Imagine walking into a bank where a virtual assistant knows your financial history, anticipates your needs, and offers tailored advice, all within seconds. Welcome to the transformative power of AI in Wealth Management, a sector experiencing unprecedented growth and innovation. The integration of AI technologies is poised to redefine client experiences, operational efficiency, and investment strategies in the financial world. This article delves into the pivotal statistics and trends shaping this evolution.

Editor’s Choice

- 80% of wealth managers believe AI will revolutionize the industry by 2025, particularly in portfolio management and risk assessment.

- The global wealth management AI market is projected to reach $9.8 billion in 2025, growing at a CAGR of 17.3%.

- In 2025, 72% of US wealth management firms report implementing AI-driven customer engagement tools, up from 65% two years ago.

- Robo-advisors now manage over $1.97 trillion in assets as of 2025, with assets expected to grow at a 7.3% CAGR to $2.80 trillion by 2030.

- Natural language processing (NLP) applications in finance reached $8.6 billion in market value in 2025, registering a 25% CAGR and streamlining client interactions across wealth management.

- 80% of high-net-worth individuals (HNWIs) now prefer hybrid advisory models, blending AI efficiency with human expertise for optimal outcomes.

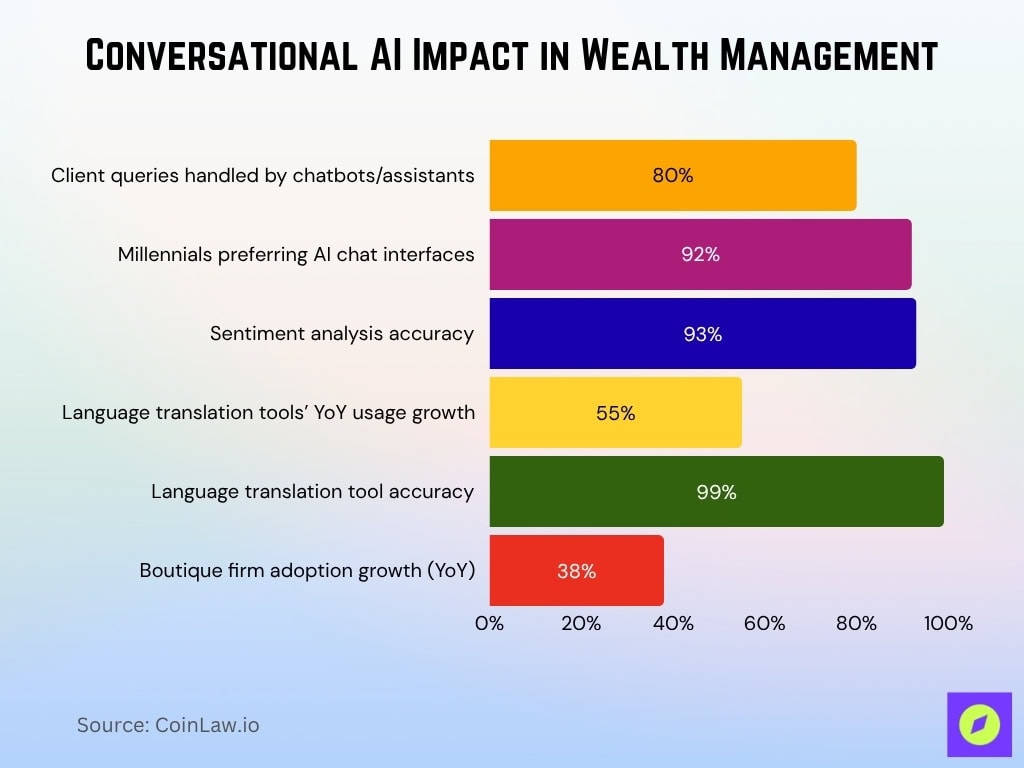

The Rise of Conversational AI

- 80% of client queries are handled by chatbots and virtual assistants in major financial institutions in 2025, significantly reducing human workload.

- By 2025, conversational AI tools will save the industry $19.4 billion annually by automating repetitive tasks in the financial sector.

- 92% of millennials are more likely to engage with AI-powered chat interfaces than traditional support channels in 2025.

- Advanced AI models like GPT-4o and Claude 3.7 are now fully integrated into wealth management platforms, delivering hyper-personalized advice at scale.

- Sentiment analysis algorithms now help advisors gauge client satisfaction with up to 93% accuracy in financial services.

- AI-driven language translation tools facilitate cross-border wealth management, with usage rising 55% year-over-year and 99% accuracy across 100+ languages.

- Conversational AI adoption grew by 38% among boutique financial firms in 2025, closing the gap with larger players.

The Evolving Wealth Management Landscape

- 90% of financial institutions use AI in some capacity, with wealth management leading adoption rates in 2025.

