In 2015, two friends at a jazz show realized it was easier to pay via mobile than cash. Fast‑forward to today, Zelle processes over $1 trillion annually through its banking partners, while Venmo remains the go‑to for younger users craving social peer‑to‑peer payments. This article explores how these two giants compare in user base, transaction volume, and growth, helping U.S. readers understand why one may suit their needs better than the other.

Key Takeaways

- 1Zelle handled $1 trillion in 2024, up 27% year‑over‑year.

- 2151 million enrolled users on Zelle in 2025, up 16 million from 2023.

- 3Zelle is projected to account for approximately 54.6% of U.S. mobile peer‑to‑peer payment transaction value in 2025, compared to 20.5% for Venmo. These estimates may vary depending on whether the metric refers to transaction value or transaction count.

- 4Zelle enrollment rose 17% in 2025, reaching 151 M users.

- 5Zelle transactions hit 3.6 billion in 2024, a 25% increase.

- 6PayPal’s Q2 2025 earnings report shows Venmo revenue increased by approximately 20% year‑over‑year, marking its fastest quarterly growth since 2023.

- 7Early Warning Services, operator of Zelle, reported that its small‑business payment volume increased by approximately 32% in 2025, driven by service‑sector adoption and expanded invoicing tools.

Recent Developments

- As of April 2, 2025, Zelle discontinued transfers via its standalone app, now only accessible through over 2,200 bank apps, as 98% of users already used those platforms, and just 2% used the app itself.

- Remaining users can view history in the Zelle app until August 11, 2025, after which transfer functions will be removed.

- Venmo continues to roll out new features like Pay with Venmo and debit card adoption, boosting recent growth.

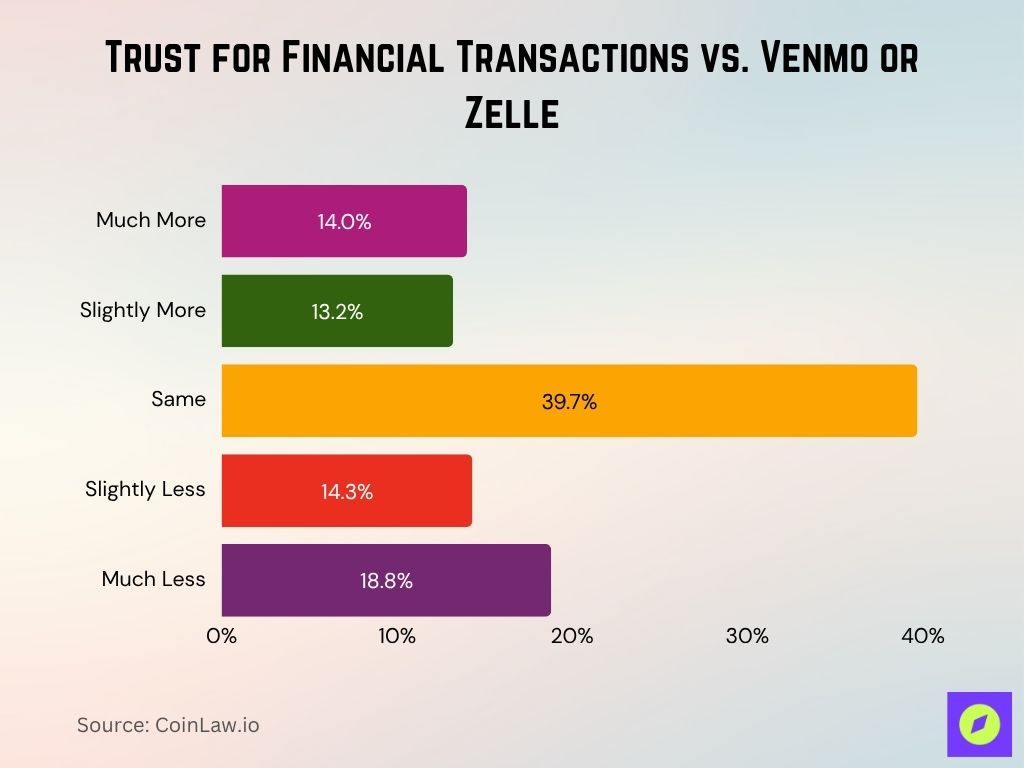

Trust for Financial Transactions vs. Venmo or Zelle

- 39.7% of respondents trust X/Twitter about the same as Venmo or Zelle.

