XRP surged to its highest level in over a month after Ripple named BNY Mellon as the primary custodian for its U.S. dollar-backed stablecoin, RLUSD.

Key Takeaways

- 1XRP jumped more than 12 percent following Ripple’s announcement involving BNY Mellon.

- 2BNY Mellon will custody Ripple’s enterprise-grade stablecoin RLUSD.

- 3Ripple’s move signals growing institutional support and long-term infrastructure building.

- 4Analysts see bullish chart patterns that could push XRP to $2.87 or even $3.72.

Ripple has Wall Street’s oldest bank backing its new stablecoin. Could this be XRP’s big turning point? Investors are certainly acting like it, as the price has rallied and analysts see more upside ahead.

Let’s break down what this partnership really means and why traders are calling this a long-game pivot for Ripple.

Ripple Names BNY Mellon as RLUSD Custodian

Ripple announced that BNY Mellon, the oldest bank in America with over 240 years of financial history, will act as the primary custodian for RLUSD, its newly launched U.S. dollar-backed stablecoin. The move immediately boosted investor confidence, pushing XRP up more than 12 percent, with prices hovering around $2.36 to $2.40.

The strategic partnership also includes transaction banking support, marking a significant institutional step for Ripple. According to Ripple SVP of Stablecoins, Jack McDonald, “BNY brings together demonstrable custody expertise and a strong commitment to financial innovation… making them the ideal partner for Ripple and RLUSD.”

Why RLUSD Matters for XRP’s Future

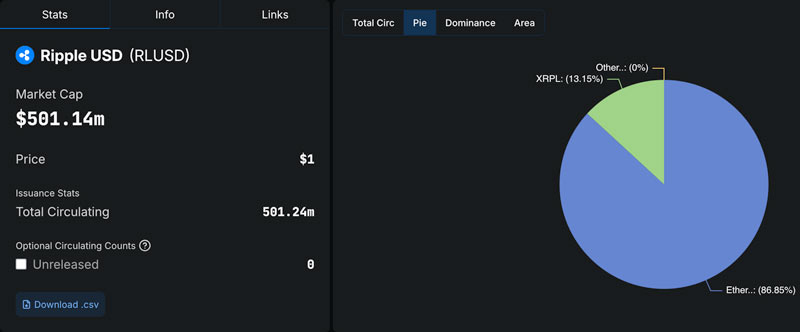

The RLUSD stablecoin currently runs on both Ethereum and the XRP Ledger (XRPL). However, 87 percent of its activity is still on Ethereum, according to DefiLlama. Ripple’s longer-term vision is to migrate more RLUSD activity to XRPL, which offers faster, cheaper settlement capabilities.

Crypto analyst Crypto Eri emphasized this strategy, writing that Ripple is “a long-game player, demanding patience from XRP investors.” She also noted Ripple’s plan to integrate smart contracts on XRPL, making RLUSD a more competitive stablecoin.

In essence, if RLUSD becomes a dominant stablecoin on XRPL, XRP could gain significantly as the native gas asset for transactions.

Bullish Chart Patterns Add Fuel to the Rally

Technical analysts are also excited. XRP recently broke out of an inverse head-and-shoulders pattern on the daily chart, a classic bullish setup. This pattern suggests a price target near $2.87, about 20 percent higher from current levels.

On a larger timeframe, XRP appears to be exiting a multimonth descending triangle, another bullish formation. If momentum holds, analysts see potential for XRP to reach $3.72 by August, representing a 55 percent rally from recent prices.

However, traders should watch for corrections. A drop below current breakout levels could delay or invalidate the bullish setup, potentially pulling prices back toward $2.00.

CoinLaw’s Takeaway

This is the kind of move I’ve been waiting to see from Ripple. Partnering with BNY Mellon isn’t just a headline, it’s a serious infrastructure upgrade that positions XRP for real-world use. If Ripple can successfully shift RLUSD traffic to XRPL, we’re not just looking at price pumps. We’re talking about XRP becoming a foundational piece of enterprise finance. I think investors who stick with it through the noise could be rewarded in a big way.