Imagine receiving a text message from your bank about a suspicious transaction you didn’t authorize. Your pulse quickens as you realize someone has accessed your account. Banking fraud like this is an unfortunate reality for millions worldwide. In 2025, with the rapid digitalization of financial systems, fraud detection is not just a security feature – it’s a lifeline. This article explores key statistics and trends shaping fraud detection, emphasizing the need for robust measures to protect both consumers and institutions.

Editor’s Choice

- 65% of respondents reported check fraud attacks, making checks the most vulnerable payment method.

- 47% of Business Email Compromise (BEC) fraud targeted ACH credits, surpassing wires as the most vulnerable payment type.

- Over 50% of banks, fintechs, and credit unions reported an increase in business fraud, with over two-thirds noting a rise in consumer fraud.

- 35% of financial institutions experienced over 1,000 fraud attempts in the last year, with 1 in 10 facing over 10,000 attempts.

- 39% of Suspicious Activity Reports (SARs) were attributed to fraud.

- 25% of financial organizations reported over $1 million in fraud losses, while consumers reported cumulative losses exceeding $10 billion.

- Advancements in generative AI are projected to cost banks an estimated $40 billion by 2027 due to more sophisticated fraud attacks.

Prevalence of Banking Fraud

- 1 in 3 adults globally fell victim to banking fraud in 2023, highlighting its widespread impact.

- Online scams targeting bank customers rose by 28%, driven by phishing emails and fake banking apps.

- Fraud involving digital wallets like Apple Pay and Google Wallet increased by 31%, emphasizing vulnerabilities in mobile payment platforms.

- The US, UK, and India reported the highest rates of financial fraud globally, with a combined loss exceeding $22 billion.

- Fraudulent transactions involving cryptocurrencies surged by 35%, reflecting the expanding use of decentralized financial systems.

- A staggering 85% of businesses experienced payment fraud attempts in 2023, underscoring the threats to corporate entities.

- Social engineering attacks, such as impersonation scams, rose by 19%, indicating a shift towards more personalized fraud strategies.

Reasons for the Increase in Banking Fraud

- The increase in digital banking usage by 63% since 2020 has provided fraudsters with more opportunities to exploit weak security measures.

- Weak passwords were the root cause of 21% of banking fraud incidents, highlighting the ongoing need for consumer education.

- Data breaches, impacting 290 million records in 2023, provided fraudsters with sensitive information to execute targeted scams.

- The rise of deepfake technology has enabled fraudsters to impersonate individuals convincingly, leading to a 15% rise in identity theft cases.

- Lax security measures in smaller financial institutions contributed to 12% of reported fraud losses.

- The COVID-19 pandemic’s push towards remote financial services saw a 42% increase in fraud cases targeting online banking systems.

- Emerging markets witnessed a 27% spike in financial fraud due to their growing but under-secured banking infrastructures.

Fraud and Identity Theft By the Numbers

- Identity theft remained the top contributor to banking fraud, accounting for 42% of all cases reported in 2023.

- Approximately 33% of Americans reported experiencing identity fraud last year, a significant jump from 28% in 2022.

- Synthetic identity fraud losses reached $6 billion globally, marking a 24% year-over-year increase.

- In the US alone, new account fraud cases rose by 14%, with fraudsters exploiting gaps in credit card application processes.

- Mobile phone account takeovers surged by 31%, reflecting the vulnerabilities in telecom-linked financial services.

- Victims of identity theft spent an average of 200 hours resolving issues, with financial costs exceeding $5,000 per case for 15% of victims.

