Bitcoin is facing renewed pressure as over $2.6 billion exits U.S. spot ETFs, extending a six-day streak of outflows and pushing BTC below key support.

Key Takeaways

- Bitcoin and Ethereum ETFs have seen six straight days of outflows, with total withdrawals surpassing $2.6 billion.

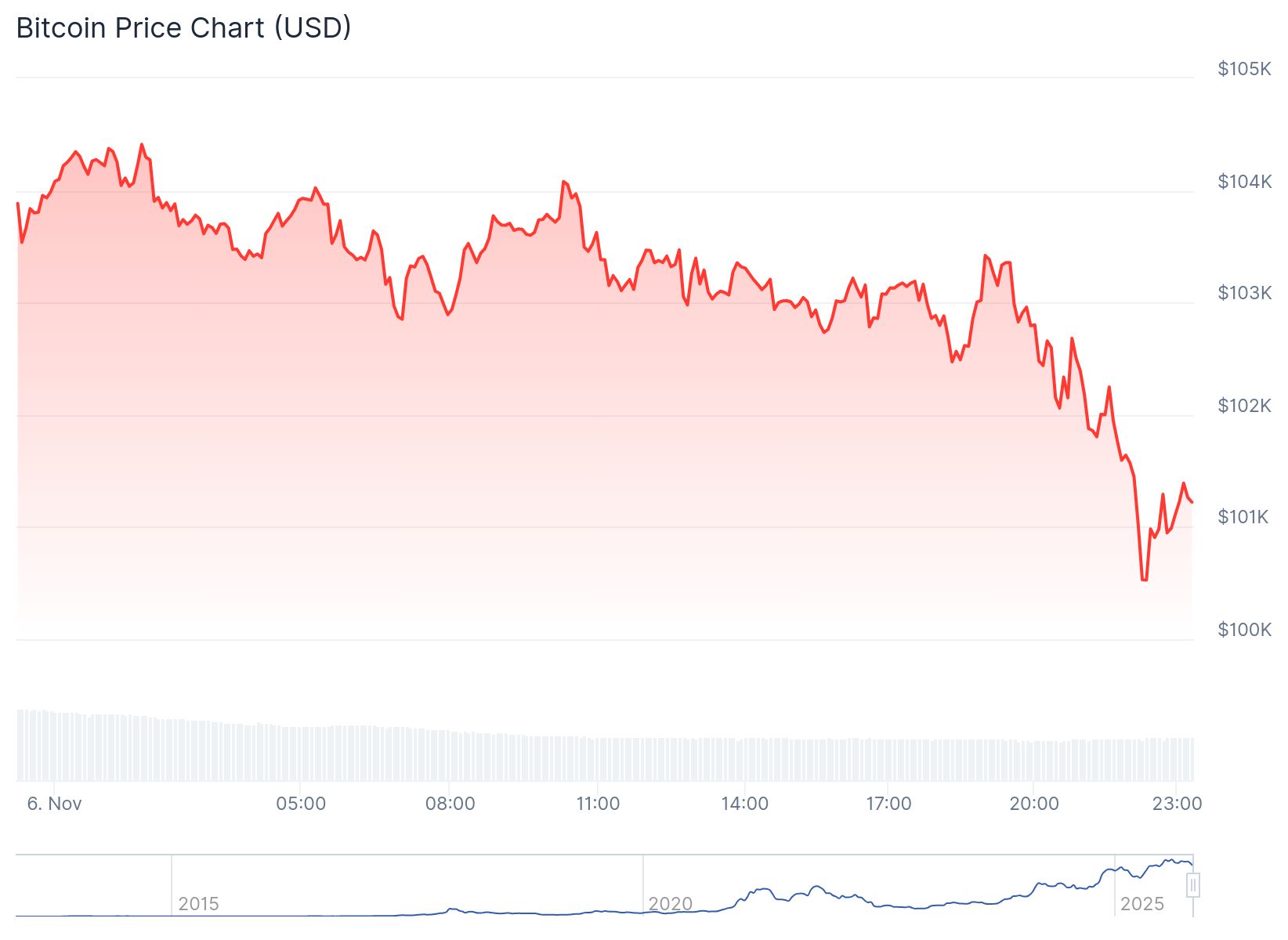

- Bitcoin dipped below $99,000 before recovering to $103,000, but market sentiment remains weak and cautious.

