Bitcoin Cash (BCH) remains one of the top cryptocurrencies nearly a decade after its launch in 2017 as a fork of Bitcoin aimed at enabling low‑fee, peer‑to‑peer payments. Its design prioritizes faster confirmations and larger blocks to support real‑world payments and scalability. BCH’s influence spans merchant payments globally and algorithmic trading strategies that exploit its liquidity and low fees. As the crypto market evolves, readers should understand these key statistics and trends shaping Bitcoin Cash’s present and future performance. Explore the full article for detailed insights.

Editor’s Choice

- Market cap: Approximately $12.8 billion in early 2026.

- 24‑hour trading volume: Roughly $572 million, highlighting active trading.

- Circulating supply: ~19.97 million BCH.

- Max supply: Capped at 21 million BCH.

- All‑time high price: $4,355.62 (Dec 2017).

- Holders: Around 34.5 K unique holders on main tracking platforms.

- Top addresses control ~45% of supply.

Recent Developments

- In late 2025, BCH price forecasts for 2026 suggest a wide range from $404 to $944, depending on the model used.

- Forecasts show BCH possibly averaging $830+ in 2026 under bullish assumptions.

- Some analysts project BCH could reach $1,500+ in favorable conditions during 2026.

- BCH liquidity continues to be strong on major centralized exchanges.

- Algorithmic trading strategies increasingly deploy BCH due to its 24/7 markets and deep liquidity.

- BCH network upgrades (like CashTokens) broaden on‑chain use cases.

- Exchange listings and delisting rumors influence trader sentiment.

- Futures markets (e.g., BCH/USD) offer hedging tools on platforms such as Kraken.

Bitcoin Cash Price Breakout and Weekly Momentum

- Bitcoin Cash surged 8% this week, signaling renewed bullish momentum in the market.

- Price broke above the $500 resistance level, confirming a key technical breakout.

- $500 now acts as support, increasing confidence in trend continuation.

- Upside target stands at $536, based on the post-breakout projection shown on the chart.

- Price traded in the $500–$510 zone following the breakout, indicating consolidation above resistance.

- Overall visible price range spans $400 to $540, highlighting the scale of the recent move.

- Ascending trendline from near $400 confirms a pattern of higher lows and strengthening structure.

- Multiple green candlesticks reflect sustained buying pressure and positive sentiment.

- Weekly timeframe performance underscores the significance of the move rather than short-term volatility.

Market Capitalization and Trading Volume

- BCH’s market capitalization is about $12.8 billion, ranking it among the top 15 largest cryptos.

- 24‑hour trading volume has fluctuated around $570 million–$600 million, indicating active market participation.

- BCH maintains significant volume on Binance, Pionex, and Coinbase.

- Volume to market cap ratio suggests reasonably liquid conditions relative to other assets.

- BCH market cap has remained in billions despite broader crypto market declines.

- BCH market share shrinks slightly when BTC and ETH outperform.

- Daily volatility can lift volume spikes on news and macro events.

Liquidity, Order Book, and Volatility Metrics

- In early 2026, BCH’s 24h spot volume averages around $130 million–$150 million on major exchanges, supporting high‑frequency trading strategies.

- Combined order book depth for BCH/USDT across top venues often exceeds $50 million within ±2% of mid‑price, helping reduce slippage on large tickets.

- BCH’s 30‑day price volatility sits near 5.07%, with 16/30 days closing green, indicating tradable swings around key events.

- Around projected 2026 catalysts, BCH’s liquidity concentration on the top 5 exchanges typically accounts for over 70% of total centralized exchange volume, shaping execution quality.

- BCH’s growing transaction volume rose about 50% YoY in Q4 2025, improving historical liquidity conditions for algotrading into 2026.

