Asset tokenization converts real-world assets, such as real estate, bonds, or commodities, into digital tokens that trade on blockchain networks. This innovation boosts liquidity and allows partial ownership, so investors can access high-value assets without intimidating costs. In practice, tokenized Treasury funds allow crypto traders to seek yield while earning faster settlements, and fractional ownership of luxury properties opens investment opportunities for individuals. Keep reading to explore how these trends are reshaping finance.

Editor’s Choice

- The global tokenization market is projected to $1,244.18 billion in 2025.

- That larger market is expected to surge to $5,254.63 billion by 2029, with a CAGR of 43.36%.

- Tokenized Treasury and money-market fund assets reached $7.4 billion in 2025, an 80% jump year-to-date.

- Real estate tokenization has reached approximately $20 billion in value, with optimistic forecasts suggesting it could approach $1.5 trillion by 2025, although this projection represents a high-end estimate.

- The Real-World Assets (RWA) tokenization market stands at $24 billion in 2025, having grown 308% over three years.

Recent Developments

- The RWA tokenization market now sits at $24 billion, a 308% increase in just three years.

- Tokenized dividend-paying funds like Treasury and money-market offerings surged 80% year-to-date, totaling $7.4 billion.

- Goldman Sachs and BNY Mellon teamed up to launch tokenized money-market funds, supported by frameworks like the Genius Act, that aim to streamline settlement and reduce costs.

- U.S. legislative changes under the current administration have eased tokenized asset adoption, allowing major firms, including Bank of America, Citi, BlackRock, and Coinbase, to explore these tools.

- Robinhood and Coinbase have championed tokenization as a way to democratize investing, though regulatory concerns emerged after Robinhood tokenized private firms, like OpenAI, without consent.

Industry Segmentation

- By component: tokenization solutions and services drive implementation.

- By services: includes professional services, managed services, and compliance and integration offerings.

- By application: usage spans payment security, authentication, and compliance management.

- By vertical industry: strong adoption in banking, fintech, healthcare, government, retail, e‑commerce, and utilities.

- By organization size: both large enterprises and SMEs deploy tokenization differently.

- Further breakdowns differentiate tokenization software, payment solutions, data-focused solutions, and cloud-based offerings.

- From an offering perspective, middleware/platforms are dominant, while compliance and legal tech grow fastest.

- By geography, North America leads with a substantial share in 2024, while Asia-Pacific is ramping fastest.

