Picture this: a small business owner completes a cross-border payment in seconds using just a virtual credit card. No delays, no physical cards, and no worries about fraud. Virtual credit cards (VCCs) are transforming the financial landscape by combining security, flexibility, and convenience. As the world pivots toward digital transactions, virtual credit cards are quickly becoming a preferred tool for both individuals and businesses.

In this article, we’ll explore the latest statistics, trends, and adoption rates driving the growth of virtual credit cards. From their market impact to growing acceptance among vendors, VCCs are changing how we pay and operate.

Editor’s Choice

- In 2025, virtual credit card transactions among small businesses surged by 48%, reflecting their growing preference for B2B and online transactions.

- 83% of financial professionals in 2025 consider virtual credit cards more secure than physical cards due to advanced one-time-use and encryption features.

- The virtual card adoption rate among millennials hit 61.6% in 2025, highlighting a strong inclination for digitally native payment methods.

- B2B payments now represent 76% of the virtual card market’s global usage in 2025, and total B2B spending is expected to dominate the segment.

- Businesses saved an average of $7 per transaction using virtual credit cards in 2025, as compared to legacy payment methods.

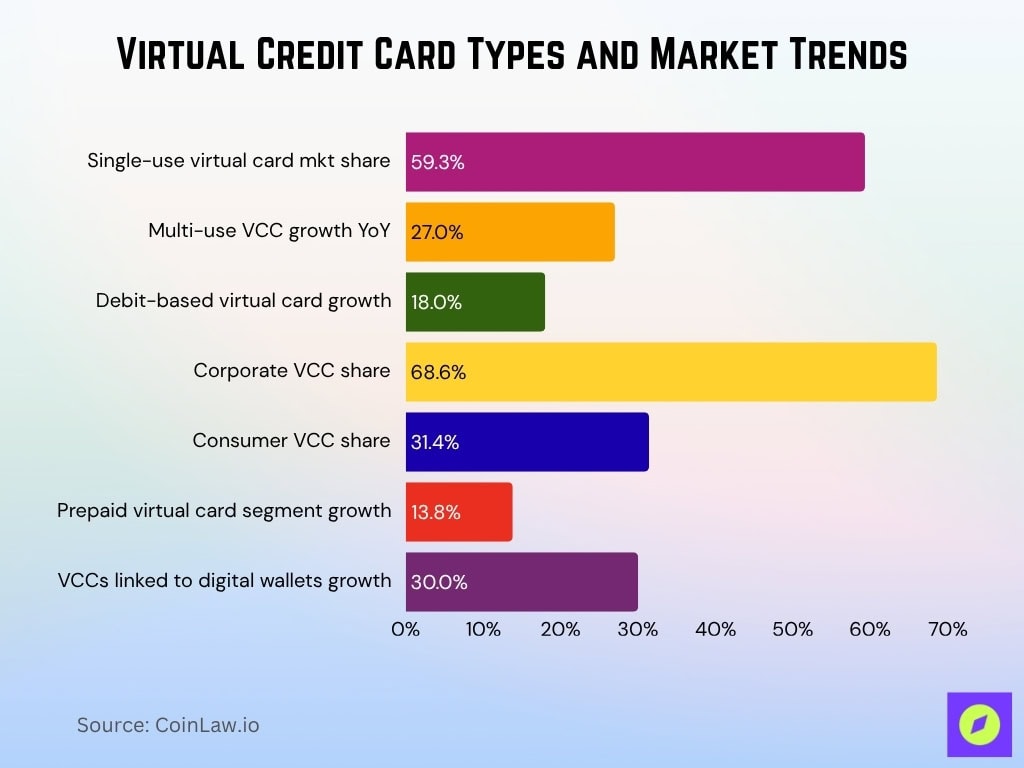

Card Type and Product Type Insights

- Single-use virtual cards held 59.3% of the global market share in 2025, remaining the primary option for secure one-time online transactions.

- Multi-use virtual cards increased by 27% year-over-year in 2025, largely due to recurring billing and SaaS subscription demand.

- Debit-based virtual cards are projected to grow by 18% in 2025, reflecting interest in non-credit spending methods.

- Corporate virtual cards accounted for 68.6% of total usage in 2025, dominating vendor payments, procurement, and employee travel workflows.

- Consumer virtual card use reached 31.4% in 2025, with millennials driving adoption across e-commerce and digital wallets.

- The prepaid virtual card segment expanded by 13.8% in 2025, supported by gig workers and freelancers seeking controlled budgeting tools.

