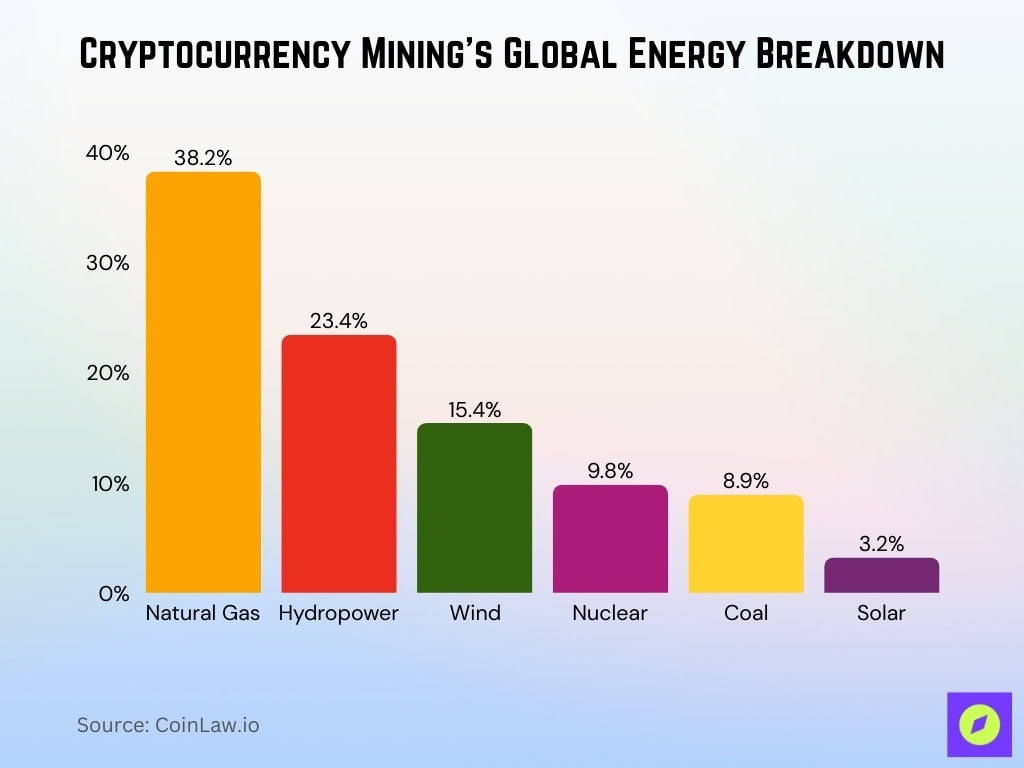

Cryptocurrency’s Environmental Impact

- Natural gas provides about 38.2% of mining energy, while coal has dropped to around 8.9% of the global Bitcoin energy mix.

- Hydropower supplies roughly 23.4% of Bitcoin’s mining electricity, with wind at 15.4%, nuclear 9.8%, and solar 3.2%.

- Bitcoin’s annual electricity demand is estimated between 155–176 TWh, roughly 0.5–0.6% of global consumption, and comparable to countries like Poland.

- Cambridge CBECI mid-range estimates put Bitcoin’s yearly energy use around 95–173 TWh, with continuous draw near 10–13 GW.

- Renewable and sustainable sources now power about 52.4–55% of Bitcoin mining.

- Bitcoin mining’s global carbon footprint is estimated to be near 39–98 million metric tons CO₂ annually, depending on methodology.

- Energy per Bitcoin mined has risen to about 209 MWh per coin, up from roughly 202 MWh the previous year, as difficulty increases.

- U.S.-based miners consume around 152–175 TWh annually for Bitcoin, with daily usage near 158 GWh according to recent estimates.

Bitcoin Trading Volume

- Bitcoin’s latest 24-hour trading volume is $63.6 billion, with a 7-day average near $106.6 billion across global markets.

- Over the last 7 days, Bitcoin has processed about $746 billion in cumulative trading volume, averaging $106.6 billion per day.

- Coinbase alone handled 218,514 Bitcoin trades in the last 24 hours, with 157,586 buyers and 69,071 sellers on the platform.

- Bitcoin currently accounts for roughly 60% of total crypto trading volume on Coinbase, reflecting its status as the most traded asset there.

- On Binance, a sample trading day in late January saw Bitcoin volume around $1.26 billion despite a 2.86% price drop to about $86,670.

- Bitcoin’s total on-chain transactions have reached 1.302 billion all-time as of January 28, up 13.42% from 1.148 billion a year earlier.

- Daily Bitcoin on-chain transactions are currently growing at an average annual rate of about 120.9%, indicating accelerating settlement activity.