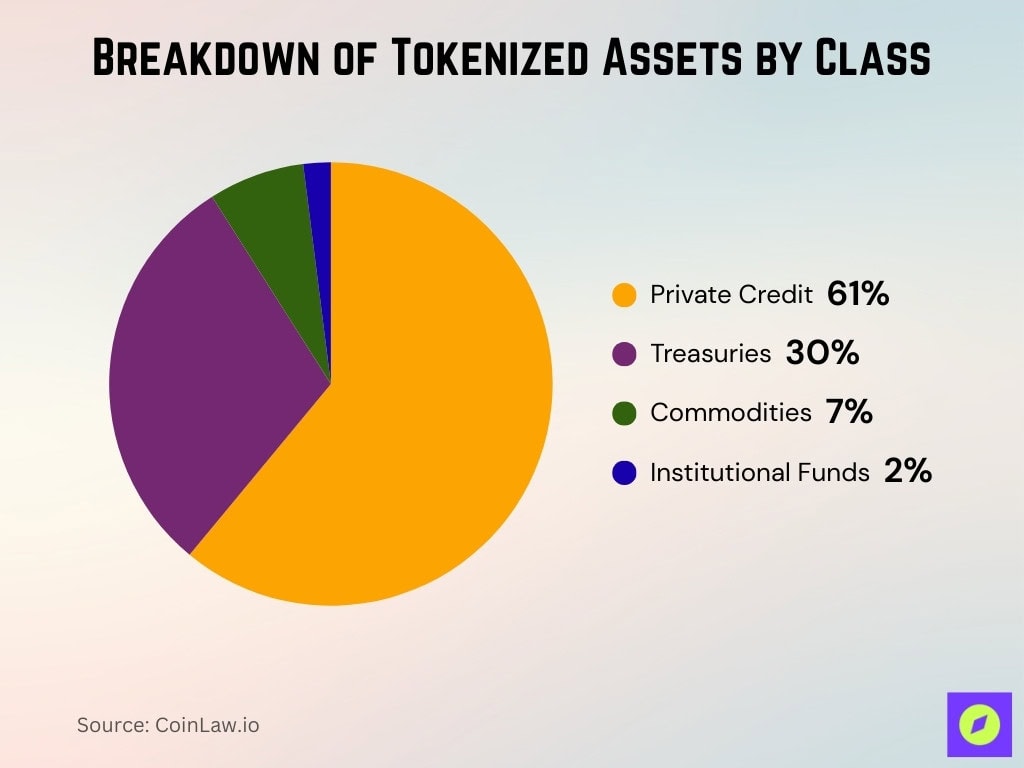

Asset Classes in Tokenization

- Institutional funds, private credit, and treasuries compose growing segments; private credit alone made up 61% of tokenized assets as of April 2025, with treasuries at 30%, commodities at 7%, and institutional funds 2%.

- Tokenization spans real estate, private equity, fine art, and private credit, with real estate leading the way.

- Tokenized assets across categories like real estate, private credit, and Treasuries were estimated to reach $412 billion by early 2025, combining both public blockchain and permissioned platform data.

- Coinbase and Robinhood promote tokenized investing to enhance access, but regulatory challenges arose when Robinhood allowed fractional trading of private companies like OpenAI without formal agreements or issuer approvals.

- Tokenized artwork and collectibles are gaining traction through fractional ownership, blending digital access with real-world assets.

- Real estate remains dominant, with precise valuation and regulatory clarity facilitating adoption across jurisdictions.

- Carbon credits and structured products are also entering the tokenization mix via specialized platforms.

- Overall, tokenization covers tangible and intangible assets, each bringing its own investor dynamics and regulatory considerations.

Real Estate Tokenization Statistics

- As of mid‑2025, real estate tokens are part of the $412 billion total tokenized assets globally.

- The RWA tokenization market has reached $24 billion in 2025, up 308% over three years.

- By June 2025, RWA token value on public blockchains neared $18 billion.

- Deloitte projects $1 trillion in tokenized private real estate funds by 2035, with 8.5% market penetration.

- Global tokenized real estate could reach $3 trillion by 2030, potentially representing 15% of global property AUM, although actual adoption will depend on regulatory clarity and investor confidence.

- BCG expects real estate tokenization to grow from ~$120 billion in 2023 to $3.2 trillion by 2030 (~49% CAGR).

- As of June 2024, 12% of global real estate firms had implemented tokenization, and 46% were piloting such solutions.

- Real estate tokens offer fractional ownership, faster settlement, and lower costs, boosting liquidity and enabling access for smaller investors.

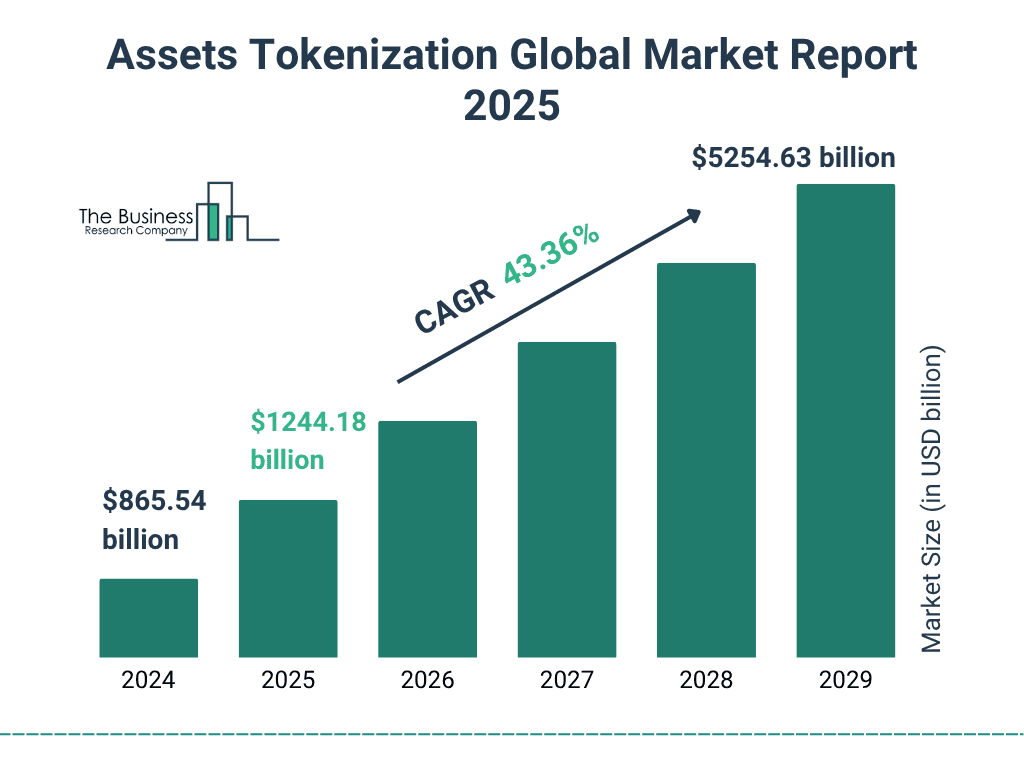

Global Asset Tokenization Market Size

- The market was valued at $865.54 billion in 2024.

