Avalanche (AVAX) continues to shine, driven by its ultra‑fast finality and growing adoption across decentralized finance and real‑world asset tokenization. Its robust performance helps institutions and developers alike. For instance, decreased transaction fees from the Octane upgrade are boosting network throughput, while partnerships like SkyBridge’s $300 million tokenized hedge fund loom large in mainstream finance. Explore the full article to understand how AVAX’s metrics shape its trajectory.

Editor’s Choice

- Avalanche processed approximately 1.5 million daily transactions in August 2025, reflecting a significant uptick in on-chain activity.

- Transaction fees dropped 42.7% post-Octane upgrade.

- As per Avalanche Explorer, daily active addresses rose 57% month-over-month to 46,397 in August 2025.

- Current price ranges between $24.50–$24.70, depending on platforms.

- Market cap hovers around $10.3–$10.5 billion.

- Circulating supply stands at about 422 million AVAX, roughly 59% of its max supply.

- Trading volume (24h) ranges from $750 million to over $1 billion across platforms.

Recent Developments

- In August 2025, daily transactions shot up to 1.5 million, a dramatic increase in on‑chain activity.

- The Octane upgrade slashed transaction fees by 42.7%, enhancing affordability.

- C‑Chain transactions grew by approximately 493% quarter-over-quarter, indicating major throughput improvements.

- Daily active addresses rose by 57% to 46,397.

- SkyBridge announced plans to tokenize $300 million in hedge fund assets on Avalanche, signaling growing institutional interest in blockchain infrastructure.

- Wyoming’s stablecoin FRNT launched on Avalanche, expanding cross‑border utility and regulatory credibility.

- Partnership optimism boosts sentiment, with forecasts for AVAX reaching $33 by June 2025 and $50 by year‑end.

AVAX Overview Statistics

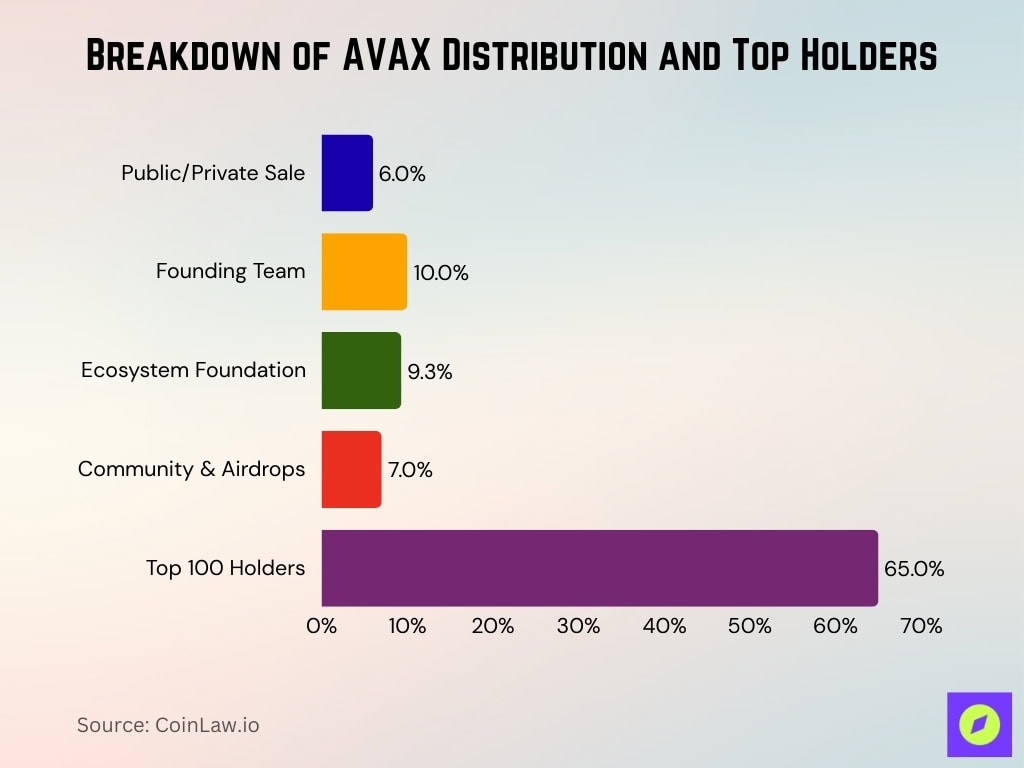

- Governance and distribution: initial allocation included 6% public/private sale, 10% founding team, 9.3% ecosystem foundation, and 7% community and airdrops.