- 18.8% trust X/Twitter much less, indicating notable skepticism.

- 14.3% trust X/Twitter slightly less than traditional payment providers.

- 14.0% have much more trust in X/Twitter compared to Venmo or Zelle.

- 13.2% trust X/Twitter slightly more than established payment providers.

User Base Statistics

- Zelle had 151 million enrolled user accounts in 2024, rising from 135 million in 2023, a 17% increase.

- Active user growth, Zelle members projected at 78.4 million in 2025, up from 73.2 M in 2024, about 7.1% growth, and expected to reach 82.4 M in 2026.

- Industry forecasts project Venmo’s user base will reach around 107.6 million by year‑end 2025.

- Venmo is projected to have a 61.8% share of U.S. mobile P2P payment users in 2025, compared to 36.2% for Zelle and 31% for Cash App. These figures represent user share, not transaction value, where Zelle currently leads.

Transaction Volume Statistics

- Zelle processed 3.6 billion transactions in 2024, a 25% increase from 2023.

- Total payment volume exceeded $1 trillion in 2024, up 27% year‑over‑year.

- Zelle is forecast to hold 54.6% of total mobile P2P value in 2025 versus 20.5% for Venmo and 10.6% for Cash App.

- Venmo’s annual payment volume grew 17% YoY in 2024; earlier estimates had Venmo at $230 billion in 2021.

Growth Rate Statistics

- Zelle users increased 17% year‑over‑year from 2023 to 2024.

- Transactions surged 25%, while dollar moves rose 27% in the same period.

- Zelle small‑business usage jumped 32% in 2025.

- Venmo revenue growth topped 20% in Q2 2025, the fastest since 2023.