- Fraudsters leveraged biometric spoofing techniques to bypass security, leading to 18% more successful fraud attempts compared to the previous year.

| Metric | Value |

| Identity theft cases (2023) | 42% of fraud cases |

| Americans experiencing identity fraud | 33% |

| Synthetic identity fraud losses | $6 billion |

| US new account fraud cases | 14% increase |

| Mobile account takeovers | 31% increase |

| Average time spent resolving fraud | 200 hours |

| Cases costing over $5,000 per victim | 15% |

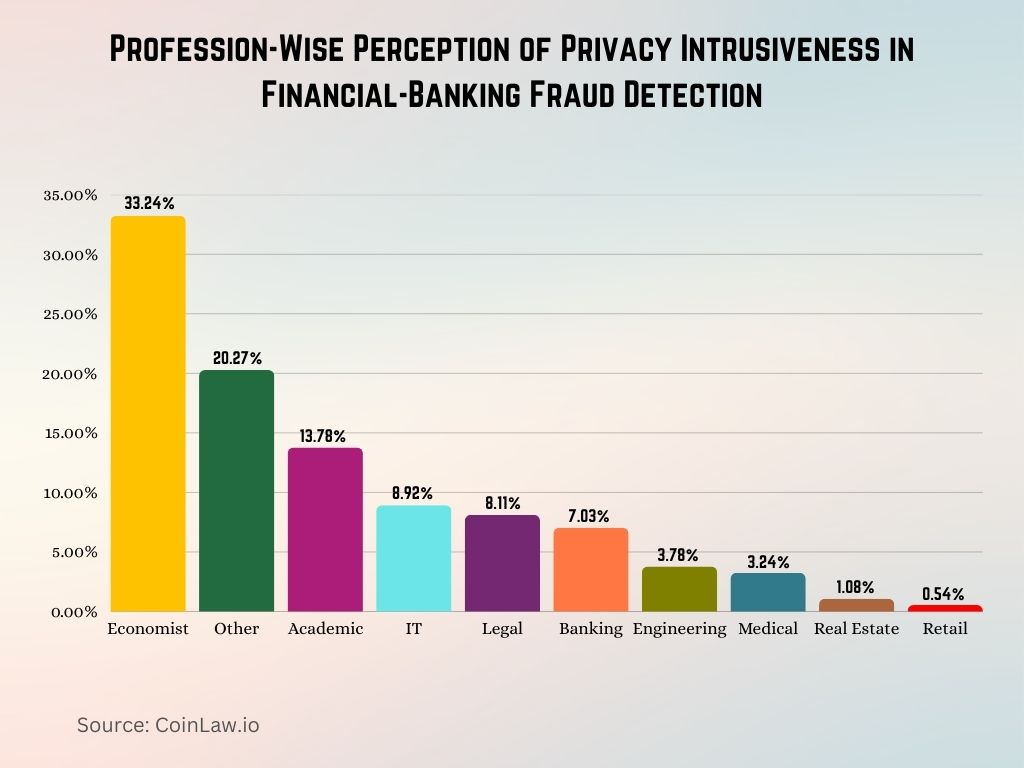

Profession-Wise Perception of Privacy Intrusiveness in Financial-Banking Fraud Detection

- The Economist group shows the highest concern, with 33.24% perceiving privacy intrusiveness in fraud detection systems.

- 20.27% of respondents from Other professions (not specifically listed) also reported privacy concerns, making it the second-largest group.

- Academics follow closely with 13.78%, indicating notable sensitivity to privacy implications.

- Professionals in Information Technology account for 8.92%, reflecting moderate concern, possibly due to deeper technical awareness.

- The Legal sector represents 8.11%, underscoring their attentiveness to data rights and compliance.

- Those in Banking, ironically the most directly involved industry, make up only 7.03%, perhaps indicating greater trust in internal systems.

- Engineering professionals contribute 3.78%, showing lower levels of concern compared to other technical fields.

- The Medical field accounts for 3.24%, likely reflecting mixed views on data use and confidentiality.

- Respondents from Real Estate make up just 1.08%, while those in the Retail sector are the least concerned, at 0.54%.

Common Types of Banking Fraud

- Phishing scams were the most common type of fraud, affecting 52% of victims in 2023, often through deceptive emails and fake banking websites.

- Card-not-present fraud (transactions where the cardholder isn’t physically present) accounted for 63% of all card-related fraud losses.

- The use of malware and spyware to steal sensitive banking credentials rose by 22%, particularly targeting small businesses.