- BlackRock’s iShares Bitcoin Trust (IBIT) led the exodus, recording over $375 million in daily outflows.

- Analysts warn that BTC may retest $92,000, citing a CME gap and fading buying momentum.

What Happened?

Bitcoin’s price has come under pressure following sustained outflows from U.S. spot ETFs, which have now lasted six consecutive trading days. Combined data from multiple sources shows more than $2.6 billion pulled from Bitcoin and Ethereum ETFs since October 29. The pullback has sparked fears of a broader correction, with analysts eyeing $92,000 as a potential target before any recovery can take hold.

$BTC is back above the $103,000 level.

— Ted (@TedPillows) November 6, 2025

This is a key level for Bitcoin to hold; otherwise, there’ll be another low.

I still don’t feel confident about this rally and think that BTC could fill the CME gap at the $92,000 level. pic.twitter.com/09sKmA5ak1

Bitcoin ETF Outflows Hit $2.6 Billion

U.S. spot Bitcoin ETFs saw $137 million in net outflows on November 5, extending a downward trend that began on October 29. Across the past week, investors have withdrawn $1.9 billion from Bitcoin ETFs and $718.9 million from Ethereum ETFs, marking one of the largest redemption periods in the sector’s history.

Despite some funds like Fidelity’s FBTC ($113 million) and Ark & 21Shares’ ARKB ($83 million) posting inflows, these gains were outweighed by significant outflows. BlackRock’s IBIT alone accounted for $375 million in withdrawals, dragging the entire sector into the red.

Trading activity was also muted, with only half of the twelve ETF issuers recording any trading activity. ETF data shows that the net asset value of Bitcoin spot ETFs now stands at $139.1 billion, with a net asset ratio of 6.72%. While that still reflects strong institutional participation overall, the recent pullback underscores growing caution.

Price Action Weak Despite Recovery

Bitcoin managed to climb back above $103,000, recovering from an earlier low near $99,000, but analysts say the rebound lacks conviction. The digital asset has fallen over 7% in the past week and more than 16% over the past month, bringing it roughly 20% below its recent all-time high.

Analysts flagged the $92,000 CME gap as a potential liquidity target, which could prompt a controlled correction. As Ted Pillows noted, this kind of move may help flush out excessive leverage and allow for healthier accumulation afterward.

“Bitcoin remains vulnerable after reclaiming the $103,000 level,” said Pillows, adding that buyer momentum appears weak between $102K and $95K, where sellers still dominate.

Technical patterns suggest BTC is still within its long-term ascending channel formed earlier in 2024. Some analysts believe this reflects a consolidation phase rather than a breakdown, although they caution that resistance at $106,000 may cap any short-term rallies unless buying strength returns.

Ethereum and Solana ETFs Show Mixed Signals

Ethereum spot ETFs also recorded a sixth day of outflows, losing $119 million, with BlackRock’s ETHA fund leading the retreat. However, Grayscale and Fidelity’s ETH funds posted modest inflows, suggesting some resilience among long-term holders.

Interestingly, Solana ETFs bucked the trend, with a net inflow of $9.7 million on the same day. Bitwise’s BSOL fund led with $7.5 million, followed by Grayscale’s GSOL with $2.2 million, indicating that investors are diversifying into alternative assets amid Bitcoin and Ethereum turbulence.

Expert Perspectives: Macro Concerns Linger

Several analysts linked the outflows to macro uncertainty, including the ongoing U.S. government shutdown, trade tensions with China, and a shrinking chance of further interest rate cuts in 2025.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, framed the current drawdown as part of a “two steps forward, one step back” growth pattern for crypto ETFs. He emphasized that volatility is expected, especially given the asset class’s youth.

Financial advisor Ric Edelman added that the fact BTC prices haven’t completely crashed is a testament to underlying institutional strength, suggesting a maturing market that can handle such pullbacks.

CoinLaw’s Takeaway

In my experience, ETF flows act as a major sentiment signal, especially for institutional traders. When over $2.6 billion leaves the space in less than a week, it’s not just noise. This tells me that many big players are sitting on the sidelines waiting for clarity. Still, I don’t see this as a structural collapse. The Bitcoin market has matured, and corrections like this are part of the cycle. If anything, I’d say this is a healthy reset that might pave the way for stronger, more committed inflows in the future.