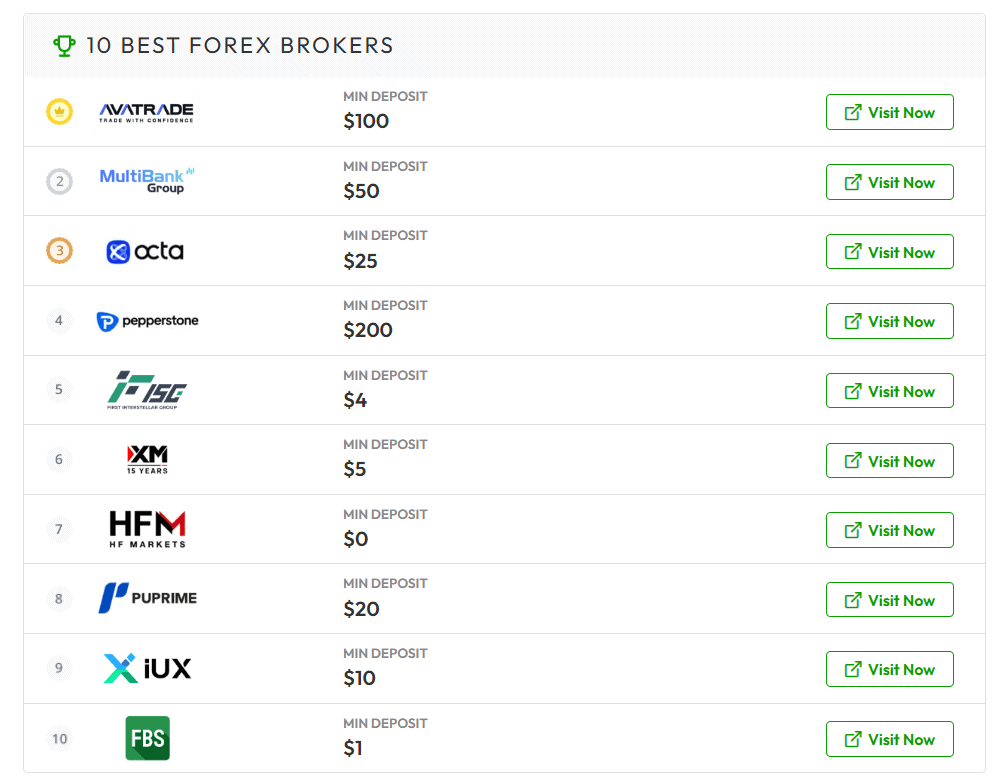

Minimum Deposit Requirements Among Top Forex Brokers

- Pepperstone requires the highest minimum deposit at $200, positioning it toward higher-capital traders.

- AvaTrade sets a $100 minimum deposit, aligning with mid-range entry requirements.

- MultiBank Group requires $50, offering a more accessible starting point than many major brokers.

- Octa lists a $25 minimum deposit, appealing to cost-conscious retail traders.

- PU Prime allows entry with just $20, lowering the barrier for new participants.

- IUX requires a $10 minimum deposit, catering to small-budget traders.

- XM sets a $5 minimum deposit, making it highly accessible for beginners.

- First Interstellar Group (FIG) requires only $4, ranking among the lowest entry thresholds.

- FBS offers a $1 minimum deposit, one of the smallest capital requirements in the market.

- HFM (HF Markets) stands out with a $0 minimum deposit, removing capital barriers entirely for account opening.

Daily, Weekly, and Year‑to‑Date Price Changes

- Daily price ranges in this period have fluctuated between roughly $638 and $654 over 24‑hour intervals.

- Weekly price changes recently showed a 7‑day range of approximately $587 to $658.

- Year‑to‑date performance into early Jan 2026 shows moderate volatility with narrow swings relative to larger crypto assets.

- Monthly forecasts project BCH prices moving gradually higher through 2026, e.g., $649 in Jan, $663 in Jun 2026 per trend model.

- Some projections anticipate annual average prices near $830.53 in 2026 across monthly periods under optimistic scenarios

- Recent monthly outlooks suggest ~8.5% growth potential in price by the end of Jan 2026 from mid-December levels.

- The width of daily price bands indicates that BCH experiences consistent intraday volatility typical of mid‑cap cryptos.

All‑Time High, All‑Time Low, and Major Drawdowns

- BCH reached its all‑time high of about $3,785.82 on Dec 20, 2017.

- BCH’s all‑time low was $76.93 on Dec 16, 2018.

- The current trading value remains over 80% below its all‑time peak, underscoring long‑term drawdown.

- Major drawdowns have coincided with broader bear markets in crypto, e.g., 2018–2019, 2022.

- BCH’s drawdown from peak positions often exceeds 70% in extended corrections.

- Bull runs tend to occur alongside Bitcoin rallies, showing correlated upside during BTC strength periods.

- Relative lows in mid‑2025 saw prices retreat near support zones around $300–$500.

- Historical volatility suggests significant drawdowns can persist for months to years before recovery.

