Imagine a world where AI systems handle billions of transactions, detect fraud in real-time, and personalize financial advice in seconds. That’s the reality fintech is moving towards, with artificial intelligence transforming how we interact with financial services daily. This growth isn’t just about convenience; it’s creating more efficient, secure, and accessible financial ecosystems. AI’s role in the fintech industry is more crucial than ever, driving trends and setting new standards that redefine modern finance.

Editor’s Choice

- The global AI fintech market is valued at $36.61 billion in 2026 and is projected to reach about $99.09 billion by 2031 at around 22% CAGR.

- AI adoption among top-performing fintech and financial firms has reached roughly 88%, driving efficiency gains and cost reductions across banking, payments, and lending.

- AI-powered fraud and risk analytics are cutting fraud-related losses by up to 20–30% while enabling near real-time monitoring.

- Conversational AI and chatbots in financial services are projected to deliver annual savings approaching $500 billion globally by 2030, with over $100 billion already realized.

- AI tools in credit, trading, and risk are expected to support a market exceeding $80 billion by 2030, growing from around $30 billion in 2025.

Recent Developments

- AI-powered cybersecurity in BFSI is driving a market growing from $35.40 billion to about $167.77 billion by 2035 at a roughly 18.9% CAGR.

- Fintech partnerships with major cloud and tech providers are embedding AI security and fraud tools into platforms, with related markets growing at a 19–24% CAGR.

- The global robo advisory market is projected to rise from about $14.08 billion in 2026 to roughly $102.03 billion by 2034 as AI‑enhanced platforms scale.

- Around 42% of card issuers and 26% of acquirers save over $5 million in two years using AI for payment fraud prevention, with anomaly detection used by 60% of firms.

- Over three in five financial organizations now use advanced machine learning for real‑time fraud detection and automation, improving accuracy and scalability.

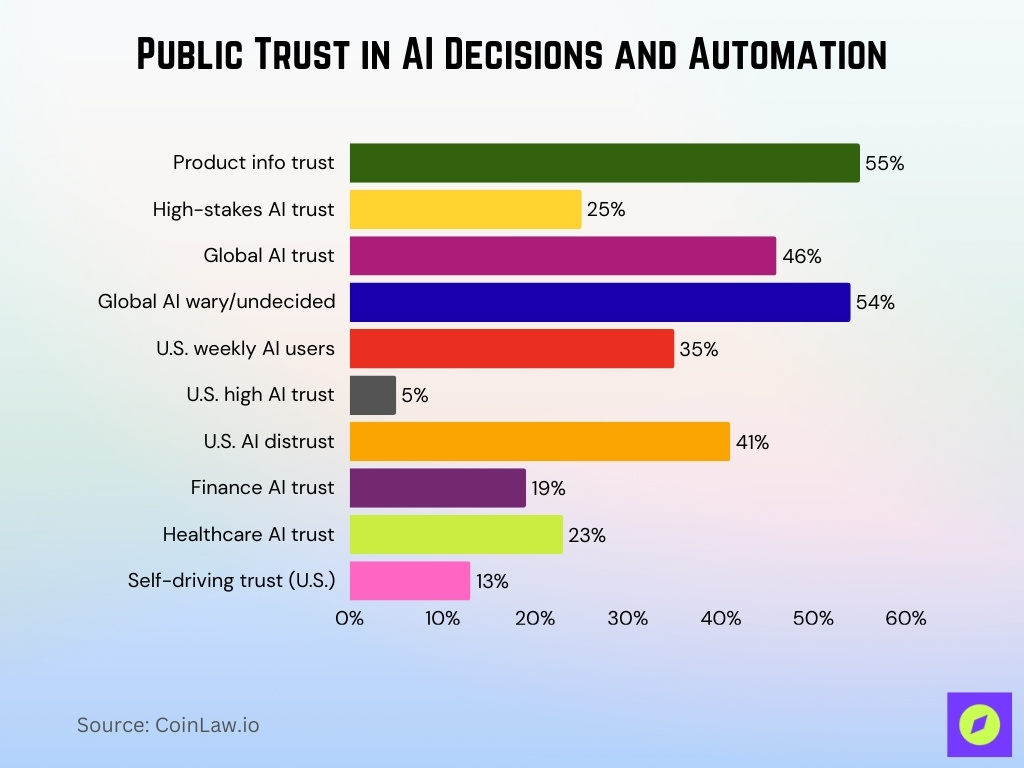

Public Trust in AI-Driven Decisions and Automation

- 55% of global consumers trust AI to collect and combine product information, but less than 25% trust it to provide high‑stakes services like legal advice.