- It is projected to reach $1,244.18 billion in 2025.

- By 2029, the market is expected to grow to $5,254.63 billion.

- The industry is expanding at a CAGR of 43.36%, highlighting rapid adoption.

Financial Instruments Tokenization Statistics

- Tokenized money-market and Treasury fund assets surged 80% year-to-date, totaling around $7.4 billion in 2025.

- Goldman Sachs and BNY Mellon are tokenizing money-market funds with partners like BlackRock and Fidelity, addressing efficiency and lowering settlement times.

- Institutional tokenization of RWAs includes over 200 active projects and a TVL (total value locked) of $65 billion in 2025, an 800% jump from 2023.

- Tokenized equities (stock tokens) are emerging on platforms like Coinbase, Robinhood, Kraken, and BitGo, though still limited by legal caveats.

- Ripple and BCG forecast tokenized RWAs expanding from approximately. $0.6 trillion in 2025 to $18.9 trillion by 2033 (~53% CAGR).

- Tokenized assets grew from only $85 million in 2020 to over $21 billion by April 2025 (245-fold increase).

- Traditional instruments like bonds and shares are being tokenized for peer-to-peer trades, though real transformation awaits regulatory and infrastructure support.

Adoption by Investor Type (Retail vs Institutional)

- In early 2025, 86% of surveyed institutional investors had exposure to, or intended to allocate to, digital assets.

- High-net-worth individuals and institutional investors plan to allocate 8.6% and 5.6% of their portfolios, respectively, to tokenized assets by 2026.

- Over 60% of investors, retail and institutional, are already investing or planning to invest in tokenized assets, with real estate as a top choice.

- Institutional projects number over 200 active RWA token initiatives, with participation from more than 40 major financial institutions.

- Retail platforms like Robinhood and Coinbase are offering tokenized private equities, like fractional OpenAI shares, though these often omit voting rights and carry regulatory risk.

- Coinbase reports institutional funds as just 2% of tokenized asset categories, versus private credit (61%) and treasuries (30%).

- Regulatory expansion under frameworks like the Genius Act supports both investor types by enabling fractional ownership and streamlined transactions.

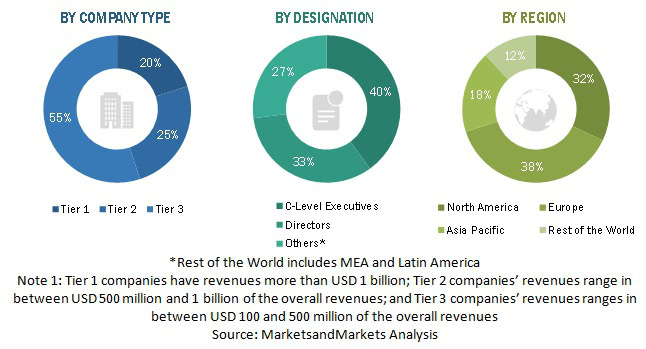

Market Insights by Company Type, Designation, and Region

- 55% of companies involved are Tier 1, with revenues above USD 1 billion.

- 25% of companies are Tier 2, earning between $500 million and $1 billion.

- 20% of companies are Tier 3, with revenues ranging from USD 100 million to 500 million.

- 40% of respondents are C-Level Executives, showing strong leadership representation.

- 33% of respondents are Directors, while 27% fall under Other roles.

- Regionally, North America leads with 38%, followed by Europe at 32%, Asia Pacific at 18%, and the Rest of the World (MEA & Latin America) at 12%.

Cost Savings with Tokenization

- Tokenization can cut intermediaries, speeding settlement and reducing transaction costs, especially for money-market funds.

- Real estate tokens avoid large down payments and complex financing steps, making deals faster and cheaper.

- Efficiency gains through programmable tokens facilitate 24/7 trading, eliminating traditional delays.

- Asset servicing automation, such as fund administration, investor onboarding, and transfer agent services, reduces manual operations for platforms like Securitize.