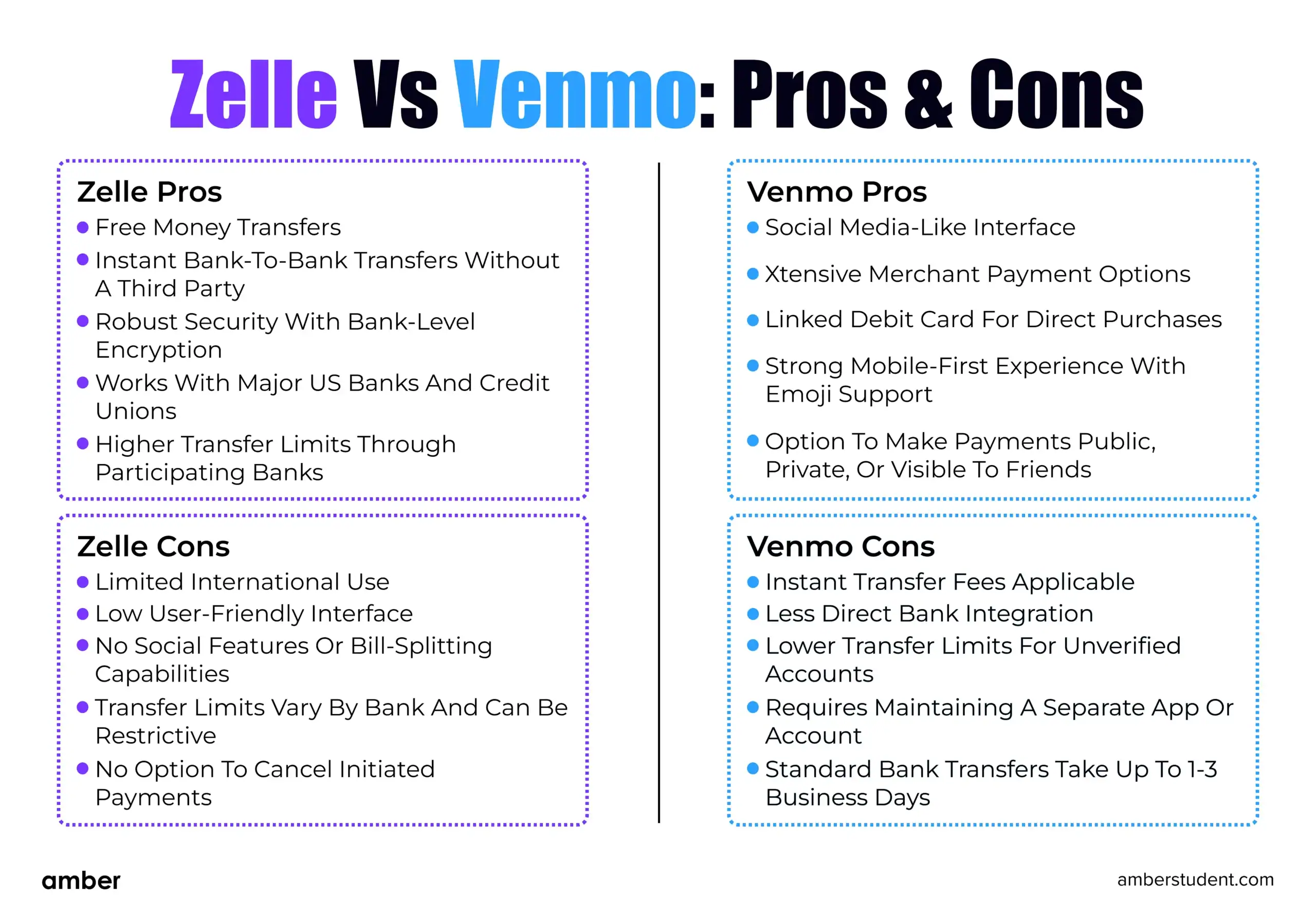

Zelle vs. Venmo: Key Pros and Cons

- Zelle offers free, instant bank-to-bank transfers with bank-level encryption and works with major US banks.

- Higher transfer limits are possible through participating banks, but international use is limited.

- Zelle lacks social features and bill-splitting, has a less user-friendly interface, and no option to cancel initiated payments.

- Venmo provides a social media-like interface, emoji support, and extensive merchant payment options.

- Offers linked debit cards for purchases and lets users choose public, private, or friends-only payment visibility.

- Venmo charges instant transfer fees, has lower transfer limits for unverified accounts, and requires a separate app/account.

- Standard transfers with Venmo can take 1–3 business days.

Market Share Statistics

- Zelle is expected to account for 54.6% of mobile P2P volume in 2025, far ahead of Venmo’s 20.5% and Cash App’s 10.6%.

- In the broader P2P context, PayPal leads globally with about 30% market share, Google Pay at 25%, Zelle at 20%, Venmo at 15%, and Cash App at 7% in 2025.

Revenue Statistics

- Venmo generated $1.15 billion in net revenue in 2024, up from $0.98 billion in 2023, marking a 17% year‑over‑year increase.

- In Q2 2025, Venmo’s revenue growth hit 20%, its fastest pace since 2023.

- Zelle does not directly monetize transfers for most consumers; instead, its revenue comes from bank partnerships and small‑business payment fees.

- In 2025, Zelle’s small‑business payment volume surged 32%, contributing to increased bank fee income.

- Venmo’s share of PayPal’s total revenue stands at 18% in 2025, compared to 15% in 2023.

- PayPal aims to grow Venmo’s revenue to $2 billion annually by 2026.

- Zelle’s transaction processing costs are significantly lower than Venmo’s, giving partner banks higher margins on P2P activity.