- Unauthorized wire transfers, typically executed through compromised accounts, caused financial institutions a loss of $2 billion globally.

- Check fraud, though declining, still made up 7% of total fraud cases, with fake checks circulating through digital image capture technologies.

- Account takeover fraud increased by 19%, with criminals accessing legitimate user accounts to siphon funds or execute unauthorized transactions.

- Scams involving cryptocurrency wallets escalated, with $3 billion in stolen assets, primarily through fake investment platforms.

| Fraud Type | Percentage/Impact |

| Phishing scams | 52% of victims |

| Card-not-present fraud | 63% of card-related losses |

| Malware and spyware attacks | 22% increase |

| Unauthorized wire transfers | $2 billion losses |

| Check fraud | 7% of cases |

| Account takeover fraud | 19% increase |

| Cryptocurrency wallet scams | $3 billion stolen |

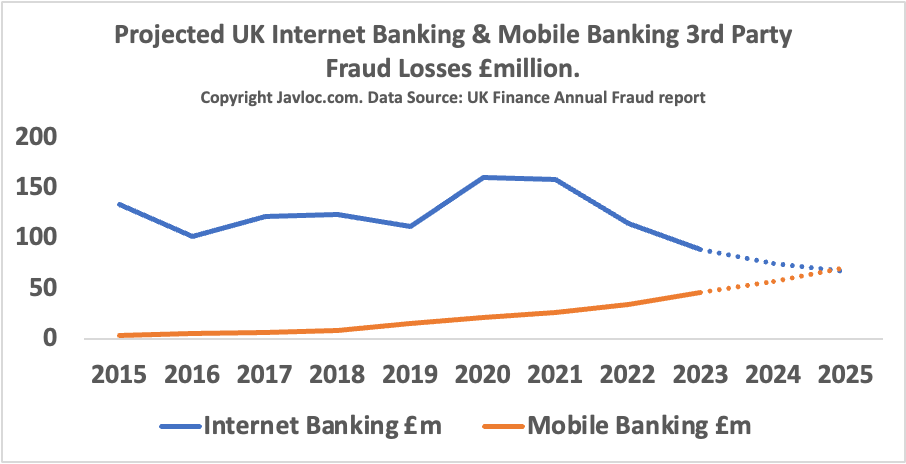

Trends in UK Internet & Mobile Banking Fraud Losses

- Internet banking fraud losses were highest in 2020, peaking at £160 million.

- Losses declined steadily after 2021, with a projected drop to £60 million by 2025.

- Mobile banking fraud, while initially low (£3 million in 2015), has risen consistently over the years.

- By 2022, mobile fraud reached £45 million, with a projected rise to £65 million in 2025.

- The crossover point is expected around 2025, when mobile banking fraud may surpass internet banking fraud.

- This shift highlights the growing security risks in mobile platforms as adoption increases.

Financial Impact on Banks and Consumers

- Global banking fraud costs are projected to exceed $45 billion in 2024, driven by increasingly sophisticated attack methods.

- The average cost of fraud for financial institutions was $4.3 million per incident, including investigation, recovery, and regulatory fines.

- Consumer trust in financial systems dropped by 15%, with 4 out of 10 people reporting reluctance to adopt new banking technologies.

- Fraud-related lawsuits against banks rose by 18%, with consumers seeking reparations for breaches in security and negligence.

- Businesses experienced $14 billion in losses due to fraud, with small businesses disproportionately impacted at 47% of reported cases.

- The financial services sector allocated $12.6 billion towards anti-fraud technology and services, marking a 20% increase in spending from the prior year.

- Insurance claims for fraud-related damages spiked by 26%, emphasizing the collateral damage to consumers and businesses alike.

| Impact Metric | Value |

| Projected global fraud costs (2024) | $45 billion |

| Avg. cost per incident (institutions) | $4.3 million |

| Drop in consumer trust | 15% |

| Fraud-related lawsuits | 18% increase |

| Business losses | $14 billion |

| Anti-fraud spending by financial sector | $12.6 billion |

| Insurance claims increase | 26% |

Detection and Prevention Technologies

- Real-time transaction monitoring was adopted by 78% of financial institutions in 2023, significantly reducing the window for fraud to occur.