- Goldman and BNY’s initiative emphasizes faster settlement, lower administration costs, and easier token collateral use.

- Fractional ownership lowers the barrier to entry, allowing more investors to access high-value assets via smaller investments.

- Overall, tokenization offers operational efficiency, scalable administration, and transparent tracking on-chain.

Geographic Distribution of Asset Tokenization

- Tokenization frameworks are active across Europe, India, and globally, with regulators experimenting with DLT Pilot Regimes and MiCA.

- In Latin America, Mercado Bitcoin and Polygon Labs launched over 340 tokenized products (~$180 million) in investment categories like private credit and fixed income.

- Institutional expansion reflects global reach; over 40 major financial institutions worldwide are involved in RWA tokenization.

- Digital platforms such as Securitize serve global audiences across multiple blockchains, supporting projects across the U.S., Europe, and Asia.

- Emerging markets like the UAE are piloting digital asset use to improve financial infrastructure.

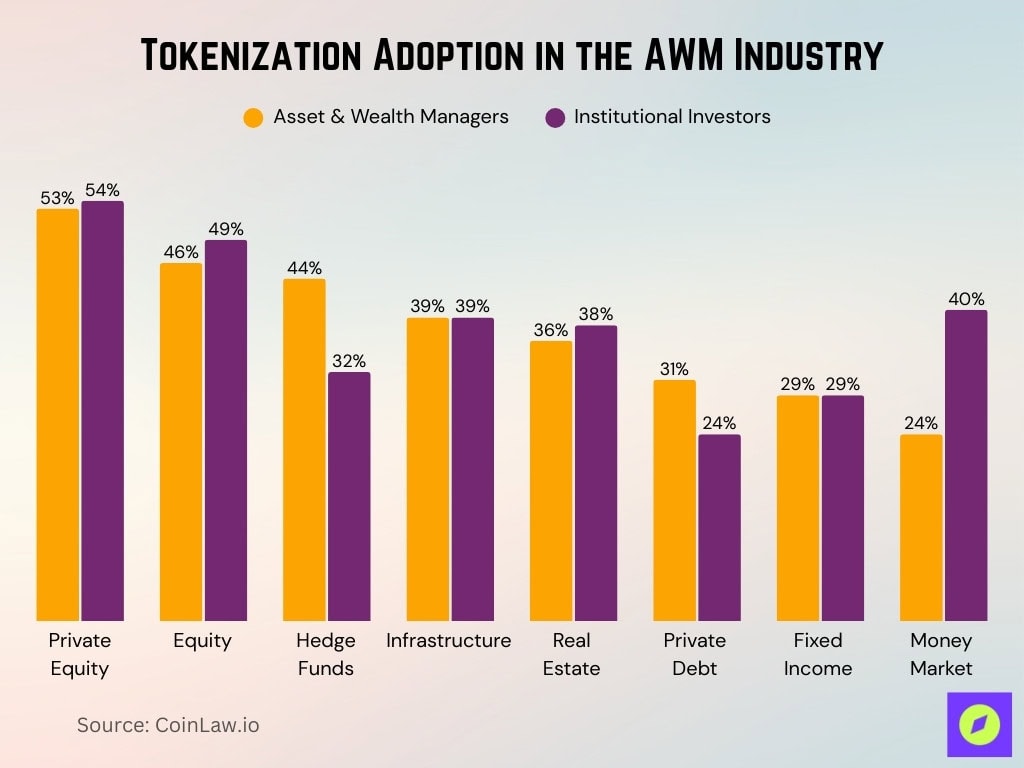

Tokenization Adoption in the AWM Industry

- Private equity leads adoption, with 53% of asset & wealth managers and 54% of institutional investors engaged.

- Equity tokenization is strong, chosen by 46% of asset & wealth managers and 49% of institutional investors.

- Hedge funds are favored by 44% of asset & wealth managers, compared to 32% of institutional investors.

- Infrastructure tokenisation shows balance, with 39% of both groups adopting.

- Real estate tokenisation is planned by 36% of asset & wealth managers and 38% of institutional investors.

- Private debt is less popular, with 31% of asset & wealth managers and 24% of institutional investors.

- Fixed income tokenisation is equal at 29% for both groups.

- Money market tokenisation is stronger with 40% of institutional investors, while only 24% of asset & wealth managers are involved.

Institutional Adoption of Asset Tokenization

- Institutional involvement is strong, with over 200 active RWA projects and 800% growth since 2023, with TVL hitting $65 billion in 2025.