- Virtual cards linked to digital wallets rose by 30% in 2025, driven by users prioritizing smooth, cross-platform payments.

Application and Regional Insights

- The B2B payments segment accounts for 76% of global VCC usage in 2025, representing the largest application share.

- Travel and expense management sees 50% of corporate travel programs using virtual cards for their employees in 2025.

- Online retail payments represent 35% of virtual card usage in 2025, as consumers prioritize privacy and fraud protection for e-commerce transactions.

- North America leads the virtual card market in 2025, with the US contributing 34.4% of total global transactions.

- Europe holds 23% of the global market share in 2025, driven by an 18.4% CAGR, and countries like Germany and the UK are seeing continued double-digit VCC adoption growth.

- The Asia-Pacific region is projected to have the fastest growth in 2025, with virtual card adoption projected to rise at a 22.6% CAGR, led by India and China.

- In Latin America, virtual card adoption reached 41% among companies and expense controllers in 2025, with Brazil as the largest market.

- Middle Eastern markets report a 20.8% CAGR in virtual card usage in 2025, especially among fintech companies in Saudi Arabia and the UAE.

- Virtual credit cards in Africa grew by 13.4% year-over-year in 2025, primarily fueled by digital banking expansion in Nigeria and South Africa.

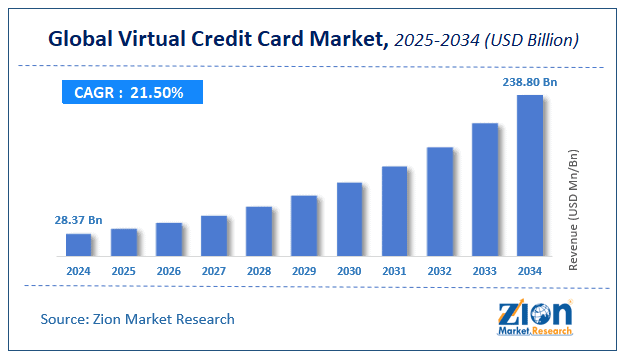

Global Virtual Credit Card Market Growth Highlights

- The global virtual credit card (VCC) market is projected to grow at a CAGR of 21.50% from 2025 to 2034.

- Market size will surge from $28.37 billion in 2024 to $238.80 billion by 2034, reflecting nearly a 9x expansion over the decade.

- Between 2024 and 2028, the market is expected to nearly double, reaching about $60 billion, driven by increased adoption in B2B payments and cross-border transactions.

- By 2030, the market is forecast to surpass $85 billion, highlighting strong institutional and consumer acceptance.

- Growth accelerates sharply after 2031, with revenues projected to exceed $100 billion, supported by digital banking integration and contactless payment trends.

- By 2033, global revenues could reach around $155 billion, ahead of the final jump to $238.80 billion in 2034.

Security Features and Fraud Prevention

- 94% of financial institutions in 2025 cite virtual cards as a key tool in combating payment fraud due to temporary card numbers and advanced encryption.

- In 2025, businesses using VCCs reported a 78% reduction in fraud cases compared to traditional credit cards.

- Tokenization technology protects virtual card details, making it nearly impossible for hackers to intercept sensitive data in 2025.

- Single-use virtual cards help prevent data breaches, reducing fraud risks by 62% for e-commerce and B2B payments in 2025.

- PCI DSS compliance remains standard across all major virtual card providers in 2025, ensuring secure payment requirements are met.

- 82% of consumers using virtual cards reported increased confidence in online payments, driven by robust fraud prevention measures in 2025.

- In 2025, global losses from credit card fraud are projected to surpass $12.5 billion, while businesses using virtual cards see significantly lower impact.

- AI-based fraud detection tools integrated with virtual card systems reduced unauthorized transactions by 31% in 2025.