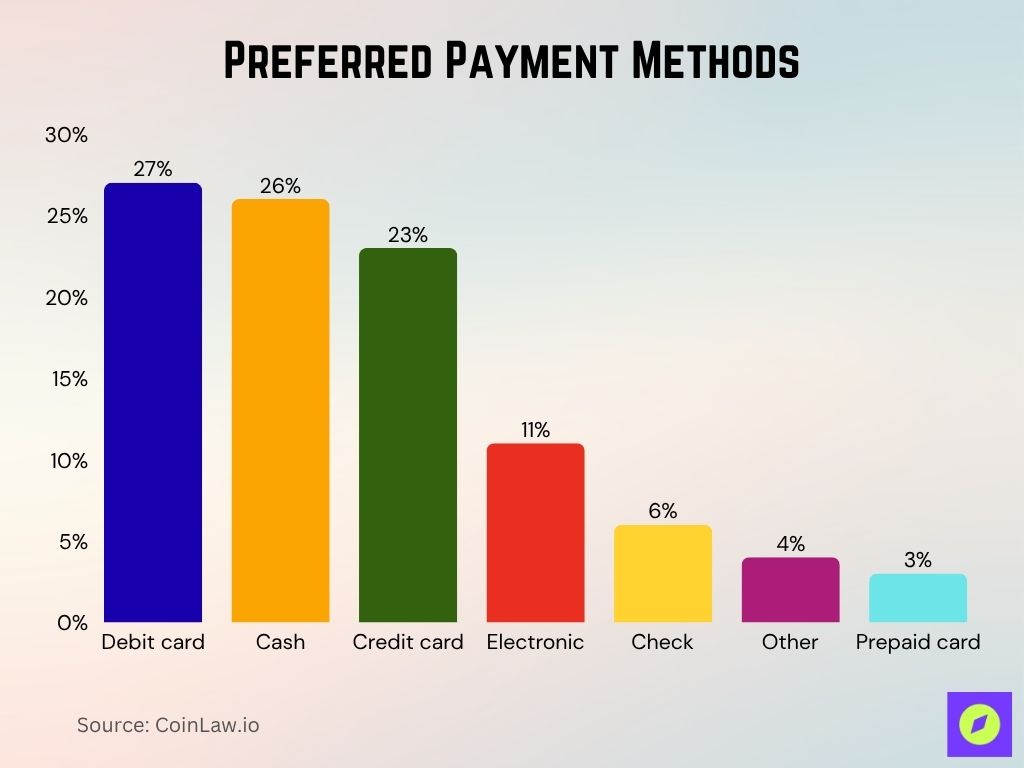

Preferred Payment Methods

- Debit cards are the most used, making up 27% of all transactions.

- Cash follows closely at 26%, showing its continued relevance despite digital options.

- Credit cards account for 23%, highlighting strong consumer reliance on revolving credit.

- Electronic payments make up 11%, reflecting steady adoption of digital methods.

- Checks represent 6%, indicating declining but ongoing use for certain transactions.

- Other payment methods account for 4% of usage.

- Prepaid cards are the least common, used in only 3% of transactions.

Transfer Speed Statistics

- Zelle transfers typically clear within minutes, thanks to integration with the ACH network and bank‑level settlement systems.

- Venmo’s standard bank transfer takes 1–3 business days.

- Venmo Instant Transfer arrives in minutes, but carries a 1.75% fee (minimum $0.25, maximum $25).

- 91% of Zelle transactions in 2025 were completed in under 60 seconds, reflecting the efficiency of its bank‑integrated real‑time payment network.

- Venmo Instant Transfer usage rose 28% year‑over‑year in early 2025, as users sought faster access to funds.

- Zelle’s real‑time transfer capability is now available through 2,200+ participating financial institutions.

- Venmo continues to work on expanding real‑time settlement partnerships to reduce costs and fees.

Transfer Limit Statistics

- Zelle’s sending limit averages $3,500 per day for most major U.S. banks, though exact amounts vary by institution.

- Venmo’s standard weekly sending limit is $6,999.99 after identity verification.

- Zelle has no set receiving limit, as limits are determined by individual banks.

- Venmo limits person‑to‑person payments to $4,999.99 per transaction.

- Some Zelle partner banks allow single transfers up to $10,000 for business accounts.

- Venmo business profiles can process up to $50,000 per week.

- Zelle limits can be increased for certain business or premium accounts through bank approval.