- The 100 largest addresses hold around 65% of the supply, much of it on exchanges.

- Launched in September 2020 by Ava Labs, a Layer‑1 blockchain with X‑Chain, C‑Chain, and P‑Chain.

- Designed for high throughput, sub‑second finality, and composable, low‑cost multiservice chains.

- Employs Avalanche consensus with randomized subsampling to scale efficiently.

- Frosty, a consensus improvement protocol researched by Ava Labs and Cornell University, enhances liveness in partially synchronous networks by optimizing leaderless consensus paths.

- Avalanche’s proof-of-stake architecture emphasizes validator inclusivity, allowing a low minimum stake (2,000 AVAX) and no slashing, contributing to its reputation for openness.

Current AVAX Price Statistics

- Price varies slightly: $24.50 to $24.71 depending on the platform.

- 24‑hour price change: roughly +2% to +3%.

- Weekly gain: about 5–6%.

- All‑time high: around $146, reached November 21, 2021; current price remains –83% below that peak.

- All‑time low: near $2.79, December 2020, now up 780% from that level.

- Volatility around 5%, with 50% green days in the past 30 days.

- Supply inflation is estimated at 7.5% annually, suggesting modest token issuance.

Historical AVAX Price Data

- Start of 2025: AVAX traded above $40, then fell below $15 amid volatility.

- Technical indicators show a breakout from descending trends, supporting recovery.

- April–August 2025: price steadily climbed into the $24–25 range.

- Aug 22: high of $25.36, low $22.77; Aug 20–21: ranged between $22.33–$23.70.

- Long‑term, the AVAX ICO price ($0.25) now equates to a 49x return.

- Cycle low/high: $8.69 and $65.26, respectively, highlighting volatility within this cycle.

Top Holdings in Bot Crypto Portfolio

- Ethereum holds the largest share at 19.1%, signaling continued dominance in smart contract infrastructure.

- Polygon makes up 15.9%, showing strong confidence in Ethereum scaling solutions.

- Terra accounts for 14.7%, suggesting notable exposure despite its past volatility.

- Fantom represents 10.8%, reflecting its appeal in fast, low-fee Layer 1 solutions.

- Bitcoin holds 10.3%, showing moderate exposure to the most established asset.

- Cosmos takes up 10.2%, likely due to its interoperability and modular ecosystem focus.

- Avalanche has a 9.87% allocation, aligning with its growing role in tokenization and subnets.

- Decentraland captures 5.97%, showing interest in metaverse assets.

- Chainlink has the smallest share at 3.09%, highlighting limited exposure to oracle infrastructure.

Market Capitalization

- Current market cap is around $10.3–$10.5 billion.

- Fully diluted valuation (FDV) sits near $17–17.7 billion, assuming max supply issuance.

- Volume-to-market cap ratio (24h): ranges from 5% to 14% depending on the source.

- Avalanche holds a dominance of 0.27% in the crypto market.

- Trading volumes: from $750 million to $1.5 billion across platforms.

- Market rank: typically falls around #23 among all crypto assets.

- In its category, Avalanche is ranked among the top in the L1 and PoS sectors.

Supply and Circulation

- Circulating supply stands at 422.28 million AVAX, which is about 59% of the maximum capped supply of 720 million.

- Total supply matches the max, at 720 million AVAX.

- Fully diluted valuation is around $17.67 billion.

- The next significant unlock is scheduled for November 13, 2025, tied to the Foundation allocation.

- Avalanche uses both cliff and linear vesting schedules, adjusting token release according to milestones or time-based triggers.

- A portion of transaction fees is burned, creating a mild deflationary effect over time.

- Originally, 360 million AVAX were minted at genesis; the remainder is gradually minted as staking rewards.