- The use of predictive analytics increased ROI for wealth management firms by 27% on average in 2025.

- The global adoption of AI in asset management rose by 22% in 2025, driven by demand for efficiency and personalization.

- Financial institutions reported a 41% reduction in operational costs after deploying AI-based solutions in 2025.

- Custom AI models enabled firms to achieve 30% higher client retention rates in 2025, showcasing the value of personalized strategies.

- AI-driven platforms are helping firms adhere to evolving regulations, with compliance accuracy improving by 35% in 2025.

AI Applications in Client Onboarding and KYC

- AI reduced KYC verification time by 87% in 2025, saving financial institutions billions annually.

- Over 92% of global banks implemented AI-driven onboarding solutions to improve user experience in 2025.

- Advanced AI algorithms flagged 98% of fraudulent applications in real time in 2025, significantly reducing compliance risks.

- 30% of biometric authentication in onboarding now uses facial recognition, ensuring secure and seamless processes in 2025.

- AI-driven systems processed 40% more applications per day compared to manual methods in 2025.

- Identity verification accuracy rates have reached 99.9% with AI-powered tools in 2025.

- By 2025, 89% of wealth management firms will have adopted AI for KYC and AML compliance.

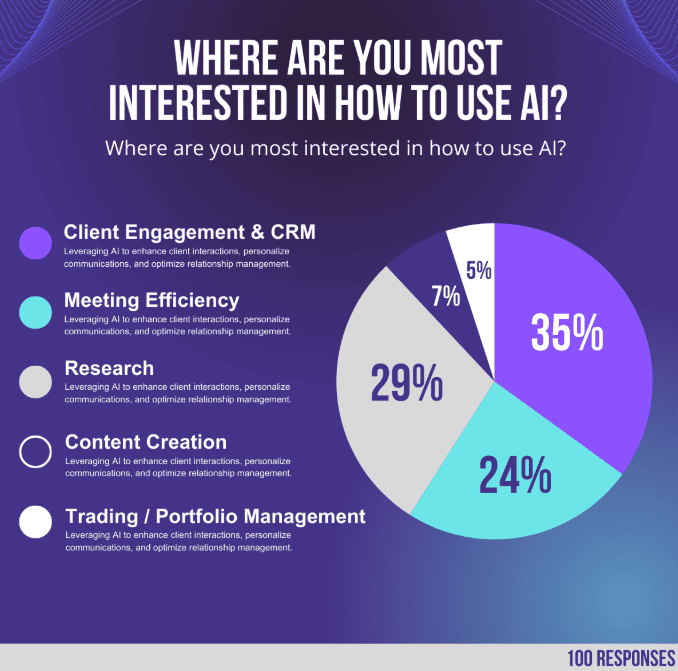

Where People Are Most Interested in Using AI

- Client Engagement and CRM leads with 35%, showing the strongest interest in using AI to enhance client interactions and personalize communications.

- Meeting Efficiency ranks second at 24%, reflecting a rising demand for AI tools that streamline meeting workflows and improve team productivity.

- Research accounts for 29%, indicating significant interest in AI-driven data analysis and insight generation.

- Content Creation holds 7%, highlighting a smaller but growing segment exploring AI for generating written and visual content.

- Trading and Portfolio Management captures 5%, showing niche but notable interest in using AI for investment decisions and portfolio optimization.

Harnessing AI for Client Acquisition and Retention

- Predictive analytics increased client acquisition rates by 15% for firms adopting AI tools in 2025.

- Personalized marketing campaigns driven by AI boosted client engagement by 37%, enhancing brand loyalty in 2025.

- AI-based customer relationship management (CRM) systems reduced churn rates by up to 25% in 2025.

- 81% of clients reported higher satisfaction with AI-enhanced customer service experiences in 2025.

- Machine learning algorithms identify at-risk clients, enabling proactive churn reduction of 28% in 2025.

- AI-driven insights helped advisors increase cross-selling opportunities by 30% in 2025.

- Firms using AI-powered sentiment analysis saw a 24% improvement in client feedback scores in 2025.

AI in Portfolio Management and Optimization

- AI-powered portfolio management tools outperformed traditional methods by 14% in 2025.

- Dynamic rebalancing algorithms processed market changes within milliseconds in 2025, reducing risk and improving returns.

- Wealth managers using AI achieved a 17% higher annual return on investment portfolios in 2025.

- AI-driven market prediction models boast accuracy rates exceeding 90% in 2025, aiding strategic decisions.

- Smart beta strategies, powered by AI, gained a 31.6% adoption rate among asset managers in 2025.

- Automated investment platforms like robo-advisors reduced advisory fees by up to 50% in 2025, increasing accessibility.

- Real-time risk analysis tools enabled 34% faster adjustments to volatile market conditions in 2025.