- BCH typically experiences higher relative drawdowns than Bitcoin during downturns.

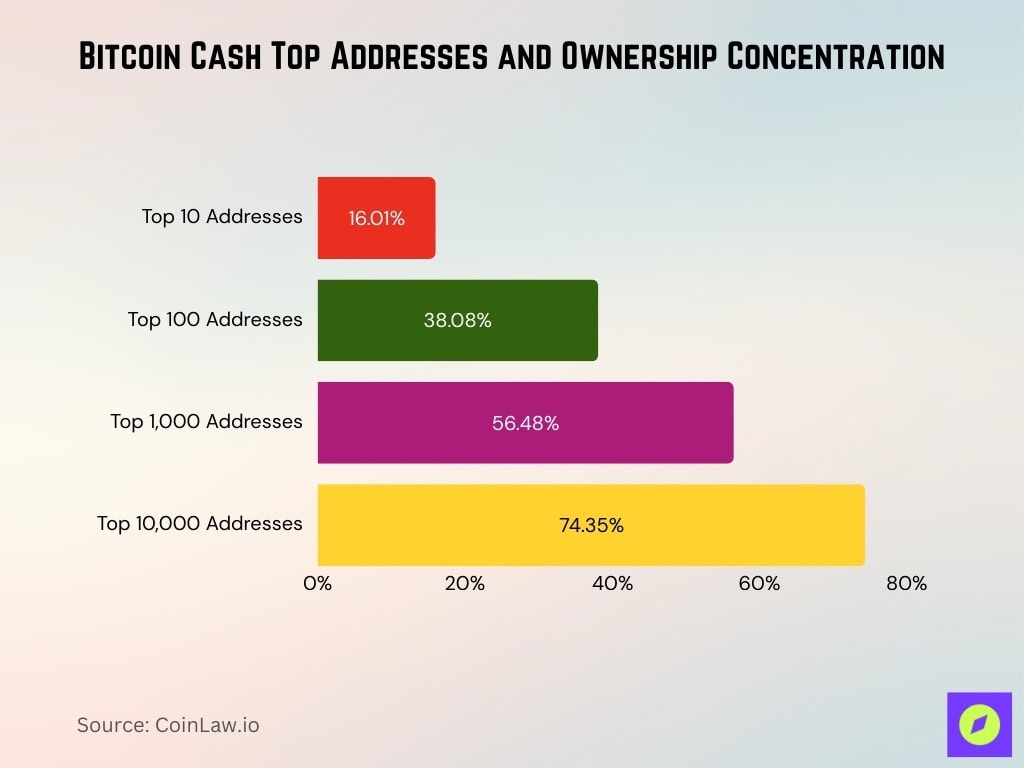

Top Addresses and Ownership Concentration

- The top 100 richest BCH addresses hold an estimated 38.08% of the total BCH supply, indicating moderate concentration.

- The largest 10 addresses alone control ~16.01% of BCH’s circulating supply.

- The top 1,000 addresses collectively control 56.48% of the BCH supply.

- The top 10,000 addresses hold 74.35% of BCH.

- Active BCH addresses counted ~18,959 in 24h, reflecting sustained usage.

- In the past 24 hours, BCH addresses collectively sent ~85,501 BCH, equal to over $55.5 million in volume.

- Average transaction value stood at ~8.31 BCH (~$5,400).

- Median transaction value was 0.492 BCH (~$320).

- Active transfer metrics illustrate BCH’s dual nature as both a speculative and utility asset.

Bitcoin Cash Price Correlation with Bitcoin

- BCH exhibits a positive correlation with BTC, recently gaining 7.6% vs BTC’s 5% in a rally.

- BCH/BTC pair at 0.00702 BTC indicates a tight price linkage in 2026.

- Correlation coefficient reaches up to 0.93 with BTC in strong market phases.

- BCH positively correlated with top coins at an 0.82 index, excluding stables.

- BCH is up 13.68% against BTC over the last 30 days, showing directional alignment.

- 50% green days for BCH with 3.55% volatility tied to BTC trends.

- BCH maintains a positive correlation during BTC weakness phases in 2026.

- Historical monthly correlation ranges from moderate to high, 0.61-0.93.

Energy Usage Estimates for Bitcoin Cash Mining

- BCH network hashrate at 6.93 EH/s, consuming electricity proportional to SHA-256 share.