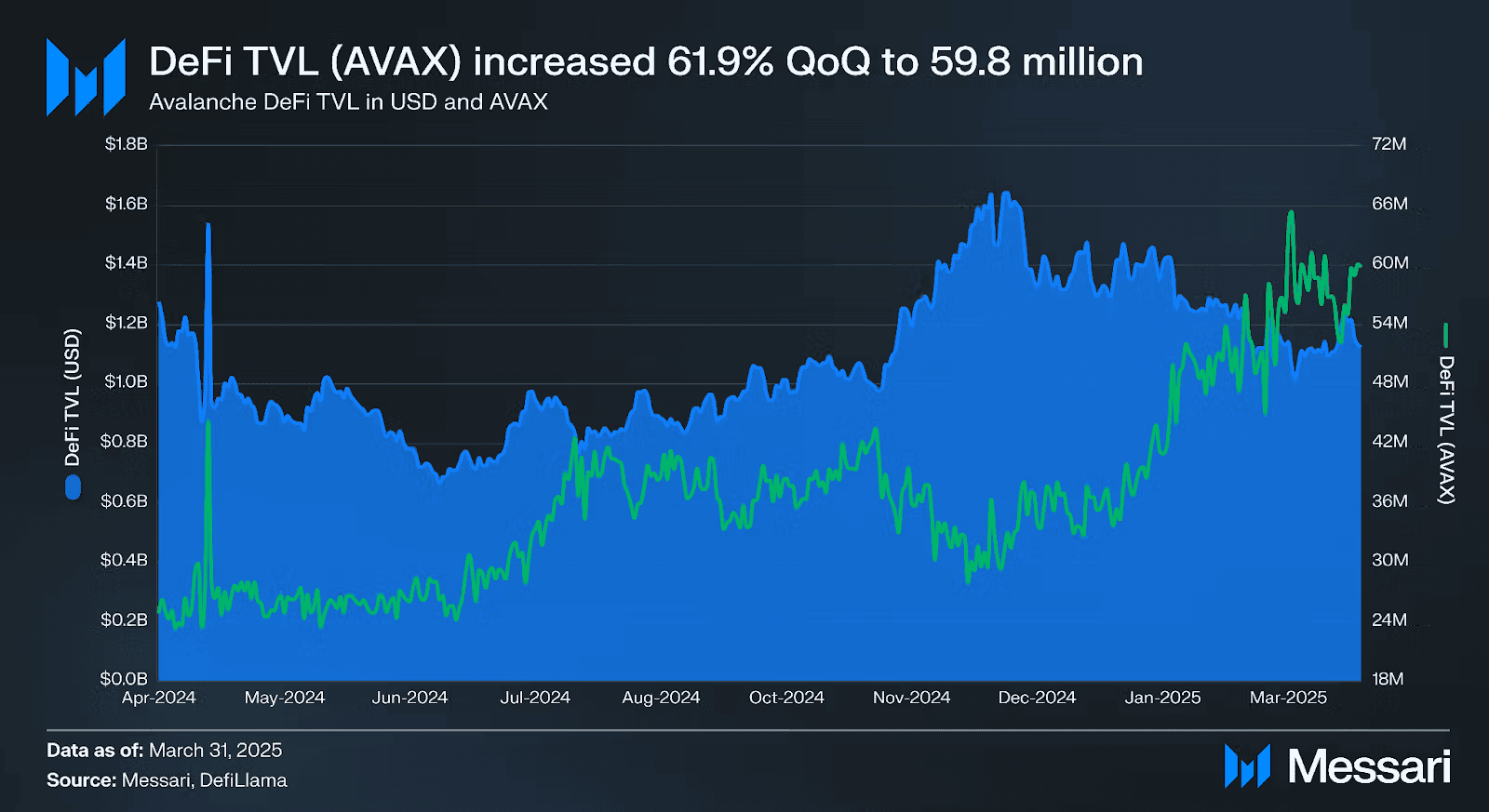

DeFi TVL Surges

- Total Value Locked (TVL) in Avalanche DeFi reached 59.8 million AVAX by March 31, 2025.

- This marks a 61.9% quarter-over-quarter increase, signaling renewed DeFi momentum.

- In USD terms, TVL climbed to approximately $1.5 billion–$1.6 billion, up from around $0.6 billion in mid-2024.

- Growth accelerated between January and March 2025, following a recovery that began in late Q4 2024.

- The rise in both AVAX-denominated and USD-denominated TVL indicates a dual impact from increased DeFi activity and rising token value.

- AVAX TVL jumped from ~36M AVAX in late 2024 to nearly 60M AVAX in Q1 2025.

- This uptick highlights Avalanche’s strength in regaining DeFi market share after earlier dips.

Trading Volume and Activity

- 24-hour trading volume is $737 million–$790 million, depending on the source.

- 24-hour volume increased 32.7%, now at $750 million.

- On Kraken, 748 million AVAX worth $748 million were traded in one day.

