World Liberty Financial’s bank charter bid signals a massive step toward regulatory legitimacy, while its USD1 stablecoin continues record-setting growth.

Key Takeaways

- WLFI has applied for a national trust bank charter with the Office of the Comptroller of the Currency (OCC), a move that could bring its stablecoin and custody operations under direct federal oversight.

- USD1, WLFI’s stablecoin, has rapidly grown to over $3.3 billion in circulation, outpacing early growth rates of rivals like USDC and USDT.

- The bank charter application aligns with the GENIUS Act, a law signed by President Trump to support innovation in U.S. stablecoins, adding political weight to WLFI’s efforts.

- WLFI’s close ties to the Trump family and past controversies have sparked criticism and questions about potential conflicts of interest.

What Happened?

On January 7, 2026, World Liberty Financial (WLFI), a cryptocurrency venture backed by members of the Trump family, filed an application with the OCC to establish a national trust bank. If approved, the new entity named World Liberty Trust Company (WLTC) would be authorized to issue, convert, and custody its USD1 stablecoin under federal regulations. The move has sparked both excitement and scrutiny as WLFI positions itself at the intersection of crypto innovation and traditional banking.

JUST IN: 🇺🇸 Trump family’s crypto firm World Liberty Financial applies for US banking license. pic.twitter.com/zaIMhiahDy

— Watcher.Guru (@WatcherGuru) January 7, 2026

WLFI’s Bank Charter Bid: A First Among Equals

WLFI’s application to become a national trust bank places it in an exclusive club of crypto-native firms seeking serious regulatory standing. The trust charter would allow WLFI to:

- Issue and redeem its USD1 stablecoin.

- Convert other stablecoins like USDC and USDT to USD1.

- Hold reserves and provide custody for digital and fiat assets.

This structure aligns with the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, signed by President Trump in July 2025. The act provides the legal clarity crypto firms need to pursue federal licensure and institutional adoption.

According to Mack McCain, WLFI General Counsel and proposed Trust Officer for WLTC:

So far, only one other firm, Anchorage Digital, has successfully secured a similar federal trust charter. WLFI could soon join that short list.

USD1 Stablecoin Growth Breaks Records

The strength of WLFI’s application is underpinned by the rapid rise of USD1, its native stablecoin. Since its launch, USD1 has:

- Reached $3.3 billion in circulation in under a year.

- Processed nearly 50 million transactions.

- Integrated with 10 blockchain networks, including Ethereum, Solana, and BNB Smart Chain.

- Attracted over 393,000 wallet addresses.

- Enabled institutional deals, including a $2 billion transaction involving Binance and MGX.

WLFI has also proposed using $120 million from its treasury to boost liquidity for USD1, aiming to reinforce its growing role in the crypto economy.