- BTC network hashrate reaches 1069 EH/s (1.069 ZH/s), powering dominant mining energy.

- BCH hashrate represents ~0.65% of total BTC hashrate, dictating its energy allocation.

- 390 TH/s BCH mining rig uses 7215 W at $0.05/kWh, costing $8.67 daily.

- Bitcoin annual energy ~138 TWh with BCH footprint scaled by lower hashrate.

- Bitcoin consumes 0.5% global electricity; BCH adds marginal SHA-256 demand.

- BTC emissions steady at 39.8 MtCO2e; BCH benefits from shared sustainable sources.

- 52.4% Bitcoin mining uses renewables, influencing BCH pooled operations.

- BTC carbon intensity 288.2 gCO2e/kWh applies to BCH hardware pools.

- BCH mining profitability ties to $0.05/kWh average power costs.

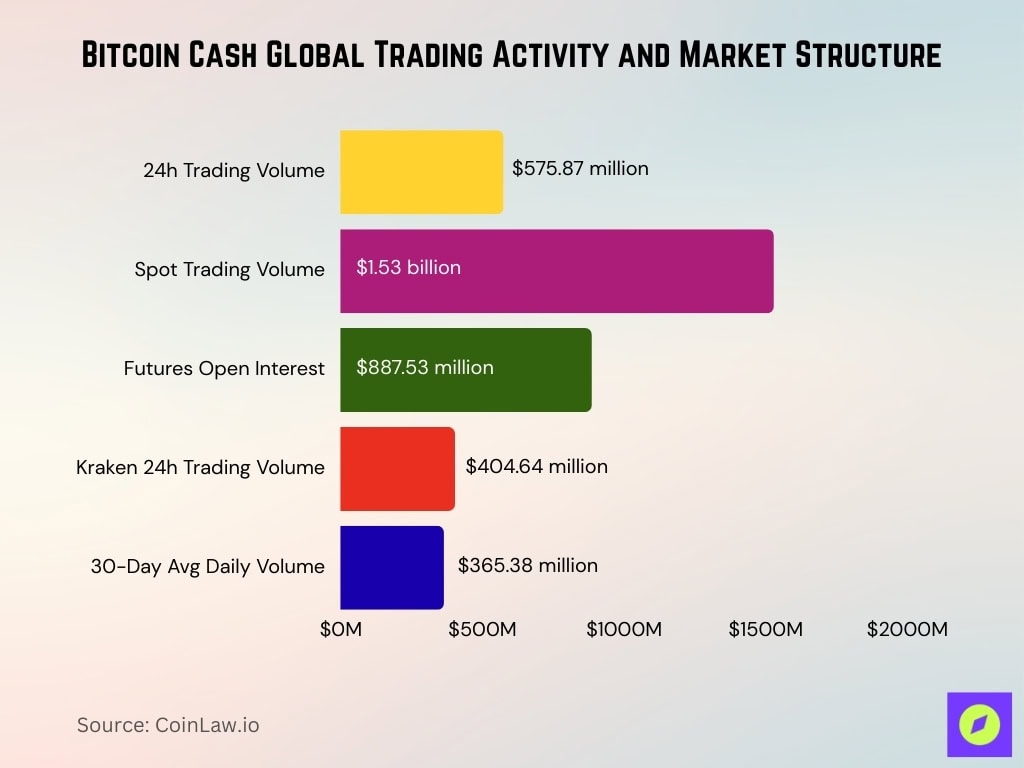

Global Trading Activity and Market Structure

- BCH 24h trading volume reaches $575.87 million across centralized exchanges.

- Spot volume totals $1.53 billion with futures open interest $887.53 million.

- Kraken records 782,237 BCH traded worth $404.64 million in 24h.

- 30-day trading volume averages $365.38 million with 2,050 daily trades on Coinbase.

- Volume-to-market cap ratio at 4.5% indicating solid liquidity.

- BCH trades on Binance, Coinbase, and Kraken, leading CEX platforms.

- Circulating supply 19.97 million BCH supports USD, USDT, BTC, and ETH pairs.

- BCH holds 34.47 thousand unique holders amid global 24/7 market activity.

- Vol/Mkt Cap (24h) 4.5% reflects heightened activity in rallies.

Circulating, Total, and Maximum Supply

- BCH has a circulating supply of roughly 19.97 million coins.