- Volume-to-market-cap ratio is roughly 7–7.6%, indicating high turnover.

- Weekly trading average on Coinbase is around $785 million.

- In ranked popularity, AVAX sits around #23–#30 on major platforms.

- Binance’s AVAX/USDT pair alone sees $89 million in volume.

AVAX Staking Metrics

- Approximately 48.3% of the circulating supply is staked at present.

- Another source estimates 53% staked, translating to about $2.5 billion in staked value.

- The minimum to run a validator node is 2,000 AVAX; delegators can stake with as little as 25 AVAX.

- Avalanche does not employ slashing, though validator misbehavior is discouraged.

- The Core Stake wallet upgrade and the Avalanche 9000 upgrade improved staking efficiency.

- Allnodes: 6.14% reward, 4.62M AVAX staked.

- Chorus One: 6.3% reward, 369K AVAX.

- Stake Capital: 6.82% reward, 100.3K AVAX.

- Nodes International: 6% reward, 7.06K AVAX.

- Stakely: 6.63% reward, 5.91K AVAX.

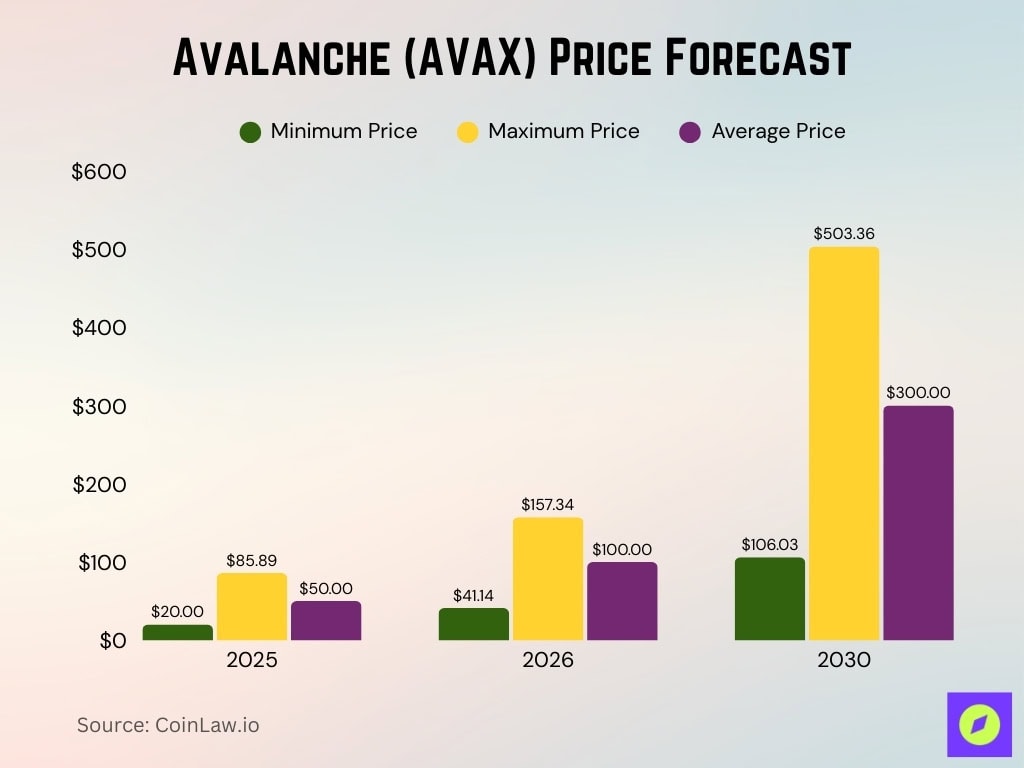

Avalanche (AVAX) Price Forecast

- In 2025, AVAX is projected to hit a minimum of $20, a maximum of $85.89, and an average of $50.

- By 2026, forecasts show growth with a minimum of $41.14, a maximum of $157.34, and an average price of $100.

- Looking ahead to 2030, AVAX could reach a minimum of $106.03, soar to a maximum of $503.36, with an average around $300.

- These predictions suggest a 6× jump in average price from 2025 to 2030 if the trend holds.

- The long-term outlook reflects strong investor confidence in Avalanche’s ecosystem scalability and adoption.

Network Performance Statistics

- Avalanche supports sub-second finality via its Snowman consensus.

- Network architecture includes X-Chain, C-Chain, and P-Chain.