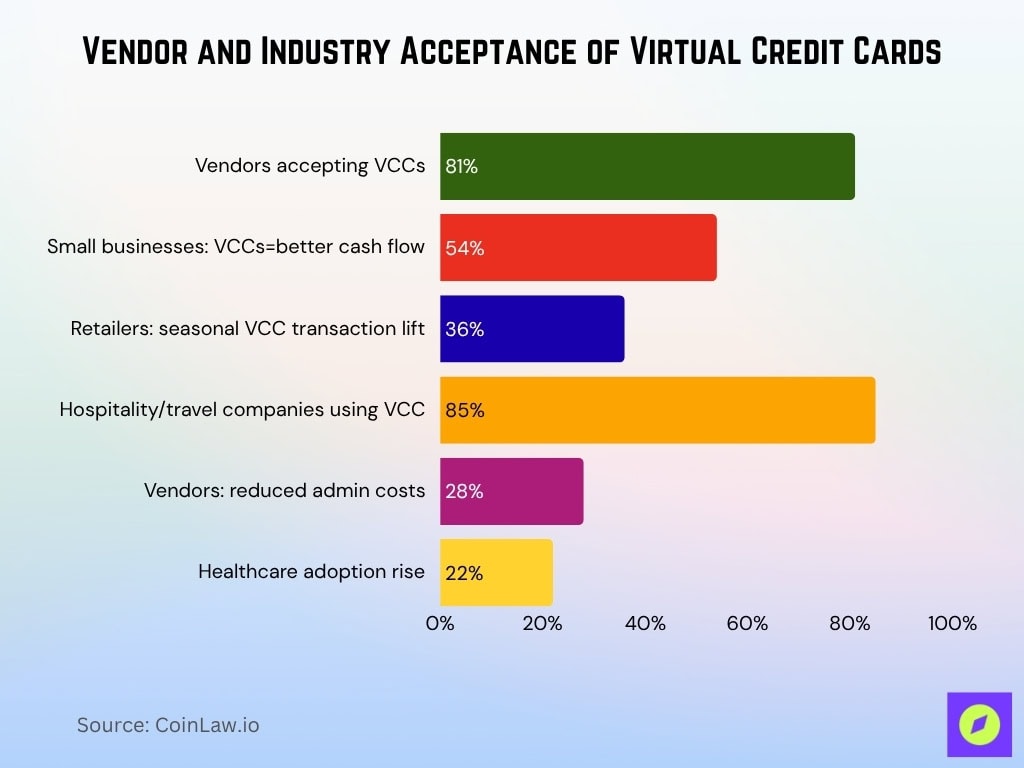

A Growing Acceptance Among Vendors

- In 2025, 81% of vendors report accepting virtual credit cards, reflecting rapid mainstream adoption.

- 54% of small businesses say vendor acceptance of virtual cards improved cash flow management in 2025.

- Retailers report a 36% increase in virtual card transactions during the 2025 holiday season, driven by digital demand.

- The hospitality and travel industries lead with 85% of companies adopting virtual cards for booking and transaction flow in 2025.

- 28% of vendors in 2025 report that accepting VCCs helped reduce administrative costs such as invoice processing and payment delays.

- In the healthcare sector, virtual card adoption grew by 22% in 2025, especially for managing insurance claims and payments.

Technological Developments and Innovations

- AI-driven fraud detection systems reduced fraudulent transactions by 50% in 2025, improving real-time payment security.

- Blockchain integration improved transparency for 18% of businesses adopting blockchain-based VCCs in 2025.

- The growth of mobile wallets led to a 30% increase in virtual card integration for multi-device payments in 2025.

- Biometric authentication was adopted by 74% of fintech platforms in 2025, strengthening VCC security.

- API-driven payment systems reduced payment processing time by 45% in 2025 through automation.

- Smart expense management tools saw a 28% increase in SME adoption in 2025 for real-time spending control.

- VCCs cut international transaction fees by 20% in 2025, boosting global cross-border payment adoption.

- AI budgeting–integrated virtual cards were used by 35% of consumers in 2025 for better personal expense tracking.