- Only 46% of people globally say they trust AI systems, while 54% are wary or undecided about relying on AI.

- A 2025 survey shows 35% of Americans use AI tools weekly, yet only 5% “trust AI a lot,” with 41% expressing distrust.

- Trust in AI is lowest in finance and healthcare, where just 19% and 23% of respondents, respectively, report confidence in AI use.

- Only 13% of U.S. drivers say they trust riding in a self-driving vehicle, even as autonomous tech investments continue to grow.

Key Applications of AI in Fintech

- Customer service automation in banking can now handle up to 90% of interactions via digital assistants, with 80% of financial institutions viewing bots as a valuable channel.

- AI-powered fraud detection can reduce false positives by 70–80% and cut fraud losses by about 20%, with some banks seeing a 25% drop in fraud cases.

- AI credit scoring delivers around 15–25% more accurate risk prediction than traditional scorecards and can cut default rates by up to 30%.

- AI-driven chatbots and virtual agents are projected to power over 95% of banking customer interactions, adding roughly $1 billion in value to operations.

- AI in banking can cut operating costs by 20–35%, save more than 4 minutes per chatbot-handled inquiry, and generate over $7 billion in global savings.

- AI-powered fraud systems can reach detection rates of 86–94%, lower false positives to 5–12%, and complete over 92% of reports in under 2 hours.

- Modern AI credit platforms can assess up to 200 behavioral indicators per customer, improving risk accuracy by around 34% versus traditional methods.

Regional Market Insights

- North America leads with about 36.8–42.1% of global AI fintech revenue, while the U.S. fintech market is projected to reach $100.57 billion at roughly 17–18% CAGR.

- Europe holds around 28% of the global AI fintech market, supported by strong UK and Germany ecosystems and mid-teens CAGR growth.

- Asia-Pacific is the fastest-growing region, expected to reach about $11.2 billion by 2030 at nearly 19.7% CAGR, driven by China, India, and Singapore.

- Latin America’s AI fintech market is forecast to grow at 18.5–22.7% CAGR, reaching roughly $2.18 billion by 2030 and over $100.5 billion in broader fintech value by 2033.

- The Middle East and Africa AI fintech market is expanding at about 18.1% CAGR, alongside wider fintech growth to around $103.65 billion by 2033 at 21.42% CAGR.

- Strong regulatory and government support in Singapore, China, the UAE, and the U.S. drives well over 50% of global AI fintech investment and activity.