- Academic improvements like Frosty boost consistency under partial synchronization.

- Avalanche is recognized among PoS blockchains for high network openness.

Avalanche Ecosystem Growth

- Avalanche has attracted enterprise adoption through collaborations like Turkey’s Tixbase and Passolig.

- The network broadens its global developer and builder community through open innovation initiatives.

- With the release of Avalanche 9000 and a $250 million funding round, it’s enabling expanded infrastructure.

AVAX Holders and Distribution

- Token ownership remains concentrated, with top-tier addresses holding a significant share.

- Allocation breakdown at launch included sales, team, foundation, staking rewards, grants, and endowment.

- Token economics continue to evolve with phased vesting for staking rewards.

Avalanche DeFi Project Statistics

- Avalanche’s DeFi Total Value Locked (TVL) surpassed $2 billion in 2025.

- Liquidity pools and lending protocols experienced growth across platforms like Trader Joe and Aave.

- Daily DeFi DEX trading volume exceeded $500 million.

- USDC, USDT, and DAI remained the top 3 stablecoins on Avalanche.

- Incentive programs expanded across subnets, increasing protocol onboarding.

- Projects like Struct Finance and DeltaPrime saw month-on-month growth of 25–40%.

- Stablecoin supply on Avalanche, including USDC, USDT, and DAI, exceeded $1.7 billion in mid-2025.

- Dexalot and Platypus saw liquidity inflows following Octane upgrades.

- AVAX usage in DeFi increased due to reduced fees and faster settlement.

NFT and Gaming Ecosystem Data

- The Avalanche ecosystem lists over 500 decentralized applications.

- Avalanche’s architecture enables real-world throughput of 4,500 TPS, with stress testing indicating peaks as high as 20,000 TPS under optimal conditions.

- Daily transaction volume in dollars frequently exceeds $500 million.

- Avalanche gaming titles collectively attracted up to 500,000 daily active users across various subnets in peak periods.

- In Q2 2025, Avalanche’s NFT marketplaces reported monthly trading volume nearing $800 million, driven by launches on platforms like Joepegs and Kalao.

- Avalanche’s low-latency and minimal fees are drawing creators.

- Developer interest remains high with projects like Zero One and Solo Leveling: Unlimited.

AVAX Technical Analysis Metrics

- Total Value Locked (TVL) is above $2 billion.

- $1.7 billion stablecoin market cap and $500 million daily DEX volume.

- Avalanche9000 upgrade reduced the base C‑Chain transaction fee from 25 nAVAX to 1 nAVAX.

- Analyst predictions see breakout potential toward $35–$50, with resistance at $27.

- Q3 2025 metrics:

- Average daily transactions: 18.5 million (+203% QoQ).

- Daily active addresses: 146,579 (+70% QoQ).

- DeFi TVL: $2.77 billion (+53% QoQ).

- Q2 C‑Chain metrics:

- Daily transactions +493.4%.

- Daily active addresses +57%.

- Stablecoin cap dropped 23.8%.

- Summit activity reflects broader adoption.

Token Burn and Deflationary Stats

- Avalanche9000’s dynamic fee burn introduces deflationary pressure.

- Fee compression implies fewer AVAX entering circulation for the same usage.

Validator and Node Statistics

- Avalanche maintains high validator openness.

- 100 active custom subnets by Q1 2025, each with tailored validator sets.

Subnet and Network Upgrade Stats

- Avalanche supports over 100 active subnets, and stress tests demonstrate theoretical throughput up to 300,000 TPS, though real-world averages are significantly lower.

- Avalanche9000 upgrade drives fee efficiency and subnet adoption.

Risk and Volatility Metrics

- Price remains about 83% below the all-time high ($146) and 780% above the all-time

- 2025 forecast ranges show wide volatility, from $19 to $33.

- Market shifts continue to influence AVAX’s stability.

Conclusion

Avalanche’s trajectory demonstrates a network in ascendancy. Activity metrics, from 18.5 million daily transactions to $2 billion+ DeFi TVL, underline real momentum, not speculation. Subnet scalability, thriving NFT/gaming usage, and deflationary fee mechanisms all point to structural robustness. While medium-term price forecasts span $22 to $33, with upside scenarios targeting $35–$50, growth remains tethered to overall market dynamics and institutional flows. As Avalanche cements itself in DeFi, tokenization, and gaming, it sets the stage for long-term relevance, making now an opportune time for close observation and, for some, strategic entry.