- The maximum supply of BCH is capped at 21 million coins.

- The protocol ensures that supply never exceeds 21 million BCH.

- As of late 2025, the circulating supply sits at about 95% of the maximum cap.

- Total supply counts include those in circulation plus locked and reserve coins.

- BCH supply progression slows over time due to scheduled halvings.

- Full supply will be approached near 2140 as block rewards diminish.

- Supply scarcity is a key factor in BCH’s long‑term valuation models.

- The mined proportion of BCH has increased steadily year‑to‑year.

Inflation Rate and Issuance Schedule

- BCH’s inflation rate drops after every halving, reducing new coin issuance.

- The most recent halving in April 2024 cut the block reward to 3.125 BCH per block.

- This halving lowered BCH’s inflation rate by roughly 50%.

- Halvings occur every 210,000 blocks, or about every four years.

- Post‑2024, annual inflation rates continue a downward trend toward near zero by 2140.

- The issuance schedule impacts miner reward economics and market supply.

- Lower inflation often correlates with upward price pressure.

- Historical inflation periods correspond with higher supply growth.

- BCH’s slow issuance schedule supports its use case as digital cash.

Bitcoin Cash Network Hashrate and Security

- The current BCH network hashrate stands at 6.57 EH/s at block 932,450.

- BCH mining difficulty reaches 999.83 G with -1.31% 24h decrease.

- Network hashrate alternative estimate 6.93 EH/s equaling 6,925 PH/s.

- All-time high BCH hashrate hit 16.55 EH/s on Aug 20, 2025.

- BCH difficulty at block 932,455 totals 993,348,330,226.50.

- 7-day difficulty change -0.77% while 30-day up 9.35%.

- 90-day difficulty increased 40.11% bolstering network security.

- BCH block reward fixed at 3.1264-3.1269 BCH.

- Average block time targets ~10 min via difficulty adjustments.

- Shared SHA-256 PoW ensures robust security mirroring Bitcoin.

Transaction Throughput, Fees, and Scalability

- BCH processes on‑chain transactions with lower fee structures compared to Bitcoin.

- Average transaction fee stays extremely low, often less than $0.01 per transaction.

- In the last 24 hours, there were ~10,293 BCH transactions on the blockchain.

- Average block time is around 10 m 35 s.

- BCH throughput benefits from larger blocks, increasing capacity.

- Median transaction fee remained around 0.0000037 BCH (~$0.0024).

- Scalability via on‑chain capacity supports BCH’s electronic cash goal.

- BCH block size (up to 32 MB) supports higher throughput.

- Transaction value metrics suggest a mix of retail and larger transfers.

Merchant Adoption and User Demographics

- 2,476 merchants worldwide accept BCH via 82 payment gateways like BitPay.

- BCH ranks 4th most accepted cryptocurrency after BTC, ETH, and LTC.

- Thousands of businesses integrate BCH through processors, including Coinify.

- 34% popularity share among listed cryptocurrencies on merchant platforms.

- 2,468 merchants confirmed accepting BCH per Cryptwerk’s recent data.

- Over 2,550 merchants accept BCH, concentrated in online retail, tourism.

- Top countries: USA, Slovenia, UK lead BCH-accepting businesses.

- 55% new crypto users aged 18–34 drive BCH remittance, and small merchants use.

- Shops, online markets dominate the BCH sectors with strong everyday spending.

- 93% crypto-accepting firms take BTC, but BCH trails in merchant rates.

Frequently Asked Questions (FAQs)

BCH trades around $594 – $652 per coin, depending on the exchange and live feed.

Bitcoin Cash’s average network hashrate is near 7.47 EH/s.

BCH posted a +10.89% gain over the past 7 days and +36.82% year‑on‑year in one report.

The maximum supply of Bitcoin Cash is 21 million BCH.

Conclusion

Bitcoin Cash remains a statistically rich and distinctive cryptocurrency, balancing market liquidity, broad exchange access, and practical use cases. Its ownership concentration and global trading activity show active participation across retail and institutional layers. BCH’s hashrate and transaction throughput highlight a secure, scalable network, while transaction fees support micro and merchant payments.

Adoption continues globally, albeit behind some larger networks, underscoring BCH’s role as a digital cash alternative with evolving real‑world use. As the crypto ecosystem advances, these metrics form a robust basis for evaluating BCH’s role through this cycle and beyond.