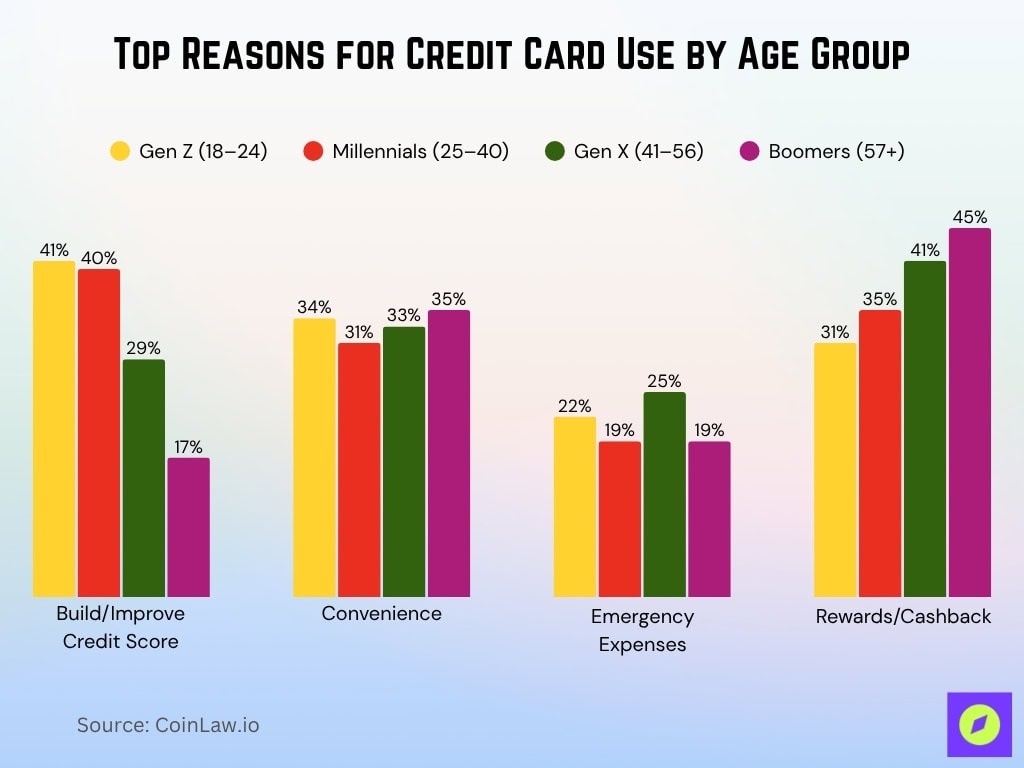

Top Reasons for Credit Card Use by Age Group

- Building or improving credit scores is most common among Gen Z (41%) and Millennials (40%), compared to Gen X (29%) and Boomers (17%), showing that younger adults are more focused on establishing credit history.

- Convenience ranks fairly evenly across generations, with Boomers (35%), Gen X (33%), Gen Z (34%), and Millennials (31%) using credit cards to simplify payments.

- Emergency expenses are a key motivator for Gen X (25%), followed by Gen Z (22%), while Millennials (19%) and Boomers (19%) are less likely to rely on credit for emergencies.

- Rewards and cashback appeal more to older generations, with Boomers (45%) and Gen X (41%) leading adoption, while Millennials (35%) and Gen Z (31%) follow closely behind.

The Meteoric Rise of Virtual Cards in B2B Payments

- The global B2B virtual card market is projected to grow at a 20.2% CAGR, reaching $27.5 billion by 2026.

- 91% of financial professionals say virtual cards simplify procurement and vendor payments, reducing manual errors and delays in 2025.

- Businesses using virtual cards in 2025 report a 41% improvement in payment approval times and reconciliation efficiency.

- In the manufacturing sector, virtual card adoption rose by 25% in 2025 as companies streamlined supply chain payments.

- Virtual cards cut processing costs by up to 72% for businesses in 2025 when compared to checks and ACH payments.

- Employee expense management saw major gains, with 59% of corporations deploying virtual cards for travel and work-related purchases in 2025.

- Real-time expense tracking driven by virtual cards saves businesses an average of 18 hours per month on manual reconciliation tasks in 2025.

Recent Developments

- Fintech partnerships fueled innovation in 2025, with collaborations between banks and tech companies rising by 33%.

- Major payment platforms such as PayPal and Stripe offer virtual card solutions, contributing to a 36% growth in VCC usage in 2025.

- Virtual card adoption in government programs increased by 22% in 2025, especially for managing public sector expenses and subsidies.

- Visa and Mastercard reported a 27% increase in virtual card issuance among businesses and consumers in 2025.

- BNPL (Buy Now, Pay Later) features integrated with virtual cards drove a 34% increase in consumer adoption in 2025.

- The healthcare sector saw a 25% rise in virtual card payments for insurance reimbursements and medical expenses in 2025.

- Digital-first banks like Chime and Revolut reported a 46% surge in virtual card applications since 2023, accelerated by digital banking trends in 2025.

Frequently Asked Questions (FAQs)

B2B virtual card transactions account for 76% of the total virtual card market usage in 2025.

76% of large US corporations are using virtual credit cards for payments in 2025.

Businesses save an average of $7 per transaction with virtual credit cards compared to traditional payment methods.

Conclusion

Virtual credit cards are quickly becoming a mainstream payment option, offering enhanced security, cost efficiency, and seamless digital use. Their rising adoption in both consumer and B2B payments highlights how they solve modern financial challenges.

As businesses and individuals prioritize secure, digital-first transactions, the virtual card market will continue to grow, potentially leading to a future where physical cards are no longer needed.