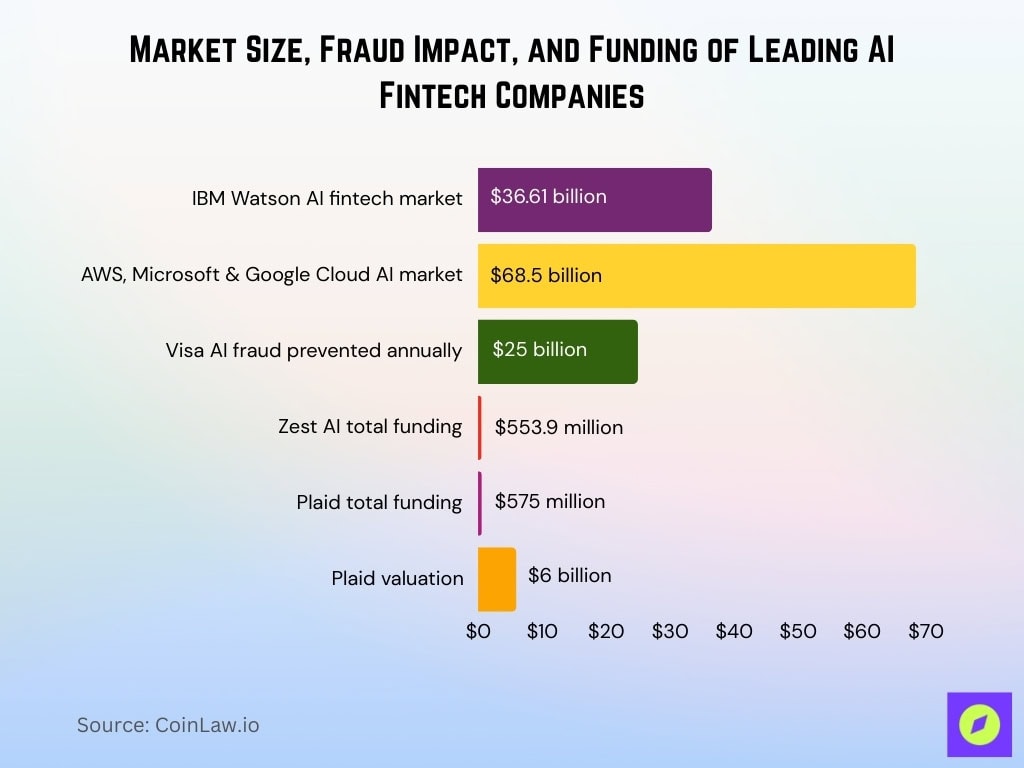

Leading Players and Competitors

- Tier-1 cloud and AI vendors account for roughly 50–55% of global AI fintech revenue, driven by large-scale banking and payment deployments.

- IBM’s Watson and financial AI tools operate in a market projected to grow to $36.61 billion in 2026.

- AWS, Microsoft, and Google lead a market expected to reach roughly $68.5 billion by 2035, expanding at nearly 15.9% CAGR.

- Visa’s AI-based Advanced Authorisation helps prevent an estimated $25 billion in fraud annually by scanning more than 127 billion transactions each year.

- Microsoft Azure, Google Cloud AI, and AWS support hundreds of institutions globally as the U.S. AI fintech segment alone moves toward over $100 billion in value.

- Zest AI has raised about $553.9 million across 15 funding rounds.

- Plaid secured $575 million in funding at roughly a $6 billion valuation, highlighting strong investor interest in AI-driven fintech data platforms.

Technology Innovations and AI Advancements

- NLP-powered chatbots and assistants can improve customer satisfaction in fintech by up to 30% compared with traditional service channels.

- Predictive analytics in finance can improve forecast accuracy by about 10–20% and cut loan defaults by roughly 20%.

- AI and ML adoption in finance has reached 94% of institutions, with 83% using advanced ML and 72% using NLP for financial crime detection.

- AI-driven onboarding and KYC can cut verification and onboarding times by around 40–70%, moving many banks toward near “zero‑touch” onboarding.

- In backtests, AI‑powered portfolio forecasting and optimization models can outperform static portfolios by about 5% in annual returns.

- Banks using AI for digital onboarding and document verification report onboarding time drops from days to minutes, with review times falling by up to 70%.

