1. What Is Cloud Mining?

Cloud mining enables users to mine cryptocurrencies without the need for expensive hardware or the costs associated with electricity and maintenance. Instead, you rent computing power (hashrate) from remote data centers, and the platform handles all the mining work while you receive daily payouts.

Compared to traditional GPU or ASIC mining, cloud mining removes the technical barriers and hardware hassles. It’s ideal for everyday investors seeking passive crypto income with minimal risk.

By 2025, cloud mining cryptocurrency has become one of the most popular and accessible investment options in the U.S. market, valued for its simplicity, transparency, and legal compliance.

2. AutoHash: A Swiss-Regulated Cloud Mining Platform Powered by Green Energy

Among the many cloud mining services available today, AutoHash stands out as one of the most trusted Swiss-registered platforms.

Headquartered in Zug, Switzerland’s Crypto Valley, AutoHash operates under KYC, AML, and FINMA regulatory standards, known for its exceptional transparency and safety.

Backed by Swiss and Nordic renewable energy networks, AutoHash runs its mining operations on hydropower, wind, and geothermal energy, achieving high efficiency and low carbon emissions. Users can track their earnings in real time through the iOS, Android, or web app, with withdrawals processed in just 3 minutes on average.

New users can also claim a $100 free hash power trial, allowing them to test real profits before committing any investment.

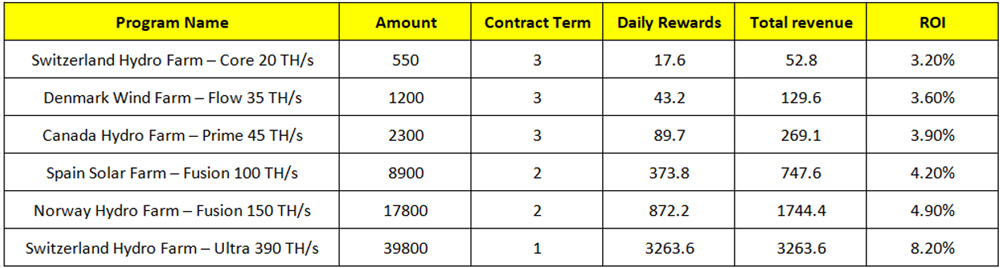

AutoHash Mining Contracts (2025 Standard)

👉 Visit AutoHash to claim $100 and view the full contract!

💬 Reddit User Review:

“I tried AutoHash for a week, withdrawals were fast, and the process felt transparent and legit. Definitely one of the few mining apps that actually delivers.”

3. Five Tips to Maximize Your Bitcoin Mining Profit

To achieve consistent returns like those of AutoHash users, a smart strategy is essential.

Here are five practical tips to help you get the most out of cloud mining:

- Choose short-term contracts for faster returns

1–3 day contracts help you lock in profits quickly and react to market volatility. - Use a reinvestment strategy

Reinvest your daily profits into new contracts to steadily increase your total ROI. - Focus on mining efficiency

Pick platforms that adjust their mining allocation dynamically to maximize hashrate output. - Diversify your investments

Don’t rely on just one service; split your funds across multiple legitimate platforms to reduce risk. - Track market trends and Bitcoin difficulty

Energy costs and Bitcoin price movements can impact profitability; stay informed and adapt early.

4. Key Cloud Mining Trends in 2025

| Trend | Description |

| Green Energy Mining | Clean power reduces electricity costs and carbon footprint |

| Smart Allocation | Algorithms optimize pool selection and improve efficiency |

| Mobile Accessibility | Apps let you monitor profits and contracts anytime |

| No Hardware Needed | Rent cloud hashrate directly and start mining instantly |

| Regulatory Compliance | Swiss, UK, and Canadian-registered companies lead in trust |

5. Is Cloud Mining Still Worth It in 2025?

With Bitcoin halving and rising network difficulty, profitability is one of the hottest topics among investors. Overall, cloud mining can still be profitable, but the outcome depends on each platform’s energy cost, algorithm efficiency, and contract design.

Mining centers powered by hydroelectric, wind, or geothermal energy can significantly cut costs, while platforms with intelligent allocation systems can automatically adjust mining strategies for better stability. Short-term and transparent contracts give users more control over risk and liquidity, and platforms with legal registration and fast withdrawals ensure a safer investment environment.

In short, cloud mining in 2025 remains a viable passive income option, provided you choose a regulated, transparent, and green-energy-driven platform that focuses on long-term sustainability.

6. How to Choose a Reliable Cloud Mining Platform

Before investing, always verify the company’s background and transparency.

Reputable platforms publish registration details, physical addresses, and regulator information.

For example, AutoHash is registered in Zug, Switzerland, and operates under FINMA-compliant standards.

Also, check payout schedules, withdrawal speeds, and user feedback on communities like Reddit or Trustpilot.

Start small with free hash power or low-entry contracts, then scale up gradually once you confirm consistent returns.

Remember: always invest only what you can afford to lose.

7. FAQ for U.S. Users

Yes. As long as the platform is properly registered and follows tax reporting laws, cloud mining is legal.

Some states, like California, limit energy-intensive operations, which is why many U.S. users prefer Swiss or UK-based cloud services.

No. All mining operations run on remote servers. Your device is only used to monitor earnings.

Individual investors don’t. Only companies that run mining operations are required to obtain business licenses.

It depends on the platform. Always choose transparent, regulated, and fast-withdrawal platforms like AutoHash.

Bitcoin (BTC) remains the leader, while Dogecoin (DOGE) and Ethereum Classic (ETC) are popular alternatives for lower-cost mining.

8. Conclusion: Turn Cloud Mining into Your Passive Income Engine

In 2025, cloud mining has evolved from a tech-heavy niche into a smart investment tool for everyone.

By choosing a Swiss-regulated, energy-efficient platform like AutoHash and applying the right reinvestment and diversification strategies, you can earn passive crypto income safely and sustainably.

👉 Start small with a free trial or short-term contract, test your returns, and scale up as you gain confidence.

With the right platform and strategy, cloud mining could be your gateway to steady digital wealth growth in 2025.

Third-Party Content Notice: This press release/article is provided by a third party, which is solely responsible for its content. It is published on CoinLaw exactly as received from the issuing organization, without any edits, verification, or endorsement by CoinLaw.

CoinLaw does not guarantee the accuracy, completeness, or reliability of the information. All investments involve risk, and readers should conduct their own research or consult a qualified advisor before making financial decisions. Any questions, concerns, or issues regarding this material should be directed to the original content provider.