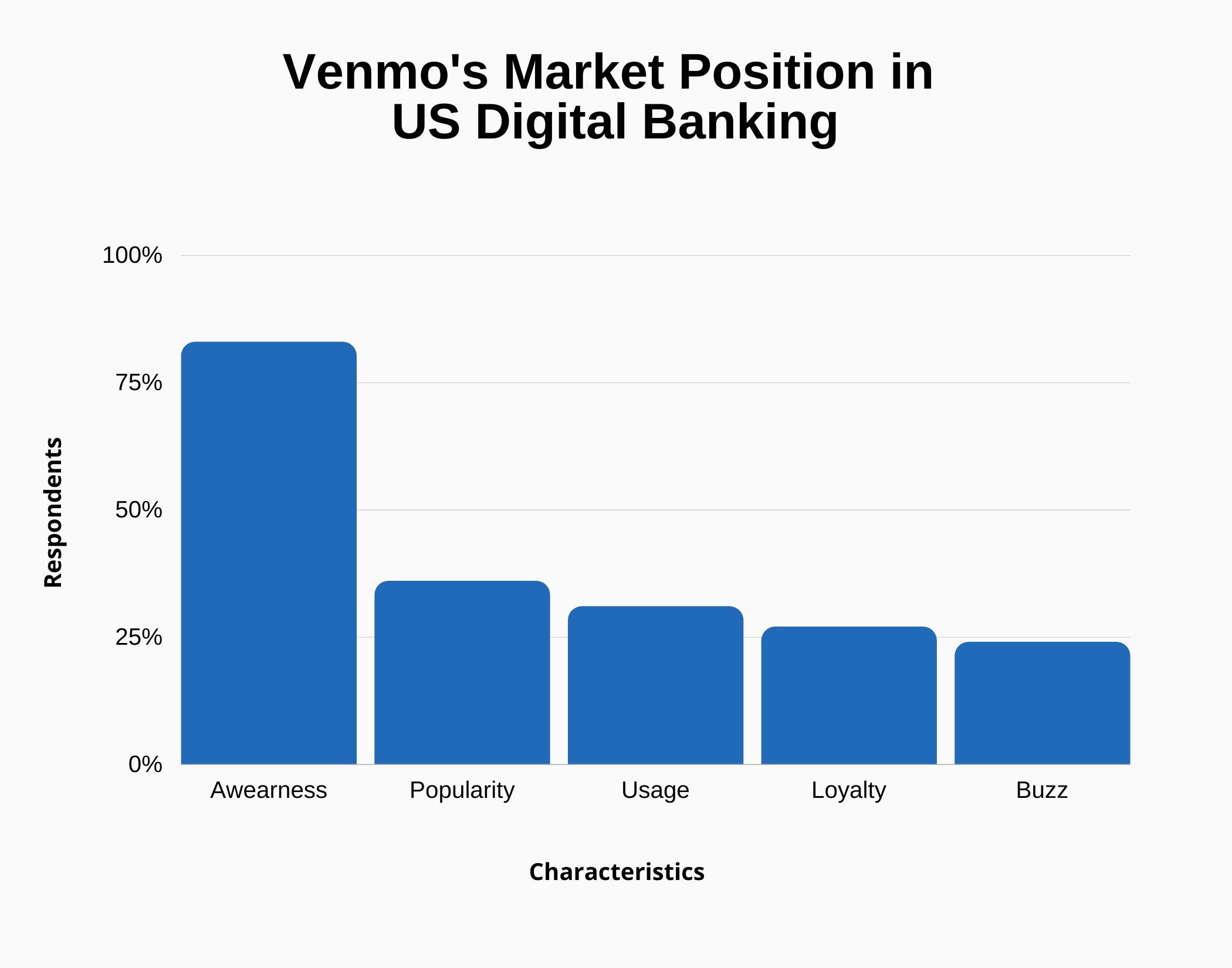

Venmo’s Market Position in US Digital Banking

- Awareness of Venmo is extremely high, reaching over 80% of respondents.

- Popularity sits around 35%, showing a smaller share actively favors Venmo despite high recognition.

- Usage is about 30%, indicating many aware users don’t actively transact on Venmo.

- Loyalty stands near 25%, reflecting moderate retention of existing users.

- Buzz is around 23%, suggesting limited current hype or word-of-mouth growth compared to awareness levels.

Usage Frequency Statistics

- In 2025, over 80% of Zelle’s active users send or receive money at least once per month.

- Venmo reports that 65% of users engage with the app weekly.

- Zelle’s typical user initiates 12 transactions per month.

- Venmo users average 8.5 transactions per month, but often include smaller casual payments.

- Zelle’s business‑to‑consumer payments increased 40% year‑over‑year in 2025.

- Venmo’s bill‑splitting and shared expense features account for 25% of its transaction volume.

- Zelle sees higher frequency among older demographics, while Venmo dominates with younger social spenders.

Demographic Statistics

- Zelle’s core demographic is ages 35–54, typically bank customers with higher household incomes.

- Venmo skews younger; over 70% of users are under age 35.

- Zelle adoption is highest among college‑educated professionals and small‑business owners.

- Venmo is most popular in urban and suburban areas with high millennial and Gen Z populations.

- Zelle usage penetration exceeds 65% among households earning over $100,000 annually.

- Venmo maintains a strong foothold among students and gig‑economy workers.

- Both services have higher adoption among smartphone‑first consumers than those relying on desktop banking.