- The implementation of biometric authentication systems led to a 35% decrease in fraudulent account access compared to traditional passwords.

- Behavioral analytics tools, which analyze spending and usage patterns, identified 56% more suspicious transactions than rule-based systems alone.

- Banks using tokenization technology reported a 25% drop in payment fraud, as sensitive data was replaced with non-exploitable tokens.

- Cloud-based fraud prevention platforms grew in popularity, with 42% of banks migrating to scalable solutions for enhanced security.

- Multi-factor authentication (MFA) was deployed by 85% of institutions, reducing successful phishing attacks by 70%.

- The adoption of blockchain for secure transaction recording increased by 18%, offering tamper-proof ledgers for financial activities.

Artificial Intelligence in Fraud Detection

- AI-driven fraud detection saved financial institutions over $20 billion globally in 2023, proving its value in mitigating risks.

- AI tools like natural language processing (NLP) helped identify over 60% of phishing emails, using pattern recognition and contextual analysis.

- Machine vision technologies caught $3 billion worth of forged documents in identity verification processes.

- Financial institutions utilizing predictive analytics detected fraud attempts 85% faster, preventing potential losses.

- AI-powered chatbots resolved 75% of fraud-related inquiries, reducing pressure on human customer service teams.

- Banks with AI-integrated systems experienced a 30% lower false-positive rate, minimizing unnecessary disruptions for genuine customers.

- Deep learning algorithms effectively detected emerging fraud tactics, with 92% accuracy in high-risk transaction scenarios.

Machine Learning and Data Mining

- Machine learning models analyzed over 10 billion transactions in 2023, identifying unusual patterns with 96% precision.

- Data mining uncovered new fraud trends, such as layered money laundering schemes, resulting in 15% more arrests.

- Financial institutions utilizing unsupervised learning algorithms identified 30% more insider fraud cases.

- Federated learning approaches, which enable secure data sharing across banks, grew by 22%, enhancing collective fraud defenses.

- Machine learning-enabled risk scoring systems flagged fraudulent activity 50% faster than conventional methods.

- Real-time graph analytics detected fraud rings operating across multiple accounts and regions, disrupting operations before significant losses occurred.

- Automated anomaly detection systems reduced manual intervention by 40%, freeing up resources for other critical operations.