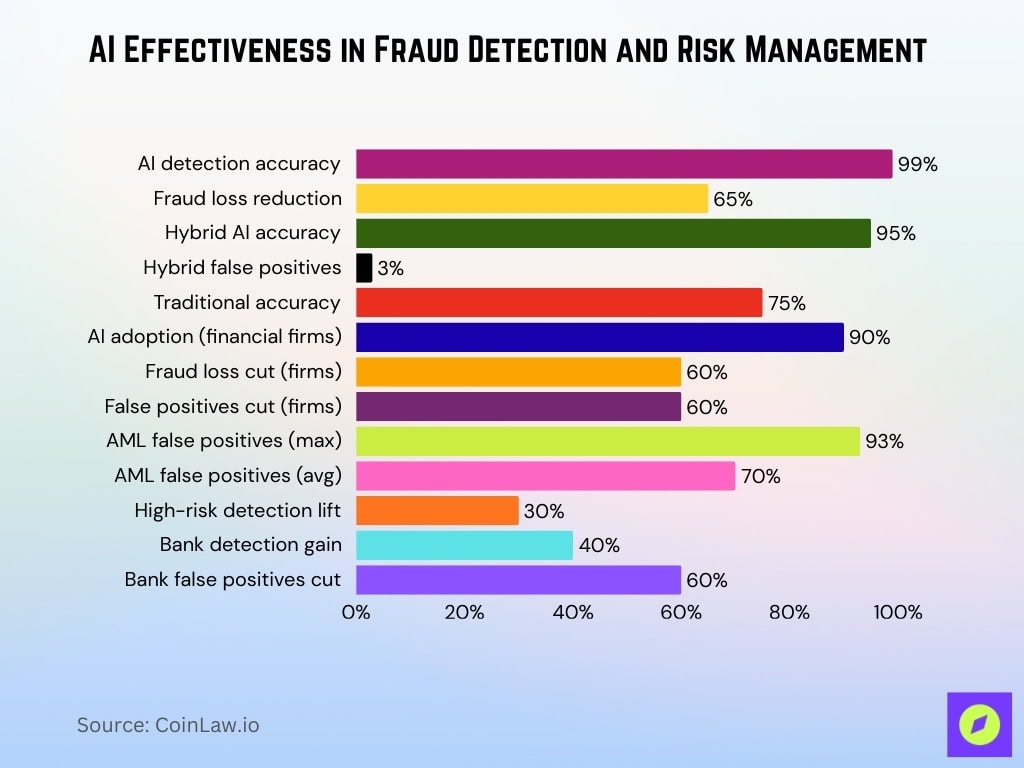

Trends in Fraud Detection and Risk Management

- Real-time AI fraud detection systems can reach 99% accuracy and cut fraud losses by around 65% versus legacy rules-based tools.

- Behavioral analytics and hybrid AI models achieve about 95% detection accuracy with false positives as low as 3%, sharply improving over traditional methods at 75% accuracy.

- 90% of financial institutions now use AI to fight fraud and financial crime, with 39% reporting 60% fraud-loss reduction and 34% seeing 60% fewer false positives.

- AI-driven AML and screening can cut false positives by up to 93% while keeping decisions fully auditable and compliant.

- AI adoption in AML can reduce false positives by about 70% while boosting high‑risk event detection by roughly 30%.

- Banks using AI for fraud detection report up to 40% better detection rates and a 60% reduction in false positives in some deployments.

Role of AI in Enhancing Customer Experience

- AI-driven personalization can boost banking customer satisfaction by about 25%, increase cross-selling success by 20–30%, and lift campaign ROI by roughly 25%.

- Chatbots in banking resolve around 87% of inquiries in under 60 seconds, cutting support costs from about $6 to $0.11 per interaction and improving productivity by 32%.

- Banks using chatbots report a 38% reduction in case resolution time, a 41% drop in ticket backlogs, and 74% first-contact resolution rates.

- Voice-enabled banking chatbots handled roughly 21% of all customer service traffic, with voicebot integration up by about 43% among omnichannel banks.

- AI loan approval systems let financial institutions process credit applications 25x faster, cutting timelines by about 83% and operating costs by 20–70%.

- AI-powered loan analytics can raise loan approval rates by up to 30% while eliminating over 75% of manual credit decisioning tasks.

- After chatbot adoption, banks saw around a 24% drop in support overhead and a 21% reduction in time-to-resolution across service channels.