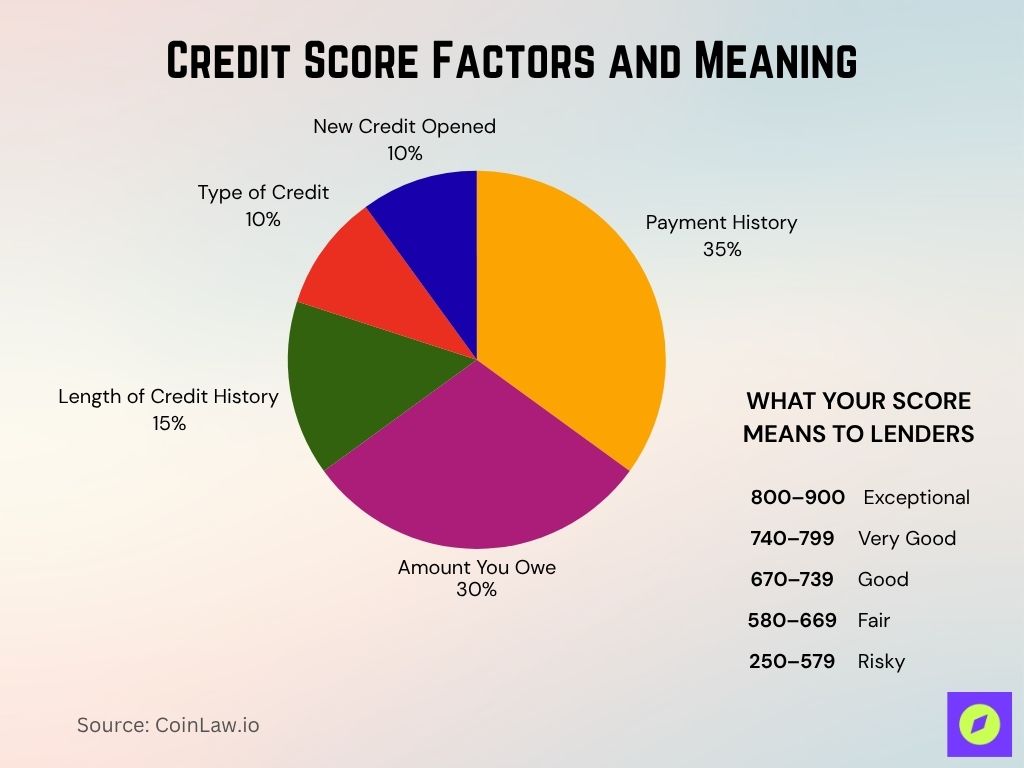

Credit Score Factors and Meaning

- Payment history is the biggest factor, making up 35% of your credit score.

- The amount you owe contributes 30%, showing the impact of outstanding debt levels.

- Length of credit history accounts for 15%, rewarding longer borrowing records.

- The type of credit used makes up 10%, favoring a healthy mix of credit types.

- New credit opened also weighs 10%, with frequent new accounts potentially lowering scores.

- A score of 800–900 is considered exceptional, while 740–799 is very good.

- 670–739 is rated good, 580–669 is fair, and 250–579 is risky for lenders.

Business Usage Statistics

- Zelle’s business payments grew 32% in 2025, driven by service industries and small‑business invoicing.

- Venmo business profiles have increased 28% year‑over‑year.

- 2025 data shows Zelle adoption in small‑business merchant accounts exceeding 40% in certain regions.

- Venmo business users average $1,200 per month in incoming payments.

- Zelle’s integration with business checking accounts gives it a stronger presence in professional services and contractors.

- Venmo’s brand recognition drives higher adoption in creative industries and gig‑based work.

- Zelle now processes more than $15 billion annually in small‑business payments.

Fee Comparison Statistics

- Zelle, No fee for standard consumer or business transfers; banks may charge separately for certain services.

- Venmo, 1.75% fee for Instant Transfer to a linked bank account or debit card.

- Venmo business profiles are charged 1.9% + $0.10 per transaction.

- Zelle’s fee‑free model is seen as a competitive advantage in business‑to‑consumer transactions.

- Venmo waives some business fees for promotional periods but maintains higher processing costs overall.

- Zelle’s bank‑integrated approach reduces the likelihood of surprise fees for users.

- Venmo still offers free standard transfers to linked bank accounts, but with longer processing times.

