The world of wealth management is constantly evolving, driven by shifts in demographics, technology, and market trends. Picture this: a seasoned wealth manager sits down with a Gen Z entrepreneur who has amassed a fortune through NFTs. They discuss portfolio diversification while simultaneously navigating compliance challenges and leveraging AI-powered tools for decision-making.

This blend of tradition and innovation exemplifies the current state of the wealth management industry today. As financial ecosystems adapt to new demands, understanding the statistics shaping this landscape becomes crucial for both professionals and clients.

Editor’s Choice

- Global assets under management are projected to reach $145.4 trillion by 2025, with annual growth of around 6.2%.

- The wealth management market is expected to generate an additional $460.1 billion in revenue between 2025 and 2029.

- Global wealth rose by 4.6% in 2024, with the Americas contributing over 11% of the total growth.

- The wealth management platform market is valued at $6.72 billion in 2025 and is forecast to hit $17.88 billion by 2032.

- Asia-Pacific and Latin America have achieved over 50% organic growth in assets under management during the past decade.

- An estimated $83.5 trillion will be passed down to younger generations by 2048, reshaping future advisory models.

Key Market Indicators

- Global assets under management reached $162 trillion in 2025, driven by a 5.9% annual growth rate.

- The United States holds 54.2% of total AUM in 2025, while Europe has 29.7% and Asia‑Pacific has 13.1% of the global share.

- Wealth managers project average AUM growth of 13.7% in 2025, alone pointing to significantly stronger expansion.

- The wealth management platform market is valued at $6.72 billion in 2025 with a forecasted CAGR of 15.0% through 2032.

Global Assets Under Management (AUM)

- The United States holds approximately 54.2% of global AUM in 2025, with Europe around 29.7% and Asia‑Pacific at 13.1%.

- The total global AUM is estimated at $162 trillion in 2025, showing growth of about 5.9% year‑over‑year.

- Private equity AUM is expected to reach about $9.7 trillion by end‑2025 reflecting a near 12.3% annual growth.

- Institutional investors (including pension funds) represent a dominant share of global AUM, with private markets continuing to attract increasing allocations.

- Real assets, private equity, and private debt together are projected to form around 15% of global AUM by 2025, with values of roughly $21.1 trillion.

- The record for global AUM in 2024 was about $128 trillion, highlighting a strong rebound year.

Worldwide Growth of High‑Net‑Worth Individuals

- The global HNWI population grew by 2.6% in 2024, reaching about 53 million individuals by early 2025.

- Global HNWI wealth rose by 4.2% in 2024 to approximately $90.5 trillion in combined assets.

- The United States added around 562,000 new millionaires in 2024, marking a 7.6% increase year-over-year.

- Asia-Pacific markets like India and Japan posted growth near 5.6% while China’s HNWI count slightly declined.

- About 72% of HNWIs prefer AI-enhanced personalized services to manage their portfolios more efficiently.