- Institutional investors represent 86% of participants in digital assets allocation surveys.

- Major institutions, BlackRock, Fidelity, Apollo, and Blockchain Capital, are launching tokenized funds. Securitize administers the largest tokenized fund offerings.

- Regulations like the Genius Act provide stablecoin clarity, encouraging institutional token adoption.

- Traditional finance firms, JPMorgan, Goldman Sachs, and BNY Mellon, are spearheading token initiatives, integrating blockchain with established infrastructure.

- RWA tokenization could reach $30 trillion by 2034, driven by institutional lack, infrastructure maturity, and regulatory approval.

Leading Asset Tokenization Platforms

- BlackRock BUIDL tops the list by total value locked at $2.88 billion, offering on‑chain access to U.S. Treasuries via Ethereum.

- Securitize controls around 70% share of the U.S. tokenization market and manages the largest tokenized U.S. Treasury offering, $2.8 billion.

- Tokeny has enabled over $28 billion in tokenized assets and processed 3 billion transactions via its modular platform.

- Blockchain App Factory provides end-to-end tokenization services with a strong compliance focus.

- Other notable platforms include RealT, Ondo Finance, Spydra, tZERO, Fireblocks, Kaleido, Stobox 4, and Token City.

- Stobox 4 allows splitting a $50 million Manhattan property into 500,000 tokens at $100 each, democratizing access to premium real estate.

- Ecosystem diversity, platforms now span services from token issuance and compliance to custody, distribution, and data analytics.

Regulatory Developments in Asset Tokenization

- The U.S. GENIUS Act established the first federal framework for stablecoins, prompting institutions like Bank of America and Citigroup to explore token issuance.

- The FCA introduced a five‑year pro-growth strategy supporting fund tokenization, aiding around 200 firms with AI/ML implementation.

- In Spain, the CNMV approved Ursus‑3 Capital as the first entity able to register and manage tokenized funds.

- Global institutions increasingly engage with tokenization, with regulatory bodies setting compliant paths rather than prohibitions.

- Mainland challenges remain; tokenization of stocks and bonds faces structural, legal, and technological hurdles.

Blockchain Integration in Asset Tokenization

- Traditional banks, including HSBC, Bank of America, Euroclear, and MAS, are integrating Solana’s public blockchain to support asset tokenization.

- Ethereum-based platforms remain central, bridging DeFi and traditional finance.

- Long-term tokenization may require upgrades from exchanges, clearinghouses, and legal systems.

Security and Compliance Trends in Tokenization

- Cybercrime is projected to cost over $10.5 trillion by 2025, emphasizing the urgency of proactive security strategies.

- Tokenization now embeds data-driven compliance, third-party risk monitoring, and early detection systems.

- Token standards like ERC‑3643 promote interoperability and compliance.

- Security responsibilities expand, with custody, AML/KYC, and smart contract auditing becoming priorities.

Economic Impact of Asset Tokenization

- RWA tokenization surged over 260% in H1 2025, hitting $23 billion. Private credit leads with 58%, U.S. Treasuries at 34%.

- The overall RWA market sits at $24 billion in 2025, and growth could reach $30 trillion by 2034.

- RWA tokenization is expanding from $0.6 trillion in 2025 to $18.9 trillion by 2033.

- McKinsey estimates the tokenized market cap could be $2–4 trillion by 2030.

- Economic drivers include improved liquidity, fractional ownership, faster settlements, and cross-border efficiencies.

- Broader adoption across asset classes is set to reshape capital market architecture.

Future Outlook

- Tokenized asset markets may become multi-trillion-dollar industries by 2030.

- Estimated growth trajectories: $2 trillion to $4 trillion by McKinsey, $30 trillion in upper projections.

- Adoption hinges on improved regulatory clarity, mature infrastructure, and institutional trust.

- Tokenization is positioned to democratize access, enabling fractional investing.

- Tokenization may fundamentally transform capital markets, from back-office mechanics to ownership and transfer.

Conclusion

Asset tokenization is rapidly evolving, from pioneering platforms to regulatory embrace and institutional momentum. The RWA tokenization market exceeded $23 billion, and projections suggest multi‑trillion-dollar growth is well within reach by this decade’s end. Platforms like BlackRock BUIDL, Securitize, and Tokeny drive innovations in access and compliance. Meanwhile, regulators in the U.S. and UK foster frameworks that enhance investor confidence. As security, scalability, and governance improve, tokenization is poised to remake capital markets, making investment simpler, faster, and more inclusive.