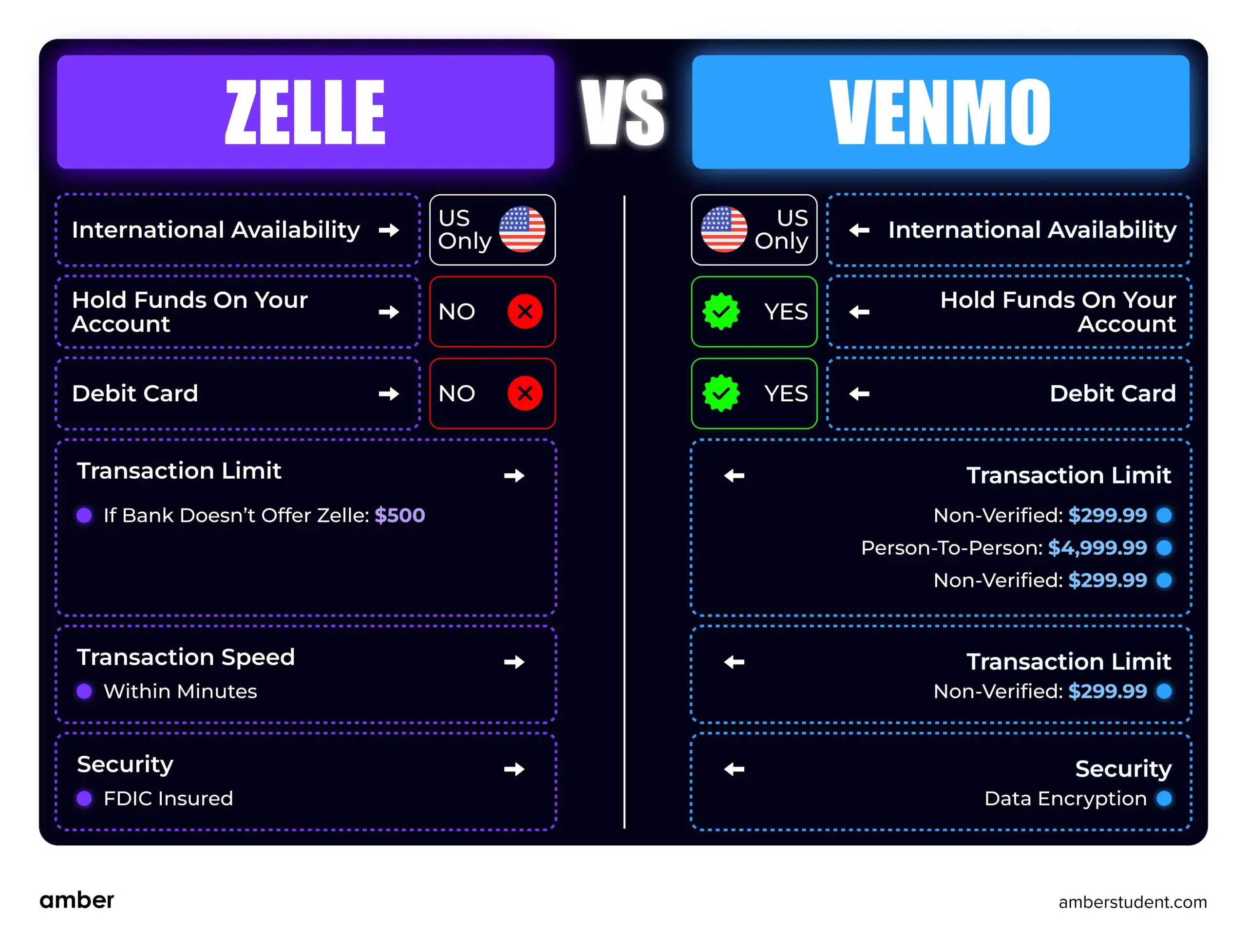

Zelle vs. Venmo: Key Feature Comparison

- International availability: Both are US only; no cross-border transfers.

- Funds storage: Venmo can hold funds in the app, but Zelle cannot.

- Debit card: Venmo offers a linked debit card; Zelle does not.

- Transaction limits:

- Zelle: If the bank doesn’t offer Zelle, the limit is $500.

- Venmo: $299.99 for unverified users, $4,999.99 for person-to-person transfers.

- Transaction speed: Zelle delivers funds within minutes; Venmo’s speed depends on transfer type.

- Security: Zelle is FDIC insured; Venmo uses data encryption for protection.

Security and Fraud Statistics

- Zelle uses bank‑grade authentication, fraud monitoring, and multi‑factor authentication through participating financial institutions.

- Venmo employs encryption, multifactor authentication, and purchase protection for eligible transactions.

- In 2024, fraud losses linked to imposter scams on Zelle totaled around $440 million, prompting the company to strengthen fraud‑prevention measures.

- Internal PayPal security reports indicate that Venmo’s fraud reports fell by about 12% year‑over‑year in early 2025, coinciding with enhanced account verification measures.