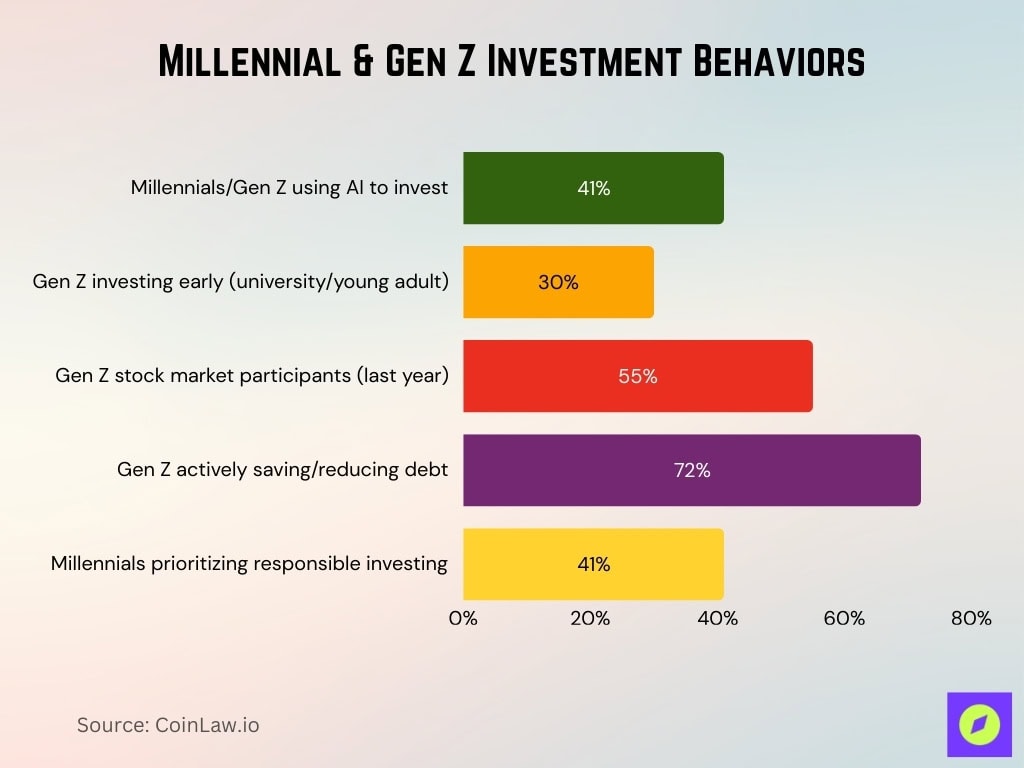

Millennial and Gen Z Preferences

- Around 41% of Millennials and Gen Z are comfortable using AI tools to manage their investments in 2025.

- About 30% of Gen Z start investing during their university years or early adulthood.

- Roughly 55% of Gen Z have invested in the stock market over the past year.

- Nearly 72% of Gen Z are actively improving their financial health through saving or reducing debt.

- Approximately 41% of Millennials prioritize socially responsible or ethical investing.

Technology and AI Statistics

- Over 42% of wealth managers are using AI tools in 2025, with adoption expected to rise to 77% in the next two years.

- Generative AI adoption has reached 78% among advisors, with 41% using it as a core part of operations.

- AI implementation is projected to reduce operational costs by 25–40% through automation and enhanced efficiency.

- Wealth tech platforms now manage over $1.7 trillion in assets for more than 24 million end investors globally.

Rising Alternative Investment Opportunities

- Alternative investments now account for about 15% of global AUM in 2025, driven by real assets, private equity, and private debt.

- Private equity AUM is expected to surpass $11.7 trillion in 2025, reflecting strong investor demand.

- In 2025, roughly 59% of institutional investors plan to allocate over 5% of their portfolios to cryptocurrencies.

- Hedge funds manage approximately $5.3 trillion globally in 2025, growing by about 6.1% year‑over‑year.

- Real estate investments are seeing a CAGR of 9.2% from 2023 to 2025 as income‑generating assets gain popularity.

- The alternative investments market is projected to reach $26.4 trillion by the end of 2025, reflecting broad diversification trends.