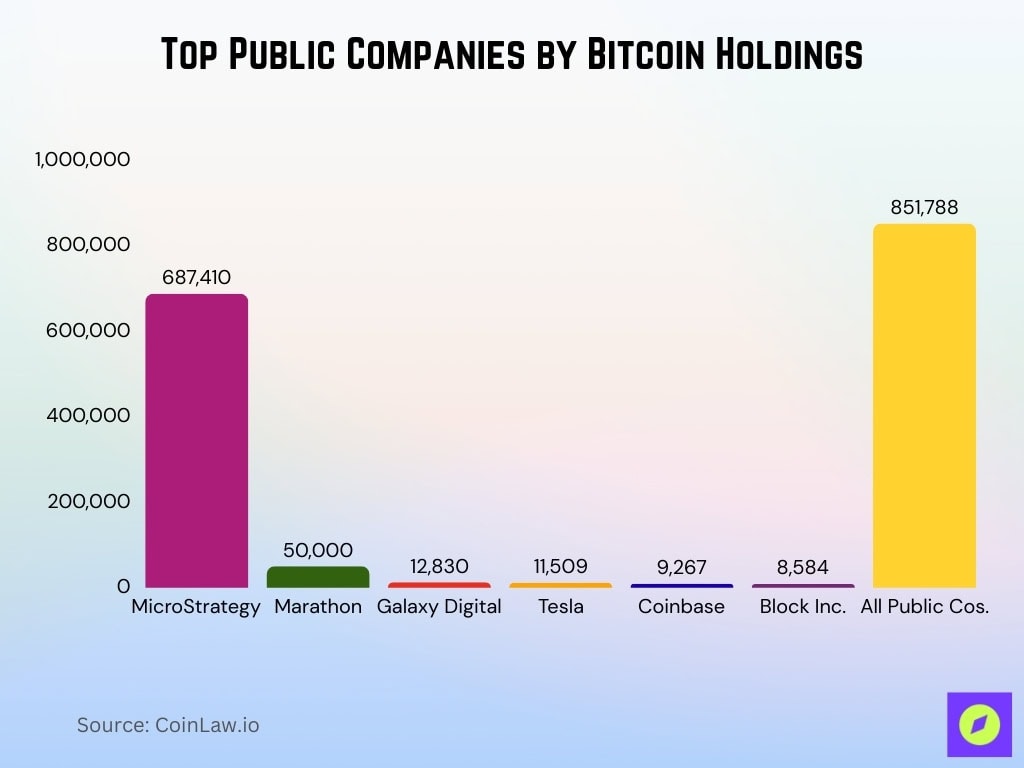

Biggest Public Companies with Bitcoin

- MicroStrategy (Strategy Inc.) now holds 687,410 BTC worth roughly $55–$65 billion, equal to about 3.5% of the total Bitcoin supply.

- Strategy previously reported 673,783 BTC valued at $50.55 billion as of January 4, before adding another 13,627 BTC the following week.

- Tesla holds 11,509 BTC valued at over $1.3 billion, keeping it among the largest corporate Bitcoin treasuries.

- Public companies collectively hold about 851,788 BTC worth more than $101.3 billion, representing 4.28% of the total Bitcoin supply.

- Marathon (MARA Holdings) controls around 50,000 BTC worth nearly $6.0 billion, making it the second-largest public holder.

- Galaxy Digital’s treasury includes about 12,830 BTC valued at roughly $1.53 billion across its holdings.

- Coinbase holds approximately 9,267 BTC worth about $1.10 billion, while Block Inc. owns 8,584 BTC valued at nearly $1.02 billion.

Price Performance of Bitcoin

- Bitcoin is trading around $82,134 on January 30 after sliding from the $89,000 zone earlier in the week.

- Bitcoin set a fresh all-time high above $126,198 on October 6, 2025, before correcting more than 30% into early this year.

- Intraday, Bitcoin has recently ranged between lows near $82,000 and highs around $89,198, reflecting elevated short-term volatility.

- Historical data show a daily gain record this year of +$4,128.79 on January 13, underscoring sharp single-day price swings.

- Forecast tables project Bitcoin’s short-term price near $88,648–$89,195, with an average around $88,921 over the coming days.

- Longer-horizon models see potential moves toward $100,000–$111,000 this year, with average monthly prices projected above $106,000 later on.

- Over 93% of all Bitcoin (about 19.68 million BTC) has already been mined, leaving roughly 1.32 million BTC unmined and reinforcing scarcity.

- Analysts estimate 17–20% of total BTC (around 3–4 million coins) are permanently lost, reducing the effective maximum supply to roughly 17 million BTC.