- Zelle transactions are irrevocable once sent, making scam prevention education critical.

- Venmo offers dispute resolution for unauthorized transactions and eligible goods/services disputes, which Zelle does not.

- Both platforms comply with PCI DSS standards for secure payment processing.

Payment Methods and Integration

- Zelle works exclusively with linked U.S. bank accounts through 2,200+ participating financial institutions.

- Venmo supports U.S. bank accounts, debit cards, credit cards with a 3% fee, and Venmo balance.

- Zelle is deeply embedded in major banking apps, eliminating the need for a standalone wallet for most users.

- Venmo integrates with PayPal, allowing cross‑platform transfers and expanded merchant acceptance.

- Venmo supports in‑store QR code payments at tens of thousands of U.S. retailers.

- Zelle does not currently support in‑store merchant QR payments, but is expanding small‑business invoice and payment link tools.

- Venmo is more compatible with digital commerce platforms, while Zelle dominates in direct bank‑to‑bank transfers.

Confidence in Payment App Security

- Only 20% of users feel extremely or very confident that payment apps keep their personal information safe.

- 46% are somewhat confident, while a significant 34% have little or no confidence.

- Black users show the highest skepticism, with 43% reporting little or no confidence.

- Hispanic users have the highest somewhat confident rate at 49%.

- Younger adults (18–49) express slightly more trust, with 22% extremely/very confident, compared to 17% for those 50+.

- Older adults (50+) are more skeptical, with 39% having little or no confidence in payment app security.

App Rankings and Popularity

- In early 2025, Venmo ranked among the top 15 finance apps in the U.S. across iOS and Android.

- Zelle consistently appears in the top 25 finance apps despite sunsetting its standalone app in April 2025.

- Venmo has over 100 million app downloads on Google Play alone.

- Zelle downloads dipped 9% year‑over‑year due to reliance on bank app integration.

- Venmo maintains higher engagement in app‑based payments thanks to its social transaction feed.

- Zelle’s brand awareness is strongest among older demographics, while Venmo maintains a higher overall app rating among Gen Z.

- Both platforms consistently trend in top peer‑to‑peer payment searches in the U.S.

Customer Satisfaction and Reviews

- Venmo maintains an average 4.2/5 rating on major app stores in 2025.

- Zelle’s standalone app rating is 4.0/5, though most users now engage via bank apps with varying satisfaction scores.

- In a 2025 survey, 72% of Venmo users reported being “satisfied” or “very satisfied” with the service.

- Zelle satisfaction levels reached 76% among active users, with higher marks for reliability.

- Venmo users most value ease of use and the ability to split bills and share payment notes.

- Zelle users praise instant settlement and bank‑integrated convenience.

- Both platforms receive lower marks for dispute resolution processes.

Bank Integration Statistics

- Zelle is integrated with nearly all major U.S. banks, including Bank of America, Wells Fargo, Chase, and Citibank.

- Over 80% of U.S. bank account holders have access to Zelle through their existing banking app.

- Venmo is supported by all major banks for transfers but requires separate app usage.

- In 2025, 98% of Zelle transactions originated from bank‑integrated environments.

- Zelle’s bank partnerships provide unmatched direct deposit account connectivity.

- Venmo depends on linked account authorization through Plaid and similar APIs.

- Banks using Zelle report higher customer engagement in digital banking channels.

Notable Trends and Future Projections

- Zelle is expected to retain its lead in U.S. mobile P2P transaction value through 2026.

- Venmo will continue expanding into merchant acceptance and subscription billing.

- Zelle’s small‑business and B2C payouts will grow faster than its consumer P2P segment.

- Venmo is expected to push deeper into social commerce with PayPal ecosystem integration.

- Zelle’s app retirement marks a shift toward bank‑only payment ecosystems.

- Venmo’s Gen Z dominance will drive sustained double‑digit revenue growth through 2027.

- Both services will face increasing competition from real‑time payment networks like FedNow.

Conclusion

Zelle and Venmo continue to dominate U.S. peer‑to‑peer payments, yet they cater to distinctly different audiences. Zelle thrives with bank‑integrated speed, fee‑free transfers, and higher transaction values, making it the preferred choice for older, higher‑income, and small‑business users. Venmo holds its ground with social features, brand familiarity, and broader payment method support, resonating with younger, mobile‑first consumers. The choice between them depends on whether you value instant bank settlement or a socially connected payment experience, both of which will shape the future of digital payments in the United States.