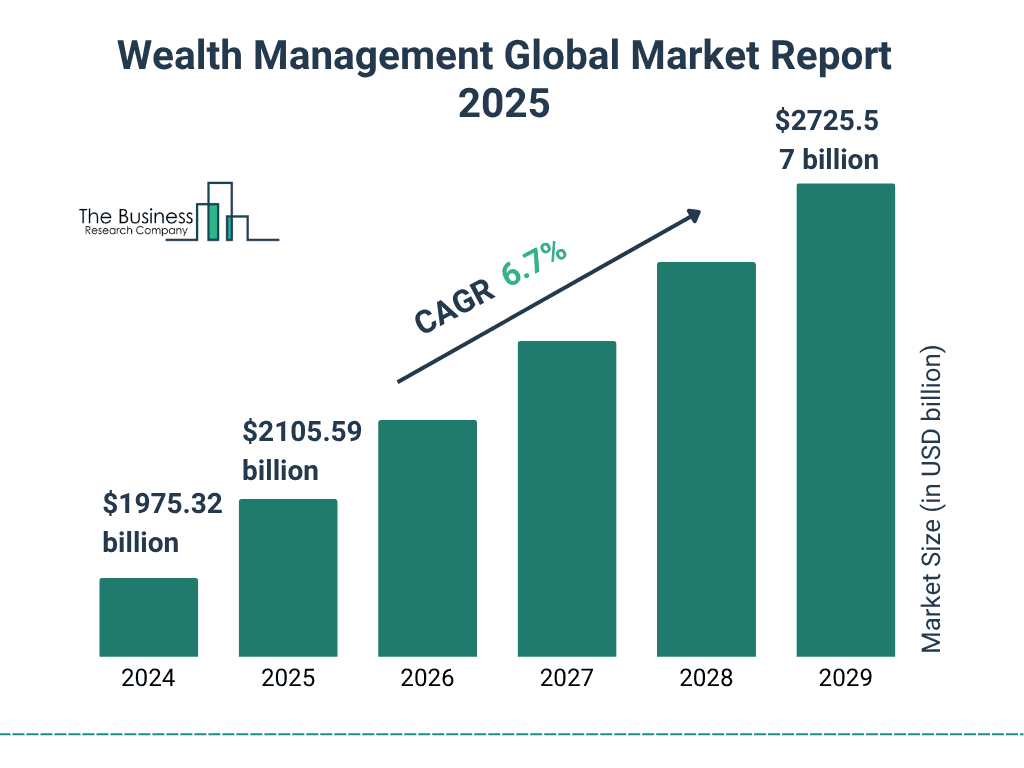

Global Wealth Management Market Growth

- It is projected to rise to $2105.59 billion by 2025, marking the start of steady growth.

- By 2029, the market is expected to hit $2725.57 billion, showing strong momentum.

- The industry is growing at a CAGR of 6.7% from 2025 to 2029.

- This growth reflects increasing demand for digital advisory tools, personalized portfolios, and cross-border investment strategies.

Wealth Management Market by Advisory Type

- Hybrid robo‑advisory services are expected to capture about 60.7% of the robo‑advisor market in 2024, growing rapidly into 2025.

- The robo‑advisory services market size is estimated at $14.29 billion in 2025, with pure‑play models rising fast.

- Fee‑based advisory structures remain dominant in revenue among full‑service wealth managers, with over 60% of market share in recent years.

- Commission‑based advisory models continue to lose ground with market share declining into the teens percent range by 2025.

- Family offices manage over $10 trillion globally as of 2025, continuing to serve ultra‑high‑net‑worth clients.

- Custom advisory services for niche communities are expanding by around 12% year‑over‑year into 2025.

Wealth Management Market by Services

- US retirement‑related assets are about $43.4 trillion in early 2025, with retirement planning remaining a top advisory service.

- The estate tax exemption is now $13.99 million per individual in 2025, raising the stakes in estate planning advice.

- Clients with advisors are realizing an added 2.4%–2.8% annual return net of fees and inflation through combined tax optimization, behavioral coaching, and technical planning.

- The charitable giving/planning segment is receiving greater attention in 2025, especially from high‑net‑worth clients focused on legacy and philanthropic advisory.

- Investment planning dominates many portfolios in 2025, leaning heavily toward diversified strategies including global equities, fixed income, and alternatives.