WLFI Price and Market Movement

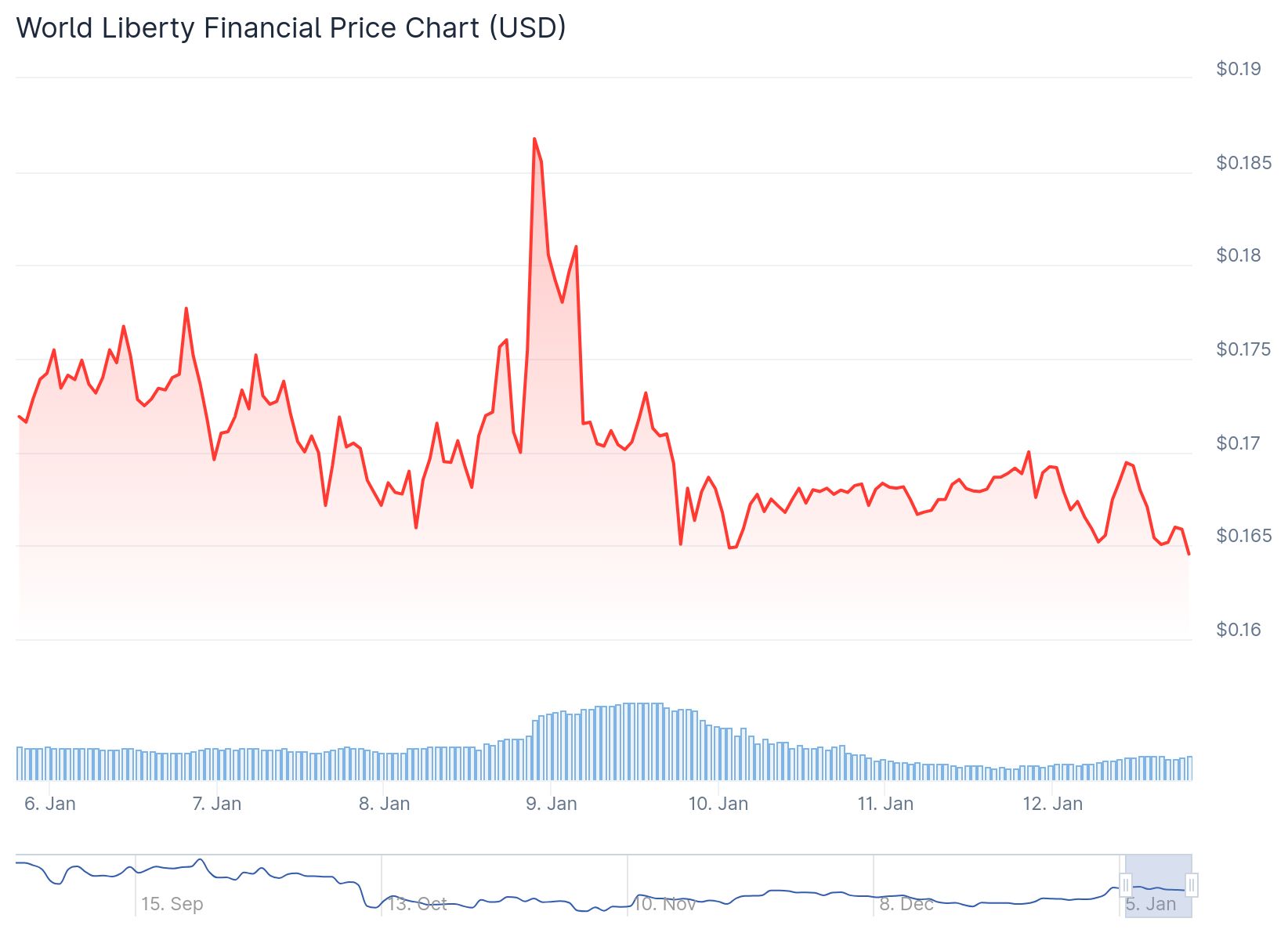

The charter announcement sparked immediate bullish sentiment for WLFI’s governance token, which rose 1.92% in 24 hours and over 18% in a week, even as broader crypto markets declined. Technical indicators suggest strong momentum:

- WLFI broke above its 7-day and 30-day simple moving averages.

- The Relative Strength Index (RSI) sits in bullish territory at 65.42.

- Analysts see the current pattern as a bullish flag, potentially signaling a breakout if support at $0.16 holds.

Political Firestorm and Regulatory Tensions

WLFI’s efforts haven’t come without controversy. The company was co-founded by Donald Trump Jr. and Eric Trump, among others, and the Trump family reportedly receives 75% of the net revenue from token sales and stablecoin operations.

This deep entanglement with a sitting U.S. president has alarmed critics. Democratic lawmakers, including Rep. Stephen Lynch, have flagged possible conflicts of interest and proposed legislation like the “Stop TRUMP in Crypto Act,” which would bar elected officials and their families from owning digital assets.

Banking groups have also raised concerns. The American Bankers Association argues that such trust charters could erode traditional banking models, while the FDIC insists on tight oversight for stablecoin issuers.

CoinLaw’s Takeaway

In my experience watching crypto’s evolution, this is one of the most significant regulatory plays we’ve seen yet. WLFI is not just angling to grow, it’s angling to reshape how crypto firms operate in the U.S. The USD1 stablecoin’s performance already makes it a force to reckon with. Now, with a federal charter in play, WLFI is going full throttle into the financial mainstream. Still, the Trump family ties and legal fog make this a bold, high-risk gambit. If they pull it off, this could be the blueprint for all future stablecoin issuers.