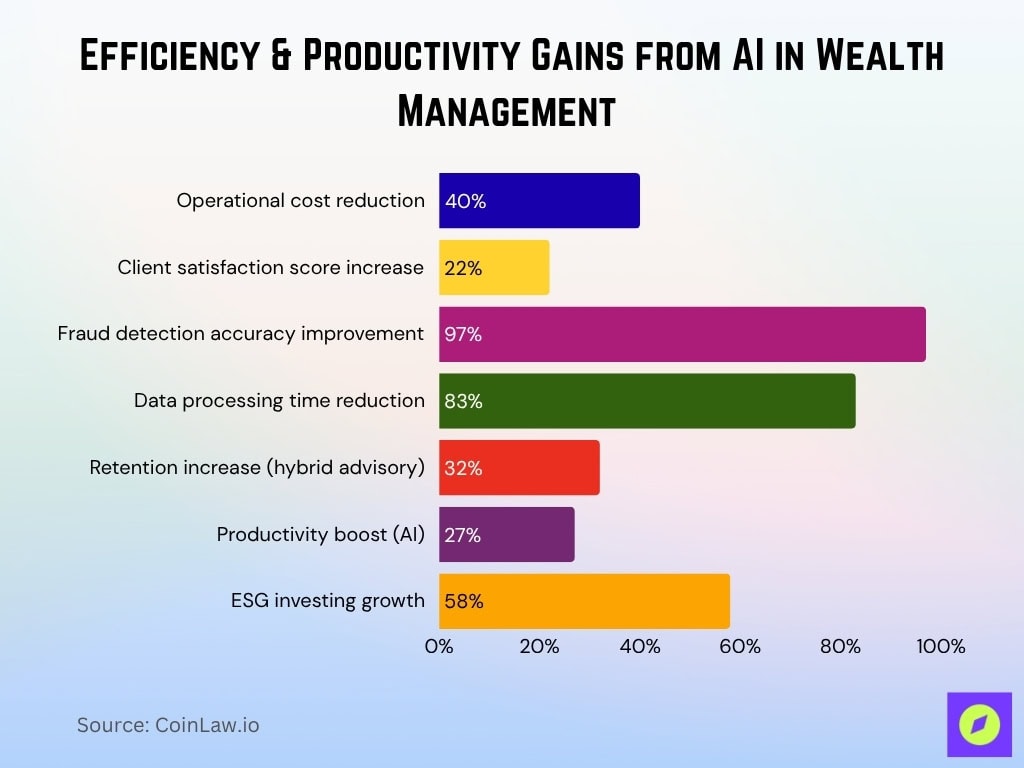

Advantages of Using AI in Wealth Management

- AI-powered tools decreased operational costs by 40% in 2025, driving profitability for financial firms.

- Client satisfaction scores rose by 22% due to personalized insights delivered by AI platforms in 2025.

- Fraud detection accuracy improved by up to 97% with AI in 2025, safeguarding client assets and firm reputation.

- AI-driven tools reduced data processing times by 83% in 2025, ensuring faster service delivery.

- Hybrid advisory models, combining AI and human expertise, led to a 32% increase in client retention in 2025.

- Wealth managers using AI reported a 27% higher productivity rate in 2025, enabling better client focus.

- Environmental, Social, and Governance (ESG) investing powered by AI grew by 58% in 2025, reflecting changing investor priorities.

AI’s Role in Risk Assessment and Fraud Detection

- AI systems identified and prevented $15.6 billion worth of fraudulent transactions globally in 2025.

- Machine learning algorithms reduced credit risk assessment times by 45% in wealth management in 2025.

- 90% of financial firms reported enhanced fraud detection accuracy with AI-driven tools in 2025.

- Predictive modeling tools identified emerging risks 34% faster than traditional methods in 2025.

- Behavioral analytics powered by AI detected unusual account activities with a 96.8% success rate in 2025.

- AI-enabled platforms streamlined regulatory compliance processes, reducing penalties by 30% in 2025.

- In 2025, 95% of financial firms are using AI for risk management and fraud detection.

Human-AI Collaboration in Wealth Management

- 72% of wealth managers believe AI enhances their decision-making processes in 2025, not replacing them.

- Hybrid advisory models integrating AI increased client satisfaction rates by 28% in 2025.

- AI-driven insights helped advisors customize portfolios, improving performance by 18% on average in 2025.

- AI tools freed up 32% of advisors’ time in 2025, enabling more focus on relationship building.

- Human-AI collaboration improved accuracy in financial forecasting by 35% in 2025.

- 87% of clients prefer interacting with human advisors supplemented by AI insights for complex financial decisions in 2025.

- AI-powered tools supported human advisors in analyzing 2x more client data than manual methods in 2025.