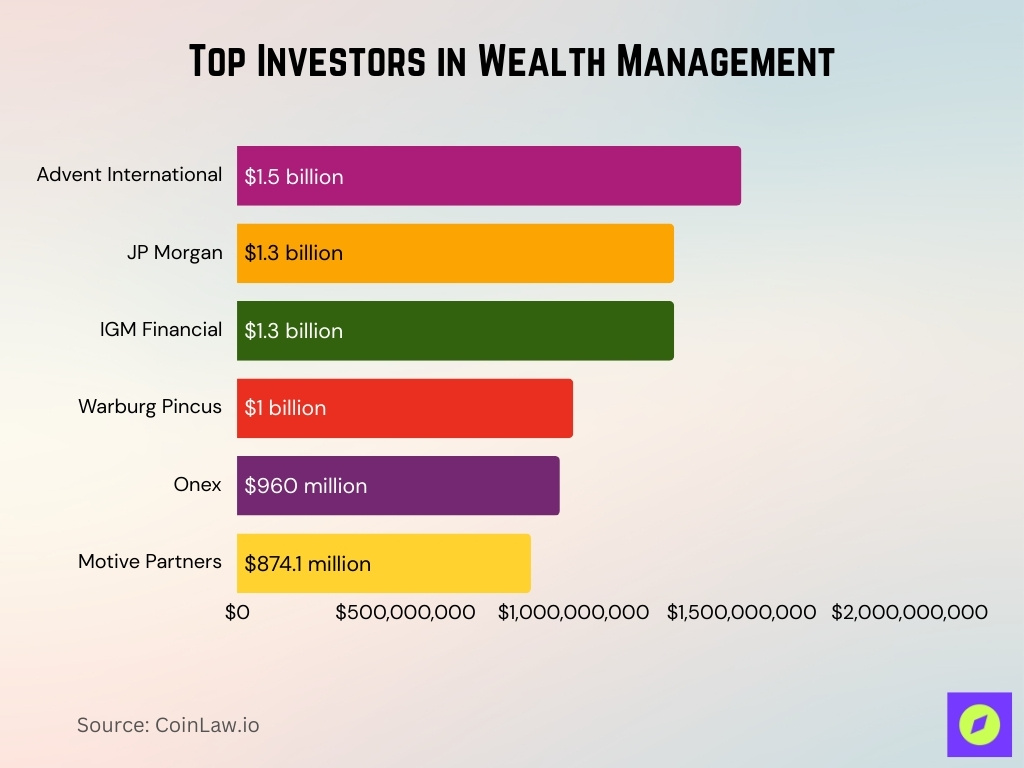

Top Investors in Wealth Management

- Advent International is the largest investor with a total of $1.5 billion invested in wealth management firms.

- JP Morgan and IGM Financial each committed $1.3 billion, highlighting major backing from traditional finance giants.

- Warburg Pincus invested $1 billion, showing a strong interest in long-term asset growth platforms.

- Onex has contributed $960 million, supporting scalable advisory and fintech-driven solutions.

- Motive Partners invested $874.1 million, focusing on digital innovation and infrastructure in the sector.

Recent Developments

- Mass-affluent investor assets are projected to grow at a 5.4% CAGR through 2028, down from prior growth levels.

- Wealth managers expect average AUM growth of 13.7% in 2025, with US firms projecting up to 17.6%.

- New anti-money laundering rules for investment advisers have been delayed until 2028, impacting compliance timelines.

- The SEC has postponed certain fund reporting rule changes with new compliance dates extending to 2027–2028.

- Cross-border wealth flows are rising as clients seek diversification and global access to alternative investments.

- Mergers and acquisitions are accelerating as firms pursue scale, regulatory leverage, and private market exposure.

Frequently Asked Questions (FAQs)

Global assets under management (AUM) are projected to reach $145.4 trillion by 2025 with a 6.2% CAGR from 2016.

Wealth managers estimate 13.7% AUM growth globally in 2025, with the US expecting about 17.6% growth.

The robo‑advisory market was valued at $8.39 billion in 2024 and is projected to grow to $10.86 billion in 2025.

Global assets under management (AUM) are projected to reach US$145.4 trillion by 2025 with a 6.2% CAGR from 2016.

Conclusion

The wealth management industry today stands at the crossroads of tradition and innovation. With technology reshaping advisory models and alternative investments gaining traction, professionals must adapt to meet the evolving needs of a diverse clientele. By embracing AI-driven tools, addressing compliance challenges, and focusing on sustainable growth, the industry is poised to thrive in a dynamic global economy.

For wealth managers, the opportunities are vast, but so are the challenges. As the financial world grows increasingly interconnected, staying informed on these trends is essential for success in the ever-competitive landscape of wealth management.