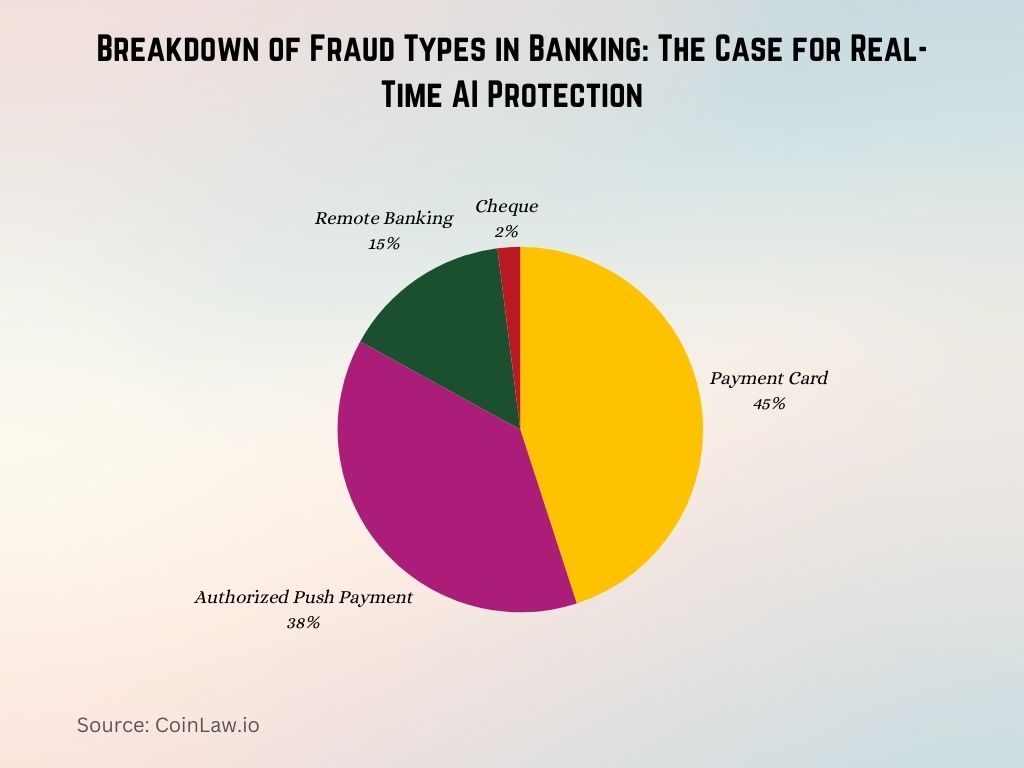

Breakdown of Fraud Types in Banking: The Case for Real-Time AI Protection

- Payment Card fraud accounts for the largest share, representing 45% of total banking fraud cases.

Authorized Push Payment (APP) fraud follows closely, making up 38% of incidents, highlighting a growing need for AI-powered transaction monitoring. - Remote Banking fraud, often involving compromised credentials or unauthorized access, contributes to 15% of fraud cases.

- Cheque fraud, while nearly obsolete in volume, still makes up 1%, showing that traditional channels remain vulnerable.

- This distribution emphasizes the urgency for AI-driven real-time detection, especially in digital and card-based payment systems where threats are most prevalent.

Regulatory Measures and Compliance

- Regulatory frameworks like GDPR and CCPA prompted 65% of financial institutions to overhaul their data protection strategies.

- The US Office of the Comptroller of the Currency (OCC) issued $1.2 billion in fines to banks for insufficient fraud prevention in 2023.

- KYC (Know Your Customer) compliance violations led to penalties exceeding $800 million globally.

- Anti-Money Laundering (AML) regulations helped recover $4.5 billion in fraudulent funds through coordinated efforts.

- Cross-border fraud prevention agreements among 15 countries facilitated real-time fraud alerts, reducing losses by 20%.

- Banks investing in compliance training programs saw a 25% improvement in staff adherence to fraud detection protocols.

- Regulatory sandboxes, which allow controlled testing of anti-fraud technologies, expanded by 18%, enabling innovative approaches to fraud prevention.

Recent Developments

- AI-Powered Cybercrime Surge: A recent survey revealed that 80% of bank cybersecurity executives feel they cannot keep up with AI-powered cybercriminals, highlighting the rapid advancement of generative AI in facilitating sophisticated attacks.

- Rise in Identity Fraud: Identity fraud cases have intensified by an estimated 12% annually since 2020, with synthetic identity fraud now comprising about 30% of all identity fraud cases.

- Increased Fraud in Financial Institutions: Approximately 60% of financial institutions and fintechs reported an increase in fraud, with nearly 70% of enterprise banks experiencing significant fraud growth over the past twelve months.

- Emergence of Fraud-as-a-Service Models: Dark web retailers are now offering tools and services required to execute scams like Business Email Compromise (BEC) and online account takeover, democratizing fraud for individuals with limited technical skills.

- Advancements in Deep Learning for Fraud Detection: Recent studies have highlighted the effectiveness of deep learning models, such as Convolutional Neural Networks and transformers, in detecting financial fraud across various domains, including credit card transactions and insurance claims.

Conclusion

As banking fraud continues to evolve in complexity, the collaboration between technology, regulation, and consumer awareness becomes increasingly crucial. The statistics underscore the need for proactive and innovative measures to stay ahead of fraudsters. From AI-driven detection tools to enhanced regulatory frameworks, the fight against fraud is advancing rapidly. However, financial institutions and consumers alike must remain vigilant, as the stakes are higher than ever. Together, these efforts promise a safer, more secure future for global financial systems.