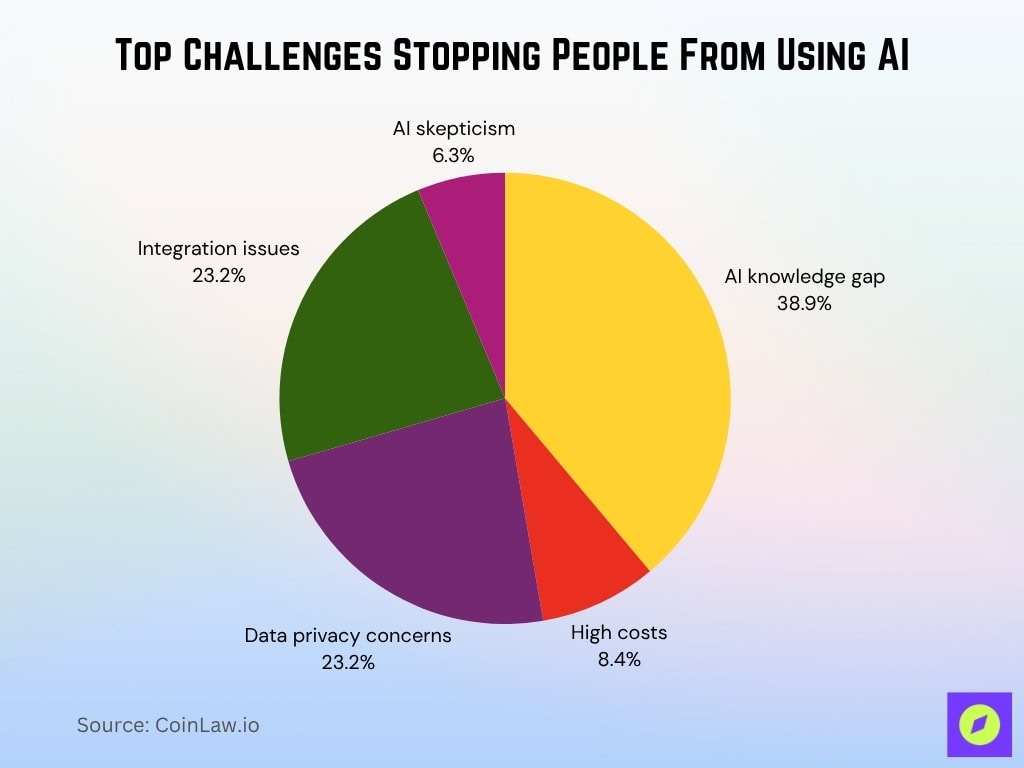

Top Challenges Stopping People From Using AI

- AI knowledge gap leads with 38.9%, showing that limited understanding and expertise remain the biggest obstacle to wider AI use.

- Data privacy concerns account for 23.2%, indicating strong hesitation around how AI systems handle and protect sensitive information.

- Integration issues also stand at 23.2%, highlighting the difficulty of connecting AI tools with existing systems and workflows.

- High costs represent 8.4%, reflecting that budget constraints still hinder some organizations from implementing AI solutions.

- AI skepticism is the smallest barrier at 6.3%, suggesting only a small portion of users still question AI reliability or effectiveness.

Recent Developments

- AI investment platforms attracted $192.7 billion in funding from venture capital firms globally in 2025, dominating over half of all VC investments.

- Generative AI tools like ChatGPT and Anthropic are being integrated into wealth management platforms in 2025, delivering hyper-personalized client interactions and portfolio summaries.

- AI-driven ESG frameworks gained 20% more adoption in 2025 compared to last year in wealth management firms.

- Wealth management firms expanded their use of cloud-based AI tools for scalability and cost efficiency in 2025, enabling more competitive pricing and streamlined operations.

- Real-time portfolio optimization algorithms introduced in 2025 promise faster, more accurate adjustments via predictive modeling and automated trade execution.

- In 2025, AI-powered tax optimization tools gained significant traction for HNWIs, enabling personalized cross-border strategies and maximizing deductions.

- AI adoption in mid-sized wealth management firms grew by 30% in 2025, narrowing the technology gap with larger players.

Frequently Asked Questions (FAQs)

15% higher annual returns.

45-75% of users are under 35.

$192.7 billion globally.

40% reduction in operational costs.

Conclusion

The rise of AI in wealth management is reshaping the industry, offering a new level of precision, efficiency, and personalization. From onboarding clients faster to optimizing portfolios and mitigating fraud, AI is enabling firms to adapt to the complexities of modern finance. However, as with any transformative technology, challenges such as data security and ethical considerations must be addressed. This year stands as a testament to the growing potential of AI to empower wealth managers and redefine the client experience. Embracing AI thoughtfully and responsibly will ensure its continued success in this dynamic field.