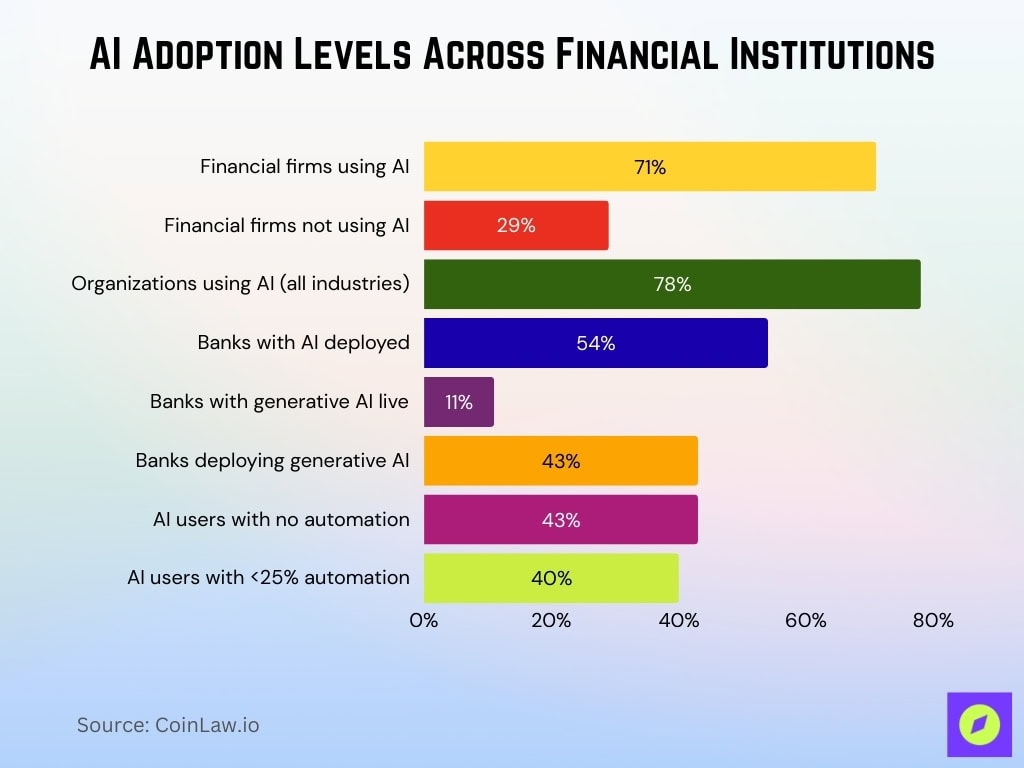

AI Adoption Rates in Financial Businesses

- About 71% of financial services firms now formally use AI, while 29% remain non‑adopters or informal users.

- Across industries, 78% of organizations use AI in at least one function, indicating rapid mainstreaming.

- Among banks surveyed globally, 54% had deployed AI initiatives by early 2025.

- A global banking survey found 11% of institutions have fully implemented generative AI, while another 43% are in the process of deployment.

- In one jurisdictional survey, 43% of financial institutions using AI reported no automated decision-making, while 40% had automation below 25%, showing cautious deployment.

Investment and Funding Landscape

- Global fintech funding rose 21% in 2025 to about $53 billion across 5,918 deals, rebounding from 2024 and signaling renewed investor confidence.

- VC-backed fintech startups raised roughly $51.8 billion in 2025, with larger late-stage rounds driving growth.

- In 2025, fintech captured about 11% of global venture funding (around $52.7 billion), while AI startups attracted roughly $226 billion and 48% of total funding.

- One week in January 2026 saw fintech companies raise just over $1 billion, following two weeks where funding topped $2.3 billion, highlighting strong early‑year momentum.

- The U.S. drew about $25.1 billion in fintech investment in 2025, compared with $3.6 billion for the UK, $3.4 billion for India, $2.5 billion for the UAE, and $2 billion for Singapore.

- In 2025, fintech investments in H1 alone totaled around $24 billion across 2,597 deals, with AI-enabled a major driver.

- Global tech startups raised about $469 billion in 2025, with mega‑rounds of $1 billion+ accounting for 65% of total funding.

Frequently Asked Questions (FAQs)

The AI in the Fintech market is projected to be worth $36.61 billion in 2026.

It is forecasted to grow at a 22.04% CAGR from 2026 to 2031.

FinTech funding reached $52.7 billion across 5,918 deals in 2025.

Conclusion

As AI continues to gain momentum in the fintech industry, its impact is undeniable. From transforming customer experience with real-time support and predictive analytics to enhancing security through advanced fraud detection, AI’s applications in fintech are expansive and vital. Investment and regulatory focus on AI underscore its role as a cornerstone of modern financial technology, and the advances in machine learning, blockchain integration, and NLP promise a more secure, personalized, and efficient financial ecosystem.

Looking forward, the AI in the fintech market is poised for substantial growth, set to redefine financial services with enhanced capabilities that adapt to both user expectations and regulatory demands.