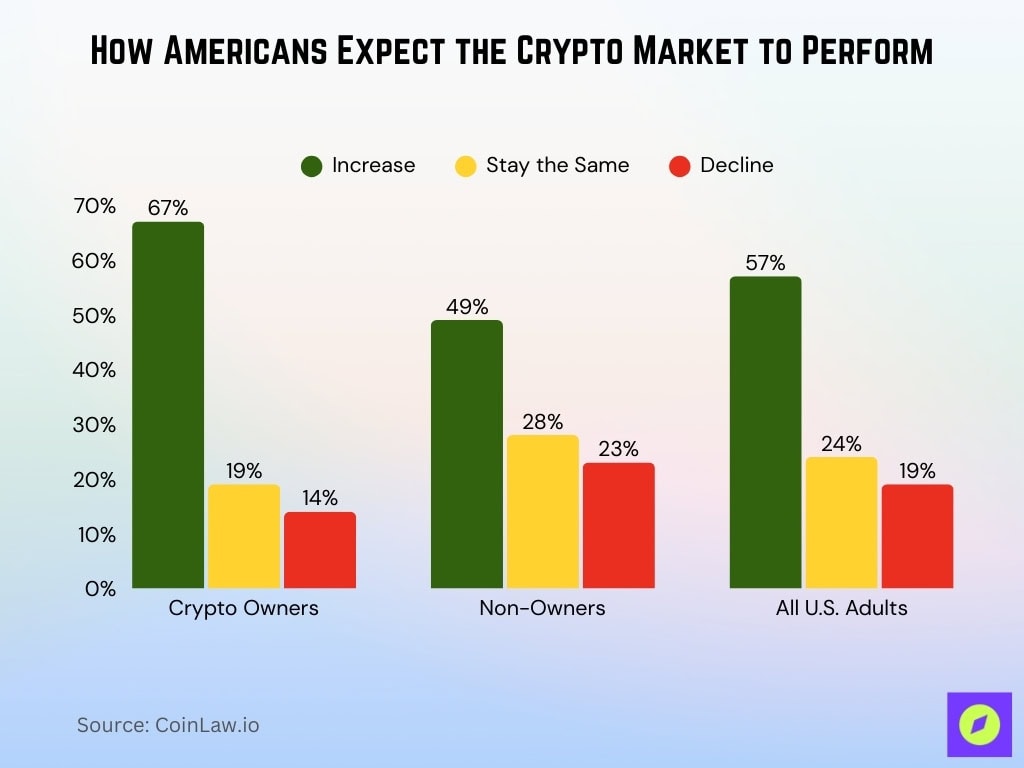

Expectations for Cryptocurrency Market Performance

- Among current crypto owners, 67% expect the market to increase, 19% think it will stay the same, and 14% foresee a decline.

- Among non-owners, 49% expect the market to increase, 28% think it will stay the same, and 23% anticipate a decline.

- Across all U.S. adults surveyed, 57% expect crypto markets to increase, 24% think they’ll stay the same, and 19% expect a decline.

- 61% of current crypto owners plan to buy more within 12 months, while only 6% of non-owners plan to enter the market.

- Overall, more than 50% of Americans anticipate higher crypto values this year, while fewer than 20% expect prices to drop.

- Survey data show 29% of Americans cite potential price increases as the top perceived benefit of crypto investing.

- Institutional surveys indicate 53–58% of investors expect crypto performance this year to be better than last year, with the rest neutral or cautious.

Cryptocurrency Statistics: Investors and Demographics

- Approximately 30% of American adults, or 70.4 million people, own cryptocurrency today.

- Global cryptocurrency owners reached 741 million in 2025, a 12.4% annual increase from 659 million users in 2024.

- Bitcoin owners rose 8.3% to 365 million, now accounting for 49.3% of all crypto owners worldwide.

- Ethereum owners grew 22.6% to 175 million, representing 23.6% of global cryptocurrency users.

- In 2025, crypto payment users in the US grew 24.8% to 4.9 million adults using digital assets for purchases.

- A recent report finds 28–30% of American adults own crypto, with adoption particularly strong among ages 30–44.

- Global crypto adoption climbed to 741 million users, with Bitcoin and Ethereum together representing over 70% of all owners.

- Institutional surveys show 74% of family offices are now exploring or investing in digital assets.

Frequently Asked Questions (FAQs)

74% of cryptocurrency holders reported owning Bitcoin in 2026.

The Bitcoin network hash rate saw averages near 1,024 EH/s with pullbacks from a late‑2025 peak.

Technical indicators showed a 13% bullish sentiment with approximately 47% green days in a recent 30‑day window.

In 2025, about 69% of the total Bitcoin supply was held by long‑term holders, reducing liquid circulation.

Conclusion

Bitcoin’s role as a major asset class continues to solidify. With growing institutional adoption, strong price performance, and ongoing technological advancements, Bitcoin remains at the forefront of the cryptocurrency market. However, challenges such as environmental impact and regulatory hurdles must be addressed to ensure sustainable growth. Investors, companies, and governments worldwide are increasingly embracing Bitcoin as both a store of value and a medium of exchange, indicating a promising future for the world’s first cryptocurrency.